Utilizing a standardized form for tracking financial activity offers numerous advantages. It facilitates informed decision-making by providing a clear understanding of available resources and spending patterns. This transparency promotes accountability to donors and stakeholders, demonstrating responsible financial management. Furthermore, it aids in budgeting and forecasting, enabling organizations to anticipate future needs and allocate resources effectively. This can lead to improved financial stability and the ability to pursue strategic goals more effectively.

This overview provides a foundation for exploring key aspects of financial management within the non-profit sector. Subsequent sections will delve into the specific components, creation, and practical application of these vital financial tools.

1. Standardized Format

A standardized format is fundamental to the utility of a charity cash flow statement template. Consistency in structure and content ensures comparability across reporting periods, facilitates analysis, and promotes transparency for stakeholders. This standardization allows for efficient review by auditors, boards, and regulatory bodies.

- Consistent CategorizationConsistent categorization of cash inflows and outflows is crucial. Standard categories, such as donations, grants, program expenses, and administrative costs, enable clear tracking and analysis of spending patterns. For instance, consistently categorizing all staff salaries under “Administrative Expenses” provides a clear picture of personnel costs over time. This consistency allows for year-over-year comparisons and trend identification.

- Defined Reporting PeriodsUsing defined reporting periods, whether monthly, quarterly, or annually, provides a structured timeframe for analysis. This regularity enables tracking of performance against budget and identification of seasonal variations in cash flow. Comparing cash flow from one quarter to the next can reveal seasonal fundraising patterns.

- Uniform TerminologyUniform terminology ensures clarity and prevents misinterpretations. Using standard financial terms eliminates ambiguity and promotes accurate reporting. For example, consistently using the term “Operating Activities” to describe core program activities ensures all stakeholders understand the data presented.

- Prescribed LayoutA prescribed layout ensures all essential information is presented in a logical and accessible manner. This facilitates review and analysis by both internal and external stakeholders. A standardized layout might include sections for operating activities, investing activities, and financing activities, ensuring comprehensive reporting.

These elements of a standardized format work together to provide a clear, concise, and comparable view of a charity’s financial performance. This promotes informed decision-making, enhances accountability, and strengthens the organization’s overall financial management practices.

2. Tracks Cash Flow

The core function of a charity cash flow statement template lies in its ability to track cash flow. This involves meticulously documenting all cash inflows and outflows within a specific reporting period. Understanding the dynamics of cash flow is essential for the financial health and sustainability of any non-profit organization. A well-designed template facilitates this tracking by categorizing cash movements into distinct sections: operating activities, investing activities, and financing activities. For example, donations received would fall under operating activities, while the purchase of new equipment would be categorized as an investing activity. Accurately tracking these flows allows organizations to identify trends, assess financial stability, and make informed decisions regarding resource allocation.

The practical significance of tracking cash flow becomes evident when considering real-world scenarios. Imagine a charity experiencing a surge in donations following a natural disaster. The template allows them to monitor the influx of funds and ensure appropriate allocation towards disaster relief efforts. Conversely, during periods of economic downturn, the template can highlight a decline in recurring donations, prompting the organization to adjust fundraising strategies or implement cost-saving measures. Without a system for tracking these fluctuations, the organization risks financial instability and may struggle to fulfill its mission. Further, accurate tracking facilitates compliance with regulatory requirements and strengthens accountability to donors and stakeholders.

In essence, tracking cash flow is not merely a bookkeeping exercise; it is a crucial element of strategic financial management for charitable organizations. A robust template provides the framework for this tracking, enabling organizations to navigate financial complexities, optimize resource utilization, and ensure long-term sustainability. Challenges may arise in maintaining accurate records and interpreting complex cash flow patterns, but the insights gained from effective tracking ultimately contribute to the organization’s ability to achieve its mission and serve its beneficiaries.

3. Transparency and Accountability

Transparency and accountability are paramount for charities, fostering trust with donors and the public. A well-maintained cash flow statement template plays a crucial role in achieving these essential elements of responsible financial management. It provides a clear, concise, and accessible overview of an organization’s financial activities, enabling stakeholders to understand how funds are received and utilized. This transparency builds confidence and demonstrates a commitment to ethical financial practices.

