Utilizing a pre-designed format offers several advantages. It promotes transparency and accountability by providing a standardized framework for reporting financial activity. This consistency simplifies internal analysis, allowing organizations to track trends and identify areas for improvement. Furthermore, a clear, concise financial overview aids in securing funding from donors and grant providers who require evidence of responsible financial management. Standardized reporting also simplifies compliance with regulatory requirements and facilitates external audits.

This overview serves as a foundation for a more detailed exploration of key aspects of financial reporting for non-profit entities. Subsequent sections will delve into specific components of this crucial financial document, offering practical guidance and best practices for its preparation and interpretation.

1. Revenues

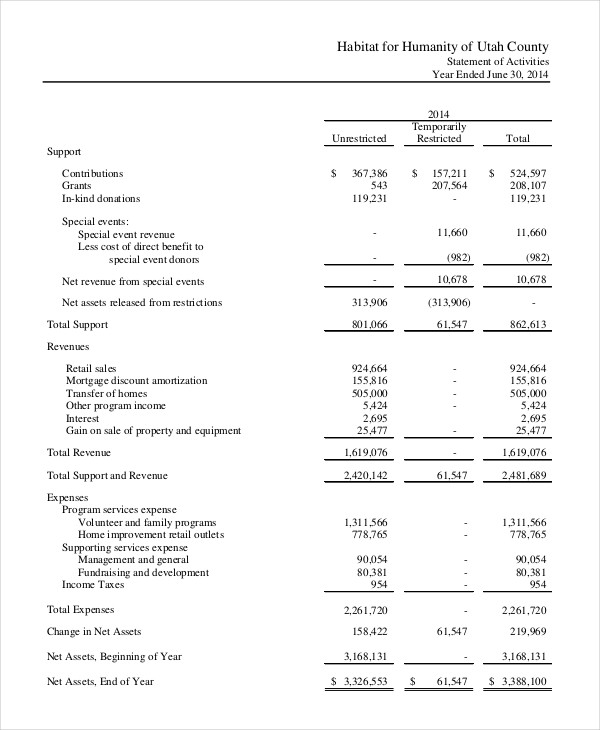

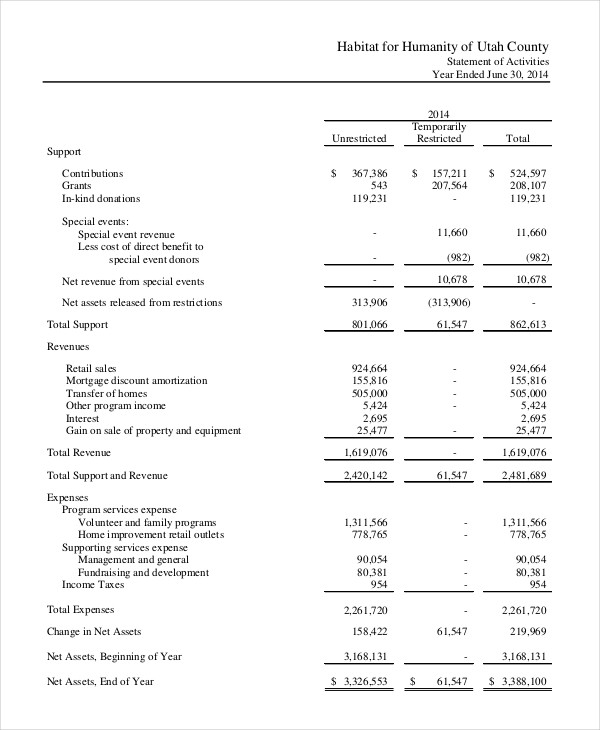

Accurate revenue reporting is fundamental to a credible non-profit income statement. A clear understanding of revenue sources and their proper categorization is essential for demonstrating financial health and accountability to stakeholders. This section explores key facets of revenue reporting within the context of a non-profit financial statement.

- ContributionsContributions, often the primary revenue source for non-profits, encompass donations from individuals, corporations, and foundations. These can be unrestricted, allowing flexible use, or temporarily or permanently restricted for specific programs or purposes. Accurate recording and classification of contributions are crucial for compliance and demonstrating responsible resource allocation.

- GrantsGrants, typically awarded by government agencies or private foundations, provide funding for specific projects or programs. Revenue recognition for grants often follows specific guidelines depending on the grant terms and applicable accounting standards. Detailed tracking of grant revenue and related expenses is essential for demonstrating compliance with grant requirements.

- Program Service RevenueProgram service revenue represents income generated through activities directly related to the organization’s mission. Examples include fees for services, membership dues, or tuition. This revenue stream demonstrates the organization’s ability to generate income through its core activities and contributes to financial sustainability.

