Accessing these valuable planning tools without cost offers numerous advantages. It enables startups and small businesses with limited budgets to perform critical financial forecasting. Accessibility allows businesses to experiment with different growth strategies and assess their potential impact without financial barriers. Furthermore, readily available resources empower entrepreneurs and managers to gain valuable insights into their businesses’ potential financial trajectories and make data-driven decisions.

This foundational understanding of financial projections facilitates exploration of more detailed aspects, including how to create, interpret, and effectively utilize these essential planning documents. The following sections delve into the practical applications and best practices for leveraging these forecasts to achieve business objectives.

1. Accessibility

Accessibility of financial planning tools is paramount, particularly for startups and small businesses. A free pro forma income statement template democratizes access to essential financial forecasting capabilities, enabling businesses of all sizes to engage in robust financial planning. This accessibility fosters informed decision-making, strategic growth, and enhanced financial stability across the business landscape.

- Cost-EffectivenessEliminating the financial barrier associated with premium software or professional financial services allows businesses to allocate resources more strategically. This is particularly beneficial for early-stage ventures where capital is often limited. A freely available template ensures that financial forecasting is not restricted to well-funded organizations.

- Ease of UseMany free templates are designed with user-friendliness in mind. Intuitive interfaces and clear instructions simplify the process of creating financial projections, even for users without specialized financial expertise. This ease of use empowers entrepreneurs and managers to take control of their financial planning.

- Wide AvailabilityFree templates are readily available through various online platforms, software repositories, and business resource websites. This wide availability ensures convenient access for a diverse range of users, regardless of their location or technical capabilities. Businesses can quickly acquire the tools necessary to commence financial planning.

- Technological InclusivityFree templates often come in various formats compatible with commonly used software, including spreadsheet programs and online applications. This technological inclusivity ensures that users can leverage existing tools and infrastructure for financial planning, minimizing the need for specialized software investments.

The enhanced accessibility afforded by free templates empowers businesses to proactively manage their finances, explore potential growth scenarios, and navigate economic uncertainties with greater confidence. This accessibility contributes to a more informed and robust business ecosystem where financial planning is within reach for all.

2. Customization

Customization is a critical feature of effective pro forma income statement templates. While free templates offer a valuable starting point, their adaptability to specific business circumstances is essential for generating meaningful projections. Generic templates may not accurately reflect the unique revenue streams, cost structures, and growth trajectories of individual businesses. Customization allows users to tailor the template to reflect their specific industry, business model, and strategic goals.

The ability to modify revenue categories, expense lines, and growth assumptions ensures that the projected financial statement accurately reflects the business’s reality. For instance, a subscription-based software company needs to project recurring revenue based on subscriber growth rates, while a retail business might focus on sales volume and pricing strategies. Customization allows each business to model its specific drivers of revenue and expenses. Without this adaptability, the pro forma statement loses its value as a predictive tool. A manufacturing company, for example, might need to incorporate detailed cost projections for raw materials, labor, and overhead, which a generic template may not accommodate. The ability to customize these cost elements is crucial for generating a realistic and informative pro forma income statement. Similarly, a rapidly growing startup might project aggressive revenue growth, while a mature business may anticipate more moderate expansion. Customization allows for these varying growth trajectories to be reflected in the financial projections.

Effective customization empowers businesses to generate pro forma income statements that truly reflect their unique financial landscape. This tailored approach to financial forecasting leads to more accurate projections, which in turn supports more informed decision-making. Failure to customize a template can result in misleading projections that do not accurately reflect the business’s potential. The ability to adapt a free pro forma income statement template to individual circumstances maximizes its utility as a planning and analysis tool.

3. Forecasting Accuracy

Forecasting accuracy is paramount when utilizing a free pro forma income statement template. While the template provides a structured framework, the accuracy of the projections hinges entirely on the underlying assumptions. A template, regardless of its design, cannot compensate for unrealistic or poorly researched inputs. The value derived from a pro forma statement is directly proportional to the reliability of its projected figures. Inaccurate forecasts can lead to misinformed decisions, unrealistic expectations, and ultimately, compromised business outcomes.

