Utilizing this type of model offers numerous advantages, including improved forecasting accuracy, better-informed strategic planning, and enhanced communication with stakeholders. It facilitates scenario analysis, enabling businesses to evaluate the potential impact of different market conditions or business strategies on their overall financial health.

Further exploration will delve into the individual components of this financial framework and demonstrate practical applications for diverse business contexts.

1. Income Statement

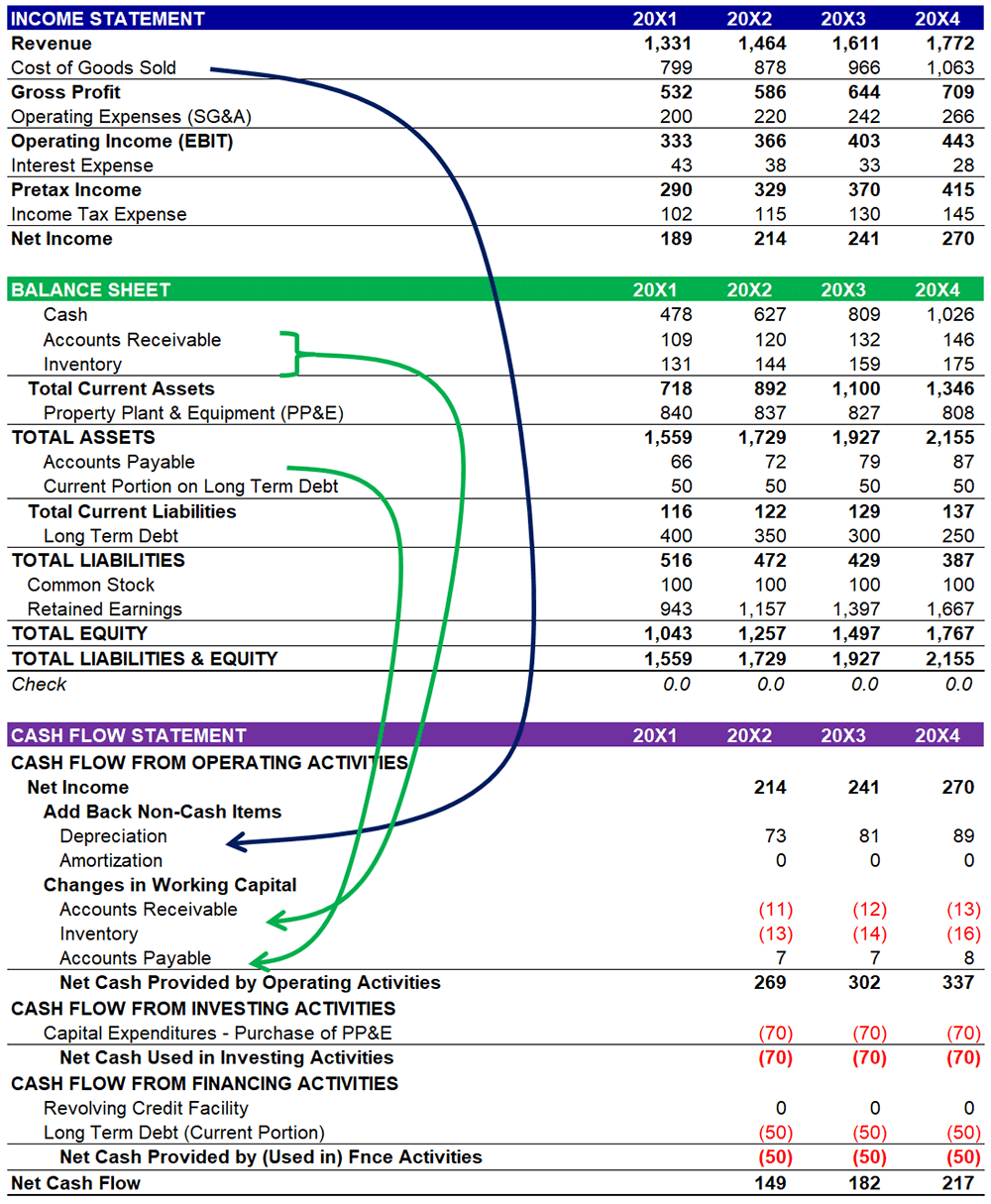

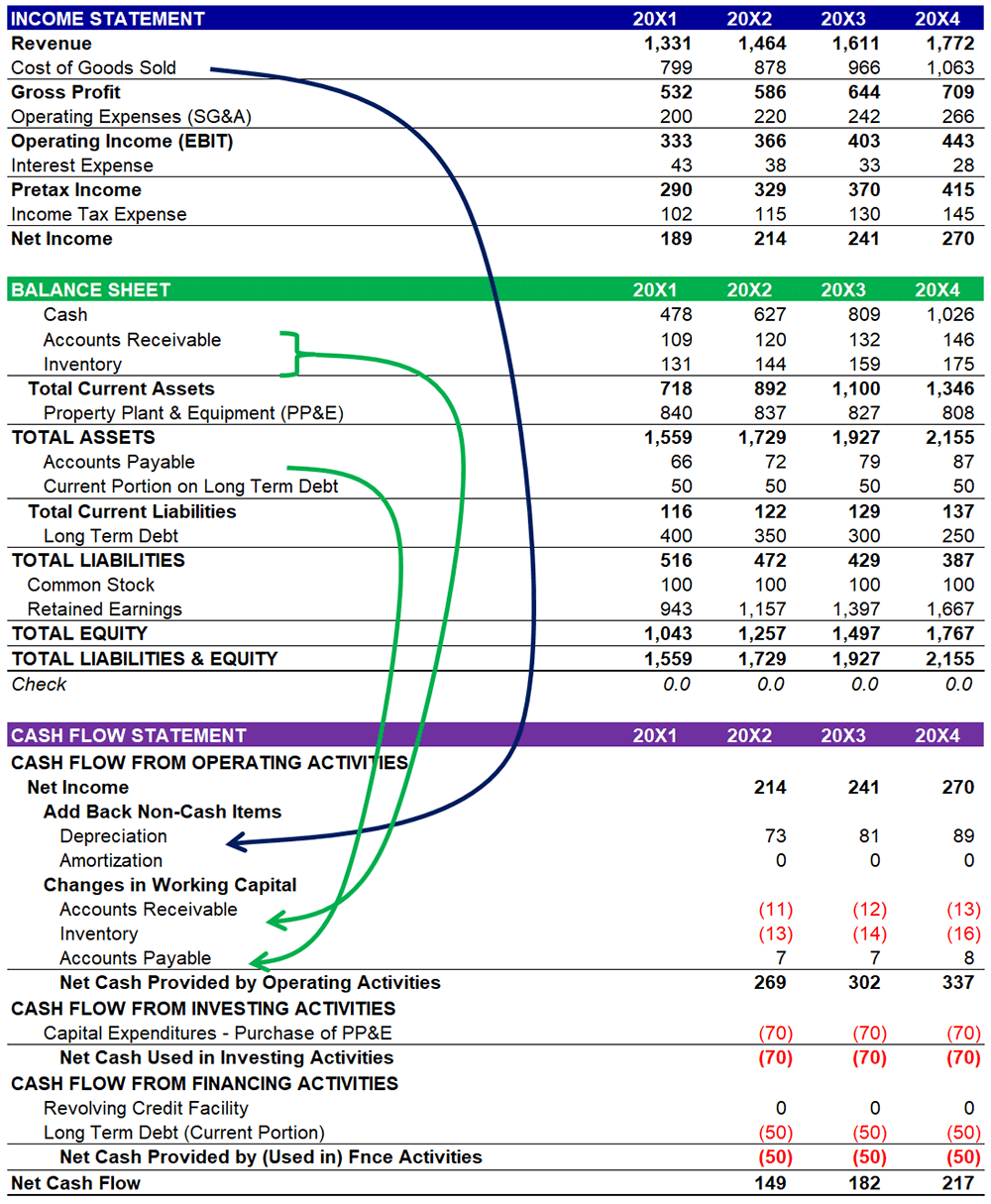

The income statement serves as a cornerstone within a streamlined financial model. It provides a detailed account of a company’s financial performance over a specific period, typically a quarter or a year. This statement outlines revenues generated, costs incurred, and the resulting profit or loss. Its importance lies in its ability to reveal operational efficiency and profitability trends, crucial factors for evaluating a company’s current financial health and projecting its future performance. For instance, a growing disparity between revenue and cost of goods sold could signal declining margins, prompting further investigation and potential corrective actions. This information flows directly into the other components of the model, impacting projected cash flows and balance sheet figures.

A key aspect of the income statement’s role within the model lies in its influence on other financial statements. Projected sales revenue from the income statement directly impacts the cash flow projection within the statement of cash flows. Profitability also influences retained earnings, a key component of the balance sheet’s equity section. Consider a scenario where a company projects significant sales growth. This increased revenue will translate into higher projected cash inflows from operations and a larger retained earnings balance, influencing both the cash flow statement and the balance sheet. This interconnectedness highlights the critical role the income statement plays in creating a dynamic and integrated financial model.

