Utilizing this type of long-term projection facilitates informed decision-making, enhances strategic planning, and supports proactive financial management. It enables businesses to anticipate potential cash shortfalls or surpluses, secure funding, and evaluate the viability of long-term investments. This forward-looking approach is crucial for sustainable growth and stability.

The following sections will delve deeper into the key components, construction, and practical applications of these valuable financial tools. Specific examples and detailed explanations will illustrate how such projections can be effectively utilized in various business contexts.

1. Operating Activities

Within a five-year cash flow projection, operating activities represent the core day-to-day business functions that generate cash inflows and outflows. Accurately forecasting these activities is fundamental to understanding long-term financial sustainability and profitability.

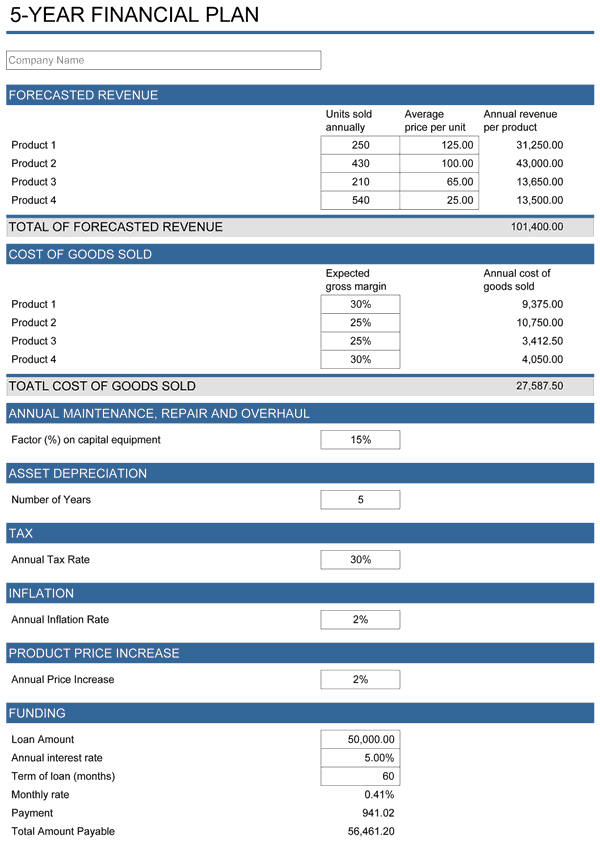

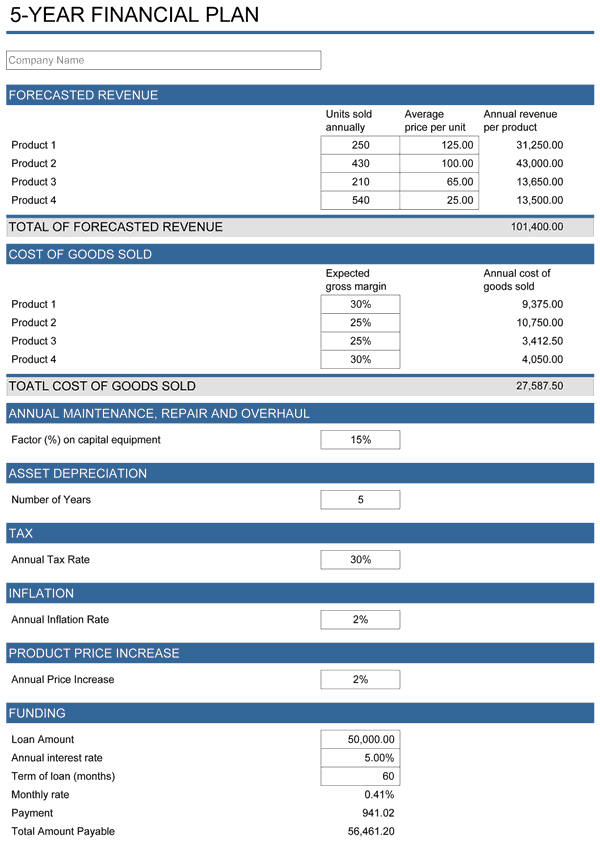

- Sales Revenue:Projecting sales revenue forms the foundation of operating activities. This involves estimating future sales volume and pricing, considering market trends, competitive landscape, and historical performance. Realistic revenue projections are crucial for accurate cash flow forecasting.

