Utilizing a structured format for calculating net worth offers several advantages. It allows individuals to track financial progress, identify areas for improvement, and make informed decisions about spending, saving, and investing. This structured approach can also be crucial for securing loans, planning for retirement, or navigating complex financial situations. A clear overview of assets and liabilities empowers individuals to take control of their financial future.

This foundational understanding of a personal balance sheet and its benefits allows for a deeper exploration of its components and practical application. Topics such as asset valuation, liability management, and strategies for increasing net worth will be addressed in the following sections.

1. Assets

Accurate asset documentation is fundamental to a reliable net worth calculation. Assets represent items of economic value owned by an individual and contribute positively to their overall financial position. Understanding the various categories and their proper valuation is essential for constructing a comprehensive personal balance sheet.

- Liquid AssetsLiquid assets are readily convertible to cash. Examples include checking and savings accounts, money market funds, and certificates of deposit. These assets provide financial flexibility and are crucial for meeting short-term obligations. Their readily available nature makes them easily quantifiable for inclusion on a net worth statement.

- InvestmentsInvestments represent resources allocated with the expectation of future growth. These include stocks, bonds, mutual funds, and retirement accounts. Accurately valuing investments, often fluctuating in market value, is critical for a realistic net worth assessment. Regular updates are necessary to reflect market changes.

- Real PropertyReal property encompasses tangible assets such as land, buildings, and homes. Current market value, often determined through appraisals, is used for net worth calculations. Factors like location and property condition significantly influence valuation.

- Personal PropertyPersonal property includes tangible possessions like vehicles, jewelry, and artwork. Determining fair market value for these assets can be more challenging than for real property. Appraisals or market comparisons might be necessary for accurate valuation on a net worth statement.

A thorough understanding of these asset categories and their valuation ensures a precise and informative net worth statement. Regularly reviewing and updating these values, considering market fluctuations and changes in personal circumstances, provides an evolving picture of financial health.

2. Liabilities

Accurate representation of liabilities is crucial for a comprehensive net worth statement. Liabilities represent obligations owed to others, reducing overall net worth. Understanding different liability types and their implications is essential for effective financial planning.

- Secured DebtSecured debt is backed by collateral, which lenders can seize if the borrower defaults. Common examples include mortgages and auto loans. The outstanding balance of these loans directly impacts net worth and is a significant factor in overall financial health. Properly documenting these liabilities, including interest rates and repayment terms, facilitates accurate net worth calculation and financial planning.

- Unsecured DebtUnsecured debt lacks collateral. Examples include credit card balances, student loans, and personal loans. Managing unsecured debt is vital due to potentially higher interest rates. Tracking these balances accurately reflects their impact on net worth and informs responsible credit management.

- Short-Term LiabilitiesShort-term liabilities are due within one year. Examples include utility bills, credit card balances (if paid monthly), and short-term loans. Managing these liabilities effectively ensures timely payments and avoids penalties, contributing to a stable financial foundation.

- Long-Term LiabilitiesLong-term liabilities extend beyond one year. Examples include mortgages, student loans, and car loans. Understanding the long-term implications of these obligations, including total interest paid and payoff timelines, allows for informed financial decisions and effective long-term planning.

A comprehensive understanding of liabilities, including their categorization, implications, and accurate documentation, is fundamental for constructing a reliable net worth statement. This understanding informs responsible financial management, facilitating informed decisions about debt reduction strategies, spending habits, and overall financial well-being.

3. Calculations

Accurate calculations are the cornerstone of a reliable net worth statement. A precise understanding of the underlying arithmetic, coupled with correct data input, ensures the resulting figure accurately reflects one’s financial position. This understanding facilitates informed financial decision-making and effective progress tracking.

- Total AssetsCalculating total assets involves summing the current market value of all owned possessions. This includes liquid assets, investments, real property, and personal property. Accurate valuation of each asset type is crucial for a reliable total asset figure. For example, real estate holdings should reflect current market appraisals, while investment values should be based on current market prices. This comprehensive summation provides the foundation for calculating net worth.