Understanding the income statement’s function within the broader financial model is essential for accurate forecasting and informed decision-making. Analyzing trends in revenue, costs, and profitability allows for the identification of potential challenges and opportunities. The income statement provides the foundational data required for robust scenario planning and strategic adjustments, contributing significantly to a comprehensive understanding of a company’s financial trajectory. This understanding then enables more informed resource allocation, strategic planning, and stakeholder communication, ultimately contributing to improved financial outcomes.

2. Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It details assets, liabilities, and equity, demonstrating the fundamental accounting equation: Assets = Liabilities + Equity. Within a streamlined financial model, the balance sheet plays a crucial role in illustrating the impact of operational performance and financing decisions on a company’s overall financial health. For example, an increase in accounts receivable, an asset, resulting from higher sales, must be balanced by a corresponding increase in either liabilities or equity. This could manifest as increased cash from sales, higher retained earnings due to profit, or a combination of both.

The balance sheet’s connection to other statements within the model highlights its dynamic nature. Retained earnings, a component of equity, are directly influenced by net income from the income statement. Financing activities, such as taking on debt or issuing equity, alter both the balance sheet’s liability and equity sections, while simultaneously impacting the cash flow statement. Consider a company investing in new equipment. This transaction increases assets (equipment) and is balanced by a decrease in assets (cash) if paid for outright, or an increase in liabilities if financed through a loan. This interconnectedness underscores the importance of understanding how operational decisions and financing strategies influence a company’s overall financial structure as reflected in the balance sheet.

Analyzing the balance sheet within the context of a streamlined financial model provides key insights into a company’s financial stability and risk profile. Key ratios derived from balance sheet data, such as the current ratio and debt-to-equity ratio, offer valuable perspectives on liquidity and leverage. These insights are essential for effective financial planning and decision-making. Furthermore, understanding the balance sheet’s dynamic relationship with the income statement and cash flow statement allows for a comprehensive assessment of a company’s financial performance and its implications for future growth and stability. This understanding is crucial for stakeholders to make informed decisions regarding investment, lending, and overall business strategy.

3. Cash Flow Statement

The cash flow statement completes the streamlined financial model by providing a detailed account of all cash inflows and outflows during a specific period. Unlike the income statement, which operates on an accrual basis, the cash flow statement focuses solely on cash transactions. This focus provides critical insights into a company’s liquidity and its ability to meet short-term and long-term obligations. Understanding cash flow is essential for assessing financial health and making informed decisions regarding investments, financing, and operations.

- Operating ActivitiesThis section details cash flows generated from the core business operations. It includes cash received from customers, cash paid to suppliers, and cash paid for operating expenses like salaries and rent. Analyzing operating cash flow reveals the efficiency of day-to-day operations in generating cash. For example, a consistent positive operating cash flow indicates a sustainable business model, while negative operating cash flow may signal underlying operational challenges. This information is crucial for evaluating the viability and sustainability of a business.

- Investing ActivitiesThis section tracks cash flows related to long-term investments. It includes purchases and sales of property, plant, and equipment (PP&E), as well as investments in other companies. Analyzing investing cash flows provides insights into a company’s growth strategy and capital allocation decisions. For instance, significant investments in PP&E might suggest expansion plans, while divesting assets could indicate a strategic shift. This data offers valuable context for understanding long-term strategic objectives.

- Financing ActivitiesThis section details cash flows related to financing the business. This includes proceeds from debt or equity issuance, repayment of debt, and dividend payments. Analyzing financing cash flows illuminates how a company raises capital and manages its financial structure. For example, an increase in debt might indicate expansion plans or financial difficulties, while share repurchases could suggest confidence in future profitability. This information offers a crucial perspective on the company’s financial strategy and risk profile.

- Net Change in CashThis crucial figure represents the overall change in a company’s cash balance during the reporting period. It is the sum of cash flows from operating, investing, and financing activities. This number offers a concise summary of how cash has been generated and utilized, providing a direct link to the cash balance presented on the balance sheet. Monitoring the net change in cash is essential for managing liquidity and ensuring the company’s ability to meet its financial obligations.

