Utilizing a standardized, legally sound structure offers several advantages. It ensures clarity and transparency in financial dealings, reducing potential disputes. The sworn nature of the document lends weight and credibility, strengthening its legal standing in collection efforts. Furthermore, adherence to a recognized format simplifies the process for all involved parties, promoting efficient resolution of financial matters.

This article will further explore the specific requirements for creating and utilizing such a document in Florida, including necessary components, legal implications, and best practices.

1. Legal Compliance

Legal compliance is paramount when preparing a sworn statement of account in Florida. Adherence to Florida statutes governing debt collection practices, including specific requirements for affidavits and sworn statements, is essential for the document’s legal validity. Non-compliance can render the statement inadmissible in court, undermining its intended purpose. For example, omitting required elements, such as the affiant’s signature and the notary’s seal and signature, can invalidate the entire document. Furthermore, including false or misleading information can expose the affiant to legal repercussions. A legally compliant sworn statement establishes a strong foundation for debt recovery efforts.

Florida law mandates specific procedures for serving the sworn statement of account to the debtor. Proper service ensures the debtor receives formal notification of the outstanding debt and the creditor’s intent to pursue legal action if necessary. Failure to adhere to these service requirements can delay or even prevent legal proceedings. For instance, serving the statement to an incorrect address or failing to provide adequate proof of service can jeopardize the creditor’s ability to collect the debt through legal channels. Meticulous attention to legal requirements throughout the process safeguards the creditor’s rights and strengthens their position in potential litigation.

Understanding and adhering to Florida’s legal framework for sworn statements of account is critical for successful debt recovery. A legally sound document ensures enforceability and provides a solid basis for legal action, protecting the creditor’s interests and promoting efficient resolution of financial disputes. Consulting with legal counsel specializing in Florida debt collection practices is advisable to ensure full compliance and maximize the effectiveness of the sworn statement of account.

2. Notarized Statement

Notarization forms a critical component of a sworn statement of account in Florida, transforming it from a simple declaration into a legally binding document. The act of notarization involves a sworn oath administered by a notary public, attesting to the affiant’s identity and the veracity of the information contained within the statement. This process adds a layer of legal weight and credibility, essential for its use in legal proceedings. Without notarization, the statement lacks the legal authority necessary for effective debt collection efforts. This requirement underscores the importance of strict adherence to Florida’s notary procedures.

Consider a scenario where a business seeks to recover an outstanding debt. A simple, unsigned account statement might be disputed. However, a notarized sworn statement of account provides irrefutable evidence of the debt, strengthening the business’s legal standing in court. The notary’s seal and signature serve as official verification of the affiant’s identity and sworn testimony, increasing the document’s evidentiary value. This heightened legal validity can significantly influence the outcome of debt collection lawsuits, potentially leading to quicker judgments and more efficient recovery processes.

Failure to properly notarize a sworn statement of account can have significant legal consequences. An improperly notarized, or un-notarized, statement can be deemed inadmissible in court, effectively nullifying its intended purpose. This oversight can undermine debt recovery efforts and potentially expose the claimant to legal challenges. Therefore, ensuring proper notarization is paramount for anyone seeking to use a sworn statement of account for debt collection in Florida. Understanding and adhering to these requirements strengthens the document’s legal force and increases its effectiveness in resolving financial disputes.

3. Accurate Transactions

Accuracy in recording transactions forms the bedrock of a credible sworn statement of account in Florida. Every transaction detail within the statement, including dates, descriptions, amounts, and payment methods, must reflect the actual financial activity between the parties. Inaccuracies, even seemingly minor ones, can undermine the statement’s credibility and expose the affiant to legal challenges. For example, an incorrect invoice number or a transposed digit in the amount owed can cast doubt on the entire document’s veracity. A meticulously maintained transaction record, therefore, is crucial for preparing a reliable and legally sound sworn statement.

Consider a scenario where a supplier provides goods to a retailer. If the sworn statement of account includes discrepancies, such as inflated quantities or incorrect pricing, the retailer can challenge the statement’s validity. This can lead to disputes, delays in payment, and potential legal action. Conversely, a precisely documented account, reflecting all transactions accurately, reinforces the supplier’s claim and facilitates efficient debt recovery. The importance of accuracy extends beyond individual transactions to the overall balance. An incorrect balance calculation, stemming from inaccurate transaction entries, can invalidate the entire statement and jeopardize legal proceedings. Maintaining meticulous records from the outset is essential for producing an accurate and legally sound document.

