A standardized document provided by a specific financial institution allows customers to review their transaction history, balances, and other account details over a defined period. This document serves as an official record of account activity and can be used for various purposes, such as budgeting, financial planning, and tax reporting.

Access to this organized financial record offers several advantages. It enables users to monitor spending patterns, identify potential errors or discrepancies, and track account growth. Having a readily available record also simplifies financial management and facilitates informed financial decisions. Furthermore, these documents can be crucial for resolving disputes, substantiating transactions, and providing necessary documentation for loan applications or other financial processes.

Understanding the structure and content of these documents is essential for effective financial management. The following sections will explore how to access and interpret these records, along with tips for utilizing the information for improved financial well-being.

1. Account Summary

The account summary within a bank statement template provides a concise overview of key account information, allowing for quick comprehension of financial standing. This section serves as an initial point of reference for understanding overall account activity during the statement period.

-

Beginning and Ending Balances

Displayed prominently, these figures represent the account’s value at the start and end of the statement period. The difference between these balances reflects the net change in funds due to transactions and accrued interest. For example, a higher ending balance than the beginning balance indicates a net gain in funds. This data is crucial for tracking financial progress and spotting irregularities.

-

Total Deposits and Withdrawals

These summarized figures offer a quick overview of the total funds added to and subtracted from the account. They provide insights into overall cash flow and spending habits. High withdrawal totals might prompt a review of spending patterns, while significant deposit totals can indicate effective savings strategies.

-

Interest Earned (if applicable)

For interest-bearing accounts, this section displays the total interest accrued during the statement period. This information is essential for tracking investment growth and understanding the impact of compound interest. The interest earned contributes to the overall change in account balance.

-

Account Number and Statement Date

Clearly identifying the specific account and the period covered, these details ensure proper record-keeping and facilitate accurate reconciliation. The account number confirms the specific account being reviewed, while the statement date defines the exact timeframe the information pertains to. These details are essential for accurate filing and retrieval.

By presenting these key figures concisely, the account summary within a bank statement template allows for efficient assessment of financial health. Understanding these components is fundamental for leveraging the information contained within the statement for informed financial decision-making.

2. Transaction Details

Transaction details comprise the core of a bank statement, providing a chronological record of all account activities within a given period. This section offers a granular view of financial behavior, enabling users to understand cash flow, identify specific transactions, and reconcile balances. Accurate and detailed transaction records are crucial for effective financial management and dispute resolution.

-

Transaction Date

Each transaction is timestamped with the exact date it occurred. This chronological order allows for easy tracking of spending and income patterns over time. Understanding the timing of transactions can be vital for budgeting, expense tracking, and identifying potential unauthorized activity.

-

Transaction Description

A brief description accompanies each transaction, providing context and identifying the nature of the activity. Descriptions may include merchant names, ATM locations, or transfer details. These descriptions facilitate easy recognition of transactions and aid in categorizing expenses for budgeting or tax purposes.

-

Debit and Credit Amounts

Debits represent funds leaving the account (e.g., purchases, withdrawals), while credits represent funds entering the account (e.g., deposits, transfers). These amounts are clearly displayed alongside each transaction, providing a precise record of how funds have moved within the account. Accurate debit and credit entries ensure the integrity of the account balance.

-

Running Balance

The running balance reflects the account balance after each transaction is processed. This dynamic record allows users to track the impact of each transaction on their available funds. Monitoring the running balance helps prevent overdrafts and provides a real-time view of account health.

Comprehensive transaction details within a bank statement template empower users to gain a deep understanding of their financial activities. This detailed record serves as a cornerstone of financial management, facilitating accurate budgeting, informed decision-making, and effective dispute resolution. By meticulously documenting each transaction, the statement provides a reliable record of financial activity essential for maintaining financial well-being.

3. Period Covered

The “Period Covered” within a bank statement template defines the precise timeframe for the reported financial activity. This defined timeframe is crucial for accurate reconciliation, financial analysis, and record-keeping. A clearly stated period allows users to correlate transactions with specific events, facilitating budgeting, tax preparation, and financial planning. For example, a statement covering January 1st to January 31st will exclusively contain transactions processed within that month. This specific timeframe is essential for accurate financial reporting and analysis. Mismatched or unclear periods can lead to confusion and inaccuracies in financial assessments.

