Utilizing such a structured format facilitates informed decision-making. Tracking income and expenses allows for clear identification of areas for improvement, cost control, and revenue growth opportunities. This structured approach also simplifies tax preparation and can be crucial for securing funding from investors or lenders. A clear picture of financial health strengthens accountability and promotes sustainable business growth.

Further exploration will cover the key components, creation process, and practical applications of this essential financial tool for service businesses. Understanding its structure and interpretation is fundamental to sound financial management and long-term success.

1. Revenue

Revenue represents the lifeblood of any service business and forms the cornerstone of its income statement. A clear and accurate representation of revenue is crucial for assessing financial performance and making informed business decisions. Understanding its various facets provides valuable insights into operational efficiency and growth potential.

- Service Fees EarnedThis constitutes the core revenue stream for service businesses, encompassing payments received for services rendered. Examples include consulting fees, design retainers, or subscription charges. Accurate tracking of service fees is paramount for evaluating profitability and identifying potential growth areas within the service portfolio.

- Project-Based IncomeFor businesses operating on a project basis, revenue recognition may differ. Income is often recognized upon project completion or at specified milestones. Accurately forecasting and tracking project-based revenue is essential for maintaining a healthy cash flow and projecting future earnings.

- Recurring RevenueSubscription models or ongoing service contracts generate recurring revenue, providing a predictable income stream. Analyzing recurring revenue trends helps assess business stability and predict future performance. This stability is often a key indicator of financial health for investors and lenders.

- Other RevenueThis category encompasses ancillary income streams not directly related to core services. Examples include late payment fees, interest earned on deposits, or sales of supplementary materials. While often smaller than core revenue, accurate tracking of these sources provides a complete financial picture and can contribute to overall profitability.

A comprehensive understanding of these revenue facets within the context of a service business income statement provides crucial insights into financial health, operational efficiency, and strategic planning. Accurately categorizing and analyzing these streams allows for data-driven decision-making to optimize profitability and drive sustainable growth.

2. Expenses

Accurate expense tracking is fundamental to a comprehensive understanding of financial performance within a service business. A detailed breakdown of expenditures, categorized and documented within the income statement, provides crucial insights into operational efficiency and profitability. Analyzing expenses allows for informed decision-making regarding cost control, resource allocation, and strategic planning.

- Direct CostsDirect costs are expenses directly attributable to service delivery. These include salaries of service personnel, materials used in service provision, and software licenses directly employed for client work. Accurate allocation and tracking of direct costs are essential for determining the true cost of service delivery and pricing strategies.

- Operating ExpensesOperating expenses encompass the costs required to maintain business operations, excluding direct service delivery. These include rent, utilities, marketing and advertising expenses, and administrative salaries. Managing operating expenses efficiently is crucial for maximizing profitability and ensuring sustainable business operations.

- Salaries and WagesThis category represents compensation provided to employees involved in both direct service delivery and supporting roles. Accurately accounting for salaries, benefits, and payroll taxes is essential for compliance and provides valuable data for workforce management and resource allocation decisions.

- Depreciation and AmortizationThese represent the allocation of the cost of tangible and intangible assets over their useful life. Depreciation applies to physical assets like equipment and furniture, while amortization applies to intangible assets like software and patents. Including these costs provides a more accurate reflection of the overall cost of doing business.

Careful monitoring and analysis of these expense categories within a service business income statement template provide a critical foundation for sound financial management. Understanding the relationship between revenue, expenses, and resulting profitability enables data-driven decision-making to optimize resource allocation, improve operational efficiency, and drive sustainable business growth.

3. Profitability

Profitability, a key performance indicator for any business, represents the ultimate outcome of financial activity. Within a service business income statement template, profitability emerges as the difference between revenues generated and expenses incurred. This metric, often expressed as net income or net loss, provides critical insight into the financial health and sustainability of the enterprise. Analyzing profitability trends over time reveals the effectiveness of operational strategies, pricing models, and cost management initiatives. For example, a consistent increase in profitability might indicate successful market penetration and efficient resource allocation, while declining profitability could signal pricing pressures, escalating costs, or operational inefficiencies requiring attention.