- Total LiabilitiesTotal liabilities represent the sum of all outstanding debts. This includes secured debt like mortgages and auto loans, as well as unsecured debt like credit card balances and personal loans. Accurate calculation requires up-to-date balance information for all debt obligations. This figure, representing the total amount owed, is essential for determining net worth.

- Net Worth CalculationNet worth is derived by subtracting total liabilities from total assets. This resulting figure represents an individual’s overall financial position at a specific point in time. A positive net worth indicates assets exceed liabilities, while a negative net worth signifies the opposite. This key metric provides a snapshot of financial health and serves as a benchmark for tracking progress.

- Regular Updates and AnalysisRegularly updating and analyzing net worth calculations provides insights into financial progress over time. Tracking changes in net worth, whether positive or negative, allows for identifying trends, evaluating the effectiveness of financial strategies, and making necessary adjustments to achieve financial goals. This ongoing assessment is crucial for proactive financial management.

Accurate and consistent application of these calculations within a standardized template ensures a reliable and informative net worth statement. This, in turn, empowers informed financial decision-making, facilitating effective progress tracking and contributing to overall financial well-being.

4. Regular Updates

Maintaining an up-to-date statement of net worth is crucial for informed financial management. Regular updates transform a static document into a dynamic tool, reflecting changes in financial circumstances and providing valuable insights for decision-making. This practice ensures an accurate picture of one’s financial position, enabling proactive adjustments to strategies and goals.

- Frequency of UpdatesThe frequency of updates depends on individual circumstances and financial activity. Monthly updates offer a granular view of short-term changes, while quarterly updates provide a broader perspective. Major life events, such as property purchases or significant investment shifts, warrant immediate updates to reflect their impact accurately. Choosing an appropriate frequency ensures the statement remains a relevant reflection of financial reality.

- Tracking Market FluctuationsInvestment portfolios, particularly those including publicly traded securities, are subject to market fluctuations. Regular updates capture these changes, providing a realistic assessment of asset values. This practice allows for timely portfolio adjustments, informed investment decisions, and a clear understanding of investment performance within the broader context of net worth.

- Debt Management and Progress MonitoringRegularly updating debt balances provides a clear picture of progress toward debt reduction goals. Tracking changes in loan balances, credit card debt, and other liabilities allows for assessing the effectiveness of repayment strategies and making necessary adjustments to accelerate progress and improve overall financial health.

- Life Event IntegrationSignificant life events, such as marriage, divorce, inheritance, or job changes, often have profound financial implications. Integrating these events into net worth calculations through timely updates ensures an accurate representation of one’s evolving financial situation. This practice enables proactive financial planning and informed decision-making during times of significant change.

Integrating regular updates into the practice of maintaining a statement of net worth transforms it into a powerful tool for financial management. This dynamic approach fosters financial awareness, empowers informed decision-making, and provides valuable insights into the evolving landscape of one’s financial well-being. The consistent application of this practice contributes significantly to long-term financial success.

5. Standardized Format

A standardized format is essential for creating a clear, consistent, and easily interpretable statement of net worth. Consistency facilitates accurate tracking of financial progress over time, simplifies comparison across different periods, and promotes a systematic approach to financial management. A structured layout ensures all essential information is captured and presented logically, enhancing clarity and usability.

- Categorization of Assets and LiabilitiesStandardized formats typically categorize assets and liabilities into distinct groups, such as liquid assets, investments, real property, secured debt, and unsecured debt. This categorization allows for a structured overview of financial holdings, facilitates detailed analysis within each category, and promotes a comprehensive understanding of overall financial position. For instance, separating short-term from long-term liabilities provides insights into immediate obligations versus longer-term financial commitments.

