Developing such a long-term financial projection offers several advantages. It facilitates informed decision-making regarding investments, pricing strategies, and resource allocation. It enables proactive identification of potential financial challenges and opportunities, allowing for timely adjustments to business plans. Furthermore, it serves as a crucial communication tool for securing funding from investors or lenders, demonstrating the financial viability and growth potential of a venture.

The following sections delve deeper into the key components of this projection, offering guidance on its creation and interpretation. Topics covered will include revenue forecasting techniques, expense budgeting strategies, and sensitivity analysis for assessing the impact of varying assumptions. Practical examples and best practices will be provided to assist in developing a robust and insightful financial roadmap.

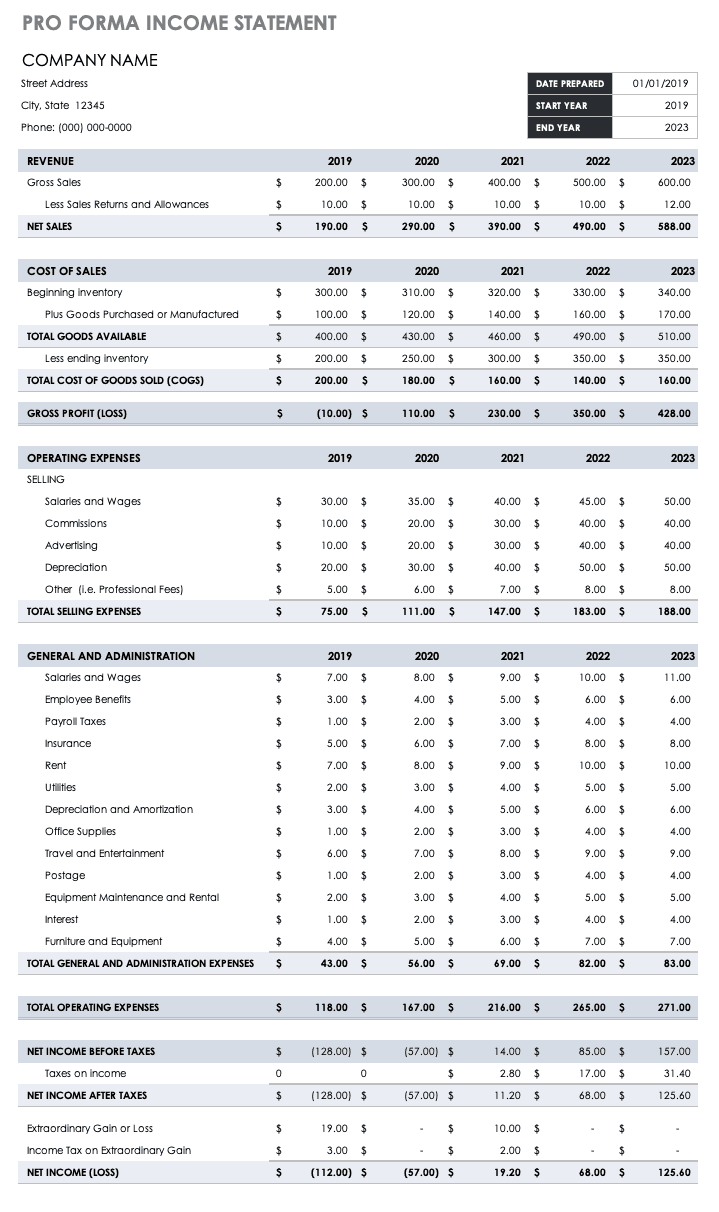

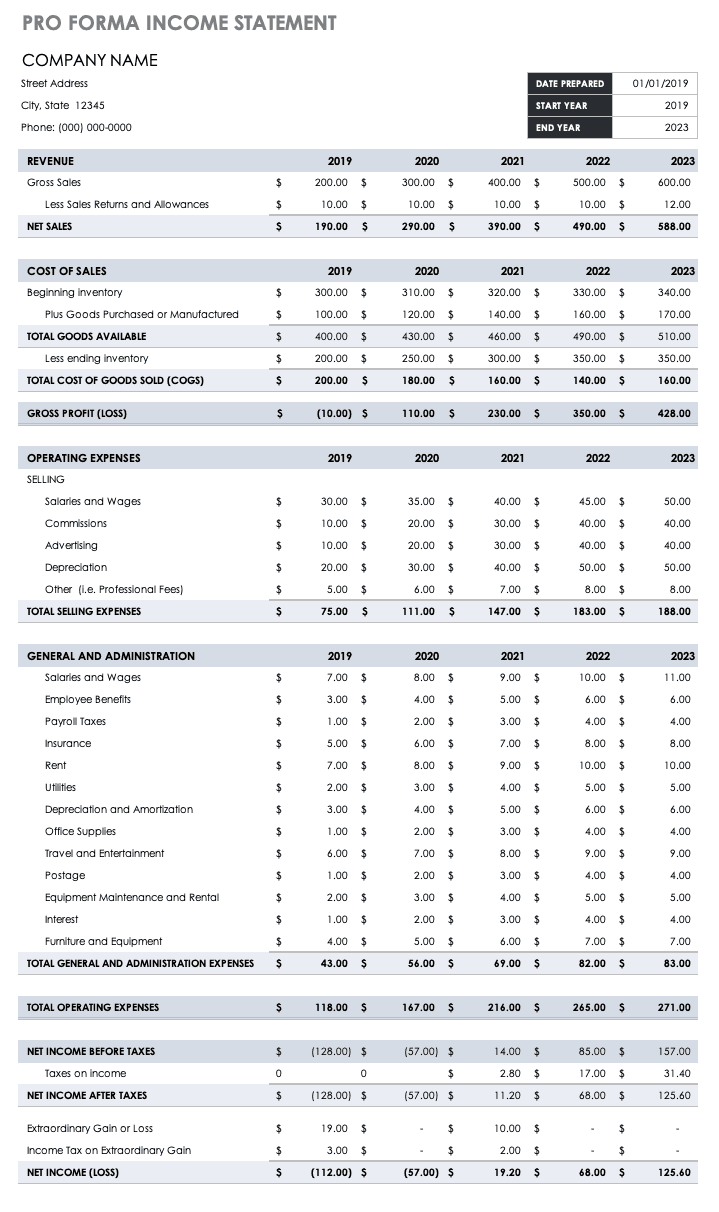

1. Revenue Projections

Revenue projections form the cornerstone of a five-year financial projection, serving as the primary driver of projected profitability and overall financial health. Accurately forecasting revenue is crucial for informed decision-making, resource allocation, and attracting potential investors. Understanding the various facets of revenue projection is essential for developing a robust and credible financial forecast.

- Market AnalysisThorough market research is fundamental to realistic revenue projections. Analyzing market size, growth trends, and competitive landscape provides a basis for estimating potential market share and achievable sales volumes. For example, a company launching a new product would research the target market’s size, demographics, and purchasing power to estimate potential demand.

- Pricing StrategyPricing significantly impacts revenue projections. Factors influencing pricing include production costs, competitor pricing, perceived value, and market positioning. A premium pricing strategy might target a smaller market segment but yield higher revenue per unit, while a competitive pricing strategy aims for higher sales volume with lower profit margins per unit. Careful consideration of pricing strategy within the market context is crucial for accurate revenue forecasting.

- Sales Volume ForecastsProjecting sales volume requires considering factors like market penetration rates, customer acquisition costs, and sales conversion ratios. For instance, a software company might project sales volume based on anticipated subscription growth rates and churn rates. Realistic sales volume projections are essential for accurate revenue forecasting.

- Growth AssumptionsRevenue projections typically incorporate assumptions about future growth. These assumptions should be based on historical data, market trends, and company-specific factors such as expansion plans or new product launches. For established businesses, historical sales data can inform future growth projections. Startups, however, might rely more heavily on market analysis and industry benchmarks to establish growth trajectories.