- Cost of Goods Sold (COGS):Direct costs associated with producing goods or services are reflected in COGS. Accurate COGS projections are essential for determining gross profit margins and understanding the overall profitability of operations within the five-year timeframe.

- Operating Expenses:Expenses incurred in running the business, such as salaries, rent, and marketing costs, are categorized as operating expenses. Projecting these costs requires careful consideration of anticipated growth, inflation, and efficiency improvements. Accurate operating expense projections are critical for assessing long-term profitability and resource allocation.

- Working Capital Changes:Fluctuations in current assets (like inventory and accounts receivable) and current liabilities (like accounts payable) impact operating cash flow. Accurately forecasting these changes is vital for understanding short-term liquidity needs and ensuring sufficient working capital to support projected growth within the five-year horizon.

A thorough understanding of these operating activities provides a crucial foundation for a robust five-year cash flow statement. By carefully projecting these elements, businesses can gain valuable insights into their future financial performance and make informed decisions regarding investments, financing, and overall strategic direction. This detailed analysis of operating cash flow enhances the predictive power of the five-year projection and strengthens long-term financial planning.

2. Investing Activities

Investing activities within a five-year cash flow projection reflect an organization’s capital expenditures and investments, providing insights into long-term growth strategies and asset management. Analysis of these activities is crucial for understanding how a business plans to deploy resources for future expansion and potential returns on investment.

- Capital Expenditures (CAPEX):CAPEX represents investments in fixed assets, such as property, plant, and equipment (PP&E). These expenditures are crucial for maintaining or expanding operational capacity. A five-year projection allows businesses to anticipate significant CAPEX needs and plan accordingly, ensuring sufficient funding for strategic investments, such as new facilities or technology upgrades. Examples include purchasing new machinery, constructing a warehouse, or investing in software infrastructure. Accurately forecasting CAPEX within a five-year timeframe provides stakeholders with visibility into how the company plans to deploy resources for long-term growth.

- Acquisitions and Divestitures:Acquisitions of other businesses or divestitures of existing assets significantly impact cash flow. A five-year projection incorporates these strategic decisions, allowing for analysis of their potential financial impact. Acquisitions represent substantial cash outflows, while divestitures generate inflows. For example, acquiring a competitor can expand market share but requires significant upfront investment. Conversely, selling a non-performing subsidiary can free up resources. Projecting these activities within the five-year timeframe offers valuable insights into an organization’s growth strategy and its potential effects on financial performance.

- Investments in Securities:Investments in securities, such as stocks and bonds, can generate returns through dividends or interest income. A five-year projection may include anticipated returns on these investments and potential changes in the investment portfolio. For instance, allocating funds to a diversified portfolio of bonds can provide a steady income stream. Analyzing these investment activities within the projection offers insights into how a company manages its excess cash and seeks additional revenue streams beyond its core operations.

- Sale of Assets:The sale of existing assets, like equipment or real estate, generates cash inflows. Including projected asset sales within a five-year timeframe allows for a comprehensive understanding of anticipated cash sources beyond core operations. For example, selling older equipment that has been replaced by newer technology can free up capital for other investments or debt reduction. Including such planned asset sales in the five-year cash flow projection provides a complete picture of expected cash inflows and their strategic purpose.

Strategic allocation of capital through investing activities is crucial for long-term growth and value creation. Careful consideration and accurate projection of these activities within a five-year cash flow statement provide a roadmap for achieving financial objectives and maximizing returns on investment. The interplay between these investment decisions and overall financial performance is crucial for assessing the long-term viability and success of an organization’s strategic plan.

3. Financing Activities

Financing activities within a five-year cash flow projection detail how a business plans to source and manage its capital structure over the long term. Understanding these activities is critical for assessing financial stability, risk, and long-term solvency. A clear picture of financing activities is essential for stakeholders to evaluate the organization’s ability to meet its financial obligations and support its growth trajectory.

- Debt Financing:Debt financing, including loans and bonds, represents borrowed capital. A five-year projection outlines anticipated debt issuance, repayment schedules, and associated interest expenses. For instance, securing a long-term loan for expansion increases cash flow initially but necessitates future principal and interest payments. Analyzing debt financing within the projection provides insights into the company’s leverage, financial risk, and ability to manage its debt obligations over time.

- Equity Financing:Equity financing involves raising capital through the issuance of company stock. A five-year projection might include planned equity offerings, which generate cash inflows. For example, issuing new shares can fund growth initiatives without incurring debt, but it dilutes existing ownership. Analyzing equity financing within the projection clarifies how the company plans to balance its capital structure and manage ownership distribution.