The period covered serves several critical functions within a bank statement. It enables users to track spending patterns within specific timeframes, identify recurring expenses, and analyze financial progress. For businesses, the defined period aligns with accounting cycles, facilitating accurate financial reporting. For individuals, the period allows for targeted budget analysis and financial goal tracking. For instance, reviewing a statement covering the holiday season can provide insights into spending habits during that period. Comparing periods across multiple statements reveals trends and informs future financial decisions. Without a clearly defined period, the information within the statement loses its contextual relevance.

Accurate interpretation and utilization of the “Period Covered” are essential for maximizing the value of a bank statement. Understanding this element allows for precise financial analysis, informed decision-making, and effective record-keeping. Challenges can arise if the stated period is not consistent with expectations or if records are needed outside the specified timeframe. In such cases, contacting the financial institution to request statements covering different periods is necessary. Ultimately, the “Period Covered” acts as a crucial lens through which financial activity is viewed, providing context and enabling accurate interpretation of the information within the bank statement.

4. Contact Information

Contact information provided on a bank statement template facilitates communication between the financial institution and the account holder. This readily accessible information is crucial for addressing inquiries, reporting discrepancies, or seeking assistance with account-related matters. The availability of contact information ensures timely resolution of potential issues and fosters a transparent relationship between the bank and its customers. Clear and accurate contact details are essential for maintaining effective communication and ensuring prompt resolution of any financial concerns.

-

Customer Service Phone Number

The customer service phone number provides a direct line of communication for general inquiries, account-specific questions, or reporting suspicious activity. This readily available resource enables customers to quickly address concerns and receive prompt assistance. For instance, if a transaction appears unauthorized, contacting customer service immediately can help mitigate potential losses.

-

Mailing Address

The provided mailing address allows for formal written communication with the bank. This channel is typically used for official correspondence, submitting documentation, or addressing complex issues that require detailed explanation. For example, submitting a formal dispute regarding a transaction often requires written communication to the provided address.

-

Website Address

The bank’s website address offers access to online banking services, account management tools, and additional resources. This online platform often provides FAQs, electronic statement access, and secure messaging features for convenient account management. Accessing the website can provide quick answers to common questions and streamline various banking tasks.

-

Branch Address (if applicable)

For customers who prefer in-person banking, the branch address listed on the statement directs them to the nearest physical location. This allows for face-to-face interaction with bank representatives for personalized assistance with complex transactions or account inquiries. Visiting a branch can be beneficial for services requiring physical presence, such as depositing cash or opening a new account.

The inclusion of comprehensive contact information on bank statements underscores the importance of clear communication channels between financial institutions and their customers. This accessibility fosters trust and empowers account holders to effectively manage their finances. The strategic placement of this information on the statement ensures that assistance is readily available when needed, contributing to a positive banking experience and efficient resolution of any financial concerns. This ultimately strengthens the relationship between the customer and the financial institution.

5. Security Features

Security features within a bank statement template are crucial for verifying authenticity and protecting against fraud. These measures safeguard sensitive financial information from unauthorized access and manipulation, ensuring the integrity of the document and maintaining customer trust. Implementing robust security features is essential for mitigating risks associated with identity theft and financial fraud. These features contribute to a secure banking environment and provide customers with confidence in the validity of their financial records.

-

Watermarks

Embedded within the paper, watermarks are faint designs visible when held against light. These subtle markings are difficult to replicate, serving as a primary defense against counterfeiting. The presence of a watermark provides visual verification of the document’s legitimacy, deterring fraudulent reproduction and enhancing the trustworthiness of the bank statement.

-

Microprinting

Microprinting involves incorporating extremely small text, often illegible to the naked eye, into the statement design. This technique makes reproduction difficult using standard copying methods, adding another layer of protection against forgery. Examining the microprinting with a magnifying glass reveals specific details, further confirming the document’s authenticity.

-

Security Inks

Specialized inks, often reactive to UV light or containing color-shifting properties, are used in printing specific elements of the statement. These inks react differently under various lighting conditions, making alterations readily apparent. This feature provides a quick visual check for tampering and reinforces the security of the document.

-

Unique Document Numbers

Each bank statement is assigned a unique identifying number, linking it to a specific account and statement period. This individual numbering system allows for precise tracking and verification of each document, deterring unauthorized duplication. The unique number also facilitates efficient record-keeping and retrieval of specific statements.

The incorporation of these security features within bank statement templates demonstrates a commitment to protecting sensitive financial information. These measures work in concert to create a secure and reliable document, mitigating the risk of fraud and maintaining customer confidence in the integrity of their financial records. Regularly reviewing bank statements for these security features reinforces awareness of these protective measures and promotes proactive fraud prevention.