These interconnected facets of revenue projection directly influence the accuracy and reliability of a five-year financial projection. A well-defined revenue projection, grounded in robust market analysis and realistic assumptions, strengthens the overall financial forecast, providing a credible basis for strategic planning and resource allocation. Furthermore, transparent and justifiable revenue projections enhance stakeholder confidence, attracting potential investors and lenders.

2. Cost of Goods Sold

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a business. Within a five-year pro forma income statement template, COGS plays a critical role in determining gross profit and, consequently, overall profitability. Accurate COGS projections are essential for informed pricing decisions, inventory management, and assessing the financial viability of a business venture over an extended period. Understanding the various components of COGS is crucial for developing a robust and insightful financial forecast.

- Direct MaterialsDirect materials encompass the raw materials and components directly used in the production process. For a furniture manufacturer, this would include wood, fabric, and hardware. Accurately estimating the cost of direct materials requires considering factors like supplier pricing, material usage rates, and potential price fluctuations over the five-year projection period. Accurate direct material cost projections are essential for realistic COGS calculations.

- Direct LaborDirect labor represents the wages and benefits paid to employees directly involved in producing goods. In a manufacturing setting, this includes assembly line workers and production supervisors. Projecting direct labor costs necessitates considering factors like labor rates, production efficiency, and anticipated staffing levels over the five-year horizon. Precise direct labor cost projections contribute to reliable COGS estimations.

- Manufacturing OverheadManufacturing overhead includes all costs indirectly associated with production, such as factory rent, utilities, and depreciation of production equipment. These costs are allocated to the units produced. Accurately projecting manufacturing overhead requires considering factors like facility costs, equipment maintenance expenses, and production volume. Reliable manufacturing overhead projections contribute to a comprehensive COGS analysis.

- Inventory ManagementEffective inventory management directly impacts COGS. Minimizing storage costs, reducing obsolescence, and optimizing inventory levels contribute to lower COGS. For example, implementing just-in-time inventory systems can minimize storage costs and reduce the risk of inventory obsolescence. Accurate inventory management practices contribute to more precise COGS projections and improve overall profitability.

Accurately projecting COGS within a five-year pro forma income statement provides crucial insights into the relationship between production costs, pricing strategies, and profitability. By analyzing COGS trends over time, businesses can identify potential cost-saving opportunities, optimize pricing strategies, and improve overall financial performance. A thorough understanding of COGS and its components is therefore essential for developing a comprehensive and insightful long-term financial plan.

3. Operating Expenses

Operating expenses represent the costs incurred in running a business outside of direct production costs. Within a five-year pro forma income statement template, operating expenses significantly impact profitability and provide insights into a company’s efficiency. Accurately projecting these expenses is crucial for developing a realistic financial forecast and making informed strategic decisions. A clear understanding of the various categories of operating expenses and their relationship to overall financial performance is essential for long-term planning and resource allocation.

Several key categories of operating expenses typically appear in a five-year pro forma income statement. These include selling, general, and administrative expenses (SG&A), research and development (R&D), and marketing and advertising. SG&A encompasses salaries of administrative staff, office rent, and utilities. R&D expenses cover costs associated with developing new products or services. Marketing and advertising expenses include costs related to promoting products or services to target markets. For example, a technology company might allocate a significant portion of its operating budget to R&D, while a retail company might focus more on marketing and advertising. The specific allocation of resources within these categories reflects the unique operational requirements and strategic priorities of each business.

Projecting operating expenses accurately requires careful consideration of several factors. Historical data provides a starting point for estimating future expenses, but adjustments must be made to reflect anticipated changes in business operations, market conditions, and strategic initiatives. For instance, a company expanding into new markets might expect increased SG&A expenses related to establishing new offices and hiring additional personnel. Similarly, increased investment in R&D might lead to higher operating expenses in the short term but could contribute to increased revenue and profitability in the long run. Accurately forecasting these dynamic relationships between operating expenses, revenue generation, and profitability is crucial for developing a robust and insightful five-year financial plan. Understanding these interdependencies enables businesses to make informed decisions about resource allocation, cost control measures, and strategic investments to achieve sustainable growth and financial success.

