Utilizing a predefined structure for financial reporting promotes consistency and accuracy. It simplifies the process of tracking income and expenditures, facilitating informed decision-making. This accessibility allows business owners to quickly identify areas of strength and weakness, enabling proactive adjustments to strategies and operations. Furthermore, a standardized format simplifies communication with stakeholders, including potential investors and lenders, by presenting financial data in a clear and universally understood manner.

This foundational understanding of financial reporting allows for a deeper exploration of specific income statement components, such as revenue streams, cost of goods sold, operating expenses, and the calculation of net income. Further analysis will delve into interpreting these figures and utilizing them for strategic planning and growth.

1. Revenues

Revenue, the lifeblood of any business, forms the cornerstone of a simple income statement template. Accurate revenue reporting is crucial for understanding profitability and overall financial health. A clear grasp of revenue components is essential for effective financial analysis and informed decision-making.

- Sales RevenueThis represents income generated from the core business operations, typically the sale of goods or services. For a retail store, this would be the total value of goods sold. For a service provider, it would be the fees earned for services rendered. Accurately capturing sales revenue is paramount, as it directly impacts the bottom line.

- Other RevenueThis category encompasses income derived from sources other than primary business activities. Examples include interest income, rental income, or royalties. While often smaller than sales revenue, other revenue streams can contribute significantly to overall profitability and should be meticulously tracked.

- Revenue Recognition PrincipleThis accounting principle dictates when revenue should be recorded. Generally, revenue is recognized when earned, regardless of when cash is received. This ensures accurate financial reporting by matching income with the period in which it was generated. Understanding this principle is critical for proper placement within the income statement.

- Impact on ProfitabilityRevenue directly impacts a company’s profitability. Higher revenues, assuming expenses remain controlled, translate to higher profits. Analyzing revenue trends over time provides valuable insights into business growth and performance. This analysis is facilitated by a clear and concise income statement structure.

A comprehensive understanding of these revenue facets allows for a more nuanced interpretation of the simple income statement template. By accurately capturing and categorizing revenue streams, businesses gain a clearer picture of their financial standing, enabling data-driven decisions for future growth and sustainability.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a company. Its accurate calculation is critical for determining gross profit and, ultimately, net income on a simple income statement template. Understanding COGS provides insights into a company’s production efficiency and pricing strategies.

- Direct MaterialsThis encompasses the raw materials used in production. For a furniture manufacturer, this would include wood, fabric, and hardware. Accurate tracking of direct material costs is essential for precise COGS calculation.

- Direct LaborThis includes the wages and benefits paid to employees directly involved in production. For a manufacturing company, this would be the salaries of assembly line workers. Accurate allocation of direct labor costs is crucial for understanding the true cost of production.

- Manufacturing OverheadThis covers indirect costs associated with production, such as factory rent, utilities, and depreciation of manufacturing equipment. Proper allocation of these overhead costs is necessary for a complete COGS picture.

- Impact on ProfitabilityCOGS directly impacts a company’s profitability. Higher COGS, with revenue held constant, results in lower gross profit and net income. Careful management and analysis of COGS are vital for maximizing profitability. A clear understanding of these components helps businesses optimize pricing strategies and control production costs.

A well-defined COGS section within a simple income statement template allows for insightful analysis of profitability. By understanding the components of COGS, businesses can identify areas for cost optimization and improve overall financial performance. This detailed view of COGS contributes to a more accurate and informative financial statement, facilitating informed decision-making and strategic planning.

3. Gross Profit

Gross profit, a key performance indicator, occupies a central position within a simple income statement template. Calculated as revenue less the cost of goods sold (COGS), it represents the profitability of a company’s core business operations before accounting for operating expenses. Understanding gross profit is fundamental for assessing a company’s pricing strategies, production efficiency, and overall financial health. For example, a software company with high gross profit margins indicates efficient development processes and potentially premium pricing. Conversely, a retailer with low gross profit margins may suggest intense competition or high sourcing costs. This metric reveals the financial resources available to cover operating expenses and generate net income. Its placement on the income statement provides a clear progression from top-line revenue to bottom-line profitability.

