Utilizing these resources can provide individuals with a clearer picture of their financial activity, aiding in identifying potential discrepancies or areas for improvement. This can be particularly helpful for educational purposes, developing budgeting skills, or preparing for financial discussions. The ability to manipulate a sample document can streamline the process of setting up personal finance software or creating financial projections.

This understanding provides a foundation for exploring related topics such as personal finance management, budgeting techniques, and the selection of appropriate financial tools. Further investigation into these areas can empower individuals to make informed financial decisions and achieve their financial goals.

1. Budgeting

Effective budgeting requires a clear understanding of income and expenditures. A complimentary replica of a bank statement provides a practical framework for developing and refining a budget. By inputting hypothetical or estimated figures into the template, individuals can visualize their financial activity and identify areas for potential savings or adjustments.

- Income AllocationA template allows users to allocate projected income across various expense categories, such as housing, transportation, and groceries. This visualization can highlight overspending in specific areas. For instance, allocating 25% of income to housing within the template can reveal whether current housing costs align with budgetary goals.

- Expense TrackingThe structure of a statement replica facilitates the categorization and tracking of expenses. This detailed breakdown enables users to monitor spending patterns. Categorizing expenses within the template, such as differentiating between “Dining Out” and “Groceries,” provides insights into discretionary spending.

- Goal SettingUtilizing a template can aid in setting realistic financial goals. By projecting income and expenses, individuals can determine the feasibility of saving for specific objectives. For example, inputting savings goals into the template allows for a realistic assessment of how long it might take to reach a down payment target.

- Scenario PlanningA template allows for scenario planning by adjusting income and expense figures. This enables individuals to anticipate the financial impact of various life events or economic changes. For instance, adjusting income figures within the template can illustrate the budgetary impact of a potential salary increase or job change.

These budgeting facets, when applied to a bank statement replica, offer a comprehensive and practical approach to financial management. This approach empowers individuals to gain control of their finances, make informed decisions, and work towards long-term financial stability.

2. Financial Planning

Financial planning benefits significantly from the utilization of complimentary bank statement replicas. These replicas serve as valuable tools for visualizing financial activity, projecting future scenarios, and developing informed strategies. The structured format of a statement allows for the systematic organization of financial data, facilitating a comprehensive understanding of cash flow, expenses, and potential growth opportunities. This understanding forms the basis for sound financial decision-making.

The act of populating a replica with projected figures encourages proactive financial thinking. For example, anticipating a large purchase, such as a down payment on a house, can be modeled within the template. This exercise allows individuals to assess the long-term financial implications of such decisions, including the impact on savings, debt, and overall financial stability. Further, the template can be used to explore various saving and investment strategies, allowing individuals to visualize the potential growth of their assets over time. By manipulating variables like interest rates and contribution amounts, the template facilitates informed decisions regarding investment portfolios and retirement planning. A replica also aids in identifying potential financial risks and developing mitigation strategies. Analyzing projected cash flows within the template can reveal vulnerabilities to economic downturns or unexpected expenses, enabling proactive adjustments to spending habits and investment strategies.

In conclusion, integrating complimentary bank statement replicas into financial planning processes offers valuable insights and practical advantages. The ability to visualize, project, and analyze financial data within a structured format empowers individuals to make informed decisions, mitigate risks, and work towards achieving long-term financial goals. This proactive approach to financial management contributes to greater financial security and stability.

3. Software Testing

Software applications handling financial data require rigorous testing to ensure accuracy, reliability, and security. Complimentary bank statement replicas play a crucial role in this process, providing realistic data for testing various software functionalities. These replicas allow developers to simulate real-world scenarios without compromising sensitive user data.

- Data ValidationReplicas facilitate testing data validation rules within financial software. By inputting various data formats and values into the software using the template as a guide, developers can verify the system’s ability to identify and flag inconsistencies or errors. This ensures that only valid data is processed, maintaining data integrity and preventing potential issues downstream. For instance, a replica enables testing the system’s response to incorrect date formats or invalid transaction amounts.

- Import/Export FunctionalitySoftware often requires the ability to import and export financial data in various formats. Replicas, available in different file types, enable thorough testing of these functionalities. This ensures seamless data transfer between different systems and prevents data loss or corruption during import/export operations. Testing with various file formats, such as CSV, PDF, and OFX, using data from a replica, confirms compatibility and robust data handling.

