Utilizing such a structure offers several advantages. It facilitates budget creation by providing a detailed understanding of spending patterns. This, in turn, helps identify areas for potential savings and improved resource allocation. Furthermore, a well-maintained record of income and expenses simplifies tax preparation and provides valuable documentation for loan applications or other financial endeavors.

This foundational understanding of financial tracking allows for a deeper exploration of related topics such as budgeting techniques, debt management strategies, and investment planning.

1. Track Income Sources

Accurate financial assessment necessitates a comprehensive record of all income streams. Within a personal finance personal income statement template, tracking income sources provides the foundation for understanding financial health and planning for the future. This meticulous documentation allows for a clear picture of total earnings and facilitates informed decision-making.

- Employment IncomeSalaries, wages, bonuses, and commissions constitute the primary income source for many individuals. Accurately recording these amounts, including pre-tax deductions, provides a realistic view of take-home pay. For example, understanding net income after taxes and deductions helps set realistic savings goals. This detailed tracking is fundamental to effective budgeting and financial planning within the template.

- Investment IncomeDividends from stocks, interest earned on savings accounts and bonds, and capital gains from asset sales represent additional income streams. Tracking these, even small amounts, provides insights into investment performance and contributes to a comprehensive financial overview. This data allows for informed adjustments to investment strategies and more accurate projections within the income statement template.

- Self-Employment/Side Hustle IncomeIncome generated from freelance work, consulting, or other entrepreneurial endeavors needs meticulous tracking. This often involves managing irregular payments and accounting for business expenses. Accurate documentation of this income stream is crucial for tax purposes and for assessing the profitability of these ventures within the overall financial picture presented by the template.

- Other IncomeThis category encompasses various income sources such as rental income, royalties, alimony, or gifts. While potentially irregular, these sources contribute to overall financial well-being and should be included within the template for a complete financial picture. This inclusion ensures a comprehensive understanding of all income streams and their impact on overall financial health.

By diligently tracking all income sources, individuals gain a comprehensive understanding of their financial inflows. This detailed record, when incorporated into a personal income statement template, empowers informed budgeting, strategic financial planning, and effective progress tracking towards financial goals.

2. Categorize Expenses

Effective utilization of a personal finance income statement template hinges on the systematic categorization of expenses. This process provides a granular view of spending patterns, enabling informed financial decisions. Categorization allows for the identification of areas where spending exceeds budgetary allocations, facilitating adjustments to improve financial health. For example, categorizing expenses can reveal that a significant portion of income is allocated to dining out, prompting a reevaluation of spending habits and a potential shift towards home-cooked meals.

Several key expense categories should be considered within a template. Essential expenses, such as housing, utilities, and groceries, form the foundation of a budget. Discretionary expenses encompass entertainment, dining out, and hobbies. Debt payments, including mortgages, student loans, and credit card payments, require careful monitoring. Periodic expenses, like insurance premiums or annual subscriptions, necessitate allocation within a budget despite their infrequent occurrence. Accurately categorizing these expenses reveals spending patterns and informs strategic budget adjustments. For instance, tracking discretionary spending might reveal opportunities to reduce non-essential expenses and allocate funds towards debt reduction or investment goals.

Understanding and categorizing expenses allows for informed financial planning. By identifying spending trends and areas of potential savings, individuals can make strategic decisions to improve their overall financial well-being. This detailed analysis, facilitated by a well-organized income statement template, empowers proactive financial management and contributes to long-term financial stability. Failure to categorize expenses can lead to an inaccurate perception of financial health, hindering effective budgeting and potentially contributing to financial instability.

3. Calculate Net Income.

Calculating net income forms the core of a personal finance income statement template. Net income, derived by subtracting total expenses from total income, provides a crucial indicator of financial health. This calculation reveals the surplus or deficit resulting from financial activities within a given period. A positive net income signifies available funds for savings, investments, or debt reduction, while a negative net income indicates overspending and the potential need for budgetary adjustments. Understanding net income is essential for informed financial planning and achieving financial goals.