- Realistic AssumptionsFoundational to accurate forecasting is the use of realistic assumptions. These assumptions, regarding future revenue growth, cost trends, and market conditions, must be grounded in thorough research and data analysis. Simply extrapolating past performance without considering potential market shifts, competitive pressures, or economic fluctuations can lead to significant inaccuracies. For example, projecting a consistent 20% year-over-year revenue growth based on historical data, without accounting for potential market saturation or new competitors, is a recipe for overly optimistic and ultimately misleading projections.

- Sensitivity AnalysisSensitivity analysis plays a crucial role in assessing the robustness of the projections. This involves adjusting key assumptions to evaluate the impact on the projected financial results. By varying revenue growth rates, cost percentages, or other key inputs, businesses can gain a clearer understanding of the potential range of outcomes and identify critical variables that exert the greatest influence on profitability. For instance, analyzing the impact of a 5% versus a 10% increase in raw material costs provides insights into the potential vulnerability of profit margins to cost fluctuations.

- Data ValidationData validation is an ongoing process that requires continuous monitoring and refinement of the underlying assumptions. As new market data becomes available, or as business conditions evolve, it is crucial to revisit and adjust the pro forma income statement accordingly. Sticking to outdated assumptions, even with a well-structured template, will inevitably lead to inaccurate projections. For example, if market research indicates a shift in customer preferences away from a core product line, failing to adjust the revenue projections for that product line will result in an overly optimistic and inaccurate forecast.

- External FactorsExternal factors, often beyond the control of the business, can significantly impact forecasting accuracy. Economic downturns, changes in regulatory landscapes, or unexpected geopolitical events can introduce substantial uncertainty into financial projections. While a pro forma statement cannot predict these events, acknowledging their potential impact and incorporating contingency plans is essential. For instance, a business heavily reliant on international trade might consider incorporating scenarios reflecting potential tariffs or trade disruptions into its projections.

The pursuit of forecasting accuracy requires a disciplined approach, combining realistic assumptions, rigorous data analysis, and ongoing monitoring of the business environment. While a free pro forma income statement template offers a valuable framework, its effectiveness is ultimately determined by the quality of the inputs. Recognizing the limitations of forecasting and embracing a dynamic approach to financial planning are crucial for leveraging these tools effectively. By integrating these principles, businesses can transform a free template into a powerful instrument for informed decision-making and strategic growth.

4. Format Simplicity

Format simplicity is a crucial aspect of a free pro forma income statement template’s effectiveness. A clear, concise, and easily understood format contributes directly to the template’s usability and the accuracy of financial projections. An overly complex or cluttered format can obscure critical information, hinder interpretation, and increase the likelihood of errors. Simplicity in presentation allows users to focus on the financial data itself, facilitating informed decision-making and strategic planning.

- Clear StructureA well-structured template presents information logically, typically following a standard income statement format. This includes clear delineation of revenue streams, cost of goods sold, operating expenses, and net income calculations. A logical flow allows users to quickly grasp the relationships between different financial elements and understand the overall financial picture. For example, separating fixed costs from variable costs enhances understanding of cost behavior and its impact on profitability.

- Concise PresentationConciseness in presentation minimizes clutter and avoids overwhelming users with unnecessary detail. Focus should be on essential financial elements, presented clearly and without excessive jargon or technical terminology. Overly detailed breakdowns or complex calculations can obscure the key takeaways and hinder effective analysis. For instance, presenting summarized departmental expenses rather than itemized lists of individual expenditures improves clarity and facilitates higher-level analysis.

- Visual ClarityVisual clarity enhances comprehension and allows for quick identification of key trends and insights. Use of appropriate formatting, such as clear headings, consistent font styles, and effective use of whitespace, improves readability and reduces the risk of misinterpretation. Visual cues, such as charts and graphs, can further enhance understanding of the data and its implications. Color-coding key figures, for example, can highlight areas of strength or weakness within the projected financial performance.

- Accessibility Across PlatformsFormat simplicity contributes to compatibility across different software platforms and devices. A simple, standardized format ensures that the template can be easily opened, edited, and shared using various spreadsheet programs or online applications. This cross-platform compatibility promotes collaboration and ensures that the financial projections are accessible to all relevant stakeholders. A template reliant on specialized software or complex macros limits its usability and accessibility.