- Dividend Payments:Dividend payments distribute profits to shareholders, representing cash outflows. A five-year projection typically includes anticipated dividend payouts, reflecting the company’s policy towards shareholder returns. Consistent dividend payments can attract investors but reduce retained earnings available for reinvestment. Projecting dividend payments within the five-year timeframe provides insights into the company’s priorities regarding shareholder returns versus internal growth initiatives.

- Share Repurchases:Share repurchases involve a company buying back its own shares, reducing the number of outstanding shares and increasing the value of remaining shares. A five-year projection can incorporate planned share repurchases, indicating a focus on returning value to shareholders and increasing earnings per share. This activity impacts cash flow and reveals how a company prioritizes capital allocation between share repurchases and other investment opportunities.

The interplay of these financing activities within a five-year cash flow statement offers crucial insights into a company’s financial strategy and long-term sustainability. Analyzing these elements in conjunction with operating and investing activities provides a comprehensive view of how a business intends to manage its financial resources to achieve its strategic objectives. Understanding these complex dynamics is essential for stakeholders to assess the organization’s financial health, risk profile, and potential for future success.

4. Projected Revenue Growth

Projected revenue growth forms the cornerstone of a five-year cash flow statement template. It represents the anticipated increase in sales revenue over the projected period and serves as a key driver of overall cash inflows. Accurately forecasting revenue growth is crucial, as it directly impacts the accuracy of subsequent cash flow projections. Overly optimistic revenue projections can lead to unrealistic expectations and inadequate financial planning, while overly conservative projections can hinder potential growth opportunities. The projected revenue growth rate is influenced by various factors, including market conditions, competitive landscape, pricing strategies, and historical performance. For example, a company introducing a new product in a rapidly expanding market might project aggressive revenue growth, whereas a mature company in a saturated market might anticipate more modest growth. Understanding these influencing factors and their potential impact is vital for developing realistic and reliable revenue projections.

The relationship between projected revenue growth and a five-year cash flow statement is multifaceted. Revenue growth drives operating cash flow, which, in turn, influences investing and financing decisions. A higher projected revenue growth rate typically leads to increased operating cash flow, providing more resources for capital expenditures, debt reduction, or dividend payments. For instance, a company projecting significant revenue growth might invest heavily in expanding its production capacity or acquiring complementary businesses. Conversely, a company experiencing stagnant or declining revenue growth might need to curtail investments, seek additional financing, or restructure its operations. Analyzing the interplay between projected revenue growth and other cash flow components allows businesses to make informed decisions regarding resource allocation, capital structure, and long-term strategic planning.

Accurate revenue growth projections are essential for sound financial planning and decision-making. They provide a framework for anticipating future financial performance, assessing the feasibility of strategic initiatives, and securing necessary funding. However, forecasting revenue growth is inherently uncertain, and businesses must consider potential risks and sensitivities. Conducting sensitivity analysis by modeling different revenue growth scenarios allows organizations to evaluate the potential impact of varying market conditions and adjust their strategies accordingly. Understanding the limitations and potential challenges associated with revenue projections is crucial for developing robust financial plans and ensuring long-term financial stability. Integrating realistic revenue growth projections into a five-year cash flow statement provides a powerful tool for managing financial resources, evaluating investment opportunities, and navigating future economic uncertainties.

5. Capital Expenditures

Capital expenditures (CAPEX) represent significant investments in fixed assets crucial for long-term operational capacity and future growth. Within a five-year cash flow statement template, CAPEX projections provide critical insights into how a business plans to allocate resources for expansion, upgrades, and maintaining its competitive edge. Accurately forecasting CAPEX is essential for assessing the long-term financial implications of these investments and ensuring alignment with overall strategic objectives.

- Impact on Future GrowthCAPEX directly influences a company’s capacity for future growth and innovation. Investing in new equipment, technology, or facilities can enhance productivity, expand product offerings, and improve operational efficiency. For example, a manufacturing company investing in automated machinery might anticipate increased production output and reduced labor costs, leading to higher future revenue. These long-term implications are reflected in the five-year cash flow projection, demonstrating how CAPEX contributes to future profitability.

- Balancing Short-Term and Long-Term NeedsBalancing short-term profitability with long-term investments represents a crucial financial challenge. Significant CAPEX can strain short-term cash flow but is often essential for long-term sustainability and competitiveness. For instance, a software company investing heavily in research and development might experience lower short-term profits but anticipates greater market share and revenue growth in the future. The five-year cash flow statement provides a framework for evaluating this trade-off and ensuring sufficient resources for both immediate needs and long-term investments.