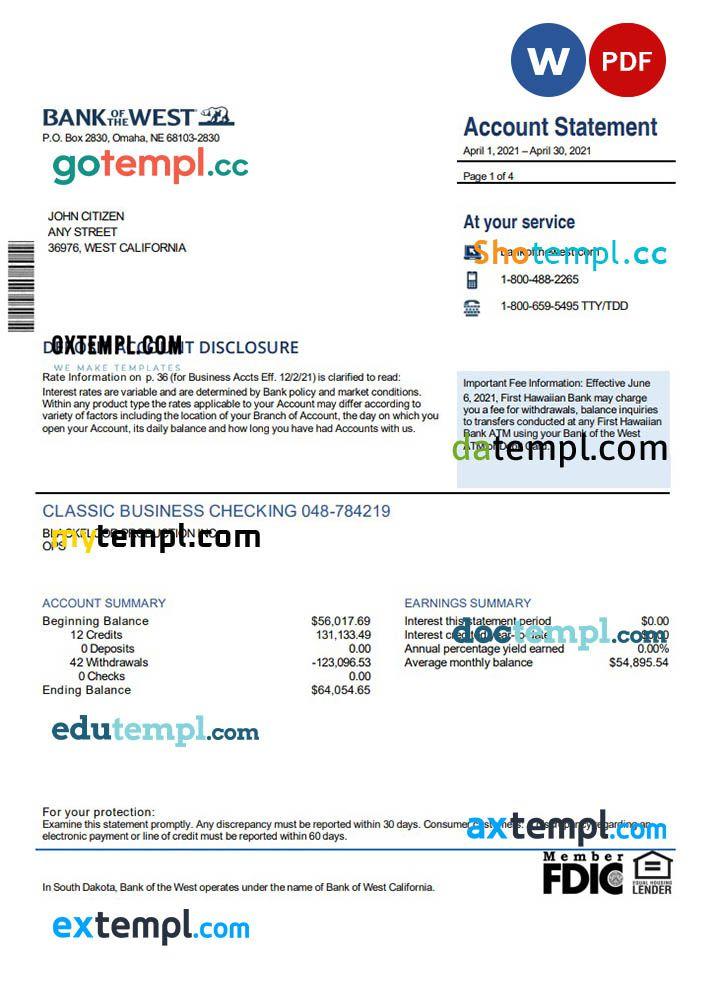

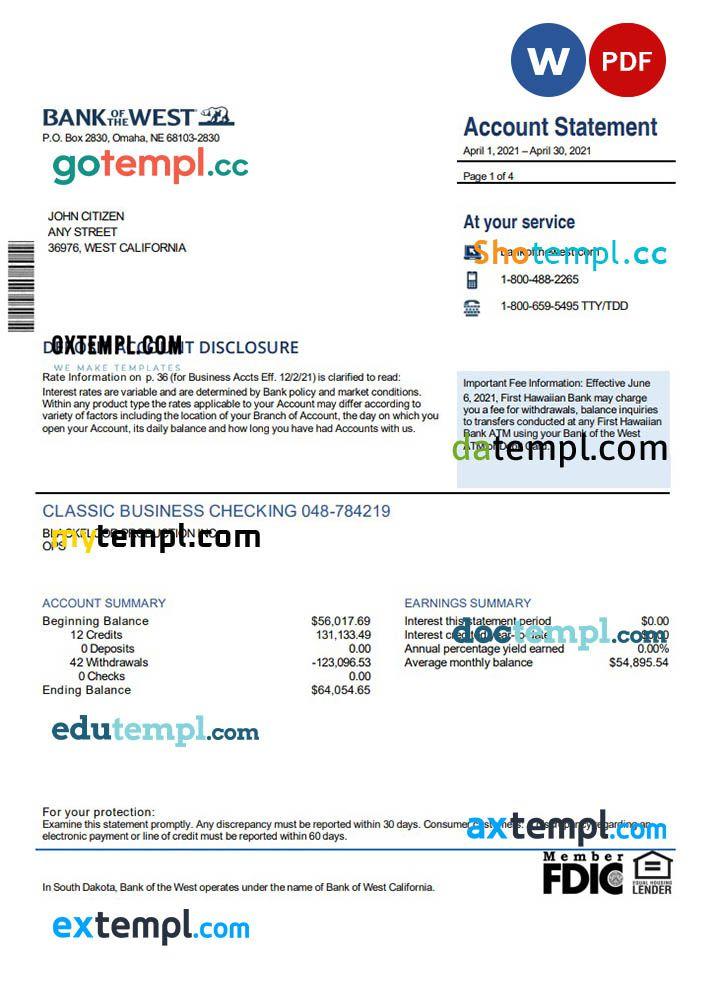

Key Components of a Bank of the West Bank Statement Template

Understanding the structure and content of a Bank of the West bank statement template is crucial for effective financial management. The following components provide a framework for interpreting the information presented within these documents.

