Utilizing such a document offers several key advantages. It allows owners and managers to monitor profitability, identify potential cash shortages or surpluses, and make informed decisions about pricing, expenses, and investments. This proactive financial management tool is crucial for securing loans, attracting investors, and ensuring long-term sustainability. It provides the data necessary for informed, strategic planning and operational adjustments.

This understanding of a restaurant’s cash dynamics is foundational for exploring more complex financial analysis. The following sections will delve into the specific components, creation methods, and practical applications of these essential reports in the restaurant industry.

1. Operations

The operations section of a restaurant cash flow statement provides a detailed view of the core business activities that generate revenue and incur expenses. This section is critical for understanding the day-to-day financial health and efficiency of the establishment.

- Sales RevenueThis represents the primary inflow of cash from customer purchases, including dine-in, takeout, and delivery services. Accurate tracking of sales is paramount for assessing overall performance and identifying trends. For example, a decline in sales revenue might signal a need to adjust pricing strategies or marketing efforts.

- Cost of Goods Sold (COGS)COGS encompasses all direct costs associated with producing menu items, including ingredients, beverages, and packaging supplies. Managing COGS effectively is crucial for profitability. Implementing inventory control measures, negotiating favorable supplier contracts, and minimizing waste can significantly impact the bottom line.

- Operating ExpensesThese are the costs required to run the restaurant beyond food and beverage costs, encompassing rent, utilities, salaries, marketing, and maintenance. Careful monitoring and control of operating expenses are essential for long-term financial stability. Analyzing these costs can reveal areas for potential savings, such as energy efficiency initiatives or optimized staffing schedules.

- DepreciationWhile not a direct cash outflow, depreciation represents the decrease in value of tangible assets like kitchen equipment and furniture over time. Including depreciation in the operating activities section provides a more accurate picture of profitability by accounting for the cost of asset use. This helps in planning for future equipment replacements.

Careful analysis of these operational components reveals key performance indicators and provides actionable insights for optimizing profitability. Understanding cash flow generated from operations is essential for making informed decisions regarding pricing, menu engineering, cost control, and overall financial strategy. This information is then used to inform decisions related to investing and financing activities, creating a comprehensive financial picture.

2. Investing

The investing section of a restaurant cash flow statement details the movement of cash related to long-term assets. This section reflects capital expenditures crucial for maintaining or expanding operations, offering valuable insights into strategic financial decisions and their impact on long-term growth.

Key aspects within the investing section include:

- Purchase of Property, Plant, and Equipment (PP&E): This represents investments in tangible assets such as ovens, refrigerators, furniture, and building improvements. These expenditures signify commitment to operational capacity and efficiency. For example, acquiring a new, high-capacity oven might improve productivity and menu offerings, potentially increasing future revenue streams. Cash outflows for these purchases are recorded here.

- Sale of PP&E: When a restaurant sells existing equipment or property, the cash inflow is documented in this section. This can offset capital expenditures, impacting the overall net cash flow from investing activities. For instance, selling older equipment after upgrading to newer models can partially fund the acquisition.

- Investments in Other Businesses: This category captures investments made in other ventures, perhaps a related food business or a franchise expansion. Such investments can diversify revenue streams and represent strategic growth initiatives. The associated cash outflows are recorded accordingly.

Analyzing the investing section reveals a restaurant’s focus on long-term growth and sustainability. Significant investments in PP&E might indicate expansion plans or efforts to enhance operational efficiency. Conversely, a lack of investment could signal stagnation or financial constraints. Understanding these patterns allows for informed assessment of financial health and future prospects. This information, combined with data from the operating and financing sections, provides a comprehensive understanding of the restaurant’s overall financial performance.

3. Financing

The financing section of a restaurant cash flow statement illuminates the sources and uses of funds related to debt, equity, and dividends. This section provides crucial insights into the restaurant’s capital structure, its ability to secure funding, and its financial obligations. Understanding this component is essential for evaluating long-term financial stability and sustainability.

Key elements within the financing section include:

- Debt Financing: This includes proceeds from loans, lines of credit, or other forms of borrowing. Procuring debt signifies an inflow of cash, providing resources for expansion, equipment purchases, or working capital needs. Conversely, principal and interest payments represent cash outflows. For example, securing a loan to renovate a dining area would appear as an inflow, while subsequent loan repayments would be recorded as outflows.