Analyzing gross profit trends over time provides valuable insights into a company’s performance. Consistent growth in gross profit, assuming stable or decreasing COGS, suggests effective management of production costs and pricing strategies. Conversely, declining gross profit may signal issues with pricing competitiveness, rising input costs, or production inefficiencies. A furniture manufacturer consistently increasing gross profit might indicate efficient raw material sourcing or successful premium product lines. Conversely, declining gross profit could signal increasing timber costs or production bottlenecks. This analysis facilitates proactive adjustments to business strategies and operations.

Accurate calculation and interpretation of gross profit are crucial for informed financial decision-making. Monitoring gross profit margins allows businesses to identify potential problems and implement corrective actions. Furthermore, understanding gross profit aids in evaluating investment opportunities and assessing overall financial stability. The position of gross profit within a simple income statement template emphasizes its importance as a bridge between revenue generation and overall profitability. It provides a crucial lens through which to assess a company’s financial health and potential for growth.

4. Operating Expenses

Operating expenses represent the costs incurred in running a business’s day-to-day activities, excluding the direct costs of producing goods or services (COGS). Within a simple income statement template, operating expenses are deducted from gross profit to arrive at net income. Accurate categorization and analysis of these expenses are crucial for understanding profitability and making informed financial decisions. A clear depiction of operating expenses allows stakeholders to assess a company’s efficiency and resource allocation. For instance, a software company might have significant operating expenses related to research and development, while a retail store might have higher expenses related to rent and marketing. Understanding this distinction provides context for evaluating overall performance.

Several key categories typically comprise operating expenses. Selling, general, and administrative expenses (SG&A) include salaries of administrative staff, marketing and advertising costs, rent, and office supplies. Research and development (R&D) expenses cover costs associated with developing new products or services. Depreciation and amortization reflect the allocation of the cost of long-term assets over their useful lives. For example, a manufacturing company would include depreciation of factory equipment within operating expenses. Careful tracking of these individual expense categories provides granular insights into cost drivers and areas for potential optimization. This detailed breakdown enhances the value of the simple income statement template as an analytical tool.

Effective management of operating expenses is essential for maximizing profitability. Analyzing trends in operating expenses, relative to revenue, provides valuable insights into a company’s operational efficiency. Unusually high operating expenses, compared to industry benchmarks, may indicate areas for cost reduction. Conversely, underinvestment in essential operating activities, like marketing or R&D, could hinder long-term growth. The clear presentation of operating expenses within a simple income statement template facilitates such analysis, enabling data-driven decisions and informed resource allocation. This understanding contributes to a comprehensive assessment of financial performance and supports strategic planning for sustainable growth.

5. Net Income

Net income, the ultimate measure of a company’s profitability, represents the residual earnings after all expenses have been deducted from revenues. Within a simple income statement template, net income occupies the bottom line, signifying its importance as the culmination of all financial activity during a specific period. Understanding net income is essential for evaluating a company’s financial performance and making informed investment decisions. Its position within the template underscores its role as the key indicator of a company’s ability to generate profit after accounting for all costs.

- Bottom Line ProfitabilityNet income reflects the actual profit generated by a company after accounting for all revenue and expense streams. This figure represents the financial resources available for reinvestment, debt reduction, or distribution to shareholders. A positive net income indicates profitability, while a negative net income (a net loss) signifies that expenses exceed revenues. For example, a retailer with a positive net income has generated sufficient revenue to cover the cost of goods, operating expenses, and still retain a profit.

- Impact of ExpensesAll expenses, including cost of goods sold (COGS) and operating expenses, directly impact net income. Effective cost management is crucial for maximizing net income. For instance, a manufacturing company implementing cost-saving measures in production can improve its net income by reducing COGS. The relationship between expenses and net income highlights the importance of efficient resource allocation.