1. Account Information: This section identifies the specific account, including the account number, account type (e.g., checking, savings), and customer name. This information ensures clarity and allows for accurate identification of the relevant financial records.

2. Statement Period: The statement period specifies the exact timeframe the document covers, typically one month. This defined period is essential for reconciling transactions and tracking financial activity within a specific timeframe.

3. Account Summary: Provides a snapshot of key financial data, including beginning and ending balances, total deposits and withdrawals, and any interest earned. This overview offers a quick assessment of account activity during the statement period.

4. Transaction Details: This section forms the core of the statement, listing individual transactions chronologically. Each entry includes the transaction date, description, amount, and running balance. This detailed record allows for meticulous tracking of all financial activities.

5. Fees and Charges: Any applicable fees or charges, such as monthly maintenance fees or overdraft charges, are clearly itemized in this section. Understanding these charges is essential for accurate budgeting and financial planning.

6. Contact Information: Provides contact details for the financial institution, including customer service phone numbers, mailing address, and website. This information enables account holders to address inquiries or report discrepancies promptly.

Careful review of these components enables accurate interpretation of bank statements and facilitates informed financial decision-making. Understanding the information presented within these documents empowers individuals to effectively manage their finances and maintain a clear overview of their financial health.

How to Create a Bank Statement Template (Generic Example)

Creating a generalized bank statement template requires careful consideration of essential components to ensure accurate representation of financial activity. While replicating a specific bank’s format precisely requires access to their proprietary design, a generic template can be constructed for educational or illustrative purposes.

1. Software Selection: Select appropriate software for template creation. Spreadsheet applications (e.g., Microsoft Excel, Google Sheets) or word processing software (e.g., Microsoft Word, Google Docs) offer sufficient functionality. Spreadsheet software is generally preferred for its calculation capabilities.

2. Header Section: Designate a header area to include essential identifying information. This section should contain placeholders for the financial institution’s name and logo, as well as the customer’s name and account number.

3. Statement Period: Clearly define the statement period with designated fields for the starting and ending dates. This ensures accurate representation of the timeframe covered by the statement.

4. Account Summary Table: Create a table to summarize key account details. Include rows for beginning balance, total deposits, total withdrawals, interest earned (if applicable), and ending balance. Formulas can be incorporated within spreadsheet software to calculate totals and balance changes automatically.

5. Transaction Details Table: Develop a detailed transaction table with columns for transaction date, description, debit amount, credit amount, and running balance. In spreadsheet software, formulas can be used to calculate the running balance automatically based on debits and credits.

6. Fees and Charges Section: Designate an area to itemize any applicable fees or charges. This section can be a separate table or incorporated into the transaction details section.

7. Contact Information: Include a footer section with contact information for the financial institution. This typically includes a customer service phone number, mailing address, and website address.

8. Disclaimer: Add a disclaimer stating that the template is a generic example and may not precisely match the format of an official bank statement. This is particularly important if the template is intended for educational use.

Meticulous design and accurate inclusion of these elements will result in a functional bank statement template suitable for illustrative purposes. This template can be further customized and adapted based on specific needs, such as for educational materials, budgeting exercises, or software development.

Careful examination of a financial institution’s statement template reveals its importance as a comprehensive record of account activity. Key elements like the account summary, transaction details, period covered, contact information, and security features contribute to its value as a financial management tool. Understanding these components empowers individuals to track spending, identify discrepancies, and make informed financial decisions. Moreover, recognizing the security features embedded within these documents helps protect against fraud and ensures the integrity of financial records.

Effective financial management hinges on accurate record-keeping and diligent analysis. Regular review of bank statements provides valuable insights into financial behavior, enabling proactive adjustments and informed decision-making. Leveraging these records contributes to improved financial well-being and fosters a greater sense of financial control. Ultimately, understanding and utilizing the information provided within bank statements are essential steps toward achieving long-term financial stability and success.