- Calculations and ReportingAccurate calculation of balances, interest, and other financial metrics is critical for financial software. Replicas provide a controlled dataset to validate these calculations. This ensures the accuracy of financial reports generated by the software. Using a replica with predefined values allows developers to verify the correctness of calculated balances and interest accruals.

- Security TestingWhile replicas do not contain real user data, they can still be instrumental in security testing. By simulating various data inputs, developers can assess the system’s vulnerability to potential attacks, such as SQL injection or cross-site scripting. This proactive approach strengthens the software’s security posture and protects sensitive financial information. For example, inputting special characters and scripts into fields within the replica can reveal vulnerabilities to injection attacks.

Leveraging complimentary bank statement replicas in software testing significantly enhances the reliability and security of financial applications. This rigorous testing process, facilitated by realistic sample data, ensures accurate data processing, seamless data transfer, and robust security measures, ultimately benefiting end-users through a more reliable and secure financial experience.

4. Educational Purposes

Complimentary bank statement replicas hold significant educational value, offering a practical and risk-free way to learn about financial documents and their underlying principles. These templates provide a tangible representation of real-world financial data, enabling learners to interact with the structure and content of a bank statement without accessing sensitive personal information. This hands-on experience facilitates a deeper understanding of financial concepts and promotes financial literacy.

- Understanding Statement StructureReplicas allow learners to familiarize themselves with the various components of a bank statement, including transaction descriptions, dates, debits, credits, and running balances. This foundational understanding is crucial for interpreting financial information and making informed financial decisions. For example, examining a replica can clarify the difference between a debit and a credit transaction, and how these affect the account balance. This knowledge is fundamental for managing personal finances effectively.

- Practical Application of Budgeting PrinciplesUsing a replica allows individuals to apply budgeting principles in a simulated environment. By inputting hypothetical income and expenses, learners can practice categorizing transactions, tracking spending, and analyzing cash flow. This practical application reinforces theoretical budgeting concepts and develops essential financial management skills. For instance, using a replica to create a mock budget can help students understand the importance of allocating funds to different expense categories and tracking spending against a budget.

- Financial Software TrainingReplicas can serve as training tools for learning how to use financial software. Inputting data from a replica into personal finance software allows users to practice data entry, reconciliation, and report generation. This hands-on experience accelerates the learning curve and promotes confident software utilization. For example, importing transactions from a replica into budgeting software allows users to familiarize themselves with the software’s interface and functionalities without the risk of corrupting real financial data.

- Financial Literacy Curriculum DevelopmentEducators can incorporate statement replicas into financial literacy curricula. These templates provide a practical and engaging resource for teaching students about financial statements, budgeting, and personal finance management. The interactive nature of working with a replica enhances student engagement and promotes deeper learning. For example, teachers can use replicas to illustrate real-world financial scenarios, such as balancing a checkbook or calculating interest earned on savings.

The educational applications of complimentary bank statement replicas contribute significantly to enhancing financial literacy and promoting responsible financial behavior. By providing a safe and accessible platform for learning, these templates empower individuals to develop essential financial skills and make informed decisions, laying a solid foundation for long-term financial well-being. The practical experience gained from using these replicas bridges the gap between theoretical knowledge and real-world application, resulting in a more comprehensive and impactful learning experience.

5. Format Compatibility

Format compatibility is a critical aspect of complimentary bank statement replicas. The usability and practical application of these templates are directly influenced by the file formats available. Compatibility ensures seamless integration with various software applications, enabling users to leverage the replicas for budgeting, financial planning, and software testing. A template’s value is diminished if its format restricts accessibility or interoperability with commonly used software.

Several factors influence the importance of format compatibility. Commonly used spreadsheet software requires compatibility with formats like .XLS or .CSV for data manipulation and analysis. Financial planning software may require specific formats like .OFX or .QFX for importing transaction data. Furthermore, the ability to convert the template to a portable document format (.PDF) can be essential for sharing and printing. For example, a user might download a .CSV version of a replica to analyze transactions in a spreadsheet program, while a developer might use a .QFX version to test the import functionality of a financial application. Incompatibility can lead to data loss, formatting errors, and significant time wasted in converting file formats.

Ensuring format compatibility maximizes the utility of complimentary bank statement replicas. Widely compatible formats expand accessibility to a broader user base, enabling diverse applications. This accessibility facilitates broader utilization for educational purposes, personal finance management, and software development. Addressing format compatibility challenges through offering diverse download options enhances the practical value and overall effectiveness of these valuable resources. Failure to address compatibility issues can limit the template’s usefulness and restrict its potential applications, hindering its overall effectiveness as a tool for financial management and software development.