Accurate transaction recording serves not only legal purposes but also fosters trust and transparency in business relationships. Clear, accurate documentation minimizes misunderstandings and disputes, promoting amicable resolution of financial matters. Furthermore, meticulous record-keeping supports efficient financial management for both parties involved. The effort invested in maintaining accurate transaction records directly contributes to a stronger legal position and smoother business operations. It underscores the critical link between accurate accounting practices and the effectiveness of a sworn statement of account in Florida.

4. Clear Documentation

Clear documentation is paramount in lending credibility and legal weight to a sworn statement of account in Florida. A well-organized, easily understood document facilitates efficient review by all parties involved, including the debtor, legal counsel, and the court. Ambiguity or lack of clarity can lead to disputes, delays, and potential legal challenges. This section explores key facets of clear documentation within the context of a sworn statement of account.

- Organized PresentationA logical flow of information is crucial for comprehension. The statement should present information chronologically, beginning with the initial transaction and progressing through subsequent debits, credits, and payments. A disorganized presentation can create confusion and raise doubts about the statement’s accuracy. For instance, a jumbled chronology of transactions can make it difficult to reconcile the stated balance, potentially leading to disputes. A clear, organized structure ensures ease of understanding and reinforces the document’s credibility.

- Itemized DetailsEach transaction should be clearly itemized, providing specific details such as date, invoice number, description of goods or services rendered, and the amount. Vague descriptions or missing information can create ambiguity and lead to disputes regarding the validity of the charges. For example, a simple entry like “Services Rendered” lacks sufficient detail. A more descriptive entry, such as “Consulting Services – Project Alpha, Phase 1,” provides clarity and reduces the likelihood of challenges. Detailed itemization strengthens the statement’s evidentiary value.

- Supporting DocumentationAttaching supporting documentation, such as invoices, contracts, and payment records, substantiates the information presented in the sworn statement. This supporting evidence provides verifiable proof of the transactions and strengthens the creditor’s claim. For example, attaching copies of signed invoices corresponding to the listed transactions provides irrefutable evidence of the debt. This practice not only enhances the statement’s credibility but also streamlines the legal process by readily providing supporting evidence.

- Legible FormatThe statement should be presented in a clear, legible format, free from typographical errors and easily readable font. A poorly formatted document can hinder comprehension and create an unprofessional impression. For example, using an excessively small font size or a cluttered layout can make the document difficult to read, potentially leading to misinterpretations. A clean, professional presentation enhances readability and underscores the seriousness of the legal document.

These facets of clear documentation contribute significantly to the legal effectiveness of a sworn statement of account in Florida. A well-documented, clearly presented statement reduces the potential for disputes, strengthens the creditor’s legal standing, and facilitates efficient resolution of outstanding debts. This attention to detail underscores the importance of clear communication in legal and financial matters, ultimately contributing to a more efficient and just legal process.

5. Debt Validation

Debt validation plays a crucial role within the framework of a sworn statement of account in Florida, particularly in legal disputes. It serves as a critical mechanism for verifying the legitimacy and accuracy of the debt, protecting debtors from unsubstantiated or erroneous claims. A sworn statement of account, while carrying legal weight, must be supported by valid documentation to withstand scrutiny in legal proceedings. This documentation, forming the core of debt validation, typically includes original contracts, invoices, payment histories, and other relevant records substantiating the debt’s existence and amount. A missing or incomplete chain of documentation weakens the creditor’s position and may lead to dismissal of the claim. For example, a sworn statement claiming a debt without accompanying invoices or contracts detailing the agreement’s terms lacks the necessary evidentiary support for validation.

Consider a scenario where a credit card company files a lawsuit based on a sworn statement of account. If the debtor challenges the debt, the company must provide documentation validating the charges, interest accrual, and payment history. This might involve producing copies of signed cardholder agreements, transaction statements showing individual purchases, and records of payments received. Failure to provide such validation can lead to the court dismissing the case, illustrating the critical link between debt validation and the enforceability of a sworn statement of account. This validation process protects consumers from potentially fraudulent or inaccurate claims, ensuring fairness and accountability in debt collection practices. Furthermore, a well-documented and validated debt strengthens the creditor’s case, increasing the likelihood of a favorable outcome in legal proceedings.

Effective debt validation strengthens the legal standing of a sworn statement of account, transforming it into a powerful tool for creditors seeking to recover legitimate debts. Conversely, inadequate validation exposes vulnerabilities in the claim, potentially leading to its dismissal in court. This underscores the importance of meticulous record-keeping and readily available documentation to support the sworn statement. It highlights the practical significance of debt validation, not merely as a legal formality but as a crucial component of effective debt recovery and consumer protection in Florida. This understanding benefits both creditors seeking to enforce legitimate claims and debtors seeking protection from unsubstantiated demands.