- Strategic Resource AllocationCAPEX decisions reflect a company’s strategic priorities and its assessment of future market opportunities. Allocating significant capital to a specific area, such as new product development or market expansion, indicates a strategic focus on that area. For example, a retail company investing heavily in e-commerce infrastructure demonstrates its commitment to online sales growth. The five-year cash flow statement reveals these strategic resource allocations and their anticipated impact on future financial performance.

- Financing ImplicationsSignificant CAPEX often requires external financing, such as debt or equity issuance. The five-year cash flow statement demonstrates the impact of CAPEX on financing needs and helps determine the optimal capital structure. For instance, a company undertaking a major expansion project might need to secure a long-term loan, which will impact future cash flows through principal and interest payments. Analyzing the interplay between CAPEX and financing activities within the five-year projection is crucial for managing long-term financial stability.

CAPEX plays a critical role in shaping a company’s future financial performance. By carefully evaluating and projecting CAPEX within a five-year cash flow statement, businesses can make informed decisions that balance short-term needs with long-term growth objectives. This strategic approach to capital allocation is essential for maintaining competitiveness, maximizing returns on investment, and ensuring long-term financial sustainability. The five-year cash flow statement serves as a crucial tool for understanding the complex interplay between CAPEX, financing strategies, and overall financial performance, providing valuable insights for strategic planning and informed decision-making.

6. Debt Repayment

Debt repayment represents a critical aspect of long-term financial planning, significantly impacting an organization’s cash flow and financial stability. Within a five-year cash flow statement template, debt repayment projections provide crucial insights into how a business plans to manage its debt obligations and allocate resources towards reducing its financial leverage. Accurately forecasting debt repayment is essential for assessing long-term solvency, evaluating financing options, and ensuring sustainable financial health.

- Impact on Cash FlowDebt repayment directly affects cash outflow within a five-year projection. Principal and interest payments consume a portion of operating cash flow, reducing the resources available for other investments or operational needs. Accurately projecting these outflows is critical for understanding the impact of debt obligations on overall financial flexibility. For example, a company with substantial debt might face limitations in its ability to pursue growth opportunities or invest in research and development due to its debt service requirements. The five-year cash flow statement provides a clear picture of how debt repayment impacts available cash resources over time.

- Financial Risk ManagementManaging debt levels effectively is crucial for mitigating financial risk. High debt levels increase financial vulnerability and limit a company’s ability to weather economic downturns or unexpected challenges. A five-year cash flow statement incorporating realistic debt repayment projections allows businesses to assess their long-term financial risk and develop strategies for reducing leverage. For instance, a company might prioritize accelerated debt repayment to strengthen its financial position and reduce its vulnerability to interest rate fluctuations or economic instability.

- Financing StrategyDebt repayment projections play a key role in shaping a company’s overall financing strategy. Decisions regarding debt issuance, refinancing, and repayment schedules are reflected in the five-year cash flow statement, demonstrating how a business plans to manage its capital structure over time. For example, a company might choose to refinance existing debt at a lower interest rate to reduce its long-term financing costs. The five-year cash flow statement helps evaluate the impact of various financing options and choose the most advantageous approach for achieving long-term financial objectives.

- Long-Term SolvencyDebt repayment directly influences long-term solvency. A company’s ability to meet its debt obligations consistently over time demonstrates financial stability and creditworthiness. A five-year cash flow statement provides a long-term perspective on debt repayment, allowing stakeholders to assess the company’s ability to maintain financial health and meet its obligations. For instance, a company with a history of consistent debt repayment and declining debt levels signals financial strength and enhances investor confidence.

Debt repayment is an integral component of long-term financial planning and significantly influences a company’s overall financial health. By carefully projecting debt repayment within a five-year cash flow statement, businesses can make informed decisions regarding capital structure, financing strategies, and resource allocation. Understanding the complex relationship between debt repayment, cash flow, and long-term solvency is crucial for effective financial management and achieving sustainable growth. The five-year cash flow statement provides a critical framework for evaluating the long-term impact of debt obligations and ensuring financial stability.

Key Components of a Five-Year Cash Flow Projection

A robust five-year cash flow projection requires careful consideration of several key components. These components, when analyzed together, provide a comprehensive view of an organization’s anticipated financial performance and its ability to meet future obligations.

