Utilizing such a document allows businesses to monitor profitability, identify potential cash shortages, and secure necessary funding. This proactive approach enhances financial stability, promotes sustainable growth, and aids in attracting investors. Regularly reviewing these financial summaries enables informed strategic adjustments, fostering better financial control and facilitating data-driven decision-making.

The subsequent sections will delve into the core components of this financial tool, providing practical guidance on its creation and effective utilization for enhanced financial management.

1. Standardized Structure

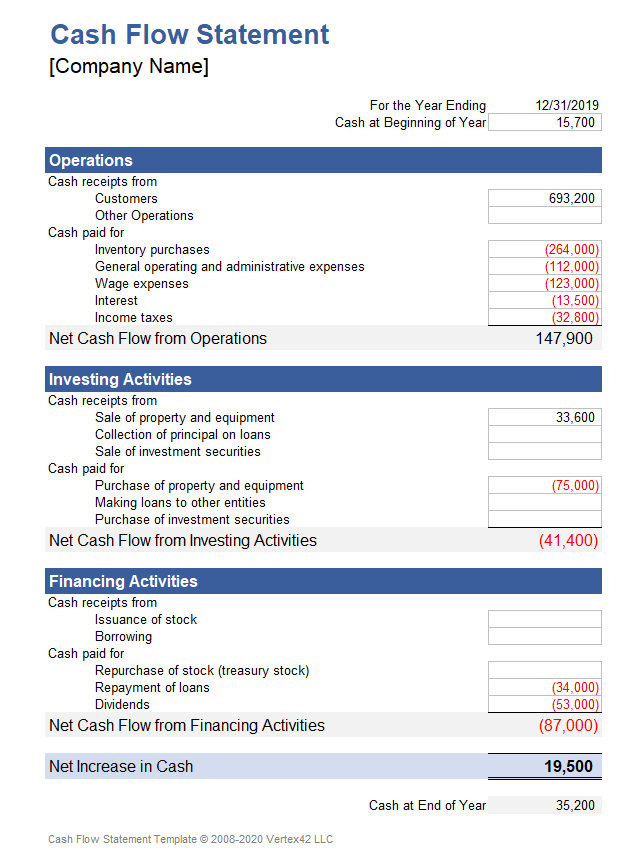

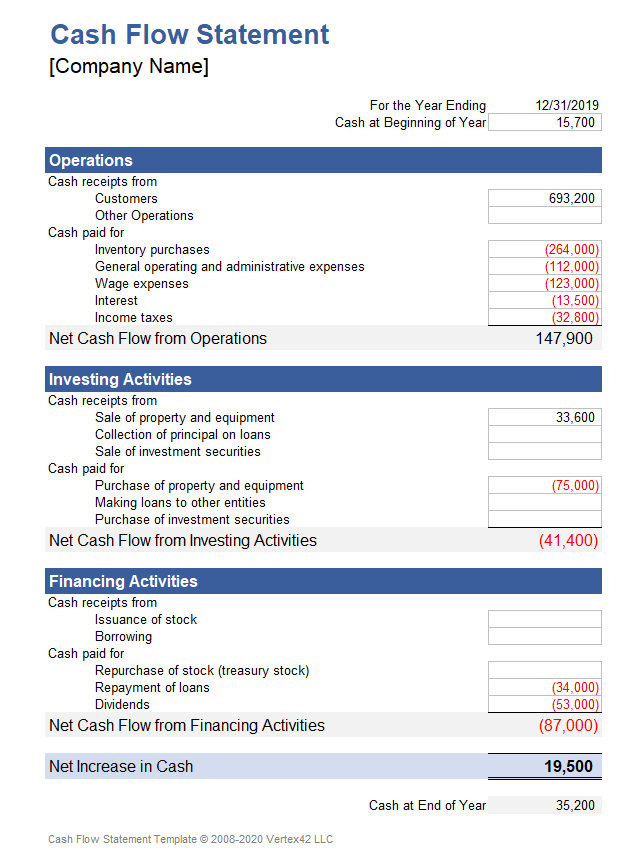

Standardized structure is a cornerstone of effective cash flow statement templates for small businesses. This consistent format ensures clarity, comparability, and informed financial decision-making. A standardized template typically categorizes cash flows into three core activities: operating, investing, and financing. This structure enables stakeholders to quickly grasp the sources and uses of funds, facilitating analysis of financial performance and trends. For example, comparing cash flow from operations across different periods can reveal the impact of sales growth or cost-cutting initiatives.