6. Formal Language

Formal language is essential for a sworn statement of account in Florida, contributing to its legal validity and ensuring clear communication. The choice of language directly impacts the document’s credibility and effectiveness in legal proceedings. Informal or colloquial language can undermine the seriousness of the document and potentially create ambiguity, jeopardizing its legal standing. Careful attention to language ensures the statement adheres to legal standards and effectively conveys the necessary information.

- Precise TerminologyPrecise legal and financial terminology ensures clarity and avoids misinterpretations. Using specific terms like “affiant,” “deponent,” “account receivable,” and “balance due” clarifies the nature of the document and the information presented. Substituting colloquial terms can introduce ambiguity and weaken the statement’s legal force. For example, using “I owe” instead of “the balance due is” diminishes the formality and legal precision of the statement.

- Objective ToneMaintaining an objective tone is crucial for conveying information impartially. Avoid emotional language, subjective opinions, or accusatory statements. Focus on presenting factual information about the financial transactions. For instance, instead of stating “the debtor refuses to pay,” a more objective phrasing would be “payment remains outstanding.” An objective tone reinforces the document’s professionalism and legal validity.

- Third-Person PerspectiveUsing the third-person perspective maintains objectivity and formality. This approach avoids personal pronouns like “I” and “you,” creating a neutral and impartial tone. For example, instead of “I provided services to the client,” the statement should read, “Services were provided to the client.” This stylistic choice contributes to the document’s professional and legal character.

- Standard English Grammar and MechanicsAdherence to standard English grammar and mechanics ensures clarity and professionalism. Grammatical errors, spelling mistakes, and improper punctuation can undermine the document’s credibility. A carefully proofread document demonstrates attention to detail and reinforces the seriousness of the legal proceedings. For example, consistent verb tenses and proper subject-verb agreement contribute to a well-crafted and legally sound document.

Employing formal language in a sworn statement of account reinforces its legal validity and strengthens its effectiveness in debt recovery efforts in Florida. Precise terminology, objective tone, third-person perspective, and adherence to grammatical standards contribute to a document that is both legally sound and easily understood by all parties involved. This attention to language demonstrates professionalism and respect for the legal process, ultimately contributing to a more efficient and equitable resolution of financial disputes.

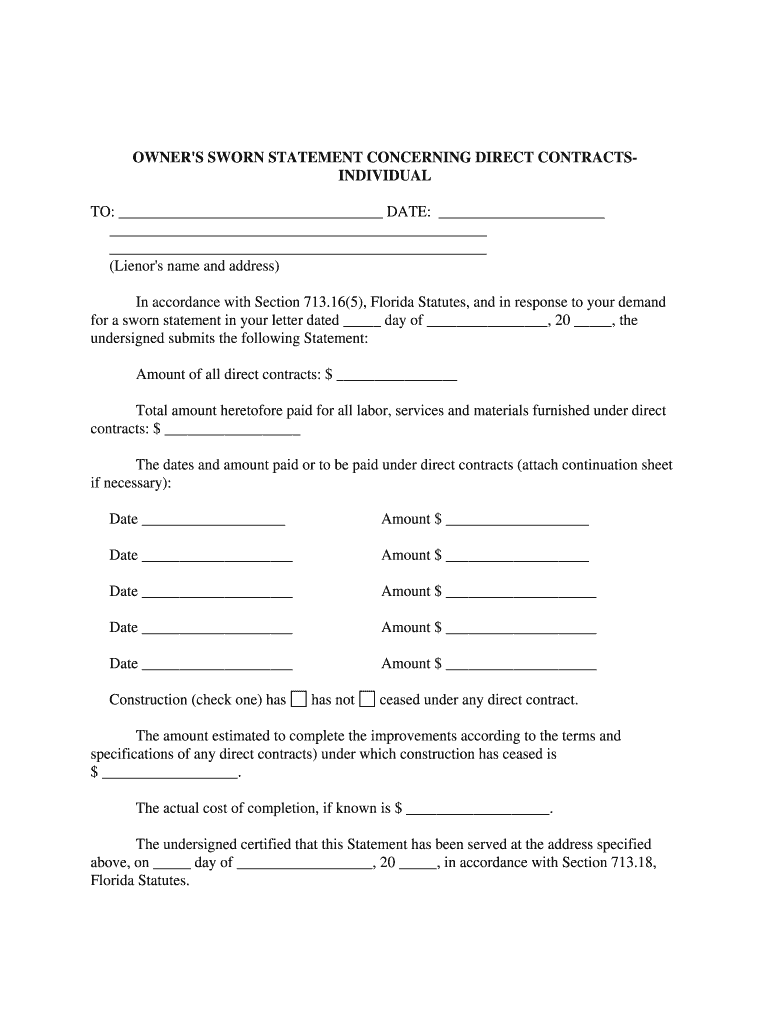

Key Components of a Florida Sworn Statement of Account

Specific elements must be present in a Florida sworn statement of account to ensure legal validity and enforceability. These components contribute to the document’s credibility and effectiveness in debt collection proceedings.