Format simplicity in a free pro forma income statement template is essential for ensuring its usability and the accuracy of financial projections. A well-designed template prioritizes clear structure, concise presentation, and visual clarity, enabling users to focus on the financial data itself and make informed decisions. By adhering to these principles, free templates can empower businesses of all sizes to engage in effective financial planning and achieve their strategic goals. A simple format democratizes access to financial forecasting, ensuring that these crucial tools are not limited to those with specialized financial expertise or access to expensive software.

5. Strategic Decision-Making

Strategic decision-making relies heavily on informed financial projections. A free pro forma income statement template provides a crucial tool for generating these projections, enabling businesses to explore potential scenarios and evaluate the financial impact of various strategic options. This connection between projected financial performance and strategic choices is fundamental to sound business management. Cause and effect relationships become clearer through financial modeling. For example, increasing marketing spend in a pro forma statement can demonstrate a projected increase in sales revenue, allowing decision-makers to assess the return on investment of such a strategy. Conversely, simulating a price increase can reveal potential impacts on sales volume and overall profitability, informing pricing decisions.

Consider a business contemplating expansion into a new market. A free pro forma income statement template allows the business to model the associated costs, projected revenue streams, and potential profit margins. This financial modeling enables informed assessment of the expansion’s financial viability and supports data-driven decisions about whether and how to proceed. Alternatively, a business evaluating the introduction of a new product can utilize a template to project development costs, anticipated sales, and potential impact on overall profitability. These projections inform crucial decisions regarding product pricing, marketing strategies, and resource allocation. Without such financial modeling, strategic decisions become significantly more speculative and risky.

The practical significance of this connection lies in the ability to make strategic decisions with greater confidence and foresight. By utilizing a free pro forma income statement template, businesses can move beyond guesswork and intuition, basing their strategies on concrete financial projections. This data-driven approach to decision-making minimizes financial risks, optimizes resource allocation, and enhances the likelihood of achieving strategic objectives. However, the inherent limitations of forecasting must be acknowledged. Projections are based on assumptions that may not always hold true. Market conditions, competitive landscapes, and economic factors can all influence actual outcomes. Therefore, while financial projections are invaluable tools for strategic decision-making, flexibility and adaptability remain crucial. Regularly revisiting and refining pro forma statements, incorporating new information and adjusting assumptions as needed, is essential for maintaining their relevance and value in a dynamic business environment.