- Relevance to InvestorsNet income serves as a key metric for investors in evaluating a company’s financial health and potential for future growth. Consistent growth in net income often signals a healthy and sustainable business model. For example, investors may view a technology company with consistently increasing net income as a promising investment opportunity. This underscores the importance of accurate and transparent net income reporting.

- Relationship to RevenueWhile revenue growth is important, it must translate into net income growth to signify true profitability. A company may experience increasing revenue but declining net income due to rising expenses. Analyzing the relationship between revenue and net income provides a comprehensive understanding of a company’s financial performance. For example, a restaurant experiencing revenue growth but declining net income may be facing increasing food costs or staffing challenges. This analysis necessitates examining both the top and bottom lines of the income statement.

Net income, as the culminating figure within a simple income statement template, provides a concise yet powerful overview of a company’s financial performance. By analyzing net income in conjunction with other components of the income statement, such as revenue, COGS, and operating expenses, stakeholders gain a comprehensive understanding of a company’s profitability, efficiency, and potential for future growth. This holistic approach to financial statement analysis enables informed decision-making and supports strategic planning for long-term success.

6. Reporting Period

The reporting period defines the timeframe covered by a simple income statement template. This specified duration, whether a month, quarter, or year, provides the context for evaluating a company’s financial performance. A clear understanding of the reporting period is crucial for accurate interpretation and comparison of financial data. Selecting an appropriate reporting period allows for meaningful analysis of trends and facilitates informed decision-making.

- Fiscal Year vs. Calendar YearA fiscal year is a 12-month period used by a company for accounting purposes. It may or may not align with the calendar year. Choosing a fiscal year aligned with a company’s natural business cycle provides a more accurate reflection of its financial activity. A retailer might choose a fiscal year ending after the holiday shopping season. The selected reporting period must be clearly stated on the income statement template for transparency.

- Comparative AnalysisAnalyzing income statements across multiple reporting periods reveals trends in revenue, expenses, and profitability. Comparing performance year-over-year or quarter-over-quarter provides insights into a company’s growth trajectory and operational efficiency. A manufacturer might compare quarterly income statements to assess seasonal sales patterns. This comparative analysis requires consistent reporting periods.

- Impact on Decision-MakingThe reporting period influences managerial decisions related to budgeting, forecasting, and resource allocation. Short reporting periods, such as monthly income statements, offer a granular view of performance, enabling rapid adjustments to strategies. Longer reporting periods, such as annual income statements, provide a broader perspective on overall financial health. A startup might use monthly income statements for close monitoring of early performance, while a mature company might focus on annual results for long-term strategic planning. The chosen reporting period must align with the decision-making timeframe.

- Regulatory RequirementsCertain regulatory bodies mandate specific reporting periods for financial statements. Publicly traded companies, for example, are typically required to file quarterly and annual reports. Adhering to these requirements ensures compliance and facilitates comparison across companies. The chosen reporting period must satisfy all applicable regulatory mandates. This consideration is crucial for maintaining transparency and accountability.

The reporting period acts as a foundational element within a simple income statement template. It provides the temporal framework for interpreting financial data, facilitating comparative analysis, and supporting informed decision-making. Selecting an appropriate reporting period, and clearly stating it on the income statement, ensures clarity, transparency, and facilitates meaningful insights into a company’s financial performance. This understanding is essential for extracting maximum value from the income statement and utilizing it effectively for strategic planning and growth.