- Consistent Valuation MethodsEmploying consistent valuation methods across different periods ensures comparability and allows for accurate tracking of changes in net worth. Adhering to standardized valuation practices, such as using fair market value for assets and outstanding balances for liabilities, prevents inconsistencies that can distort the overall picture of financial health. For example, consistently using current market values for real estate holdings, rather than fluctuating between historical cost and estimated value, provides a more reliable measure of net worth.

- Clear Presentation of CalculationsA standardized format clearly outlines the calculations used to determine net worth. Presenting the summation of assets, the summation of liabilities, and the resulting difference in a structured manner enhances transparency and allows for easy verification of the final figure. This clarity minimizes the risk of errors and ensures the accurate representation of one’s financial standing.

- Date and Time StampingIncluding a clear date and time stamp on each statement of net worth creates a historical record of financial progress. This allows for tracking changes in net worth over specific periods, analyzing trends, and evaluating the effectiveness of financial strategies. This historical record provides valuable context for understanding financial growth and making informed decisions about future financial endeavors.

Adhering to a standardized format when creating a statement of net worth ensures clarity, consistency, and comparability over time. This structured approach enhances the document’s utility as a tool for tracking financial progress, making informed decisions, and achieving long-term financial goals. The standardization promotes a systematic and reliable approach to managing one’s financial well-being.

6. Personalization

While standardized templates provide a framework for calculating net worth, personalization tailors this framework to individual circumstances. Adapting a template to reflect specific financial goals, asset types, and liability structures enhances its utility and provides a more accurate and nuanced view of one’s financial position. This customization transforms a generic tool into a personalized financial roadmap.

- Specific Asset InclusionIndividuals may possess unique assets not explicitly covered in standard templates. Examples include intellectual property, business ownership interests, or valuable collections. Incorporating these assets, along with appropriate valuation methods, ensures a comprehensive and accurate reflection of total net worth. This personalized approach acknowledges the diverse nature of individual holdings beyond traditional asset categories.

- Detailed Liability BreakdownStandard templates may not accommodate the specific nuances of individual debt structures. Personalization allows for detailed categorization of liabilities, such as differentiating between student loans with varying interest rates or separating mortgages on multiple properties. This granular approach provides a clearer understanding of debt obligations and facilitates targeted debt management strategies.

- Goal-Oriented TrackingPersonalization enables the integration of specific financial goals within the net worth statement. This might involve adding sections to track progress toward a down payment on a house, saving for a child’s education, or building a retirement fund. Integrating these goals provides a tangible connection between net worth calculations and long-term financial aspirations, enhancing motivation and focus.

- Customized Reporting and VisualizationPersonalization extends to the visual presentation of net worth data. Individuals can customize charts, graphs, and reports to highlight key metrics, track progress toward specific goals, and gain a more intuitive understanding of their financial trajectory. This tailored approach enhances the interpretability of the data and facilitates more effective financial decision-making.

Personalizing a statement of net worth template enhances its utility as a tool for managing and tracking financial progress. By incorporating individual circumstances, specific goals, and customized reporting, individuals gain a more comprehensive and nuanced understanding of their financial position, empowering them to make informed decisions and achieve their financial aspirations.