- Investment IncomeInvestment income, derived from investments in securities or other assets, can supplement other revenue sources. This category includes interest, dividends, and realized or unrealized gains from investments. Proper reporting of investment income is crucial for transparency and reflecting the overall financial performance of the organization.

Careful categorization and reporting of these revenue streams within a standardized template ensure a clear and accurate representation of an organization’s financial position. This transparency strengthens stakeholder trust and contributes to effective financial management.

2. Expenses

Accurate and detailed expense reporting is crucial for the integrity of a non-profit income statement template. Expenses reflect the resources consumed in pursuing the organization’s mission and supporting its operations. A clear understanding of expense categories and their relationship to the overall financial picture is essential for effective management and informed decision-making. Categorizing expenses provides insights into resource allocation, program effectiveness, and administrative efficiency. For instance, high fundraising expenses relative to donations raised might indicate a need to reassess fundraising strategies. Similarly, comparing program expenses to the outcomes achieved helps evaluate program impact and cost-effectiveness.

Several key expense categories typically appear within a non-profit income statement template. Program services expenses represent the direct costs associated with delivering programs and services aligned with the organization’s mission. Examples include salaries of program staff, materials, and facility costs directly attributable to program delivery. Administrative expenses encompass the costs of supporting functions such as management, finance, and human resources. These costs ensure the smooth operation of the organization and support its program activities. Fundraising expenses represent the resources invested in securing donations and grants. These might include the costs of fundraising events, marketing materials, and staff dedicated to fundraising efforts.

Careful tracking and categorization of these expenses within the template provide a comprehensive view of resource utilization. This detailed information facilitates internal analysis, enabling organizations to identify areas for potential cost savings, improve budget planning, and demonstrate responsible stewardship of resources to funders and stakeholders. Furthermore, accurate expense reporting is essential for compliance with regulatory requirements and for maintaining public trust. By providing a clear picture of how resources are utilized, non-profit organizations demonstrate their commitment to transparency and accountability.

3. Gains/Losses

Gains and losses represent changes in net assets not resulting from core operations or contributions. Within a non-profit income statement template, these items offer crucial insights into an organization’s financial activities beyond its primary mission-driven work. They often arise from peripheral transactions, such as the sale of investments or fixed assets, or from unexpected events like natural disasters or significant fluctuations in investment values. Properly accounting for gains and losses is essential for presenting a complete and accurate financial picture. For example, the sale of a donated building at a price exceeding its book value would be recorded as a gain, increasing net assets. Conversely, an unanticipated loss from a cyberattack impacting IT infrastructure would be recorded as a loss, decreasing net assets.

The inclusion of gains and losses in the non-profit income statement template allows stakeholders to understand the full scope of financial activity. While contributions and program service revenue often form the core revenue streams, gains and losses reflect the impact of financial decisions and external factors on the organization’s overall financial health. Distinguishing these items from operational revenues and expenses provides a more granular understanding of financial performance. For instance, a significant gain from an investment sale might offset operational deficits, but relying solely on such gains for long-term sustainability could be problematic. Understanding the nature and source of gains and losses enables informed decision-making regarding resource allocation and risk management. Analyzing trends in gains and losses over time can also reveal potential vulnerabilities or opportunities for improvement in financial strategies.

Accurately reporting gains and losses reinforces transparency and accountability. By providing a clear picture of all financial impacts, organizations demonstrate responsible financial management and build trust with stakeholders. This detailed reporting also facilitates compliance with regulatory requirements and aids in external audits. Regularly reviewing and analyzing gains and losses provides valuable information for strategic planning, allowing organizations to adapt to changing financial circumstances and ensure long-term financial stability.

4. Net Assets

Net assets represent the residual value of a non-profit organization’s assets after deducting its liabilities. Within a non-profit income statement template, net assets serve as a crucial indicator of financial health and sustainability. Understanding the composition and changes in net assets provides valuable insights into an organization’s financial position and its ability to fulfill its mission. Changes in net assets reflect the overall impact of revenues, expenses, gains, and losses during a specific reporting period. Analyzing these changes helps stakeholders assess the organization’s financial performance and its capacity to meet future obligations.

- Unrestricted Net AssetsUnrestricted net assets represent funds available for use at the discretion of the governing board. These funds are not subject to donor-imposed restrictions and can be used for any purpose consistent with the organization’s mission. Examples include general donations, unrestricted investment income, and revenue from program services. Growth in unrestricted net assets typically indicates a healthy financial position and provides flexibility in responding to changing needs or pursuing new opportunities.

- Temporarily Restricted Net AssetsTemporarily restricted net assets are subject to donor-imposed stipulations that limit their use for a specific period or purpose. For example, a grant designated for a particular research project or a donation earmarked for a capital campaign falls under this category. These restrictions expire either with the passage of time or the fulfillment of the specified purpose. The release of temporary restrictions is reflected in the statement of activities, showing the reclassification of these assets to unrestricted net assets.