The income statement serves as the primary tool for calculating and analyzing profitability. By systematically categorizing revenue streams and deducting associated expenses, the statement reveals gross profit, operating income, and ultimately, net income. Understanding these different levels of profitability offers a granular view of financial performance. For instance, a healthy gross profit margin suggests effective pricing strategies, while a strong operating income indicates efficient management of overhead costs. A service business might show strong revenue growth, but if expenses grow at a faster rate, net income, and therefore profitability, will suffer. This underscores the importance of analyzing both revenue and expenses to gain a complete picture of financial health.

Analyzing profitability within the framework of a service business income statement template is essential for strategic decision-making. Identifying trends, understanding contributing factors, and comparing performance against industry benchmarks enable informed decisions regarding pricing adjustments, cost optimization strategies, and investment priorities. Sustained profitability is fundamental for long-term viability and attracting investment, enabling future growth and ensuring the ongoing success of the service enterprise.

4. Time Period

The time period specified within a service business income statement template is crucial for accurate financial analysis and meaningful performance evaluation. A defined timeframe, whether a month, quarter, or year, provides the necessary boundaries for measuring revenue, expenses, and ultimately, profitability. Without a specified period, the financial data lacks context and becomes difficult to interpret or compare. The chosen timeframe influences the insights derived from the statement. For example, a monthly income statement reveals short-term performance fluctuations, useful for identifying immediate operational challenges or successes, while an annual statement provides a broader overview of yearly performance, facilitating strategic planning and long-term trend analysis.

The selection of an appropriate time period depends on the specific analytical objectives. Short-term periods, such as monthly or quarterly, allow for timely identification of emerging trends and facilitate prompt corrective action if required. For instance, a sudden drop in monthly revenue could signal a problem requiring immediate attention. Conversely, longer time periods, like annual or multi-year statements, provide a broader perspective on financial performance, enabling evaluation of long-term strategies and investment returns. Comparing performance across consistent time periods allows for meaningful trend analysis. Analyzing year-over-year performance, for example, offers valuable insights into growth patterns, expense trends, and overall financial health.

Understanding the importance of the chosen time period is fundamental for effective interpretation and utilization of a service business income statement template. The selected timeframe provides the context for analyzing financial data, enabling meaningful comparisons, trend identification, and informed decision-making. Choosing the appropriate timeframe, whether short-term for operational insights or long-term for strategic planning, is essential for gaining a comprehensive understanding of financial performance and ensuring the long-term success of the service business.

5. Standardized Format

A standardized format is essential for service business income statement templates to ensure clarity, comparability, and effective financial analysis. Consistency in presentation allows for easy understanding across different stakeholders, including business owners, investors, and financial institutions. Adherence to a standardized structure facilitates benchmarking against industry averages and tracking performance trends over time. This structured approach enables efficient data analysis and supports informed decision-making.

- Consistent StructureA consistent structure ensures that key financial data points, such as revenue, expenses, and profitability, are presented in a uniform manner. This consistency allows for easy comparison across different reporting periods and facilitates efficient trend analysis. A standardized structure typically follows a hierarchical format, starting with revenue, deducting expenses, and culminating in net income or loss. This logical flow provides a clear and concise picture of financial performance.

- Clear TerminologyUsing standardized terminology within the income statement ensures unambiguous communication of financial information. Consistent use of terms like “Gross Profit,” “Operating Expenses,” and “Net Income” prevents misinterpretations and facilitates clear communication among stakeholders. This clarity is particularly important when sharing financial information with external parties, such as investors or lenders.

- ComparabilityA standardized format allows for easy comparison of financial performance across different periods within the same business and against industry benchmarks. This comparability enables businesses to identify areas for improvement, assess their competitive position, and track progress toward financial goals. Benchmarking against industry averages allows businesses to assess their relative performance and identify areas for potential improvement.