- Public TrustOpenness about financial operations cultivates public trust. A readily available cash flow statement demonstrates an organization’s willingness to share financial information, strengthening its reputation and encouraging continued support. For instance, publishing a summarized cash flow statement on a charity’s website can reassure potential donors about the responsible use of their contributions. This transparency can lead to increased donations and broader public support.

- Donor ConfidenceDonors want assurance that their contributions are used effectively. A detailed cash flow statement provides this assurance by clearly showing how funds are allocated across different programs and administrative expenses. Demonstrating a low percentage of spending on administrative overhead can significantly boost donor confidence. Conversely, a lack of transparency can erode trust and lead to decreased funding.

- Regulatory ComplianceMany regulatory bodies require charities to submit regular financial reports, including cash flow statements. Adhering to these requirements through a standardized template ensures compliance and avoids potential legal issues. Accurate and consistent reporting also simplifies the audit process, reducing administrative burden and costs.

- Internal AccountabilityA cash flow statement template promotes internal accountability by providing a framework for monitoring financial performance against budgetary targets. This enables management to identify areas of overspending or underperformance and take corrective action. Regular review of the cash flow statement can reveal inefficiencies and inform strategic decision-making, contributing to more effective resource allocation.

By promoting transparency and accountability, a well-structured cash flow statement template strengthens a charity’s financial integrity. This fosters trust with donors, enhances public image, and ensures compliance with regulatory requirements. Ultimately, these factors contribute to the long-term sustainability and effectiveness of the organization in fulfilling its mission.

4. Budgeting and Forecasting

Effective budgeting and forecasting are essential for financial stability and strategic decision-making within charitable organizations. A charity cash flow statement template provides the historical data necessary for developing realistic budgets and projecting future financial performance. By analyzing past cash inflows and outflows, organizations can anticipate future needs, allocate resources effectively, and make informed decisions regarding program development and expansion.

- Historical Data AnalysisThe template provides a repository of historical cash flow data, enabling organizations to identify trends and patterns in revenue and expenses. Analyzing past performance allows for more accurate projections of future cash flow, informing budget development and resource allocation decisions. For example, if a charity consistently receives a surge in donations during the holiday season, this information can be used to project future holiday giving and allocate resources accordingly.

- Realistic Budget DevelopmentData-driven budgeting, informed by the cash flow statement, ensures that budgets are grounded in realistic expectations. Understanding historical cash flow patterns allows organizations to set achievable revenue targets and allocate expenses strategically. This reduces the risk of overspending and enhances financial stability. For example, projecting program expenses based on past spending patterns helps ensure that program budgets are aligned with available resources.

- Forecasting Future PerformanceAccurate forecasting enables organizations to anticipate future financial challenges and opportunities. By projecting cash inflows and outflows, charities can proactively address potential shortfalls or identify opportunities for strategic investment. For instance, forecasting a decline in government grants can prompt the organization to diversify funding sources or implement cost-saving measures.

- Informed Decision-MakingBudgeting and forecasting, informed by the cash flow statement template, empower data-driven decision-making. Organizations can make informed choices regarding program development, staffing levels, and fundraising strategies based on projected financial performance. This enhances the organization’s ability to achieve its mission and maximize its impact. For example, projecting increased fundraising revenue might justify expanding existing programs or launching new initiatives.

In summary, the charity cash flow statement template serves as a cornerstone of effective budgeting and forecasting. By providing historical data and insights into cash flow patterns, the template enables organizations to develop realistic budgets, anticipate future needs, and make informed decisions that contribute to long-term financial stability and mission fulfillment.

5. Financial Health Assessment

Assessing the financial health of a charitable organization is crucial for ensuring long-term sustainability and effective resource allocation. A charity cash flow statement template provides the foundation for this assessment by offering a detailed overview of cash inflows and outflows. Analyzing this data allows stakeholders to gain insights into the organization’s financial stability, liquidity, and ability to meet its obligations.

- Liquidity AnalysisLiquidity refers to an organization’s ability to meet short-term financial obligations. The cash flow statement reveals the availability of liquid assets to cover immediate expenses such as payroll, rent, and program costs. A consistent positive cash flow from operating activities indicates healthy liquidity, while negative cash flow may signal potential difficulties in meeting short-term obligations. For instance, a charity consistently struggling to meet payroll due to insufficient cash flow may need to reassess its fundraising strategies or implement cost-cutting measures.