The practical significance of calculating net income within a personal finance income statement template is exemplified through its application in various scenarios. For instance, an individual aiming to purchase a home can utilize the template to calculate their net income and assess affordability. Lenders also utilize this figure to determine loan eligibility. Similarly, when developing a retirement plan, understanding net income and its potential fluctuations over time allows for realistic savings and investment strategies. Furthermore, consistent tracking of net income helps identify spending patterns and facilitates adjustments to achieve financial objectives, such as reducing debt or increasing savings.

Accurate calculation and analysis of net income within a personal finance income statement template is paramount for effective financial management. This understanding empowers informed decision-making related to budgeting, saving, investing, and debt management. Challenges in accurately calculating net income may arise from inconsistent tracking of income and expenses. However, utilizing a structured template and maintaining diligent records mitigates these challenges and facilitates a clearer understanding of one’s overall financial position. This, in turn, contributes to greater financial stability and the achievement of long-term financial goals.

4. Regular Monitoring

Regular monitoring of a personal finance income statement template is crucial for maintaining financial health and achieving financial goals. It provides a dynamic view of financial progress, enabling proactive adjustments to spending habits and investment strategies. Without consistent oversight, a template becomes a static document, failing to reflect real-time financial status and hindering effective financial management.

- Tracking Spending PatternsRegular review of the template allows for the identification of evolving spending patterns. For example, an increase in discretionary spending over several months might indicate a need for budget adjustments. This ongoing analysis enables informed decisions about resource allocation and facilitates proactive adjustments to maintain financial stability. Without regular monitoring, such trends could go unnoticed, potentially leading to financial imbalances.

- Identifying Budget DeviationsA consistent monitoring schedule allows for prompt identification of deviations from the established budget. For instance, an unexpected medical expense might necessitate adjustments to other spending categories. Regularly reviewing the template provides an early warning system, enabling proactive adjustments to mitigate the impact of unforeseen circumstances. This proactive approach minimizes the risk of financial strain and promotes adherence to financial goals.

- Assessing Investment PerformanceFor individuals with investment income, regular monitoring of the template allows for an assessment of investment performance. Tracking returns and adjusting investment strategies based on market conditions ensures alignment with long-term financial goals. This ongoing review facilitates informed decisions about portfolio diversification and risk management, optimizing investment outcomes over time.

- Measuring Progress Towards GoalsRegular monitoring provides a measurable indication of progress towards financial goals, whether saving for a down payment, paying off debt, or building a retirement fund. Tracking progress within the template reinforces positive financial behavior and provides motivation to maintain financial discipline. This regular assessment enables adjustments to strategies as needed, ensuring continued progress toward desired outcomes.

The benefits of regular monitoring extend beyond simply tracking numbers. It fosters a proactive approach to financial management, enabling individuals to anticipate challenges, adjust strategies, and maintain control over their financial well-being. Integrating regular monitoring into financial routines maximizes the effectiveness of a personal finance income statement template, contributing to long-term financial stability and the achievement of financial goals.

5. Identify Spending Trends.

A personal finance income statement template facilitates the identification of spending trends, providing crucial insights into financial behavior. Recognizing these patterns empowers informed decision-making regarding budgeting, saving, and overall financial management. Analysis of spending trends reveals areas of overspending, potential savings opportunities, and the impact of financial decisions on long-term financial health.

- Recurring ExpensesTemplates allow for the identification of recurring expenses, revealing consistent spending patterns on necessities like housing, utilities, and groceries. Analyzing these recurring costs helps determine if expenses align with income and identifies potential areas for cost reduction. For example, consistently high utility bills might prompt an investigation into energy consumption and potential energy-saving measures. Understanding recurring expenses is fundamental for effective budget allocation and long-term financial planning.

- Discretionary Spending HabitsTracking discretionary expenses, such as dining out, entertainment, and hobbies, reveals spending habits that significantly impact financial well-being. A template allows for visualization of these patterns, highlighting areas where adjustments can free up resources for savings or debt reduction. For example, recognizing a consistent trend of high spending on entertainment might lead to adjustments in leisure activities, promoting better financial balance. This awareness fosters more conscious spending decisions and strengthens control over personal finances.

- Seasonal Spending FluctuationsSpending patterns often fluctuate seasonally, influenced by holidays, vacations, or back-to-school expenses. A template facilitates identification of these fluctuations, allowing for proactive adjustments to budgets and financial plans. For example, anticipating increased holiday spending enables preemptive saving strategies, mitigating potential financial strain. This proactive approach to seasonal variations promotes consistent financial stability throughout the year.