- Equity Financing: This involves raising capital through the sale of ownership shares. Issuing new shares generates cash inflows, while repurchasing existing shares results in cash outflows. Equity financing can fuel significant growth but also dilutes existing ownership. A restaurant seeking rapid expansion might raise capital through equity financing, accepting a trade-off in ownership for access to funds.

- Dividend Payments: Distributions of profits to shareholders represent cash outflows. Dividend payments signify financial health and can attract investors but also reduce retained earnings available for reinvestment. A well-established restaurant might distribute dividends to reward shareholders while balancing the need to retain earnings for future projects.

Careful analysis of the financing activities provides critical context for understanding a restaurant’s financial strategy. High levels of debt may indicate aggressive expansion plans but also increased financial risk. Significant equity financing could signal rapid growth potential while highlighting the influence of external investors. Dividend payouts can attract investors but might limit the funds available for internal reinvestment. Evaluating these factors in conjunction with operational and investing activities provides a comprehensive overview of the restaurant’s financial position and strategic direction. This holistic view is essential for informed decision-making, investor relations, and long-term financial planning.

4. Standardized Format

A standardized format is crucial for restaurant cash flow statements to ensure clarity, consistency, and comparability. This structured approach facilitates accurate analysis, informed decision-making, and effective communication with stakeholders. Adhering to established accounting principles allows for reliable interpretation of financial performance.

- Consistent Structure:A standardized template ensures consistent categorization of cash flows into operating, investing, and financing activities. This structured presentation allows for easy comparison across different periods and facilitates trend analysis. For instance, consistently classifying rent payments under operating activities allows for accurate tracking of operational expenses over time.

- Comparability:Utilizing a standardized format allows for benchmarking against industry averages and competitors. This comparability provides valuable insights into a restaurant’s relative financial performance and identifies areas for potential improvement. For example, comparing a restaurant’s cash flow from operations to industry benchmarks can reveal areas of strength and weakness.

- Clarity and Transparency:A standardized format promotes clarity and transparency, making the information accessible to various stakeholders, including investors, lenders, and management. Clearly presented data fosters trust and facilitates informed decision-making. A clear and concise cash flow statement enables investors to readily assess the restaurant’s financial health.

- Compliance and Auditing:Adhering to generally accepted accounting principles (GAAP) ensures compliance with regulatory requirements and facilitates audits. This standardization simplifies the auditing process and enhances the credibility of the financial information. A standardized cash flow statement prepared according to GAAP simplifies the audit process and provides assurance to external stakeholders.

Adopting a standardized format for restaurant cash flow statements offers numerous benefits, ranging from improved internal financial management to enhanced communication with external stakeholders. This consistency and transparency are essential for effective financial analysis, strategic planning, and long-term success in the competitive restaurant industry.

5. Projections and analysis

Projections and analysis are integral components of utilizing a restaurant cash flow statement template effectively. Developing projected cash flow statements allows restaurant management to anticipate potential financial challenges and opportunities. This forward-looking perspective facilitates proactive decision-making, supporting strategic planning and enhancing financial stability. For example, projecting lower sales during the traditionally slower winter months allows management to adjust staffing levels and inventory purchases accordingly, mitigating potential losses. Conversely, projecting increased revenue during a local festival enables proactive scaling of operations to maximize profitability. Analyzing historical cash flow data alongside projections provides a comprehensive understanding of trends and patterns. This analysis informs decisions related to menu pricing, marketing campaigns, and capital expenditures. For instance, if analysis reveals consistently low cash flow from operations during a specific day of the week, management can explore targeted promotions or menu adjustments to stimulate sales on that day.

Furthermore, analyzing variances between projected and actual cash flow provides valuable insights into operational efficiency and the accuracy of forecasting assumptions. Significant deviations warrant investigation and corrective action. For example, a larger than expected discrepancy between projected and actual food costs might indicate inventory mismanagement or theft, requiring immediate attention. Regularly comparing projected and actual results enhances the accuracy of future projections, refining the forecasting process over time. This iterative process of projecting, analyzing, and refining allows for continuous improvement in financial management practices. Moreover, well-supported projections play a crucial role in securing financing from lenders and attracting potential investors. Demonstrating a clear understanding of future cash flow strengthens credibility and instills confidence in the restaurant’s financial viability.