- Financial Efficiency EvaluationEvaluating financial efficiency involves assessing how effectively an organization utilizes its resources. The cash flow statement allows for analysis of operating expenses in relation to program revenue, providing insights into operational efficiency. A high ratio of program expenses to program revenue suggests efficient resource utilization, maximizing the impact of donations. Conversely, a high proportion of administrative or fundraising expenses may warrant further investigation and potential adjustments in operational strategies.

- Long-Term Sustainability AssessmentLong-term sustainability depends on an organization’s ability to generate sufficient cash flow to cover both operating expenses and long-term investments. Analyzing the cash flow statement over multiple reporting periods provides insights into the organization’s ability to maintain a positive cash flow trend and invest in future growth. A consistently positive cash flow from operating activities, coupled with strategic investments in infrastructure or program development, suggests a sustainable financial trajectory.

- Predictive Financial ModelingHistorical cash flow data from the template serves as a basis for predictive financial modeling. By analyzing past trends in cash inflows and outflows, organizations can project future financial performance and make proactive adjustments to their strategies. This allows for informed decision-making regarding fundraising targets, program expansion, and resource allocation, enhancing the organization’s ability to navigate changing economic conditions and maintain financial stability.

In conclusion, the charity cash flow statement template serves as a critical tool for assessing financial health. By providing a detailed record of cash inflows and outflows, the template enables analysis of liquidity, efficiency, sustainability, and future financial performance. These insights inform strategic decision-making, promote responsible resource allocation, and ultimately contribute to the long-term success and impact of the organization.

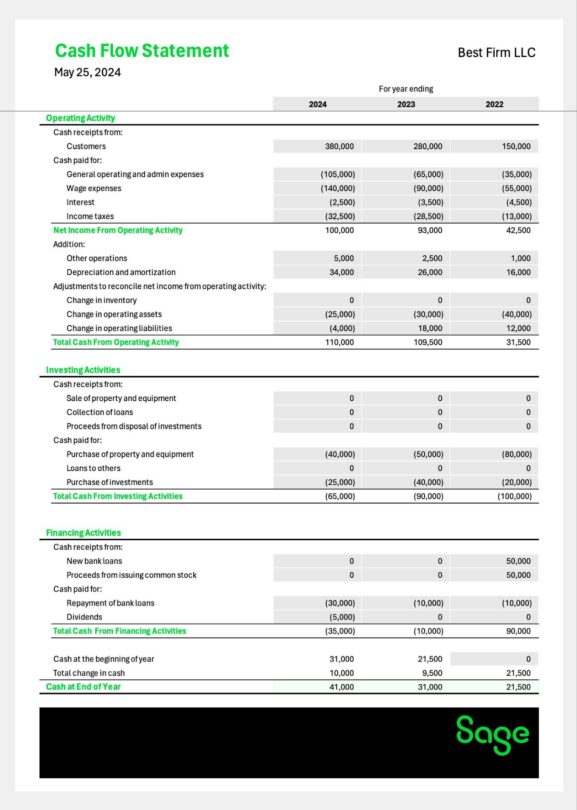

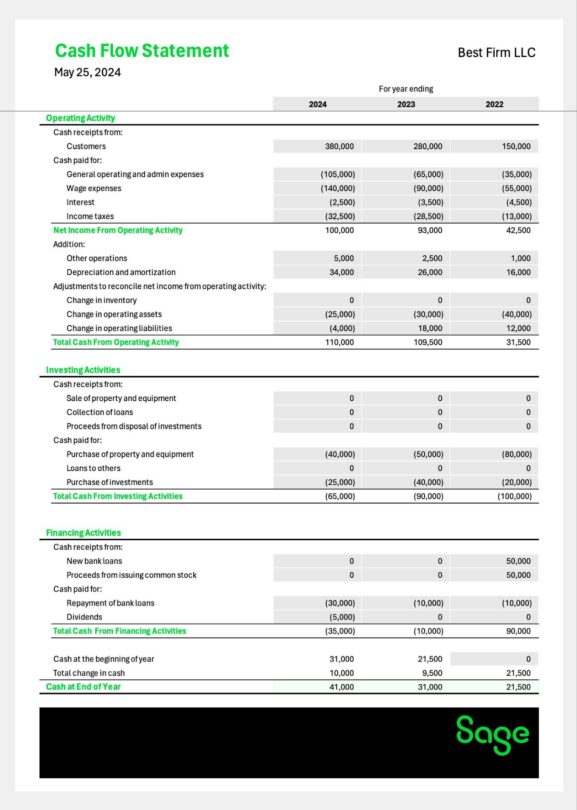

Key Components of a Charity Cash Flow Statement Template

A comprehensive understanding of the key components within a charity cash flow statement template is essential for accurate financial reporting and analysis. These components provide a structured overview of an organization’s financial activities, enabling informed decision-making and promoting transparency.