- Permanently Restricted Net AssetsPermanently restricted net assets are subject to donor-imposed stipulations that permanently limit their use. Typically, these restrictions involve endowments, where the principal is preserved, and only the investment income generated can be used for designated purposes. These assets provide a long-term source of funding but limit flexibility in resource allocation. Proper management and reporting of permanently restricted net assets demonstrate adherence to donor intent and ensure the preservation of these funds for future generations.

- Change in Net AssetsThe change in net assets during a reporting period represents the combined impact of revenues, expenses, gains, and losses. A positive change indicates an increase in the organization’s overall financial resources, while a negative change reflects a decrease. Analyzing the change in net assets provides valuable insights into the organization’s financial performance and sustainability. Tracking this change over multiple reporting periods helps identify trends and inform strategic financial planning.

The various categories of net assets provide a comprehensive view of an organization’s financial resources and their availability for different purposes. Within the non-profit income statement template, the presentation of net assets and their changes offers crucial information for stakeholders to assess the organization’s financial health, sustainability, and adherence to donor restrictions. This transparent reporting strengthens accountability and fosters trust with funders, beneficiaries, and the public. Careful management of net assets is essential for long-term financial stability and the effective fulfillment of the organization’s mission.

5. Reporting Period

The reporting period defines the timeframe covered by a non-profit income statement template. This defined timeframe provides a snapshot of an organization’s financial performance during a specific duration. Selecting an appropriate reporting period is crucial for accurate analysis, trend identification, and informed decision-making. A clear understanding of the reporting period’s implications is essential for interpreting the financial data presented within the template.

- Fiscal YearMany non-profits operate on a fiscal year that aligns with their programmatic cycle or funding schedules, rather than the calendar year. A fiscal year consists of 12 consecutive months and provides a consistent timeframe for evaluating year-over-year performance. Using a consistent fiscal year across multiple reporting periods enables meaningful comparisons and trend analysis. For instance, a non-profit focused on academic programs might use a fiscal year aligned with the academic calendar, while an organization receiving government funding might align its fiscal year with the government’s fiscal year.

- Interim ReportingIn addition to annual reporting, many organizations utilize interim reporting periods, such as quarterly or monthly statements. These shorter timeframes provide more frequent insights into financial performance, allowing for timely adjustments and more proactive management. Interim reporting is particularly valuable for tracking progress towards budgetary goals, identifying potential financial challenges early on, and making necessary course corrections throughout the year. For example, a significant drop in donations in one quarter might prompt an organization to reassess its fundraising strategy.

- Comparison Across PeriodsAnalyzing financial data across multiple reporting periods is essential for identifying trends and assessing long-term financial health. Consistent reporting periods facilitate meaningful comparisons, allowing stakeholders to understand how performance has evolved over time. Comparing income statements across multiple fiscal years allows for analysis of revenue growth, expense management, and overall financial stability. For instance, consistent growth in program service revenue over several years might indicate successful program expansion and increasing impact.

- Impact of Reporting Period ChoiceThe choice of reporting period can significantly influence the interpretation of financial data. Shorter reporting periods, while providing more frequent updates, may not capture the full impact of seasonal fluctuations or long-term projects. Conversely, longer reporting periods might obscure short-term variations and impede timely responses to emerging financial challenges. Choosing a reporting period aligned with the organization’s operational cycle and strategic goals is essential for accurate and meaningful financial analysis.

The reporting period serves as a crucial framework for understanding the financial information presented within a non-profit income statement template. Selecting and consistently applying appropriate reporting periods facilitates accurate analysis, trend identification, and informed decision-making. This clear delineation of timeframes contributes to transparency and strengthens accountability by providing stakeholders with a consistent and meaningful view of the organization’s financial performance.

6. Template Format

Template format plays a crucial role in the efficacy of a non-profit income statement. A standardized structure ensures consistency, comparability, and clarity, facilitating informed decision-making by stakeholders. A well-designed template guides the systematic presentation of financial data, promoting transparency and accountability. This structured approach enables efficient analysis of revenue streams, expense allocation, and overall financial performance. For instance, a template might group related expenses, such as program services or administration, allowing for quick assessment of resource allocation. Consistent formatting across multiple reporting periods allows for trend analysis, enabling stakeholders to track changes in revenue, expenses, and net assets over time. This historical perspective informs strategic planning and resource allocation decisions.

Several key benefits arise from utilizing a standardized template. Comparability across different non-profit organizations becomes easier, allowing for benchmarking and sector analysis. A consistent format simplifies external audits and ensures compliance with regulatory reporting requirements. Internally, a standardized template streamlines the process of preparing financial statements, reducing the risk of errors and improving efficiency. Moreover, a clear and accessible format enhances understanding for board members, donors, and other stakeholders who may not have specialized financial expertise. For example, a template that clearly separates restricted and unrestricted net assets can enhance donor confidence by demonstrating responsible management of restricted funds.