The standardized structure also simplifies communication with lenders and investors. A universally recognized format presents financial information in a clear and concise manner, enhancing credibility and fostering trust. This clarity is crucial for securing loans or attracting investments, as it allows stakeholders to readily assess the financial health and stability of the business. Furthermore, adhering to a standardized structure ensures compliance with accounting principles and reporting requirements, reducing the risk of errors and misinterpretations.

In conclusion, a standardized structure is not merely a formality but a critical element of a robust cash flow statement template. It enables clear analysis, facilitates communication with external parties, and ensures compliance with financial reporting standards. By understanding and utilizing this standardized format, small businesses can gain valuable insights into their financial performance, make informed decisions, and achieve sustainable growth.

2. Tracks cash inflows/outflows

Tracking cash inflows and outflows forms the core function of a cash flow statement template for small businesses. This meticulous tracking provides a dynamic view of the business’s financial circulatory system, revealing the origins of incoming funds and the destinations of outgoing funds. This understanding is crucial for evaluating financial performance and making informed decisions. Without a clear picture of cash movement, a business operates with limited visibility, increasing the risk of financial instability.

Consider a small retail business. Sales revenue constitutes a primary inflow, while inventory purchases, rent, and salaries represent significant outflows. A cash flow statement meticulously documents these transactions, enabling the business owner to identify trends, such as increasing inventory costs or declining sales. This information can prompt corrective actions, like negotiating better supplier terms or implementing marketing strategies to boost sales. Furthermore, tracking cash flow can highlight periods of potential cash shortages or surpluses, allowing for proactive financial planning. For instance, anticipating a seasonal sales decline allows the business to secure a line of credit in advance, mitigating potential financial strain.

In essence, tracking cash inflows and outflows within a structured template provides vital insights into the financial health of a small business. This practice facilitates proactive financial management, enabling informed decisions regarding resource allocation, expense control, and strategic planning. The ability to anticipate and address potential cash flow challenges is paramount for achieving financial stability and sustainable growth.

3. Operational Activities

Operational activities represent the core day-to-day business functions that generate revenue and incur expenses. Within a small business cash flow statement template, this section provides crucial insights into the financial sustainability of the core business model. It details the cash inflows from sales of goods or services and the cash outflows related to expenses such as inventory purchases, salaries, rent, and utilities. Analyzing operational cash flow allows stakeholders to assess the efficiency and profitability of the fundamental business operations.

A positive cash flow from operations generally indicates a healthy business capable of generating sufficient cash to cover its operating expenses. Conversely, a consistently negative operational cash flow signals potential financial distress, indicating that the business is not generating enough cash from its core activities to sustain itself. For example, a manufacturing company might experience a negative operational cash flow due to rising raw material costs or declining product demand. This insight could prompt management to explore cost-cutting measures, renegotiate supplier contracts, or invest in marketing strategies to stimulate sales. Understanding the drivers of operational cash flow is essential for making informed decisions that impact the financial health of the business.

Accurately representing operational activities within the cash flow statement is paramount for assessing the long-term viability of the business. This section provides a clear picture of the core profitability of the enterprise, independent of financing or investment activities. Challenges in accurately tracking operational cash flow can arise from complexities in revenue recognition or expense allocation. However, overcoming these challenges through diligent bookkeeping and appropriate accounting practices provides invaluable data for strategic decision-making, financial planning, and securing funding for future growth.