4. Profitability Metrics

Profitability metrics within a five-year pro forma income statement template provide crucial insights into a company’s projected financial performance and long-term sustainability. These metrics go beyond simply projecting revenue and expenses; they analyze the relationships between them to assess the efficiency of operations and the effectiveness of strategic initiatives. Understanding these metrics is essential for evaluating the financial viability of a business plan and making informed decisions about resource allocation, pricing strategies, and growth initiatives.

- Gross Profit MarginGross profit margin represents the percentage of revenue remaining after deducting the cost of goods sold (COGS). It indicates the efficiency of production and pricing strategies. A higher gross profit margin suggests effective cost management and strong pricing power. Tracking this metric over the five-year projection period allows businesses to assess the long-term impact of pricing decisions and cost optimization strategies. For example, a consistent increase in gross profit margin might indicate successful implementation of cost-saving measures or effective product differentiation leading to premium pricing.

- Operating Profit MarginOperating profit margin represents the percentage of revenue remaining after deducting both COGS and operating expenses. It reflects the overall efficiency of business operations and management’s ability to control costs. Analyzing trends in operating profit margin over the five-year projection period provides insights into the long-term sustainability of the business model and the effectiveness of cost management strategies. A declining operating profit margin, for instance, might signal increasing operational inefficiencies or escalating costs that require attention.

- Net Profit MarginNet profit margin represents the percentage of revenue remaining after deducting all expenses, including COGS, operating expenses, interest, and taxes. It signifies the overall profitability of the business and its ability to generate returns for investors. Consistent growth in net profit margin over the five-year projection period indicates a healthy and sustainable financial trajectory. Conversely, a declining net profit margin could signal underlying issues that require further investigation and corrective action.

- Return on Investment (ROI)While not strictly a profit margin, ROI measures the profitability of an investment relative to its cost. Within the context of a five-year pro forma income statement, ROI can be used to assess the projected return on various investments, such as capital expenditures or marketing campaigns. By projecting ROI over the five-year period, businesses can evaluate the long-term financial viability of different investment strategies and prioritize those with the highest potential returns. For example, comparing the projected ROI of investing in new equipment versus expanding into a new market allows for informed decision-making based on potential financial returns.

Analyzing these profitability metrics within the framework of a five-year pro forma income statement allows for a comprehensive assessment of a company’s projected financial health and sustainability. By tracking these metrics over time and comparing them to industry benchmarks, businesses can identify potential areas for improvement, optimize resource allocation, and refine strategic initiatives to achieve long-term financial success. This comprehensive understanding of profitability empowers businesses to make informed decisions, adapt to changing market conditions, and enhance long-term value creation.

5. Underlying Assumptions

A five-year pro forma income statement template relies heavily on underlying assumptions, representing educated guesses about future economic conditions, market behavior, and operational performance. These assumptions form the foundation upon which financial projections are built and directly influence the projected financial outcomes. The relationship between underlying assumptions and the pro forma statement is one of cause and effect: changes in assumptions directly lead to changes in projected financial results. Therefore, clearly defining and justifying these assumptions is crucial for the credibility and reliability of the financial forecast. For example, assumptions about sales growth rates, cost of goods sold, and operating expenses directly impact projected profitability.

Consider a company projecting revenue growth based on the assumption of a stable market share. If market competition intensifies unexpectedly, the initial assumption might prove overly optimistic, leading to an overstatement of projected revenue. Similarly, assumptions about cost inflation rates significantly impact projected expenses. Underestimating inflation could lead to an understatement of future costs and an overestimation of profitability. Therefore, sensitivity analysis, which involves testing the impact of different assumptions on the projected financials, becomes essential. By varying key assumptions within a reasonable range, businesses can assess the potential impact of unforeseen events or market fluctuations on their financial performance. For example, a company might model different scenarios with varying sales growth rates to understand the potential impact of market volatility on profitability.