- Compliance and RegulationAdhering to a standardized format often aligns with regulatory requirements for financial reporting. This compliance simplifies audits, ensures transparency, and builds trust with stakeholders. A standardized format also facilitates the preparation of tax returns and other regulatory filings.

Utilizing a standardized format within a service business income statement template enhances clarity, facilitates comparability, and promotes sound financial management practices. This structured approach supports informed decision-making, enabling businesses to effectively monitor performance, identify trends, and drive sustainable growth. The consistency afforded by a standardized format is crucial for effective communication with stakeholders, internal analysis, and compliance with regulatory requirements.

6. Service-Specific Details

Incorporating service-specific details within a service business income statement template provides granular insights into operational efficiency, profitability drivers, and resource allocation. Beyond standard revenue and expense categories, these details offer a nuanced understanding of the unique characteristics of service delivery, facilitating data-driven decision-making and strategic planning. This tailored approach allows for a more precise evaluation of performance and identification of areas for optimization within specific service offerings.

- Consulting Hours BilledTracking consulting hours billed, categorized by client or project, provides a direct link between time invested and revenue generated. This metric allows for analysis of billing rates, project profitability, and consultant utilization. For example, comparing billed hours across different consultants can reveal discrepancies in efficiency or highlight areas for skill development. Integrating this data within the income statement enhances resource allocation and pricing strategy decisions.

- Project-Based Revenue BreakdownFor businesses operating on a project basis, breaking down revenue by individual projects offers valuable insights into project profitability and resource allocation effectiveness. This detailed view allows for identification of high-performing projects, analysis of cost overruns, and optimization of project management practices. For instance, comparing actual project revenue against projected figures can highlight deviations and inform future project planning.

- Subscription Revenue by TierService businesses offering tiered subscription models benefit from tracking revenue by each tier. This reveals the popularity and profitability of different subscription levels and informs pricing adjustments and marketing strategies. For example, identifying a high-performing subscription tier can guide marketing efforts towards attracting similar clients.

- Cost of Goods Sold (COGS) for Service DeliveryWhile less prominent than in product-based businesses, some service businesses incur direct costs related to service delivery. Tracking these costs, including materials, software licenses, or subcontractor fees, is essential for accurately calculating gross profit margins and assessing the true profitability of service offerings. This granular cost analysis allows for optimization of service delivery processes and identification of potential cost savings.

Integrating these service-specific details within the income statement framework enhances the analytical value of the document. By providing a nuanced understanding of the unique aspects of service delivery, these details empower businesses to make data-driven decisions regarding pricing, resource allocation, and operational efficiency, ultimately driving profitability and sustainable growth. This granular approach facilitates targeted interventions and strategic adjustments tailored to the specific dynamics of the service business.

Key Components of a Service Business Income Statement Template

A well-structured income statement provides a clear snapshot of a service business’s financial performance. Understanding its key components is crucial for informed decision-making and strategic planning. The following elements are fundamental to a comprehensive income statement.

1. Revenue: This section details all income generated from service delivery. It encompasses various revenue streams, including service fees, project-based income, recurring revenue from subscriptions, and other ancillary income sources. Accurate revenue recognition is crucial for assessing overall financial performance.

2. Cost of Goods Sold (COGS): While less prevalent in service businesses than product-based ones, COGS accounts for direct costs associated with service delivery. This might include materials used in providing services, software licenses specifically for client projects, or subcontractor fees. Accurate COGS calculation is essential for determining gross profit.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit represents the earnings remaining after covering direct service delivery costs. This metric provides insight into the profitability of core service offerings.

4. Operating Expenses: This section encompasses all expenses incurred in running the business, excluding COGS. These include rent, utilities, marketing and advertising costs, administrative salaries, and depreciation of assets. Managing operating expenses efficiently is crucial for maximizing profitability.