6. Customization

Customization capabilities significantly enhance the utility of complimentary bank statement replicas. Adapting these templates to reflect specific financial scenarios allows for more realistic simulations and personalized analyses. This flexibility transforms a generic template into a powerful tool tailored to individual needs, whether for budgeting, software testing, or educational purposes. Without customization options, the template’s applicability remains limited, restricting its value for practical use.

- Data ModificationThe ability to modify transaction details, including dates, descriptions, and amounts, allows users to create scenarios reflecting their unique financial circumstances. This facilitates more accurate budgeting, personalized financial projections, and targeted software testing. For example, a user can modify transaction amounts to reflect anticipated expenses for an upcoming home renovation project, providing a realistic basis for budget adjustments. Similarly, developers can input specific transaction types and amounts to rigorously test the handling of various financial scenarios within an application. Without the ability to modify data, the replica remains a static representation, limiting its usefulness for dynamic simulations and personalized analyses.

- Format AdjustmentsCustomizing the visual layout and formatting of the template can enhance readability and compatibility with various software applications. Adjusting font sizes, column widths, and date formats can improve visual clarity and ensure seamless integration with personal finance software. For instance, a user might adjust the date format to match their preferred convention, or widen specific columns to accommodate longer transaction descriptions. Developers might modify the template to align with the specific import requirements of their financial software. This flexibility ensures the replica can be effectively utilized across diverse platforms and applications, maximizing its utility for various purposes.

- Scenario CreationCustomization allows users to create hypothetical financial scenarios, such as projecting the impact of a salary increase or simulating the effects of varying interest rates on investments. This facilitates informed financial planning and enables users to explore different financial strategies in a risk-free environment. For example, a user can adjust income figures to assess the impact of a potential promotion on their overall budget, while an educator can modify transaction data to illustrate the effects of compound interest on long-term savings. This ability to create personalized scenarios significantly enhances the educational and planning value of the template.

- Template Integration with External ToolsCustomizing the template to align with the input requirements of external financial tools, such as budgeting software or investment platforms, enhances data interoperability. This allows users to seamlessly import and export data between the template and their preferred financial management applications. For example, formatting the template to match the import specifications of budgeting software streamlines data transfer, enabling efficient analysis and report generation within the chosen application. This seamless integration expands the template’s functionality and enhances its practical value for managing personal finances.

These customization facets, when applied to complimentary bank statement replicas, transform them into highly versatile tools. The ability to tailor these templates to specific individual needs and integrate them with existing financial workflows amplifies their value for budgeting, financial planning, software testing, and educational purposes. By offering a flexible and adaptable framework, customizable replicas empower users to gain a deeper understanding of their financial landscape and make more informed decisions.