4. Investing Activities

Investing activities within a small business cash flow statement template encompass the acquisition and disposal of long-term assets. These activities provide crucial insights into a company’s strategic capital allocation decisions and their impact on future growth potential. Capital expenditures, such as purchasing equipment or property, represent cash outflows, while proceeds from selling assets constitute cash inflows. Analyzing this section allows stakeholders to understand how a business invests in its future and the potential returns generated from these investments. For instance, a significant investment in new manufacturing equipment might signal an expansion strategy aimed at increasing production capacity. Conversely, the sale of older equipment could indicate a shift towards newer technologies or a downsizing effort.

Understanding the relationship between investing activities and overall financial health is crucial. While significant investments can drive future growth, excessive capital expenditures can strain a company’s cash reserves and hinder short-term financial stability. Consider a small software company investing heavily in research and development. While this investment may lead to innovative products and future revenue streams, it also requires substantial upfront capital and may not generate immediate returns. Therefore, careful analysis of investing activities is essential for balancing long-term growth objectives with short-term financial constraints. This analysis can also reveal the effectiveness of past investment decisions by comparing the cash flows generated from acquired assets with their initial costs.

In conclusion, the investing activities section of the cash flow statement provides valuable insights into a company’s strategic direction and its potential for future growth. Careful scrutiny of this section allows stakeholders to assess the effectiveness of capital allocation decisions, the balance between long-term investments and short-term financial stability, and the potential impact on overall financial health. This understanding enables more informed assessments of a company’s long-term prospects and its ability to generate future returns.

5. Financing Activities

Financing activities within a small business cash flow statement template detail how a company secures and manages funding to support its operations and growth. This section provides crucial insights into the company’s capital structure, its reliance on external funding, and its financial stability. Understanding these activities is essential for assessing the long-term financial health and sustainability of a business. This section encompasses transactions related to debt, equity, and dividends.

- Debt FinancingDebt financing involves borrowing money from lenders, such as banks or other financial institutions. Cash inflows occur when loans are secured, while cash outflows represent principal and interest repayments. A company with substantial debt financing might exhibit large cash inflows from loan proceeds but also significant cash outflows for debt service. The level of debt financing can indicate the company’s risk profile and its ability to manage financial obligations. For example, a high debt-to-equity ratio might signal increased financial risk, particularly during economic downturns.

- Equity FinancingEquity financing involves raising capital by selling ownership shares in the company. Cash inflows from issuing new shares represent equity financing. This type of financing dilutes existing ownership but avoids the fixed repayment obligations associated with debt. A company relying heavily on equity financing might show significant cash inflows during periods of expansion or initial public offerings. The balance between debt and equity financing reflects the company’s capital structure and its approach to managing financial risk.

- Dividend PaymentsDividend payments represent cash outflows distributed to shareholders as a return on their investment. Regular dividend payments can signal financial stability and profitability, attracting investors seeking income. However, substantial dividend payouts can also reduce the cash available for reinvestment in the business, potentially hindering future growth opportunities. Analyzing dividend payments in conjunction with other financing activities provides a comprehensive view of the company’s financial strategy.

- Repurchasing SharesCompanies may repurchase their own shares, resulting in a cash outflow. This action can increase the value of remaining shares and signal confidence in the company’s future performance. Share repurchases are often an alternative to dividend payments as a way to return value to shareholders. Analyzing share repurchases within the context of other financing activities provides insights into a company’s capital allocation strategy.

By analyzing financing activities within the cash flow statement, stakeholders gain a comprehensive understanding of a company’s capital structure, its approach to managing financial risk, and its ability to generate sustainable growth. This analysis, in conjunction with an examination of operating and investing activities, provides a holistic view of the company’s overall financial health and its prospects for future success. Evaluating the interplay between these three core activities is essential for making informed investment decisions and assessing the long-term viability of a business.

Key Components of a Small Business Cash Flow Statement Template

A comprehensive understanding of key components is essential for effective utilization of cash flow statement templates. These components provide a structured framework for analyzing a business’s financial performance.

1. Operating Activities: This section details cash flows generated from core business operations. Key elements include cash received from customers, payments to suppliers, salary disbursements, and other operating expenses. Analyzing operational cash flow reveals the profitability and efficiency of a business’s core activities.