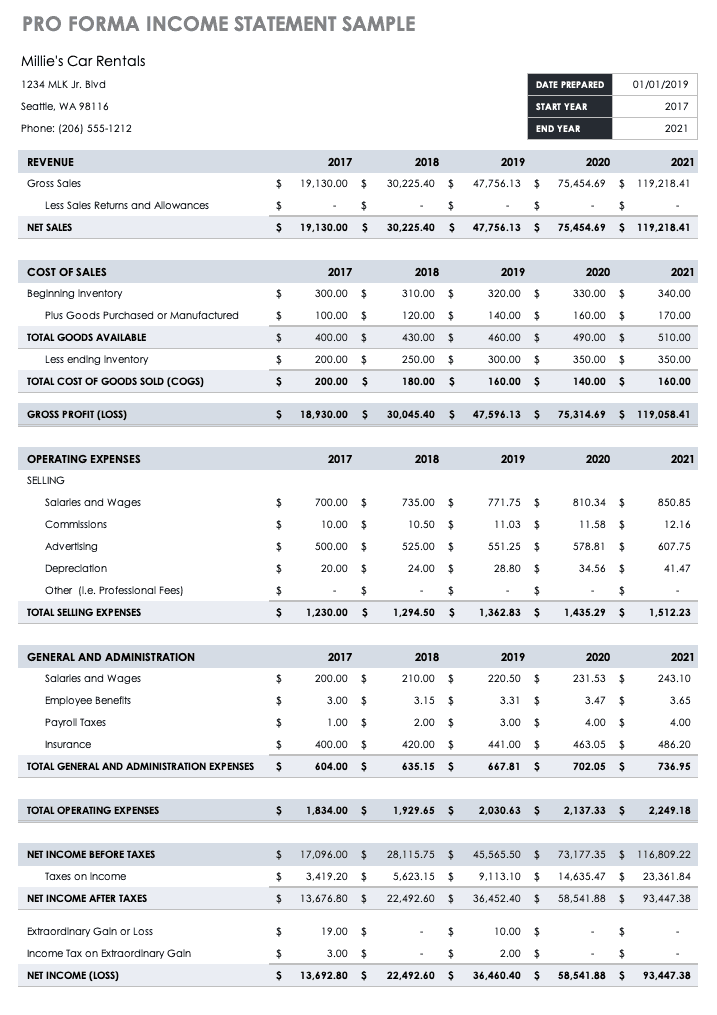

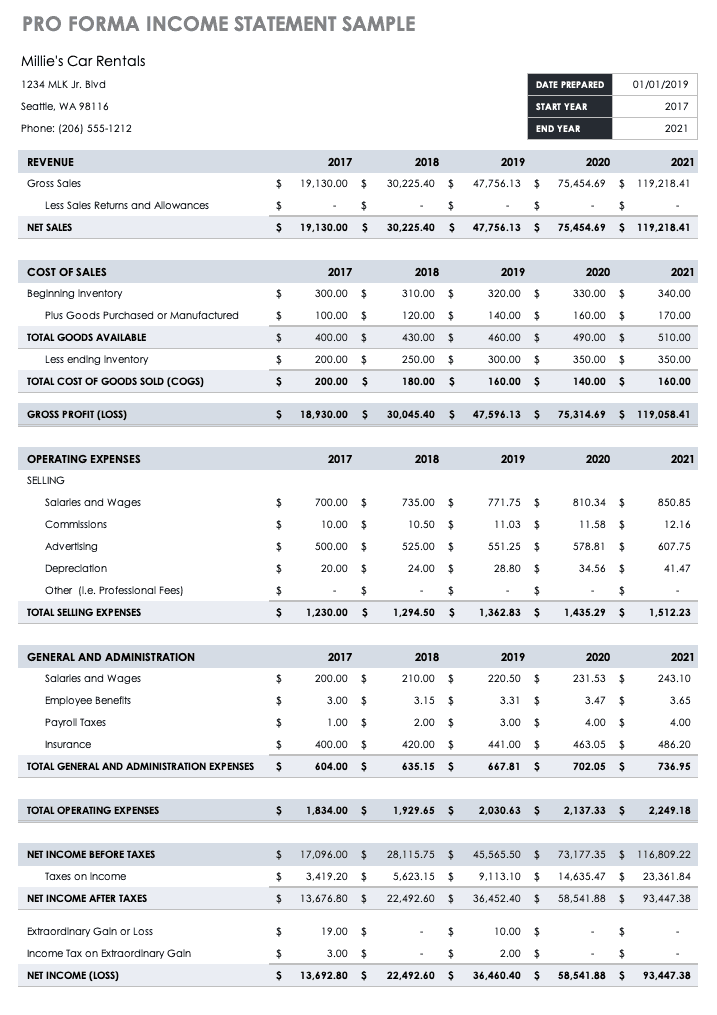

Key Components of a Pro Forma Income Statement Template

Understanding the core components of a pro forma income statement template is crucial for sound financial planning. These components provide a structured framework for projecting future performance and enable informed decision-making.

1. Revenue Projections: This section details anticipated sales revenue based on forecasted sales volume, pricing strategies, and market conditions. Accuracy in revenue projections is fundamental to the reliability of the entire pro forma statement. Various methodologies, including historical data analysis, market research, and industry benchmarks, contribute to robust revenue projections.

2. Cost of Goods Sold (COGS): For businesses selling physical products, COGS represents the direct costs associated with producing those goods. Accurate COGS projections require detailed analysis of raw material costs, manufacturing overhead, and labor expenses. This component is crucial for determining gross profit margins.

3. Operating Expenses: Operating expenses encompass all costs incurred in running the business, excluding COGS. These include expenses such as rent, utilities, marketing and advertising, salaries and wages, research and development, and administrative costs. Detailed and realistic operating expense projections are essential for accurate profit forecasting.

4. Gross Profit and Operating Income: Gross profit, calculated as revenue minus COGS, represents the profit generated from core business operations before accounting for operating expenses. Operating income, derived by subtracting operating expenses from gross profit, reflects the profitability of the business after accounting for all operating costs.

5. Interest Expense and Income: This component accounts for interest paid on outstanding debt and interest earned on cash holdings or investments. Accurately projecting interest expense requires understanding existing debt obligations and anticipated interest rate fluctuations.

6. Income Tax Expense: This section reflects the projected income tax liability based on anticipated profits. Tax projections must consider applicable tax rates and any potential tax credits or deductions.