The cash flow statement, within the context of the streamlined financial model, provides crucial insights not readily apparent from the income statement or balance sheet. By analyzing the interplay between these three statements, a comprehensive understanding of a company’s financial performance, position, and liquidity emerges. This integrated perspective is essential for effective financial planning, strategic decision-making, and stakeholder communication, contributing to a more informed and robust assessment of a company’s overall financial health and future prospects.

4. Interconnectedness

Interconnectedness is the cornerstone of a streamlined financial model, linking the income statement, balance sheet, and cash flow statement into a cohesive and dynamic representation of a company’s financial activities. This interconnectivity stems from the fundamental relationships between these statements. For instance, net income from the income statement flows into retained earnings on the balance sheet and serves as a starting point for the cash flow statement’s operating activities section. Changes in working capital accounts, such as accounts receivable and inventory, link the income statement and balance sheet to the cash flow statement. Financing activities, like debt issuance or equity financing, impact both the balance sheet (liabilities and equity) and the cash flow statement (financing activities). This intricate web of relationships ensures that changes in one statement ripple through the others, reflecting the dynamic nature of financial operations. Without this interconnectedness, the model would offer a fragmented and static view, limiting its analytical and forecasting power.

Consider a scenario where a company experiences significant sales growth. This increase in revenue, reflected on the income statement, leads to higher net income, which in turn increases retained earnings on the balance sheet. Simultaneously, the increased sales activity may lead to higher accounts receivable on the balance sheet and impact cash flow from operations on the cash flow statement. Furthermore, if the company funds this growth through debt financing, both the balance sheet (increased liabilities) and the cash flow statement (cash inflow from financing) are affected. This example illustrates the cascading impact of a single operational change across all three statements, highlighting the critical importance of interconnectedness in providing a holistic view of financial performance.

Understanding the interconnectedness of these financial statements is paramount for effective financial analysis and forecasting. It allows for a more comprehensive and nuanced interpretation of a company’s financial health, enabling stakeholders to identify trends, evaluate the impact of operational decisions, and make informed strategic choices. Failure to recognize these interdependencies can lead to inaccurate projections and flawed decision-making. Recognizing this interconnectedness is crucial for developing robust financial models that accurately reflect the complexities of business operations and provide valuable insights for future planning and strategic execution.

5. Forecasting

Forecasting forms the core purpose of a streamlined financial model, leveraging the interconnectedness of the three statements to project future performance. By inputting assumptions about future sales, costs, and other key drivers, the model generates projected financial statements, offering insights into potential future outcomes. This forward-looking perspective is crucial for strategic planning, resource allocation, and informed decision-making.

- Revenue ProjectionsRevenue projections serve as the primary driver of a financial forecast. These projections, based on market analysis, historical trends, and anticipated growth rates, feed directly into the income statement, influencing projected profitability. Accurate revenue forecasting is crucial, as it impacts all other elements of the model. Overly optimistic revenue projections can lead to unrealistic expectations and misallocation of resources, while overly conservative projections can hinder growth opportunities. For example, a company projecting rapid market share growth might forecast substantial revenue increases, impacting projected profits, asset requirements, and financing needs.

- Expense ForecastingProjecting expenses is essential for accurate profitability forecasting. This involves analyzing historical cost trends, anticipating changes in input prices, and factoring in planned operational adjustments. Accurate expense forecasting ensures realistic profit margins and helps identify potential cost-saving opportunities. For example, a company anticipating rising raw material costs might project higher cost of goods sold, impacting projected gross profit and necessitating adjustments to pricing strategies or operational efficiencies.

- Cash Flow ProjectionsProjecting future cash flows is critical for assessing liquidity and financial stability. The model, driven by projected revenue and expenses, generates a projected cash flow statement, revealing potential cash surpluses or deficits. This information is crucial for managing working capital, planning investments, and securing financing. For instance, a company anticipating significant capital expenditures might project negative free cash flow, necessitating proactive measures to secure financing or adjust investment timelines.

- Scenario PlanningScenario planning enhances forecasting by exploring the potential impact of different assumptions and external factors. By adjusting key drivers, such as sales growth rates or interest rates, the model can generate alternative scenarios, providing insights into the potential range of future outcomes. This analysis helps businesses assess risk, identify opportunities, and develop contingency plans. For example, a company might model different economic scenarios (recession, moderate growth, rapid growth) to understand the potential impact on profitability, cash flow, and financing needs, allowing for more informed and adaptable strategic planning.

These forecasting elements, working in concert within the framework of a streamlined financial model, enable businesses to make informed decisions based on a dynamic and comprehensive understanding of potential future outcomes. The ability to project financial performance under various scenarios allows for proactive risk management, strategic adaptation, and optimized resource allocation, enhancing the likelihood of achieving financial objectives and ensuring long-term sustainability.