In conclusion, incorporating projections and analysis into the use of a restaurant cash flow statement template transforms it from a historical record into a powerful decision-making tool. This forward-looking approach empowers restaurant management to anticipate challenges, capitalize on opportunities, and navigate the complexities of the industry with greater financial acumen. The ability to accurately project and analyze cash flow is essential for long-term sustainability and success in the competitive restaurant landscape. This proactive financial management fosters resilience and positions the business for sustained growth.

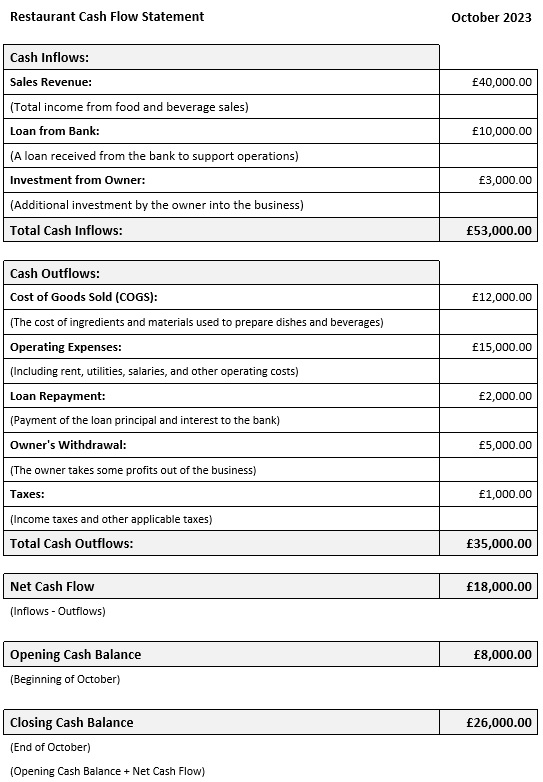

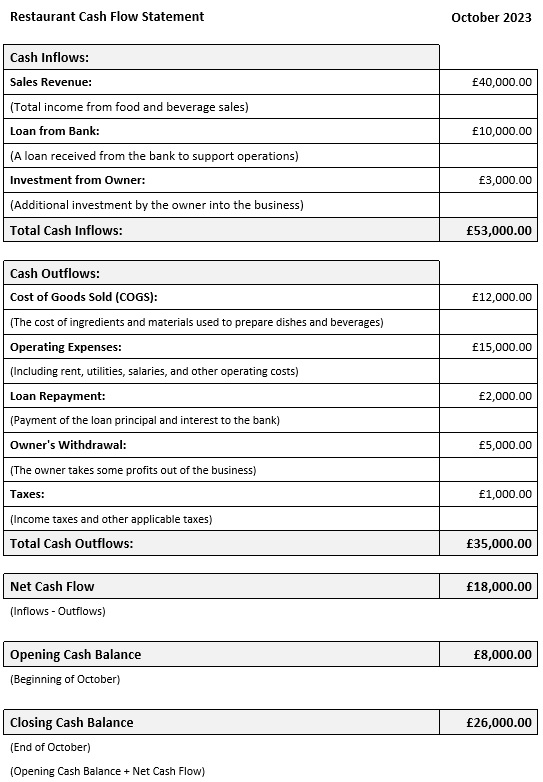

Key Components of a Restaurant Cash Flow Statement Template

A comprehensive understanding of the core components within a restaurant cash flow statement template is essential for effective financial management. These components provide a structured view of cash inflows and outflows, enabling informed decision-making and strategic planning.

1. Operating Activities: This section details cash flows related to the core business operations. Key elements include sales revenue, cost of goods sold (COGS), operating expenses (rent, utilities, salaries), and depreciation. Analyzing operational cash flow reveals profitability and efficiency.

