Utilizing a standardized format offers several advantages. It simplifies compliance with regulatory reporting requirements, facilitates internal financial analysis, and enables effective communication with donors, grant providers, and the public. This transparency builds trust and demonstrates responsible stewardship of resources, enhancing an organization’s credibility and fostering stronger relationships with stakeholders. It also allows for year-over-year comparisons, aiding in strategic planning and resource allocation.

This document serves as a critical tool for understanding an organizations financial health and sustainability. The following sections will explore its core components, best practices for its creation and utilization, and available resources for implementation.

1. Standardized Format

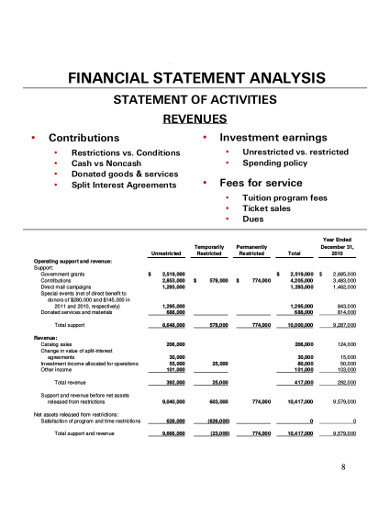

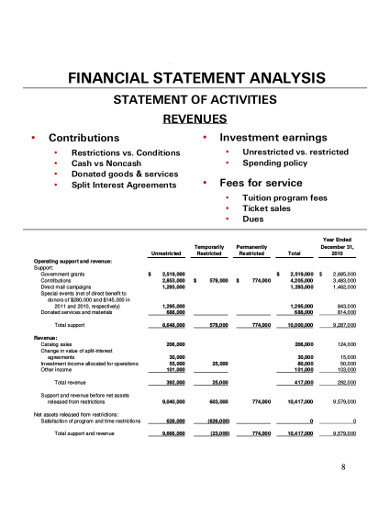

Standardized formatting provides a crucial framework for charity statements of financial activities. This consistency ensures comparability across different organizations and over time. A standardized template typically segregates information into key categories: revenues, broken down by source (e.g., donations, grants, investment income); expenses, categorized by function (e.g., program services, fundraising, administration); and changes in net assets. This structured approach facilitates analysis and understanding of an organization’s financial performance. For example, a consistent presentation of fundraising expenses allows stakeholders to assess efficiency and effectiveness across multiple charities.

Adherence to a standardized format also simplifies regulatory compliance. Many jurisdictions mandate specific reporting requirements for charitable organizations. Utilizing a template aligned with these regulations streamlines the reporting process and reduces the risk of errors or omissions. Furthermore, standardized reporting enhances transparency and accountability. Donors, grant-makers, and the public can readily access and interpret financial information presented in a familiar format. This transparency builds trust and fosters confidence in the organization’s stewardship of resources. For instance, consistent reporting of program expenses demonstrates how donations directly impact the intended beneficiaries.

In summary, a standardized format for charity statements of financial activities is essential for comparability, compliance, and transparency. This structured approach facilitates informed decision-making by stakeholders, strengthens accountability, and promotes public trust. Challenges can arise in adapting a standard template to unique organizational circumstances; however, the benefits of consistency and comparability generally outweigh these difficulties. The adoption of standardized reporting ultimately contributes to a more robust and accountable charitable sector.

2. Revenue Sources

A clear articulation of revenue sources forms a cornerstone of any robust charity statement of financial activities template. This section delineates the various channels through which the organization receives financial support. Accurately categorizing and reporting these sources is crucial for transparency and accountability, enabling stakeholders to understand the organization’s financial underpinnings. Typical revenue streams for charitable organizations include individual donations, grants from foundations or government agencies, investment income, fundraising events, and corporate sponsorships. For instance, a charity might receive a grant specifically designated for a particular program; this should be reported separately from unrestricted donations. This detailed breakdown allows for a nuanced understanding of funding streams and their intended uses.

The presentation of revenue sources within the statement offers valuable insights into an organization’s financial health and sustainability. A diversified revenue base generally indicates greater financial stability and resilience compared to reliance on a single source. Furthermore, the proportion of revenue derived from different sources can inform strategic decision-making. For example, a significant decline in individual giving might prompt the organization to explore alternative fundraising strategies or diversify its donor base. Conversely, a successful capital campaign might significantly alter the revenue mix, necessitating adjustments to budgeting and program planning. Understanding these dynamics is critical for long-term financial planning and effective resource allocation.