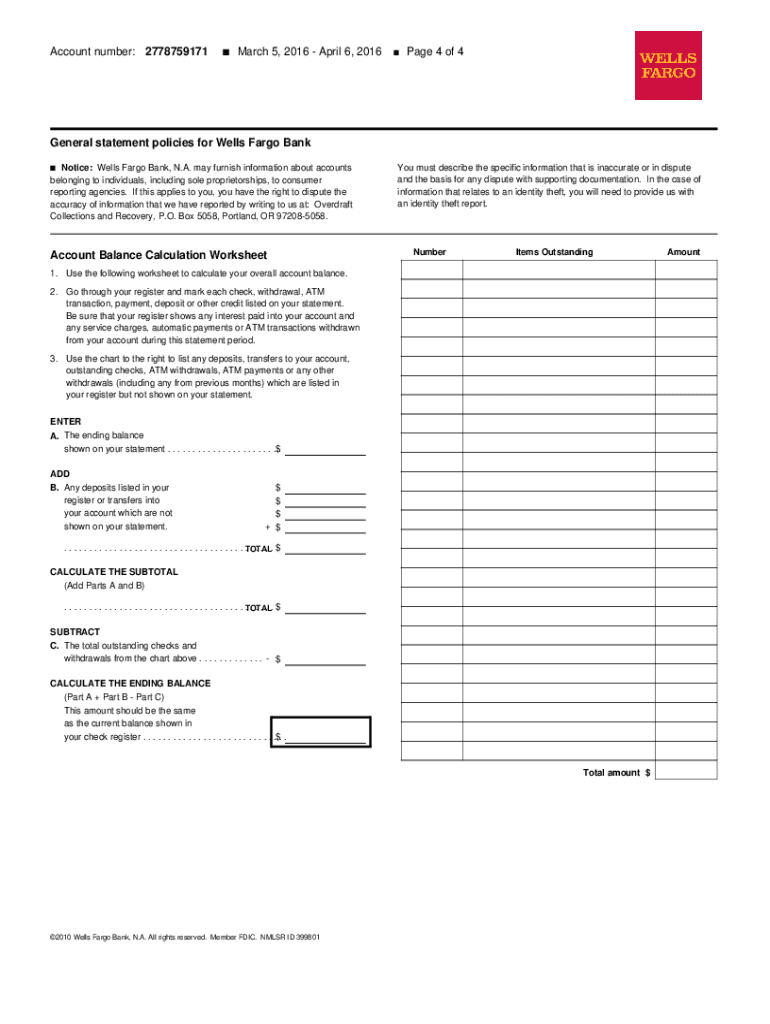

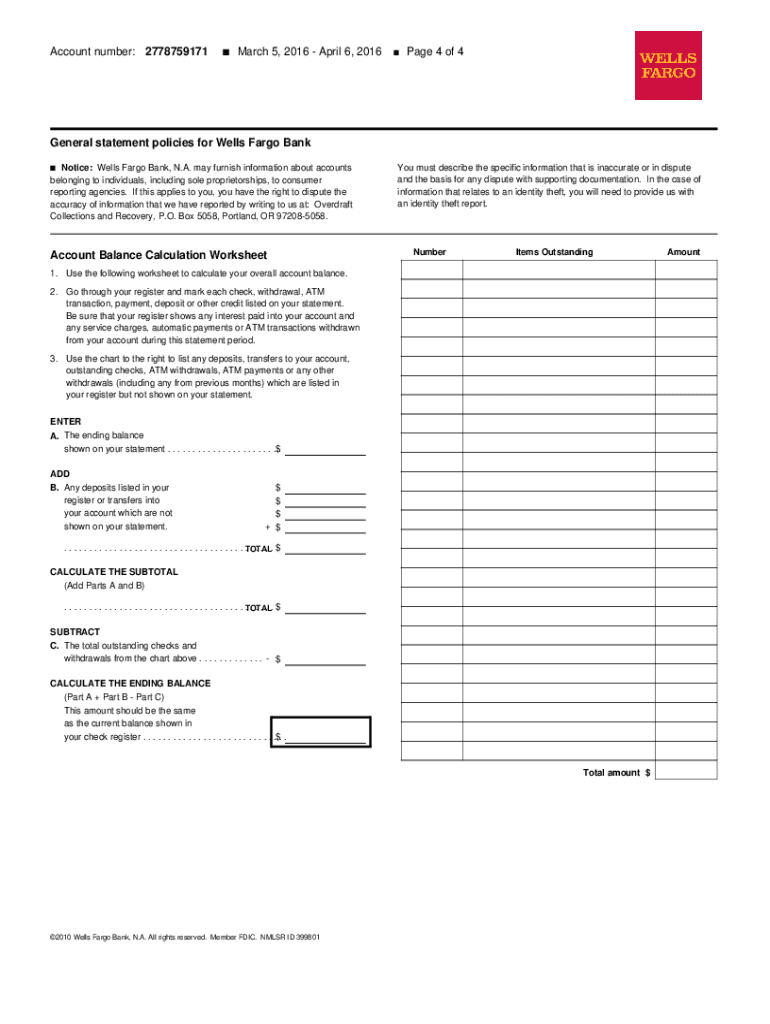

Key Components of a Complimentary Wells Fargo Bank Statement Replica

Understanding the core components of a complimentary Wells Fargo bank statement replica is essential for effective utilization. These components define the structure and content of the replica, enabling its use in various applications.

1. Header Information: The header typically includes the financial institution’s name and logo, along with the statement period. This information provides context and identifies the source of the document. Accurate header information ensures the replica aligns with the official format, enhancing realism and practical application.

2. Account Details: This section identifies the specific account, including the account number, account holder name, and address. Accurate account details are crucial for personalized simulations and practical applications in budgeting and financial planning.

3. Transaction History: This component forms the core of the statement, detailing individual transactions with dates, descriptions, and amounts. A comprehensive transaction history enables accurate analysis of spending patterns, cash flow, and account balance trends.