2. Investing Activities: This section tracks cash flows related to long-term investments. Key elements include purchases and sales of property, plant, and equipment (PP&E), acquisitions and divestitures of other businesses, and investments in securities. Analyzing investing activities provides insights into a company’s strategic capital allocation decisions and their potential impact on future growth.

3. Financing Activities: This section details cash flows related to financing the business. Key elements include proceeds from debt or equity financing, loan repayments, dividend payments, and stock repurchases. Analyzing financing activities illuminates a company’s capital structure and its reliance on external funding.

4. Beginning Cash Balance: The cash balance at the start of the reporting period provides a crucial starting point for tracking cash flow. This figure is essential for calculating the net change in cash during the period and arriving at the ending cash balance.

5. Net Increase/Decrease in Cash: This figure represents the overall change in cash during the reporting period. It is derived by summing the net cash flows from operating, investing, and financing activities. A positive value indicates a net increase in cash, while a negative value signals a net decrease.

6. Ending Cash Balance: This figure represents the cash balance at the end of the reporting period. It is calculated by adding the net increase or decrease in cash to the beginning cash balance. The ending cash balance is a crucial indicator of a company’s short-term liquidity and its ability to meet immediate financial obligations.

Careful analysis of these interconnected components provides a comprehensive understanding of a business’s financial performance, its strategic investments, and its financing strategies. This structured approach enables stakeholders to make informed decisions regarding resource allocation, growth initiatives, and financial stability.

How to Create a Small Business Cash Flow Statement

Creating a cash flow statement involves a systematic process of organizing financial data to provide a clear overview of cash inflows and outflows.

1. Choose a Reporting Period: Select a specific timeframe for the statement, such as a month, quarter, or year. Consistent reporting periods facilitate trend analysis and comparison.

2. Determine the Beginning Cash Balance: Establish the cash balance at the start of the chosen reporting period. This figure serves as the foundation for calculating net cash flow.

3. Calculate Cash Flow from Operating Activities: Document all cash inflows and outflows related to core business operations. This includes cash received from customers, payments to suppliers, salaries, rent, and other operating expenses.

4. Calculate Cash Flow from Investing Activities: Record all cash flows related to long-term investments, including purchases and sales of fixed assets, investments in other businesses, and changes in investment securities.

5. Calculate Cash Flow from Financing Activities: Document all cash flows related to financing the business, including proceeds from debt or equity financing, loan repayments, dividend payments, and stock repurchases.

6. Calculate the Net Increase or Decrease in Cash: Sum the net cash flows from operating, investing, and financing activities to determine the overall change in cash during the reporting period.

7. Calculate the Ending Cash Balance: Add the net increase or decrease in cash to the beginning cash balance to arrive at the ending cash balance for the reporting period.

8. Review and Analyze: Carefully review the completed statement for accuracy and completeness. Analyze the data to identify trends, potential cash flow issues, and opportunities for improvement.

A well-constructed statement provides valuable insights into a business’s financial health, enabling informed decision-making regarding resource allocation, growth strategies, and financial stability. Regularly generating and analyzing these statements allows for proactive financial management and facilitates sustainable growth.

Effective financial management relies on a clear understanding of cash flow dynamics. A structured financial document providing a standardized overview of inflows and outflows empowers small businesses to monitor performance, anticipate challenges, and make informed decisions. This structured approach enables proactive management of resources, facilitates securing necessary funding, and supports sustainable growth. By meticulously tracking operational revenue and expenses, investments, and financing activities, businesses gain valuable insights into their financial health, allowing for data-driven decision-making and enhanced financial stability.

Implementing a robust system for tracking and analyzing cash flow is not merely a best practice; it is a critical component of long-term business success. This proactive approach empowers businesses to navigate economic fluctuations, capitalize on growth opportunities, and build a resilient financial foundation. A thorough understanding of cash flow dynamics provides the essential tools for achieving financial stability and sustained prosperity.