Accurate and transparent reporting of revenue sources is not only essential for internal financial management but also for maintaining public trust and meeting regulatory requirements. Misrepresenting or obscuring revenue sources can damage an organization’s reputation and jeopardize its legal standing. Moreover, clear reporting facilitates compliance with regulatory bodies, which often mandate specific disclosures related to fundraising activities and revenue recognition. By adhering to best practices in revenue reporting, charitable organizations demonstrate their commitment to accountability and responsible stewardship of resources. This, in turn, strengthens their credibility and fosters trust among donors, beneficiaries, and the wider community.

3. Expense Breakdown

A comprehensive expense breakdown is an integral component of a charity statement of financial activities template. This section provides a detailed account of how an organization utilizes its financial resources, offering crucial insights into its operational efficiency and program effectiveness. Transparency in expense reporting is paramount for maintaining accountability to donors, beneficiaries, and regulatory bodies. A clear understanding of expenditure patterns allows stakeholders to assess whether resources are being deployed effectively to achieve the organization’s mission.

- Program ServicesThis category encompasses expenses directly related to fulfilling the organization’s mission and delivering services to beneficiaries. Examples include salaries of program staff, materials and supplies used in program activities, and costs associated with program delivery. A high proportion of expenses dedicated to program services generally suggests efficient resource allocation and alignment with the organization’s mission. Conversely, a disproportionately low percentage allocated to program activities may raise concerns about operational efficiency and overhead costs.

- FundraisingFundraising expenses represent the costs incurred in securing donations and other revenue. This includes expenses related to fundraising campaigns, events, grant writing, and donor cultivation. Monitoring fundraising expenses allows for an evaluation of fundraising efficiency and return on investment. High fundraising costs relative to the revenue generated may signal inefficiencies in fundraising strategies. This information can inform decisions about resource allocation and process optimization within the fundraising department.

- AdministrativeAdministrative expenses cover the general operational costs necessary to support the organization’s activities. These expenses may include salaries of administrative staff, office rent, utilities, and information technology. While necessary for organizational functioning, excessive administrative costs can raise concerns about operational efficiency. Analyzing administrative expenses in relation to program services and fundraising expenses offers valuable insights into the organization’s overall cost structure.

- GovernanceGovernance expenses pertain to the oversight and management of the organization, including board meetings, legal counsel, and audit fees. These expenses are essential for ensuring compliance, accountability, and responsible financial management. Transparent reporting of governance expenses reinforces public trust and demonstrates a commitment to ethical practices. Analyzing trends in governance expenses can reveal potential areas for improvement in organizational oversight and management.

By providing a detailed breakdown of expenses categorized by function, the charity statement of financial activities offers critical insights into resource allocation and operational efficiency. This transparency allows stakeholders to assess the organization’s financial health, program effectiveness, and commitment to responsible stewardship. Comparative analysis of expense trends over time can further enhance understanding of the organization’s financial performance and inform strategic decision-making.

4. Fund Balances

Fund balances represent the net assets of a charitable organization at a specific point in time, typically the end of the fiscal year. Within the context of a charity statement of financial activities template, fund balances provide a crucial snapshot of the organization’s financial health and sustainability. These balances reflect the cumulative effect of revenues, expenses, and other changes in net assets over time. Understanding fund balances is essential for assessing an organization’s ability to meet its current obligations, invest in future programs, and weather unforeseen financial challenges. For instance, a significant increase in unrestricted net assets might indicate strong financial performance and create opportunities for program expansion or investment in capacity building.

The statement of financial activities typically presents fund balances categorized by restriction levels: unrestricted, temporarily restricted, and permanently restricted. Unrestricted funds are available for use at the discretion of the governing board, while temporarily restricted funds are subject to donor-imposed limitations on their use, such as time constraints or specific program designations. Permanently restricted funds, often derived from endowments, are intended to be held in perpetuity, with only the investment income available for use. This categorization provides transparency regarding the availability and intended use of an organization’s resources. For example, a charity relying heavily on temporarily restricted grants for core operations might face challenges if those grants are not renewed. Analyzing the composition of fund balances helps stakeholders assess financial stability and potential vulnerabilities.