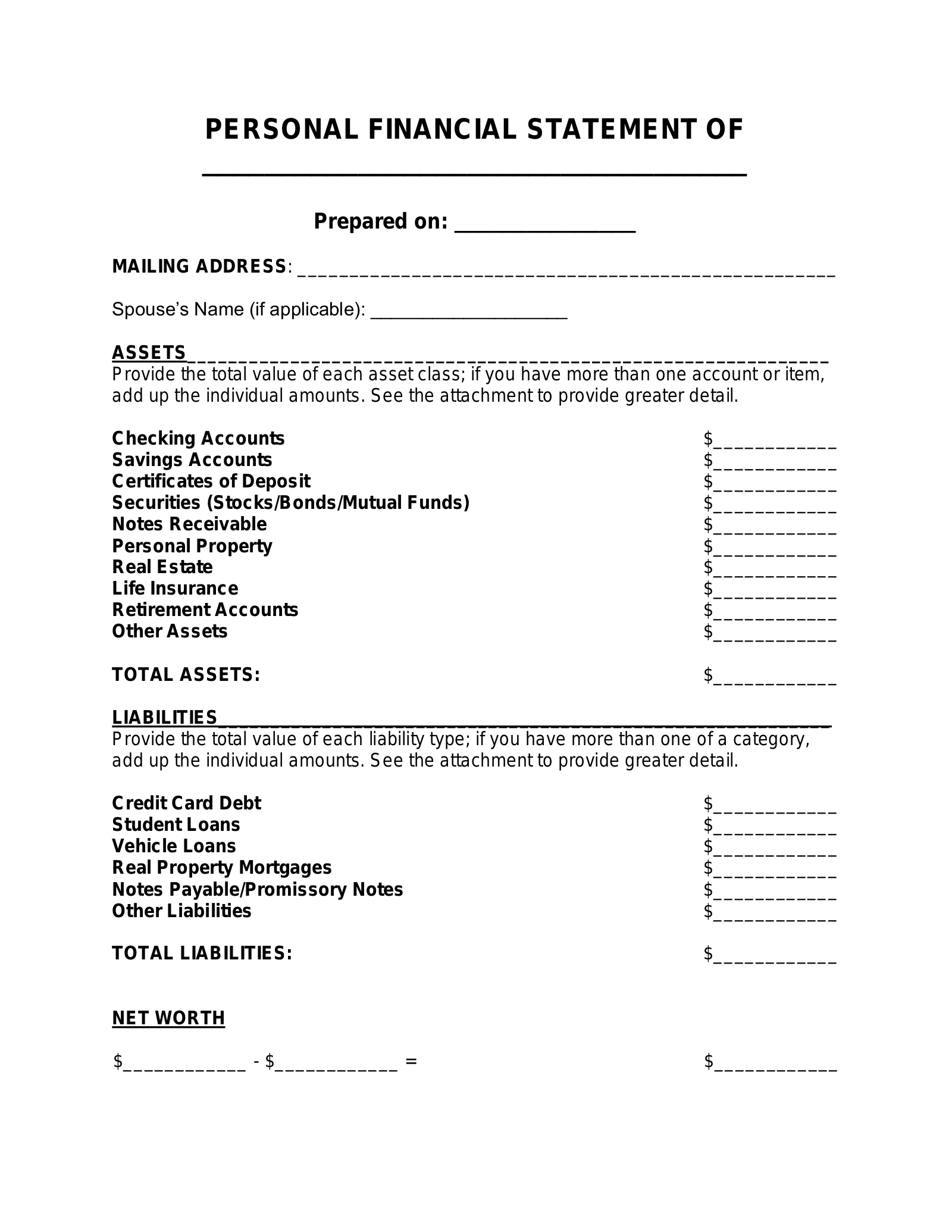

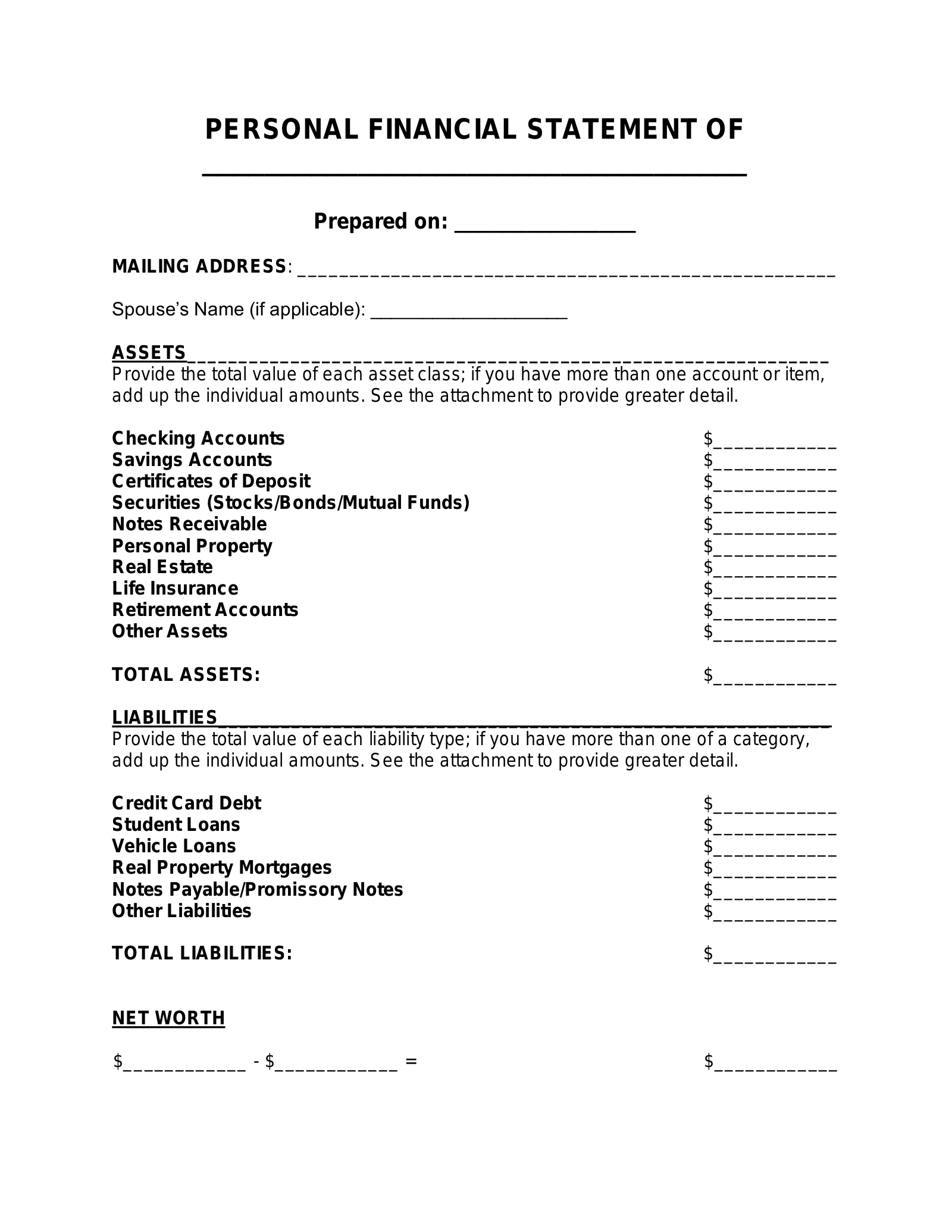

Key Components of a Statement of Net Worth Template

A comprehensive statement of net worth template requires several key components to provide a clear and accurate snapshot of one’s financial standing. These components ensure a thorough assessment of both assets and liabilities, facilitating informed financial planning and decision-making.

1. Assets: A detailed account of all owned possessions, categorized for clarity. Typical classifications include liquid assets (cash, checking and savings accounts), investments (stocks, bonds, retirement accounts), real property (land, buildings), and personal property (vehicles, jewelry). Accurate valuation is crucial, employing methods like current market appraisals for real estate and up-to-date market prices for investments.

2. Liabilities: A precise record of all outstanding debts and obligations. Categories often include secured debt (mortgages, auto loans), unsecured debt (credit card balances, personal loans), short-term liabilities (due within one year), and long-term liabilities (extending beyond one year). Accurate balance reporting and categorization are essential for a clear understanding of debt obligations.

3. Calculation Methodology: A transparent and consistent method for calculating net worth. This involves summing total assets, summing total liabilities, and then subtracting total liabilities from total assets. Clear presentation of this calculation ensures accuracy and facilitates easy verification.