7. Net Income: Net income, the bottom line of the income statement, represents the profit remaining after accounting for all revenues, expenses, and taxes. This figure is a key indicator of a company’s overall financial performance and profitability.

These interconnected components offer a comprehensive view of a company’s projected financial performance, providing valuable insights for strategic planning, resource allocation, and investment decisions. The accuracy and reliability of the pro forma income statement depend critically on the careful consideration and realistic projection of each of these components.

How to Create a Free Pro Forma Income Statement Template

Creating a pro forma income statement involves a structured approach to projecting future financial performance. While numerous free templates are readily available, understanding the underlying principles and steps involved allows for customization and ensures the projections accurately reflect the specific circumstances of the business.

1. Define the Projection Period: Specify the timeframe for the pro forma statement, whether it’s a fiscal year, a quarter, or another relevant period. The chosen timeframe should align with the business’s planning horizon and strategic objectives. A clear timeframe is essential for generating relevant and meaningful projections.

2. Gather Historical Data: Compile historical financial data, including revenue figures, cost breakdowns, and expense trends. This data serves as a crucial foundation for developing realistic projections. Analyzing past performance provides insights into revenue patterns, cost behavior, and overall financial trends.

3. Project Revenue: Forecast future revenue based on historical data, market research, and anticipated growth rates. Consider factors such as market conditions, pricing strategies, and sales volume projections. Realistic revenue projections are fundamental to the accuracy of the pro forma statement.

4. Project Cost of Goods Sold (COGS): For businesses selling physical products, project COGS based on anticipated production volumes and associated costs, including raw materials, labor, and manufacturing overhead. Accurate COGS projections are essential for determining gross profit margins and overall profitability.

5. Project Operating Expenses: Forecast operating expenses, encompassing all costs associated with running the business, excluding COGS. Consider factors such as rent, utilities, marketing and advertising, salaries and wages, and administrative costs. Detailed operating expense projections are critical for accurate profit forecasting.

6. Calculate Projected Profit: Determine projected gross profit by subtracting projected COGS from projected revenue. Calculate projected operating income by subtracting projected operating expenses from gross profit. These calculations provide key insights into the profitability of the business operations.

7. Incorporate Financing Activities: Account for interest income and expense related to debt obligations and investments. Projecting interest expense requires understanding current debt levels and anticipated interest rate trends. Incorporating financing activities provides a comprehensive view of the projected financial position.

8. Account for Income Taxes: Project income tax expense based on anticipated profits and applicable tax rates. Consider any potential tax credits or deductions that may impact the overall tax liability. Accurate tax projections are crucial for determining net income.

9. Calculate Projected Net Income: Determine projected net income by subtracting projected income tax expense from pre-tax income. Net income represents the final profit after accounting for all revenues, expenses, and taxes. This figure is a key indicator of a company’s projected financial performance.

10. Review and Refine: Critically evaluate the completed pro forma statement, ensuring the assumptions are realistic and the projections align with overall strategic goals. Refine the projections as needed, incorporating new information or adjusting assumptions based on changing market conditions or business strategies. A dynamic approach to pro forma development ensures its ongoing relevance and value.

Developing a pro forma income statement requires careful consideration of various factors, including historical performance, market conditions, and strategic objectives. Regular review and refinement of the projections are essential for maintaining accuracy and ensuring the pro forma statement remains a valuable tool for informed decision-making.

Access to free pro forma income statement templates represents a significant advantage for businesses of all sizes. Leveraging these readily available tools empowers organizations to project future financial performance, explore various strategic options, and make informed decisions based on data-driven insights. The ability to customize these templates ensures their relevance to specific business circumstances, while a focus on realistic assumptions and ongoing data validation enhances the accuracy and reliability of financial projections. Simplicity in template format contributes to clear interpretation and effective utilization across diverse platforms. Ultimately, effective use of these templates contributes directly to enhanced strategic decision-making, improved resource allocation, and increased potential for achieving financial objectives.

Informed financial projections are not merely predictive tools; they are essential instruments for navigating the complexities of the business landscape. Strategic foresight, grounded in robust financial modeling, is crucial for sustainable growth and long-term success. By embracing these readily available resources and integrating them into core business practices, organizations can proactively shape their financial future and navigate the path toward achieving their strategic goals.