The reliability of a five-year pro forma income statement hinges on the validity of its underlying assumptions. Transparency regarding these assumptions is crucial for stakeholders to understand the basis of the financial projections. Regularly reviewing and updating assumptions, particularly in dynamic market environments, is essential for maintaining the relevance and accuracy of the financial forecast. Challenges arise when assumptions are poorly defined, lack justification, or remain static despite changing market conditions. Rigorous analysis, market research, and expert input contribute to developing well-informed assumptions and strengthen the credibility of the pro forma income statement as a strategic planning tool. This ultimately fosters informed decision-making and facilitates proactive adaptation to evolving market dynamics.

6. Sensitivity Analysis

Sensitivity analysis plays a critical role in evaluating the robustness and reliability of a five-year pro forma income statement template. Because long-term financial projections inherently rely on assumptions about future conditions, understanding the potential impact of variations in these assumptions is crucial. Sensitivity analysis systematically examines how changes in key input variables, such as sales growth rates, cost of goods sold, or market share, affect the projected financial outcomes. This process provides valuable insights into the potential risks and opportunities associated with different scenarios, facilitating more informed decision-making.

Consider a company projecting revenue based on an assumed annual growth rate of 10%. Sensitivity analysis might explore scenarios with growth rates ranging from 5% to 15%. By observing the corresponding changes in projected profitability, decision-makers can assess the potential impact of market fluctuations on the business’s financial health. This understanding can inform strategic decisions, such as pricing strategies, investment plans, and cost management initiatives. For example, if sensitivity analysis reveals a significant negative impact on profitability under a lower-growth scenario, the company might prioritize cost-cutting measures or explore alternative revenue streams to mitigate potential risks.

Sensitivity analysis not only identifies potential risks but also highlights potential opportunities. For instance, exploring scenarios with higher-than-expected sales growth might reveal the need for additional capacity or resources to capitalize on favorable market conditions. This proactive approach to financial planning enables businesses to adapt quickly to changing circumstances and maximize potential gains. The practical significance of sensitivity analysis lies in its ability to bridge the gap between projected outcomes and real-world uncertainties. By explicitly acknowledging the inherent uncertainty in long-term financial projections, sensitivity analysis strengthens the decision-making process and fosters a more resilient and adaptable approach to financial planning. This ultimately empowers businesses to navigate complex and dynamic market environments more effectively.

Key Components of a Five-Year Pro Forma Income Statement

A comprehensive five-year pro forma income statement requires careful consideration of several key components. These components work together to provide a detailed and dynamic projection of a company’s anticipated financial performance over an extended period. Understanding these interconnected elements is essential for developing a robust and insightful financial forecast.

1. Revenue Projections: Forecasting future revenue involves analyzing market trends, customer behavior, pricing strategies, and competitive dynamics. Realistic revenue projections form the foundation of a credible pro forma statement.

2. Cost of Goods Sold (COGS): Accurately estimating COGS requires detailed analysis of direct material costs, direct labor costs, and manufacturing overhead. Effective COGS management is essential for maximizing profitability.

3. Operating Expenses: Operating expenses encompass all costs associated with running the business outside of direct production. Careful budgeting and management of operating expenses are crucial for maintaining healthy profit margins.

4. Depreciation and Amortization: Accounting for the depreciation of tangible assets and the amortization of intangible assets reflects their declining value over time and impacts the overall profitability projection.

5. Interest Expense: Projecting interest expense requires careful consideration of existing debt obligations and anticipated borrowing needs. Accurately forecasting interest payments is crucial for assessing the long-term financial impact of debt financing.

6. Tax Expense: Projecting income tax liability requires understanding applicable tax laws and regulations. Accurate tax expense projections ensure compliance and provide a realistic assessment of future net income.