Key Components of a Streamlined Financial Model

A robust financial model hinges on the interplay of key components, each contributing to a comprehensive understanding of a company’s financial position and potential future performance. The following elements are essential for constructing and interpreting such a model effectively.

1. Income Statement: The income statement presents a company’s financial performance over a specific period, detailing revenues, expenses, and resulting profit or loss. This statement reveals operational efficiency and profitability trends.

2. Balance Sheet: The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It outlines assets, liabilities, and equity, illustrating the fundamental accounting equation (Assets = Liabilities + Equity).

3. Statement of Cash Flows: The statement of cash flows tracks all cash inflows and outflows during a specific period, categorized into operating, investing, and financing activities. This statement offers insights into a company’s liquidity and cash management practices.

4. Interconnections: The interconnected nature of these three statements is paramount. Changes in one statement directly affect the others, creating a dynamic and integrated model. For example, net income from the income statement flows to the balance sheet and the cash flow statement.

5. Assumptions and Drivers: Underlying a financial model are key assumptions and drivers, such as sales growth rates, cost structures, and capital expenditure plans. These inputs influence projected outcomes and allow for scenario analysis.

6. Forecasting: Financial models facilitate forecasting future performance by projecting financial statements based on the interplay of historical data, assumptions, and key drivers. This forward-looking perspective is essential for strategic planning.

7. Scenario Analysis: By adjusting key assumptions and drivers, financial models enable scenario planning. This allows businesses to assess the potential impact of different market conditions or strategic decisions on future performance.

These elements combine to create a powerful tool for financial analysis, planning, and decision-making. A well-constructed model provides a comprehensive and dynamic view of a company’s financial health, enabling informed assessments of current performance and projections of future outcomes.

How to Create a Streamlined Financial Model

Building a streamlined financial model involves a structured approach, linking the income statement, balance sheet, and cash flow statement. The following steps outline the process:

1. Historical Data Collection: Gather historical financial data for at least three years, including income statements, balance sheets, and cash flow statements. This data forms the foundation for identifying trends and making informed projections.

2. Key Driver Identification: Identify the key drivers of the business, such as sales growth, cost of goods sold, and operating expenses. These drivers will be crucial for forecasting future performance.

3. Income Statement Projection: Project future revenues and expenses based on historical trends, market analysis, and assumptions about key drivers. This projection forms the basis for the other two statements.

4. Balance Sheet Projection: Project balance sheet items, such as accounts receivable, inventory, and fixed assets, based on the income statement projections and assumptions about working capital management and capital expenditures.

5. Cash Flow Statement Projection: Project cash flows from operating, investing, and financing activities based on the income statement and balance sheet projections. This statement provides crucial insights into liquidity and funding needs.

6. Interconnections: Ensure the three statements are interconnected. Net income from the income statement flows to retained earnings on the balance sheet and the cash flow statement. Changes in working capital from the balance sheet affect the cash flow statement. Financing activities impact both the balance sheet and cash flow statement.

7. Scenario Planning: Develop different scenarios by adjusting key assumptions and drivers. This allows for an assessment of the potential impact of various market conditions or strategic decisions on future performance.

8. Sensitivity Analysis: Conduct sensitivity analysis to identify which assumptions and drivers have the most significant impact on the model’s outputs. This helps prioritize areas for further analysis and refinement.

By following these steps, one can construct a robust model offering a dynamic view of a company’s financial position and potential future outcomes, facilitating informed decision-making and strategic planning.

Streamlined financial models, composed of interconnected income statements, balance sheets, and statements of cash flows, provide a crucial framework for understanding and projecting financial performance. Constructing such models requires careful consideration of historical data, key business drivers, and relevant assumptions. Through the interplay of these elements, these models facilitate forecasting, scenario planning, and sensitivity analysis, offering valuable insights into potential future outcomes under various conditions. A robust model allows for informed decision-making regarding resource allocation, strategic planning, and risk management.

Mastering this type of financial modeling empowers organizations to navigate complex financial landscapes with greater clarity and foresight. Its utility extends beyond mere numerical projections, offering a dynamic tool for strategic thinking and informed action. As business environments become increasingly complex and volatile, the ability to model and analyze financial outcomes becomes not just beneficial but essential for sustained success and resilience. A deep understanding of these interconnected financial statements provides a crucial foundation for informed financial management and strategic leadership.