4. Regular Updates: A system for consistently updating the statement to reflect changes in financial circumstances. Regular updates, whether monthly, quarterly, or triggered by significant life events, ensure the statement remains a relevant and accurate reflection of one’s financial position. This dynamic approach facilitates tracking progress and informed decision-making.

5. Standardized Format: A structured layout and consistent presentation of information enhance clarity and comparability over time. Standardized categorization of assets and liabilities, consistent valuation methods, and clear presentation of calculations promote accuracy and facilitate analysis of financial trends.

6. Personalization Options: The ability to adapt the template to individual circumstances. This includes options for incorporating unique assets, providing detailed liability breakdowns, tracking progress toward specific financial goals, and customizing reporting and visualizations. Personalization enhances the template’s relevance and utility as a personalized financial management tool.

Accurate data input, coupled with a well-structured template incorporating these key elements, provides a powerful tool for understanding, managing, and improving one’s financial health. This structured approach empowers informed financial decisions and facilitates progress toward long-term financial well-being.

How to Create a Statement of Net Worth Template

Creating a personalized statement of net worth template involves structuring a document to effectively capture and analyze financial data. A well-designed template facilitates accurate calculations, consistent tracking, and informed financial decision-making.

1. Define the Scope: Determine the intended purpose and frequency of use. Consider whether the template will focus on individual finances, household finances, or a specific financial goal. Establish the frequency of updates (e.g., monthly, quarterly, annually) based on individual needs and financial activity.

2. Structure the Asset Section: Create categories for different asset types. Typical categories include liquid assets, investments, real property, and personal property. Within each category, provide fields for item descriptions, acquisition dates, and current market values. Consider incorporating space for supporting documentation, such as appraisal reports or investment statements.

3. Structure the Liabilities Section: Create categories for different liability types, such as secured debt, unsecured debt, short-term liabilities, and long-term liabilities. Include fields for creditor names, account numbers, current balances, interest rates, and payment terms. This detailed breakdown facilitates targeted debt management strategies.

4. Design the Calculation Section: Clearly delineate the formulas for calculating total assets, total liabilities, and net worth. This ensures transparency and accuracy. Consider incorporating automatic calculation features within spreadsheet software to minimize manual data entry and reduce the risk of errors.

5. Incorporate Update Mechanisms: Establish a system for regularly updating the template with current financial information. This might involve setting calendar reminders, linking to online financial accounts, or integrating data feeds from financial institutions. A systematic approach ensures the statement remains a relevant reflection of financial reality.

6. Personalize and Refine: Tailor the template to specific individual circumstances. Add sections to track progress toward specific financial goals, incorporate unique asset types, or provide detailed liability breakdowns. Customize reporting and visualization features to enhance interpretability and facilitate informed decision-making.

A well-structured template, tailored to individual needs and regularly updated, becomes a powerful tool for managing and tracking financial progress. This structured approach promotes financial awareness, facilitates informed decision-making, and contributes to achieving long-term financial well-being.

Careful management of a personal balance sheet provides a crucial foundation for financial health. Accurate documentation of assets, liabilities, and their subsequent calculations offers a clear snapshot of one’s current financial standing. Regular updates, coupled with a standardized yet personalized approach, transform this document into a dynamic tool for tracking progress, informing financial decisions, and achieving long-term financial goals. Understanding the components, calculations, and benefits of regular maintenance empowers individuals to take control of their financial well-being.

Financial well-being relies on a clear understanding of one’s financial position. A regularly updated and personalized balance sheet serves as a cornerstone of this understanding, providing a roadmap for navigating financial complexities and achieving financial security. Consistent engagement with this crucial financial tool empowers informed decision-making and contributes significantly to long-term financial success. Diligent maintenance offers not just a snapshot of present circumstances, but also a compass for navigating the future.