Changes in fund balances over time provide valuable insights into an organization’s financial trajectory. A consistent pattern of increasing unrestricted net assets suggests sustainable growth and effective financial management. Conversely, declining fund balances may signal financial difficulties and the need for corrective action. Understanding these trends is critical for informed decision-making by the governing board, management, and other stakeholders. Furthermore, reporting of fund balances is essential for compliance with accounting standards and regulatory requirements. Accurate and transparent presentation of fund balances fosters public trust and demonstrates accountability in the management of charitable resources. Analyzing fund balance data in conjunction with other information presented in the statement of financial activities, such as revenue and expense trends, provides a comprehensive view of an organization’s financial position and performance.

5. Comparative Data

Comparative data plays a vital role within a charity statement of financial activities template, offering crucial insights into financial performance trends and informing strategic decision-making. Presenting financial information for the current reporting period alongside data from prior periodstypically the previous yearallows stakeholders to discern patterns, identify anomalies, and assess the organization’s progress over time. This comparative analysis facilitates a deeper understanding of financial health and sustainability beyond what a single-year snapshot can provide. For example, comparing fundraising revenue year-over-year reveals whether fundraising efforts are gaining or losing momentum, prompting further investigation into underlying causes and potential adjustments to fundraising strategies.

Analyzing comparative data enables stakeholders to assess the effectiveness of organizational strategies and programs. Comparing program expenses with outcome metrics across multiple periods allows for an evaluation of program efficiency and impact. Similarly, analyzing trends in administrative expenses can reveal areas for potential cost savings or process improvements. Comparative data also aids in identifying potential financial risks and opportunities. For instance, a consistent decline in unrestricted net assets might indicate underlying financial challenges requiring immediate attention. Conversely, a steady increase in revenue from a particular funding source could signal an opportunity to further cultivate that relationship. This information empowers organizations to make proactive adjustments to their strategies and operations.

The inclusion of comparative data enhances transparency and accountability. By providing a clear view of financial performance over time, organizations demonstrate their commitment to open communication and responsible stewardship of resources. This transparency builds trust with donors, grant-makers, and the public, reinforcing confidence in the organization’s ability to achieve its mission. While the specific time periods compared may vary based on reporting requirements and organizational needs, the inclusion of comparative data is essential for a comprehensive and meaningful analysis of a charity’s financial position and performance. Understanding these historical trends provides a critical foundation for informed decision-making, strategic planning, and long-term financial sustainability.

6. Compliance Requirements

Adherence to regulatory compliance requirements is paramount for charitable organizations. A properly structured charity statement of financial activities template serves as a crucial tool in meeting these obligations. This statement provides a transparent and standardized record of financial transactions, facilitating compliance with reporting standards and maintaining public trust.

- Accounting StandardsCompliance with generally accepted accounting principles (GAAP) or applicable international financial reporting standards (IFRS) is fundamental. These standards dictate how financial transactions are recorded, categorized, and reported, ensuring consistency and comparability. A template aligned with these standards ensures accurate representation of financial data, enabling stakeholders to make informed decisions. For example, adherence to revenue recognition principles ensures that donations are recorded accurately and in accordance with established accounting rules.

- Regulatory ReportingMany jurisdictions mandate specific reporting requirements for charitable organizations, including annual filings with regulatory bodies. A well-designed template streamlines this process by providing a framework for organizing and presenting the required financial information. This facilitates timely and accurate reporting, minimizing the risk of penalties or legal challenges. For instance, a template incorporating required disclosures related to fundraising activities ensures compliance with relevant regulations.

- Auditing RequirementsMany charities are subject to independent audits, which provide an external assessment of their financial statements and internal controls. A clear and well-organized statement of financial activities simplifies the audit process, allowing auditors to efficiently verify the accuracy and completeness of financial records. This reduces audit costs and strengthens the organization’s credibility. For example, a template that clearly segregates restricted and unrestricted funds facilitates the auditor’s review of fund accounting practices.

- Transparency and Public AccountabilityBeyond formal regulatory requirements, a comprehensive statement of financial activities promotes transparency and accountability to the public. By providing clear and accessible financial information, organizations demonstrate responsible stewardship of donated resources and build trust with donors and the wider community. This transparency strengthens public confidence and supports the organization’s long-term sustainability. For instance, publishing a summarized version of the statement on the organization’s website enhances transparency and demonstrates accountability to the public.

A charity statement of financial activities template, when designed and utilized effectively, serves as a cornerstone of compliance. It provides a structured framework for recording financial transactions, facilitating adherence to accounting standards, regulatory reporting requirements, and auditing processes. This ultimately strengthens an organization’s credibility, fosters public trust, and promotes long-term sustainability.