- Impact of Life ChangesSignificant life changes, such as marriage, having children, or changing careers, often lead to shifts in spending patterns. A template provides a framework for tracking these changes and adapting financial strategies accordingly. For instance, increased childcare costs associated with having a child necessitate adjustments to budgeting and savings goals. Utilizing a template to monitor these evolving needs facilitates informed financial decisions during periods of transition.

By analyzing spending trends within a personal finance income statement template, individuals gain valuable insights into their financial behavior. This awareness empowers proactive adjustments to spending habits, informed budget allocation, and the development of effective strategies for achieving long-term financial goals. Identifying and understanding these trends is fundamental to responsible financial management and the pursuit of financial security.

6. Inform Financial Decisions.

A personal finance income statement template provides the foundational data necessary for informed financial decision-making. By offering a clear overview of income, expenses, and net income, the template empowers individuals to make strategic choices regarding budgeting, saving, investing, and debt management. Without this structured information, financial decisions risk being based on assumptions rather than concrete data, potentially leading to suboptimal outcomes.

- Setting Realistic BudgetsA detailed income statement informs the creation of realistic budgets. Understanding precise income and expense figures allows for the allocation of resources in alignment with financial goals. For example, awareness of high transportation costs might lead to exploring cost-effective alternatives like public transport or carpooling. The template facilitates data-driven budget adjustments, promoting financial stability.

- Strategic Debt ManagementThe template allows for the assessment of debt levels relative to income and expenses. This clear perspective informs strategic debt management decisions. For instance, a high debt-to-income ratio might necessitate prioritizing high-interest debt repayment or exploring debt consolidation options. The template provides the necessary data for informed choices regarding debt reduction strategies.

- Effective Savings and Investment StrategiesA comprehensive income statement informs both short-term and long-term savings and investment strategies. Understanding net income and discretionary spending empowers informed decisions regarding savings allocations, investment choices, and retirement planning. For example, consistent positive net income might allow for increased contributions to retirement accounts or investment in higher-yield assets. The template facilitates strategic financial planning based on actual financial performance.

- Negotiating Financial TermsA well-maintained income statement can be a valuable tool when negotiating financial terms for loans, mortgages, or other financial agreements. Providing documented evidence of income and expenses strengthens negotiating positions and allows for informed decisions regarding acceptable terms and conditions. This data-driven approach empowers informed decision-making during critical financial negotiations.

The insights gained from a personal finance income statement template empower informed financial decisions across various aspects of personal finance. By providing a structured overview of financial status, the template facilitates strategic planning, proactive adjustments, and ultimately, greater control over long-term financial well-being. Consistent use of this tool transforms financial management from reactive to proactive, promoting financial stability and the achievement of financial goals.

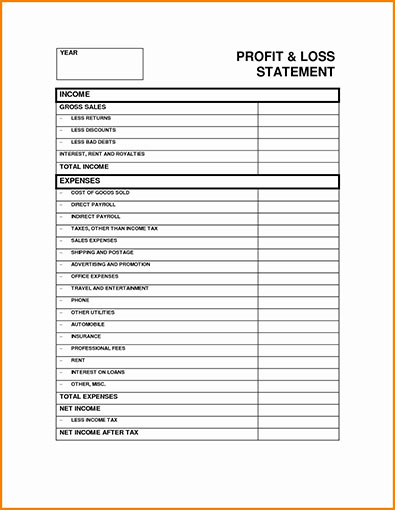

Key Components of a Personal Finance Income Statement Template

A well-structured personal finance income statement template comprises several key components, each contributing to a comprehensive understanding of an individual’s financial health. These components provide a framework for tracking income and expenses, enabling informed financial decision-making.

1. Income Section: This section details all sources of income, including salary, wages, bonuses, investment returns, and any other forms of revenue. Accurate recording of all income streams is crucial for assessing total earnings and understanding the overall financial picture.

2. Expense Section: This section categorizes all expenses, providing a detailed breakdown of spending habits. Common categories include housing, transportation, food, healthcare, debt payments, and entertainment. Categorization facilitates analysis of spending patterns and identification of areas for potential savings.