4. Beginning and Ending Balances: These figures represent the account balance at the start and end of the statement period. Clear presentation of these balances is crucial for understanding the overall financial picture and assessing the net effect of transactions during the specified period.

5. Summary Information: This section may include summaries of deposits, withdrawals, and other relevant financial activity during the statement period. Summary information provides a concise overview of key financial metrics, facilitating quick analysis and informed decision-making.

6. Footer Information: The footer typically includes contact information for the financial institution, along with any relevant disclaimers or legal notices. This information ensures compliance and provides users with access to support resources if needed.

These components work together to provide a comprehensive representation of financial activity within a specific account. The structured layout facilitates clear analysis, enabling informed financial management and effective utilization in various applications, from personal budgeting to software testing.

How to Create a Complimentary Wells Fargo Bank Statement Replica

Creating a complimentary replica of a Wells Fargo bank statement involves replicating the structure and key components of an authentic statement without including real financial data. This process allows for the creation of a realistic template for various applications, such as budgeting exercises, software testing, or educational demonstrations. Accuracy in replicating the format and including essential elements is crucial for the template’s effectiveness.

1. Software Selection: Choose appropriate software for creating the template. Spreadsheet software (e.g., Microsoft Excel, Google Sheets, LibreOffice Calc) or word processing software with table functionality offers the necessary formatting capabilities. Selecting the right software is the foundation for creating a usable and adaptable template. Software choice influences formatting flexibility and compatibility with other tools.

2. Header Replication: Replicate the header section, including the Wells Fargo logo (obtainable from official Wells Fargo resources, ensuring proper usage rights), bank name, and statement period. Accurate header replication adds authenticity and clarifies the document’s purpose. This contributes to a realistic representation of an official bank statement.

3. Account Information Input: Include placeholder text for account details like account number, account holder name, and address. Placeholder text maintains the structure while avoiding the inclusion of real personal information. This safeguards privacy and emphasizes the template’s purpose as a replica.

4. Transaction Table Creation: Create a table to represent the transaction history. Columns should include date, description, debit amount, credit amount, and running balance. This structured layout facilitates data input and analysis. A well-structured transaction table is crucial for simulating real-world financial activity.

5. Sample Transaction Data Entry: Populate the transaction table with placeholder or hypothetical data. Avoid using real financial information. This maintains the template’s anonymity and ensures its suitability for diverse applications. Sample data allows users to interact with the template and visualize its functionality.

6. Beginning and Ending Balance Input: Include fields for the beginning and ending balances, aligned with the transaction data. These fields provide context for the transaction history and facilitate calculations. Accurate balance representation enhances the template’s realism and practical value.

7. Summary Section Inclusion: Consider including a summary section for key financial metrics like total deposits and withdrawals. This provides a concise overview of financial activity. Summarizing key data enhances the template’s utility for analysis and decision-making.

8. Footer Information: Replicate the footer with placeholder contact information and any relevant disclaimers. This reinforces the template’s resemblance to an authentic statement. A complete footer enhances the replica’s realism and provides space for important notices.

Following these steps creates a functional and realistic replica of a Wells Fargo bank statement, suitable for various applications. Accurate replication of structure and inclusion of key components ensures the templates effectiveness in simulating real-world financial documents. This facilitates practical use in budgeting, financial planning, software testing, and educational contexts.

Access to complimentary replicas of financial documents, such as those issued by Wells Fargo, offers significant advantages for various applications. These replicas provide a structured framework for understanding the components and information typically presented in official bank statements. This understanding is crucial for effective budgeting, informed financial planning, and rigorous software testing. The ability to manipulate sample data within a replica allows users to explore different financial scenarios, analyze spending patterns, and develop personalized financial strategies. Furthermore, these templates serve as valuable educational resources, promoting financial literacy and enabling practical application of financial management principles. The availability of customizable and format-compatible replicas enhances their utility across diverse platforms and applications, maximizing their value for both individual and professional use.

Leveraging these freely available resources empowers individuals to take control of their financial well-being. Careful analysis of financial data, facilitated by these templates, enables informed decision-making and proactive financial management. The ability to project, analyze, and adapt to various financial scenarios contributes to greater financial stability and long-term financial health. Continued exploration and utilization of these tools are encouraged to foster greater financial awareness and empower individuals to achieve their financial goals. This proactive engagement with financial planning, supported by readily available resources, is essential for navigating the complexities of personal finance and building a secure financial future.