5. Operating Income: Calculated as Gross Profit minus Operating Expenses, operating income reflects the profitability of the core business operations after accounting for both direct and indirect costs. This metric offers a clear view of operational efficiency.

6. Other Income/Expenses: This section accounts for income or expenses not directly related to core business operations, such as interest income, gains or losses from asset sales, or one-time expenses. Including these items provides a complete picture of financial performance.

7. Net Income: This bottom-line figure represents the overall profitability of the business after accounting for all revenues and expenses, including taxes. Net income is a key indicator of financial health and sustainability.

Careful analysis of these components within a defined time period provides essential insights into financial performance, enabling informed decision-making and strategic planning for sustained growth and success.

How to Create a Service Business Income Statement Template

Creating a robust income statement template requires a systematic approach and attention to detail. The following steps outline the process for developing a template tailored to the specific needs of a service-oriented business. A well-structured template ensures accurate financial reporting and facilitates informed decision-making.

1. Define the Reporting Period: Establish a clear timeframe for the income statement, whether monthly, quarterly, or annually. The reporting period should align with business objectives and reporting requirements. A consistent reporting period facilitates trend analysis and performance comparisons over time.

2. Establish Chart of Accounts: Develop a comprehensive chart of accounts categorizing all revenue and expense streams relevant to the business. This structured categorization ensures consistent tracking and reporting of financial data. The chart of accounts should be tailored to the specific services offered and operational structure of the business.