3. Net Income Calculation: This crucial element represents the difference between total income and total expenses. A positive net income indicates a surplus, while a negative net income signifies a deficit. Understanding net income is fundamental for assessing financial health and making informed financial decisions.

4. Time Period: The template should clearly specify the time period covered, whether it’s a month, quarter, or year. This allows for tracking financial progress over specific durations and facilitates comparison across different periods. Consistent timeframes enable meaningful analysis of trends and patterns.

5. Supporting Documentation: While not directly part of the template itself, maintaining supporting documentation, such as pay stubs, bank statements, and receipts, validates the information recorded and simplifies tax preparation or financial audits. This documentation provides a verifiable record of financial activity.

These interconnected components work together to provide a comprehensive financial overview. Regularly updating and analyzing this information empowers individuals to make informed decisions regarding budgeting, saving, investing, and debt management, ultimately contributing to greater financial well-being. Accurate and consistent use of these components within a template fosters financial awareness and promotes responsible financial behavior.

How to Create a Personal Finance Income Statement Template

Creating a personal finance income statement template provides a structured approach to understanding financial health. A well-designed template facilitates informed decision-making by providing a clear overview of income, expenses, and net income.

1. Choose a Format: Select a format spreadsheet software, dedicated budgeting apps, or even a simple notebook that aligns with individual preferences and technological proficiency. Spreadsheet software offers flexibility and formula integration, while budgeting apps often provide automated tracking features.

2. Define the Time Period: Establish a consistent reporting period, such as monthly, quarterly, or annually. This consistent timeframe allows for meaningful comparisons and trend analysis over time. Choosing a timeframe aligned with financial goals, like monthly for budgeting or annually for tax planning, enhances the template’s utility.

3. List Income Sources: Thoroughly document all sources of income within the chosen timeframe. This includes salary, wages, bonuses, investment returns, self-employment income, and any other forms of revenue. Accuracy in this section is crucial for a realistic assessment of total earnings.

4. Categorize Expenses: Establish expense categories relevant to individual spending habits. Common categories include housing, transportation, food, utilities, healthcare, debt payments, entertainment, and personal care. Detailed categorization allows for targeted analysis of spending patterns.

5. Track Expenses Diligently: Maintain meticulous records of all expenses within the defined categories. Utilize bank statements, receipts, and online banking tools to ensure accurate tracking. Diligent tracking allows for the identification of areas for potential savings and budget adjustments.

6. Calculate Net Income: Subtract total expenses from total income to determine net income. This key figure provides a snapshot of financial health, revealing whether spending exceeds earnings or if there’s a surplus available for savings and investments. Regular calculation of net income facilitates proactive financial management.

7. Review and Analyze Regularly: Review the income statement regularly, ideally at the end of each reporting period. Analyze spending patterns, identify trends, and make necessary adjustments to budget allocations or financial strategies. Regular review ensures the template remains a relevant and dynamic tool for financial management.

8. Maintain Supporting Documentation: Retain supporting documentation, such as pay stubs, bank statements, and receipts. This documentation provides a verifiable record of financial activity, supports accurate tax reporting, and facilitates financial audits if necessary.

A well-maintained personal finance income statement template empowers informed financial decisions and promotes long-term financial well-being. Consistent tracking, analysis, and adjustments based on the information provided by the template contribute to greater financial stability and the achievement of financial goals.

A structured approach to managing personal finances, utilizing a template for tracking income and expenses, provides a crucial foundation for financial well-being. From meticulous income documentation and categorized expense tracking to net income calculation and trend analysis, each component contributes to a comprehensive understanding of financial health. Regular monitoring and informed decision-making based on this structured data empower individuals to achieve financial goals, whether short-term budget management or long-term wealth accumulation. This organized approach promotes financial awareness, facilitates proactive adjustments, and strengthens control over one’s financial destiny.

Financial stability and long-term success require diligent tracking and analysis of financial data. A personal finance income statement template provides the framework for this essential process, enabling informed decisions, promoting responsible financial behavior, and ultimately, paving the way for a secure financial future. Consistent application of these principles, coupled with proactive adjustments based on observed trends, empowers individuals to navigate financial complexities and achieve lasting financial security.