1. Affiant Information: Complete identification of the individual making the sworn statement, including full legal name, address, and contact information, is required. This establishes the affiant’s authority and accountability for the information presented.

2. Debtor Information: Accurate and complete identification of the debtor, including full legal name, address, and any known aliases or business affiliations, is necessary for proper legal notification and ensures the statement targets the correct individual or entity.

3. Account Details: The statement must clearly identify the account in question, including the account number, date the account was opened, and the type of account. This specificity clarifies the financial relationship between the parties.

4. Transaction History: A comprehensive and chronological record of all transactions related to the account must be included, specifying dates, descriptions, amounts, and payment methods. This detailed record forms the basis for calculating the outstanding balance.

5. Balance Due: The statement must clearly state the total amount owed as of the date of the affidavit. This figure represents the culmination of all outstanding transactions and forms the basis for any legal action.

6. Basis of Knowledge: The affiant must state the basis of their knowledge regarding the account and the transactions, establishing their authority to make the sworn statement. This might include referencing personal involvement in the transactions or access to company records.

7. Sworn Oath: The statement must include a formal declaration, attesting to the truthfulness and accuracy of the information presented under penalty of perjury. This sworn oath, administered by a notary public, transforms the document into a legally binding affidavit.

8. Notarization: The signature and seal of a notary public are essential, verifying the affiant’s identity and the administration of the oath. This final step completes the legal validation of the sworn statement of account, making it admissible in court.

These elements work in concert to create a legally sound and enforceable document, essential for successful debt recovery efforts in Florida. A complete and accurate sworn statement of account strengthens the creditor’s position and provides a clear record of the outstanding debt, facilitating efficient and legally compliant resolution.

How to Create a Sworn Statement of Account in Florida

Creating a legally sound sworn statement of account in Florida requires careful attention to detail and adherence to specific requirements. The following steps outline the process:

1. Gather Necessary Information: Compile all relevant information pertaining to the debt, including the debtor’s complete contact information, account details, and a comprehensive transaction history. This includes dates, descriptions, amounts, and payment methods for each transaction.

2. Draft the Statement: Structure the statement logically, beginning with affiant and debtor identification, followed by account details, a chronological transaction history, and the calculated balance due. Formal language and a third-person perspective are essential throughout the document. Clearly state the basis of the affiant’s knowledge regarding the account and transactions.

3. Include the Sworn Oath: Incorporate a formal declaration attesting to the truthfulness and accuracy of the information presented, acknowledging the penalties of perjury. This declaration should be placed above the signature line.

4. Notarize the Statement: Once the statement is complete and signed by the affiant, it must be notarized by a licensed notary public in Florida. The notary public will verify the affiant’s identity, witness the signature, and affix their official seal and signature. This step is crucial for legal validation.

5. Review for Accuracy and Completeness: Before finalization, thoroughly review the document for accuracy, completeness, and adherence to all legal requirements. Any errors or omissions can undermine the statement’s validity. Ensure all supporting documentation is attached.

6. Service of the Sworn Statement: The completed and notarized statement must be served on the debtor according to Florida’s legal procedures for service. Proper service ensures the debtor receives formal notification of the outstanding debt and the creditor’s intent to pursue further legal action if necessary.

Meticulous preparation, accurate information, proper notarization, and correct service are critical for creating a legally enforceable sworn statement of account in Florida. This structured approach ensures the document serves its intended purpose in debt recovery proceedings and upholds the necessary legal standards. Consultation with legal counsel is advisable to ensure compliance with all applicable laws and regulations.

Careful consideration of legal requirements, accurate record-keeping, and meticulous documentation are essential for constructing a legally sound and effective instrument for debt recovery in Florida. Understanding the necessary components, including precise affiant and debtor identification, detailed transaction histories, and proper notarization, ensures the document’s enforceability. Furthermore, adherence to formal language conventions and clear presentation enhances the statement’s credibility and professionalism, contributing to its efficacy in legal proceedings.

Effective utilization of this legal tool offers a pathway for creditors to pursue legitimate claims while ensuring fairness and transparency in financial dealings. This process underscores the importance of accurate accounting practices, clear communication, and adherence to legal standards in resolving financial disputes, ultimately contributing to a more efficient and just legal system. Seeking professional legal guidance is recommended for navigating the complexities of debt recovery and ensuring compliance with all applicable statutes.