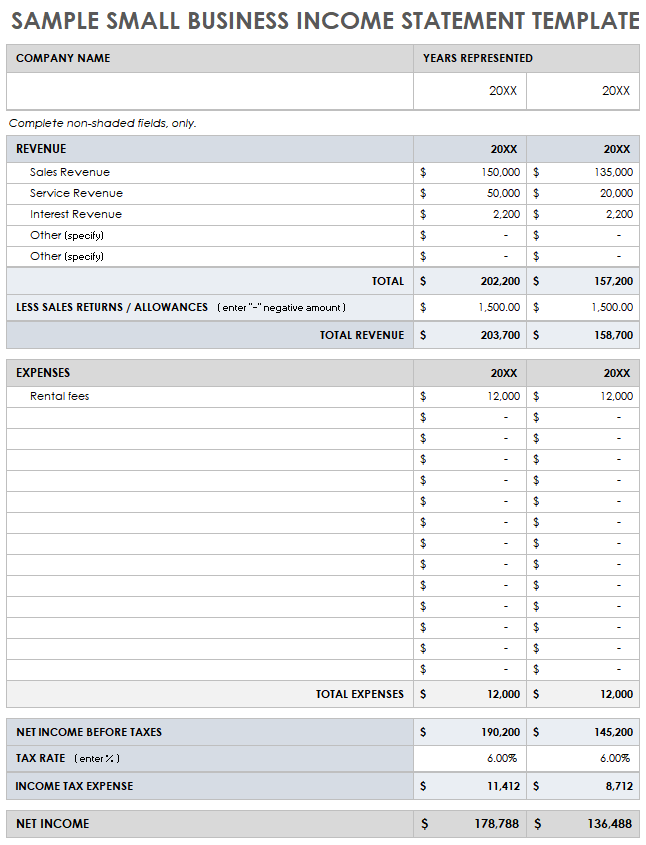

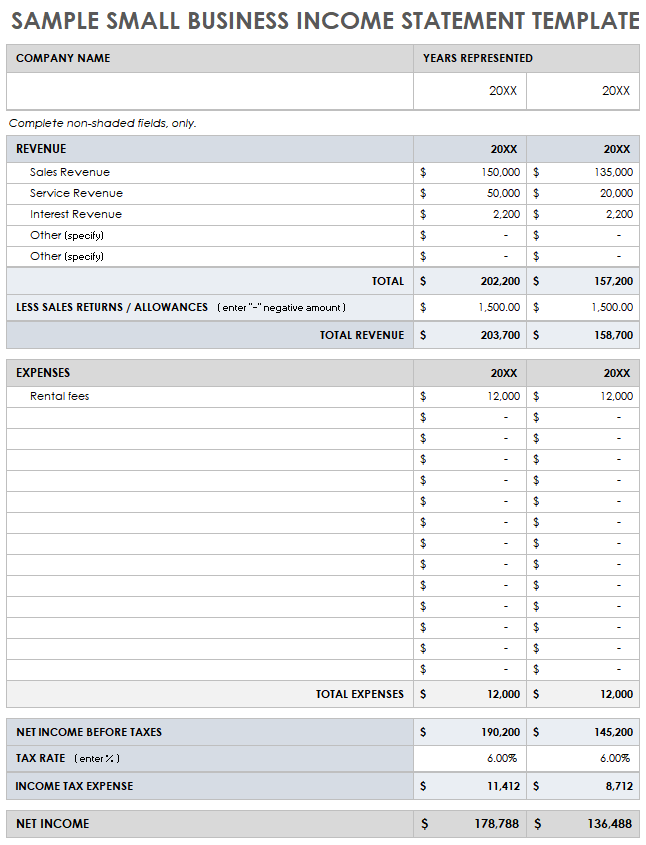

3. Choose a Template Format: Select a suitable template format, either creating one from scratch using spreadsheet software or utilizing pre-designed templates available online or within accounting software. The chosen format should clearly present key financial data points and adhere to accounting principles. Consistency in format is crucial for comparability and analysis.

4. Input Revenue Data: Systematically record all revenue generated within the defined reporting period, categorized according to the established chart of accounts. Accurate revenue recognition is paramount for a reliable income statement. This includes distinguishing between different service offerings, project-based income, and recurring revenue streams.

5. Input Expense Data: Document all expenses incurred during the reporting period, categorized according to the chart of accounts. This includes direct costs related to service delivery, operating expenses, and any other relevant expenditures. Accurate expense tracking is essential for determining true profitability.

6. Calculate Gross Profit and Operating Income: Calculate gross profit by subtracting the cost of goods sold (COGS) from revenue. Then, calculate operating income by subtracting operating expenses from gross profit. These metrics offer insights into the profitability of core operations.

7. Calculate Net Income: Determine net income by accounting for any other income or expenses, such as interest income or one-time charges, and deducting taxes. Net income represents the bottom-line profitability of the business after all expenses are considered.

8. Review and Analyze: Thoroughly review the completed income statement for accuracy and completeness. Analyze key metrics, such as gross profit margin, operating income margin, and net income margin, to assess financial performance and identify areas for potential improvement. Regular review and analysis of the income statement is crucial for sound financial management.

A meticulously crafted income statement template, incorporating these steps, provides a robust framework for monitoring financial performance, informing strategic decision-making, and fostering sustainable business growth. Accurate data entry, consistent categorization, and regular review are essential for maximizing the value of this critical financial management tool.

Careful construction and consistent utilization of a robust financial reporting structure, specifically designed for service-oriented enterprises, offers invaluable insights into financial performance. Understanding revenue streams, diligently tracking expenses, and accurately calculating profitability metrics provides a foundation for informed decision-making. From optimizing pricing strategies and streamlining operational efficiency to securing funding and fostering sustainable growth, the insights gleaned from this structured financial document are essential for long-term success. Standardized formatting, clear categorization, and the inclusion of service-specific details further enhance analytical capabilities and enable data-driven decision-making tailored to the unique dynamics of service-based operations.

Effective financial management hinges on the ability to interpret and act upon the data presented within this structured framework. Regular review and analysis of financial performance, coupled with strategic adjustments based on these insights, are paramount for navigating the complexities of the service industry landscape and achieving sustained profitability. A proactive approach to financial management, informed by accurate and timely data, empowers service businesses to adapt to evolving market conditions, capitalize on growth opportunities, and solidify their position within the competitive marketplace.