Standardized templates offer significant advantages for non-profit financial reporting. Consistency, comparability, and clarity enhance transparency and accountability, contributing to informed decision-making and effective resource management. A well-chosen template simplifies internal processes, facilitates external audits, and promotes understanding among diverse stakeholders. Ultimately, a robust template format strengthens the credibility and trustworthiness of non-profit financial reporting, fostering confidence among donors, beneficiaries, and the broader community.

Key Components of a Non-Profit Income Statement Template

A comprehensive understanding of the key components within a non-profit income statement template is essential for effective financial management and transparent reporting. These components provide a structured overview of an organization’s financial activities, enabling stakeholders to assess its performance and sustainability.

1. Revenues: This section details all income generated by the organization, including contributions, grants, program service revenue, and investment income. Proper categorization of revenue streams is crucial for demonstrating financial health and responsible resource allocation.

2. Expenses: Expenses represent resources consumed in pursuing the organization’s mission and operations. Categorizing expenses, such as program services, administration, and fundraising, provides insights into resource utilization and efficiency.

3. Gains/Losses: Gains and losses reflect changes in net assets unrelated to core operations. These items offer insights into the impact of financial decisions and external factors on the overall financial picture.

4. Net Assets: Net assets represent the residual value of assets after deducting liabilities. Understanding the composition and changes in net assets, including unrestricted, temporarily restricted, and permanently restricted categories, is critical for assessing financial health and sustainability.

5. Reporting Period: The reporting period defines the timeframe covered by the statement, whether a fiscal year or interim periods. A clearly defined reporting period ensures consistency and allows for meaningful comparisons across different timeframes.

6. Template Format: A standardized template format ensures consistency, clarity, and comparability, facilitating efficient analysis and informed decision-making. A well-designed template promotes transparency and strengthens accountability.

These interconnected components provide a holistic view of a non-profit’s financial activities. Accurate and consistent reporting within this structured framework enables informed decision-making, strengthens accountability, and fosters trust with stakeholders.

How to Create a Non-Profit Income Statement Template

Creating a robust template ensures consistent and accurate financial reporting for non-profit organizations. A well-structured template facilitates informed decision-making, enhances transparency, and strengthens accountability to stakeholders. The following steps outline the process of developing an effective template.

1: Define the Reporting Period: Establish a consistent reporting period, typically a fiscal year, aligning with the organization’s operational cycle. This consistent timeframe facilitates year-over-year comparisons and trend analysis.

2: Structure the Revenue Section: Categorize revenue streams into clear and distinct categories, such as contributions, grants, program service revenue, and investment income. This detailed categorization enhances transparency and allows for analysis of funding sources.

3: Organize Expense Categories: Group expenses into logical categories, such as program services, administration, and fundraising. This structured approach provides insights into resource allocation and cost management.

4: Incorporate Gains and Losses: Include a section for gains and losses resulting from activities outside core operations. This ensures a comprehensive view of the organization’s financial activities.

5: Present Net Asset Information: Clearly present net asset information, distinguishing between unrestricted, temporarily restricted, and permanently restricted funds. This transparency demonstrates responsible management of donor-designated funds.

6: Ensure Template Consistency: Maintain a consistent format across all reporting periods. Consistent formatting facilitates comparability and trend analysis over time.

7: Adhere to Accounting Standards: Ensure the template adheres to applicable accounting standards for non-profit organizations. This ensures compliance and enhances the credibility of financial reporting.

8: Review and Refine: Regularly review and refine the template based on evolving organizational needs and reporting requirements. This ensures the template remains relevant and effective in supporting informed financial management.

A well-designed template provides a clear and comprehensive overview of a non-profit’s financial activities. Consistent application of the template promotes transparency, accountability, and informed decision-making, ultimately contributing to the organization’s long-term financial health and sustainability. Regular review and adaptation of the template ensures its continued effectiveness in meeting evolving reporting needs and supporting sound financial management practices.

Careful and consistent use of a standardized financial reporting document designed for non-profit organizations offers crucial insights into financial performance, enabling effective resource management and informed decision-making. Understanding its core components, including revenue streams, expense categories, gains and losses, and net asset classifications, provides a comprehensive view of an organization’s financial health and sustainability. A well-designed template promotes transparency and accountability, fostering trust with stakeholders while facilitating compliance with regulatory requirements.

Effective utilization of this structured financial tool empowers non-profit organizations to demonstrate responsible stewardship of resources, secure future funding opportunities, and advance their missions effectively. Accurate and consistent financial reporting contributes significantly to long-term financial stability and the achievement of organizational goals, ultimately strengthening public trust in the non-profit sector.