Key Components of a Charity Statement of Financial Activities Template

A well-structured template ensures comprehensive financial reporting, promoting transparency and accountability within charitable organizations. Key components provide a standardized framework for presenting financial data, facilitating analysis and informed decision-making.

1. Revenue Recognition: Clear articulation of revenue sources, categorized by type (e.g., donations, grants, investment income). This section demonstrates the organization’s financial capacity and diversification of funding streams. Accurate revenue recognition is crucial for compliance with accounting standards.

2. Expense Categorization: Detailed breakdown of expenses, categorized by function (e.g., program services, fundraising, administration). This component provides insights into resource allocation and operational efficiency. Transparent expense reporting strengthens accountability and informs stakeholders about how funds are utilized.

3. Changes in Net Assets: This section reflects the overall impact of revenues, expenses, and other gains or losses on the organization’s net assets. It provides a clear picture of financial performance and sustainability over time. Analyzing changes in net assets helps assess financial health and informs strategic planning.

4. Fund Accounting: Categorization of net assets by restriction level (unrestricted, temporarily restricted, permanently restricted). This component demonstrates adherence to donor intentions and legal requirements regarding fund usage. Transparent fund accounting builds trust and ensures responsible stewardship of resources.

5. Comparative Information: Presentation of current-period financial data alongside prior-period figures enables trend analysis and facilitates assessment of progress over time. This component enhances understanding of financial performance and supports data-driven decision-making.

6. Notes to the Financial Statements: Supplementary information providing context and details about specific financial transactions or accounting policies. These notes enhance transparency and provide a more complete understanding of the organization’s financial position. They also ensure compliance with disclosure requirements.

These core elements provide a structured and comprehensive overview of a charity’s financial activities, facilitating informed decision-making by stakeholders, promoting accountability, and supporting long-term sustainability.

How to Create a Charity Statement of Financial Activities Template

Creating a robust template requires careful consideration of key components and adherence to accounting standards. A well-structured template ensures accurate representation of financial data, promotes transparency, and facilitates informed decision-making.

1. Define Reporting Period: Specify the timeframe covered by the statement, typically a fiscal year. A consistent reporting period ensures comparability across multiple periods and facilitates trend analysis.

2. Establish Chart of Accounts: Develop a structured list of accounts to categorize revenues and expenses systematically. A well-defined chart of accounts ensures consistency in financial reporting and facilitates efficient data analysis.

3. Categorize Revenue Sources: Clearly identify and categorize all revenue streams, including donations, grants, investment income, and fundraising proceeds. Accurate revenue recognition is crucial for compliance with accounting standards.

4. Detail Expenses by Function: Categorize expenses according to their purpose, such as program services, fundraising, and administration. This breakdown provides insights into resource allocation and operational efficiency.

5. Track Changes in Net Assets: Calculate and report changes in net assets, categorized by restriction level (unrestricted, temporarily restricted, permanently restricted). This reflects the overall impact of financial activities on the organization’s resources.

6. Incorporate Comparative Data: Include prior-period figures for comparison, enabling trend analysis and assessment of financial performance over time. Comparative data enhances understanding and supports data-driven decision-making.

7. Prepare Notes to the Financial Statements: Include supplementary information providing context and details about specific transactions or accounting policies. These notes enhance transparency and provide a more complete picture of the organizations financial position.

8. Review and Verify: Thoroughly review the completed statement for accuracy and completeness before finalization. Internal review processes help ensure data integrity and minimize the risk of errors.

A well-designed template, incorporating these elements, provides a comprehensive and transparent overview of a charity’s financial activities. This structured approach facilitates analysis, supports informed decision-making, and strengthens accountability.

A charity statement of financial activities template provides a crucial framework for understanding the financial health and sustainability of nonprofit organizations. Its standardized structure ensures clear articulation of revenue sources, detailed expense breakdowns, and accurate representation of fund balances. The inclusion of comparative data facilitates trend analysis and informed decision-making. Adherence to regulatory compliance requirements through accurate reporting strengthens public trust and demonstrates responsible stewardship of resources. Effective utilization of this template empowers stakeholders with the information necessary to assess an organization’s financial performance, program effectiveness, and commitment to its mission.

Accurate and transparent financial reporting is essential for the long-term viability of the charitable sector. Adoption and consistent use of a comprehensive template not only fulfills regulatory requirements but also strengthens accountability, fosters public trust, and promotes a more robust and sustainable nonprofit landscape. Continued emphasis on best practices in financial reporting empowers charitable organizations to effectively manage resources, demonstrate impact, and fulfill their missions to serve the public good.