2. Investing Activities: This section tracks cash flows associated with long-term assets. Key elements include purchases and sales of property, plant, and equipment (PP&E), as well as investments in other businesses. This section reflects capital expenditures crucial for growth and operational capacity.

3. Financing Activities: This section details cash flows related to debt, equity, and dividends. Key elements include proceeds from loans, equity financing transactions, and dividend payments. This section provides insights into the restaurant’s capital structure and financing strategies.

4. Beginning Cash Balance: The starting cash balance for the given period provides a foundation for tracking cash flow changes. This balance is carried over from the ending balance of the previous period, ensuring continuity in financial reporting. For example, the beginning cash balance for July would be the ending cash balance from June.

5. Net Cash Flow: This represents the overall change in cash during the specified period, calculated by summing the net cash flows from operating, investing, and financing activities. A positive net cash flow indicates an increase in available cash, while a negative net cash flow signifies a decrease.

6. Ending Cash Balance: The ending cash balance represents the total cash available at the end of the period. This balance is calculated by adding the net cash flow to the beginning cash balance and becomes the beginning balance for the subsequent period. Tracking ending cash balances is crucial for monitoring liquidity and short-term financial health.

Careful analysis of these interconnected components provides a comprehensive view of a restaurant’s financial performance, enabling data-driven decisions regarding operations, investments, and financing. This structured approach to cash flow management is essential for long-term sustainability and success.

How to Create a Restaurant Cash Flow Statement

Creating a restaurant cash flow statement requires a systematic approach, combining historical data, current operations, and future projections. The following steps outline the process of developing a comprehensive and insightful statement.

1. Choose a Time Period: Define the reporting period, whether monthly, quarterly, or annually. This timeframe provides the basis for tracking cash inflows and outflows. Monthly statements offer granular insights into short-term trends, while annual statements provide a broader overview of yearly performance.

2. Determine the Beginning Cash Balance: Establish the starting cash balance, which is the ending balance from the previous period. This provides a baseline for calculating net cash flow during the current period.

3. Calculate Cash Flow from Operating Activities: Begin with net income and adjust for non-cash items like depreciation and changes in working capital (accounts receivable, inventory, accounts payable). This reflects cash generated from core business operations.

4. Calculate Cash Flow from Investing Activities: Document cash flows related to the acquisition or disposal of long-term assets, such as property, plant, and equipment (PP&E). Include investments in other businesses.

5. Calculate Cash Flow from Financing Activities: Record cash flows related to debt, equity, and dividends. Include proceeds from loans, repayments of principal, equity investments, and dividend distributions.

6. Calculate Net Cash Flow: Sum the net cash flows from operating, investing, and financing activities. This figure represents the overall change in cash during the reporting period.

7. Determine the Ending Cash Balance: Add the net cash flow to the beginning cash balance to arrive at the ending cash balance for the period. This ending balance becomes the beginning balance for the subsequent period.

8. Review and Analyze: Once compiled, careful review and analysis are essential. Compare actual results to projections, investigate significant variances, and identify trends to inform strategic decision-making.

A well-constructed statement offers a clear picture of a restaurant’s financial health, providing valuable insights for strategic planning, operational adjustments, and investor relations. Consistent tracking and analysis of cash flow are essential for long-term success in the dynamic restaurant industry.

Effective financial management is paramount to success in the restaurant industry. Utilizing a dedicated financial reporting structure provides a crucial tool for understanding, monitoring, and projecting cash flow. By carefully tracking cash inflows and outflows across operations, investing, and financing activities, restaurant owners and managers gain valuable insights into profitability, liquidity, and long-term sustainability. A standardized approach ensures consistency and comparability, facilitating informed decision-making and effective communication with stakeholders. Analyzing historical data, developing accurate projections, and regularly reviewing performance against expectations are essential practices for maintaining financial health and achieving strategic objectives.

In the dynamic and competitive restaurant landscape, the ability to manage cash flow effectively is not merely a best practice but a necessity for survival and growth. Adopting a robust, structured approach to cash flow management, supported by accurate data and insightful analysis, empowers restaurants to navigate challenges, capitalize on opportunities, and build a foundation for long-term success. A proactive, data-driven approach to financial management positions restaurants to thrive in an ever-evolving market.