1. Operating Activities: These activities represent the core business operations that generate cash inflows and outflows. Accurate projections of sales revenue, cost of goods sold, operating expenses, and changes in working capital are essential for understanding the long-term profitability and sustainability of the business.

2. Investing Activities: These activities reflect an organization’s investments in long-term assets and strategic initiatives. Projecting capital expenditures, acquisitions, divestitures, and investments in securities offers insights into growth strategies and their potential impact on future cash flows.

3. Financing Activities: These activities detail how a business plans to source and manage its capital structure. Forecasting debt financing, equity financing, dividend payments, and share repurchases is crucial for assessing financial stability, risk, and long-term solvency.

4. Revenue Growth Projections: Realistic revenue growth projections are fundamental, serving as a primary driver of future cash inflows. Factors such as market conditions, competitive landscape, and historical performance influence these projections and impact subsequent cash flow components.

5. Capital Expenditure Projections: Accurately projecting capital expenditures (CAPEX) is essential for understanding the long-term financial implications of investments in fixed assets and their impact on future operational capacity.

6. Debt Repayment Projections: Forecasting debt repayment, including principal and interest payments, provides critical insights into an organization’s ability to manage its debt obligations and maintain long-term financial stability.

Careful analysis of these interconnected components provides a comprehensive understanding of a company’s anticipated financial performance, its ability to generate cash flow, and its capacity to meet future obligations. This holistic view enables informed decision-making, strategic planning, and proactive financial management crucial for long-term success.

How to Create a Five-Year Cash Flow Statement Template

Developing a comprehensive five-year cash flow statement requires a structured approach and careful consideration of key financial elements. The following steps outline the process for creating a robust and informative projection.

1: Gather Historical Financial Data: Begin by compiling historical financial statements, including income statements, balance sheets, and cash flow statements, for the past three to five years. This data provides a baseline for understanding past performance and identifying trends relevant to future projections.

2: Project Revenue Growth: Develop realistic revenue projections based on market analysis, historical performance, and anticipated growth initiatives. Consider factors such as market size, competition, pricing strategies, and economic conditions.

3: Forecast Operating Expenses: Project operating expenses, including cost of goods sold (COGS), selling, general, and administrative expenses (SG&A), and research and development (R&D) costs. Consider factors such as inflation, anticipated growth in operating activities, and efficiency improvements.

4: Project Investing Activities: Estimate future capital expenditures (CAPEX), including investments in property, plant, and equipment (PP&E), acquisitions, and divestitures. Align these projections with long-term strategic objectives and growth plans.

5: Project Financing Activities: Outline anticipated financing activities, including debt issuance, repayment schedules, equity financing, dividend payments, and share repurchases. Consider the impact of these activities on the company’s capital structure and long-term financial stability.

6: Calculate Operating Cash Flow: Determine projected operating cash flow by subtracting projected operating expenses from projected revenue and adjusting for changes in working capital.

7: Calculate Free Cash Flow: Calculate free cash flow by subtracting projected capital expenditures from operating cash flow. Free cash flow represents the cash available for debt repayment, dividends, share repurchases, or other investments.

8: Sensitivity Analysis: Conduct sensitivity analysis by modeling different scenarios for key assumptions, such as revenue growth and interest rates. This helps assess the potential impact of varying market conditions and identify potential risks and opportunities.

A well-constructed projection facilitates informed decision-making, proactive financial management, and strategic planning. By integrating these components and analyzing their interplay, organizations gain valuable insights into their future financial performance and position themselves for long-term success. Regular review and adjustments are essential for maintaining accuracy and relevance.

Developing a comprehensive projection of anticipated cash inflows and outflows over a five-year horizon provides invaluable insights into an organization’s future financial performance. Careful consideration of operating activities, investing activities, and financing activities, coupled with realistic revenue growth projections, capital expenditure planning, and debt repayment strategies, forms the foundation of a robust and informative financial model. Such projections offer a crucial framework for informed decision-making, proactive financial management, and strategic planning, enabling organizations to anticipate potential challenges, identify growth opportunities, and navigate future economic uncertainties.

Effective utilization of these financial tools empowers organizations to make strategic decisions regarding resource allocation, capital structure management, and long-term growth initiatives. The ability to anticipate future financial performance and adapt to changing market conditions is essential for achieving sustainable success in today’s dynamic business environment. Therefore, incorporating these projections into the ongoing financial planning process is not merely a best practice but a critical necessity for long-term financial health and strategic advantage.