7. Profitability Metrics: Analyzing key profitability metrics, such as gross profit margin, operating profit margin, and net profit margin, provides insights into the overall financial health and sustainability of the business. These metrics offer benchmarks for evaluating the success of strategic initiatives and operational efficiency.

These interconnected components, when analyzed in a holistic manner, provide a dynamic and comprehensive picture of a company’s projected financial performance. This integrated approach to financial forecasting facilitates informed decision-making, strategic planning, and proactive adaptation to changing market conditions.

How to Create a Five-Year Pro Forma Income Statement

Developing a robust five-year pro forma income statement requires a systematic approach and careful consideration of key financial drivers. The following steps outline a structured process for creating this essential financial planning tool.

1: Gather Historical Financial Data: Begin by collecting historical financial statements, including income statements, balance sheets, and cash flow statements, for the past three to five years. This data serves as a foundation for projecting future performance.

2: Develop Revenue Projections: Project future revenue based on market analysis, historical trends, anticipated growth rates, and pricing strategies. Consider factors such as market size, competition, and economic conditions.

3: Forecast Cost of Goods Sold (COGS): Estimate future COGS based on historical cost data, anticipated changes in raw material prices, labor rates, and production efficiency. Accurate COGS projections are essential for calculating gross profit margins.

4: Project Operating Expenses: Forecast operating expenses, including selling, general, and administrative (SG&A) expenses, research and development (R&D), and marketing and advertising costs. Consider factors such as planned expansion, headcount growth, and marketing initiatives.

5: Estimate Depreciation and Amortization: Calculate depreciation expense for tangible assets and amortization expense for intangible assets based on their useful lives and applicable accounting methods. These non-cash expenses impact profitability projections.

6: Project Interest Expense: Estimate interest expense based on existing debt obligations and anticipated borrowing needs. Consider interest rates and repayment schedules.

7: Forecast Income Tax Expense: Project income tax expense based on projected pre-tax income and applicable tax rates. Consider potential changes in tax laws and regulations.

8: Calculate Profitability Metrics: Determine key profitability metrics, including gross profit margin, operating profit margin, and net profit margin. Analyze these metrics to assess the overall financial health and sustainability of the projected business performance.

9: Conduct Sensitivity Analysis: Test the impact of variations in key assumptions on projected financial outcomes. This analysis helps identify potential risks and opportunities associated with different scenarios, such as changes in sales growth rates, cost inflation, or market share. Regularly review and refine the pro forma statement as new information becomes available and market conditions evolve.

A well-constructed five-year pro forma income statement provides a dynamic roadmap for financial planning and decision-making. By systematically analyzing historical data, projecting future performance, and incorporating sensitivity analysis, businesses can gain valuable insights into their potential financial trajectory and make informed choices to enhance long-term success. Regular review and refinement of the pro forma statement ensure its ongoing relevance and contribute to a proactive and adaptable approach to financial management.

A well-constructed five-year projection offers a crucial tool for businesses seeking to understand their potential financial trajectory. By systematically projecting key financial figures, including revenue, expenses, and profitability, organizations gain valuable insights into potential challenges and opportunities. The process necessitates careful consideration of underlying assumptions regarding market conditions, operational efficiency, and growth strategies. Furthermore, sensitivity analysis allows for an assessment of the impact of variations in these assumptions, strengthening the decision-making process. A robust projection, grounded in realistic assumptions and rigorous analysis, empowers informed decisions regarding investments, pricing strategies, and resource allocation, ultimately contributing to long-term financial health and sustainability.

Effective financial planning requires a dynamic and adaptable approach. The insights gained from a comprehensive five-year projection provide a crucial foundation for navigating the complexities of the business environment. Regularly reviewing and refining the projection, incorporating new information and adjusting assumptions as needed, ensures its ongoing relevance and strengthens its value as a strategic planning tool. This proactive approach to financial management empowers organizations to anticipate potential challenges, capitalize on emerging opportunities, and make informed decisions that contribute to long-term success.