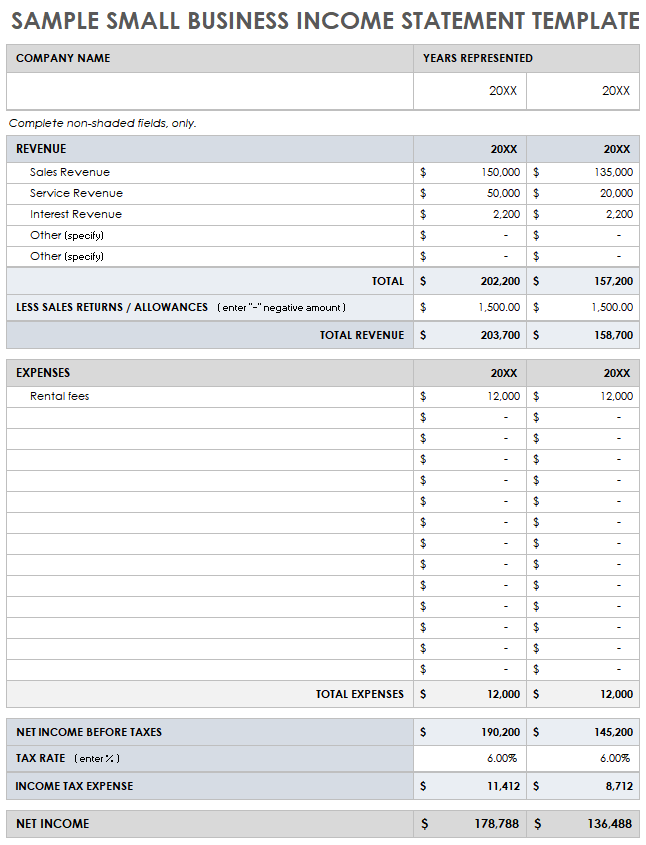

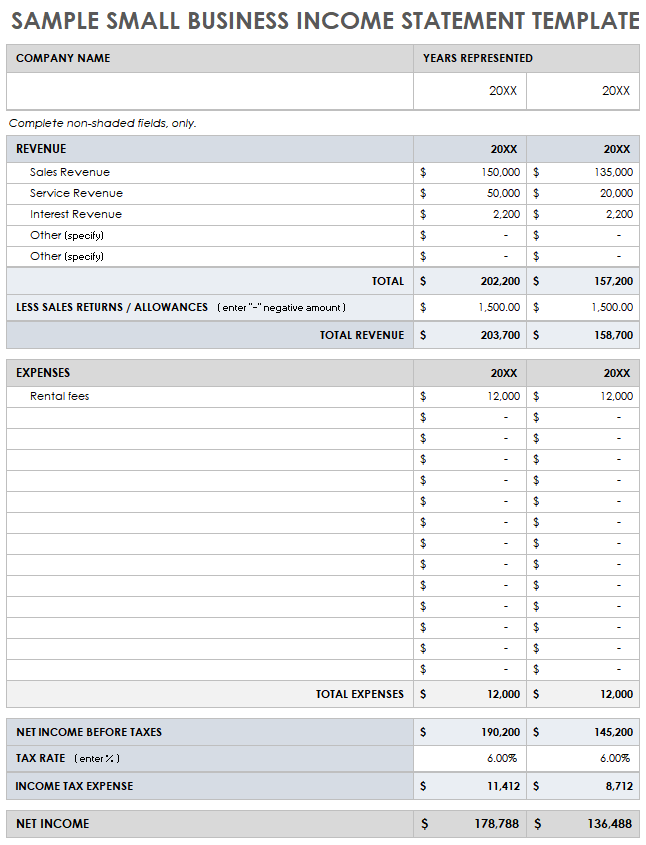

Key Components of a Simple Income Statement Template

A simple income statement template provides a concise overview of a company’s financial performance over a specific period. Understanding its key components is crucial for interpreting the information presented and making informed business decisions.

1. Revenue: Revenue represents the total income generated from a company’s primary business activities, such as sales of goods or services. It forms the top line of the income statement and serves as the starting point for calculating profitability.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing the goods sold. This includes raw materials, direct labor, and manufacturing overhead. Accurately calculating COGS is essential for determining gross profit.

3. Gross Profit: Gross profit is calculated by subtracting COGS from revenue. It represents the profit generated from a company’s core business operations before accounting for operating expenses. This metric provides insights into pricing strategies and production efficiency.

4. Operating Expenses: Operating expenses represent the costs incurred in running a business’s day-to-day activities, excluding COGS. These include selling, general, and administrative expenses (SG&A), research and development (R&D), and depreciation/amortization. Managing operating expenses effectively is crucial for maximizing profitability.

5. Operating Income: Operating income is derived by subtracting operating expenses from gross profit. This metric reflects the profitability of a company’s core business operations after accounting for all operating expenses. It provides insight into the efficiency of a company’s operations.

6. Other Income/Expenses: This category encompasses income or expenses not directly related to a company’s core business operations. Examples include interest income, gains or losses from investments, and one-time charges. These items are considered separately from operating activities.

7. Income Before Taxes: Income before taxes represents a company’s earnings before accounting for income tax expense. This metric is essential for understanding a company’s profitability before the impact of taxes.

8. Income Tax Expense: This represents the expense associated with income taxes owed by the company. The applicable tax rate depends on the company’s jurisdiction and tax regulations. Accurate calculation of income tax expense is critical for determining net income.

9. Net Income: Net income, often referred to as the “bottom line,” represents the final profit after all expenses, including taxes, have been deducted from revenues. It provides a comprehensive measure of a company’s profitability and serves as a key indicator of financial health.

10. Reporting Period: The reporting period defines the timeframe covered by the income statement, whether a month, quarter, or year. This information provides context for interpreting the financial data and facilitates comparison across different periods.

Careful analysis of these components allows stakeholders to assess a company’s financial health, identify trends, and make informed decisions regarding resource allocation, pricing strategies, and future growth prospects.

How to Create a Simple Income Statement Template

Creating a simple income statement template involves organizing key financial data in a structured format. This process facilitates clear communication of a company’s financial performance over a specific period.

1. Define the Reporting Period: Specify the timeframe covered by the income statement (e.g., month, quarter, or year). This provides context for the financial data presented.

2. Record Revenue: Document all income generated from sales of goods or services. Include any other revenue streams, such as interest or rental income.

3. Calculate Cost of Goods Sold (COGS): Determine the direct costs associated with producing goods sold, including raw materials, direct labor, and manufacturing overhead.

4. Determine Gross Profit: Subtract COGS from revenue to arrive at gross profit. This represents profit before operating expenses.

5. List Operating Expenses: Itemize all operating expenses, including selling, general, and administrative (SG&A), research and development (R&D), and depreciation/amortization.

6. Calculate Operating Income: Subtract operating expenses from gross profit to arrive at operating income. This metric reveals profitability after operating expenses.

7. Include Other Income/Expenses: Account for any non-operating income or expenses, such as interest income or investment gains/losses.

8. Calculate Income Before Taxes: Add other income and subtract other expenses from operating income.

9. Deduct Income Tax Expense: Calculate and subtract income tax expense based on applicable tax rates.

10. Calculate Net Income: Subtract income tax expense from income before taxes to arrive at net income, the final measure of profitability.

A well-structured template presents these components clearly, enabling stakeholders to assess financial performance efficiently. Consistent formatting and accurate data entry ensure the template’s reliability as a tool for analysis and decision-making.

A streamlined profit and loss statement offers a clear and accessible method for understanding financial performance. From revenue generation and cost analysis to the calculation of net income, each component contributes to a comprehensive overview of a company’s profitability. Utilizing a standardized template ensures consistency and accuracy in financial reporting, facilitating informed decision-making and effective communication with stakeholders. Understanding these key componentsrevenue, cost of goods sold, gross profit, operating expenses, and net incomeempowers businesses to identify areas of strength and weakness, enabling proactive adjustments to strategies and operations.

Effective financial management hinges on the ability to interpret and utilize data derived from a clear and concise income statement. Regular review and analysis of this information are crucial for sustained growth and long-term success. This understanding allows for proactive adaptation to changing market conditions, optimized resource allocation, and informed strategic planning. Accurate and consistent financial reporting fosters transparency, builds trust with stakeholders, and ultimately contributes to a stronger financial foundation for future endeavors.