1. Operating Activities: This section details cash flows related to the core functions of the charity, including program delivery, fundraising, and administrative expenses. Key elements include donations received, grants awarded, program service revenue, salaries, rent, and office supplies. Analyzing this section reveals the organization’s ability to generate cash from its primary operations.

2. Investing Activities: Cash flows related to the acquisition and disposal of long-term assets are documented in this section. Examples include purchases or sales of property, equipment, and investments. This section provides insights into the organization’s capital expenditures and investment strategies.

3. Financing Activities: This section tracks cash flows related to debt, equity, and other financing sources. Key elements include proceeds from loans, repayments of principal, and changes in endowment funds. Analyzing this section provides insights into the organization’s capital structure and long-term financial stability.

4. Beginning Cash Balance: The cash balance at the start of the reporting period establishes the baseline for tracking cash flow. This figure is essential for calculating the net change in cash during the period.

5. Ending Cash Balance: This represents the total cash held by the organization at the end of the reporting period. It is calculated by adding the net increase or decrease in cash to the beginning cash balance. This figure provides a snapshot of the organization’s current cash position.

6. Non-Cash Transactions: While not directly affecting cash flow, significant non-cash transactions should be disclosed in a separate note. Examples include in-kind donations or the exchange of assets. This disclosure provides a more complete picture of the organization’s financial activities.

Careful attention to these components ensures a comprehensive and accurate representation of a charity’s financial performance. This detailed insight informs stakeholders about the organization’s financial health, sustainability, and ability to fulfill its mission.

How to Create a Charity Cash Flow Statement Template

Creating a robust template requires careful consideration of key components and adherence to accounting principles. A well-structured template ensures accurate tracking of cash flow, facilitates informed decision-making, and promotes transparency.

1. Define Reporting Period: Establish a consistent reporting period (monthly, quarterly, or annually) for the statement. This ensures comparability and allows for trend analysis.

2. Structure the Template: Organize the template into three core sections: Operating Activities, Investing Activities, and Financing Activities. Include lines for beginning and ending cash balances.

3. Categorize Cash Flows: Within each section, establish clear categories for different types of cash inflows and outflows. Examples include donations, grants, program expenses, salaries, and capital expenditures. Consistent categorization is essential for accurate tracking and analysis.

4. Input Data Sources: Identify the sources of data for each category, such as bank statements, donation records, and expense reports. Ensure accurate and consistent data entry to maintain the integrity of the cash flow statement.

5. Calculate Net Cash Flow: For each section, calculate the net cash flow by subtracting total cash outflows from total cash inflows. This reveals the net change in cash resulting from each type of activity.

6. Reconcile Beginning and Ending Balances: Sum the net cash flows from all three sections and add this total to the beginning cash balance. This calculation should equal the ending cash balance, ensuring accuracy and completeness.

7. Incorporate Non-Cash Transactions: Include a separate section or footnote to disclose significant non-cash transactions, such as in-kind donations or asset exchanges. While these transactions don’t directly affect cash flow, they provide valuable context for understanding the organization’s financial activities.

8. Review and Verify: Regularly review the cash flow statement for accuracy and completeness. Implement internal controls to ensure data integrity and prevent errors. Periodic review by a qualified accountant is recommended.

A meticulously crafted template, adhering to these guidelines, provides a crucial tool for managing financial resources, ensuring transparency, and supporting the long-term sustainability of the charitable organization. Regular review and analysis of the cash flow statement empower informed decision-making and contribute to the organization’s ability to fulfill its mission effectively.

Careful management of financial resources is paramount for the success and sustainability of any charitable organization. A robust cash flow statement template provides the essential framework for tracking, analyzing, and projecting cash flow, enabling informed decision-making and promoting financial transparency. From understanding the core components and their significance to the practical steps involved in creating and utilizing a template, this exploration has highlighted the indispensable role of this tool in responsible financial stewardship. The ability to assess financial health, develop realistic budgets, and forecast future performance empowers organizations to navigate financial complexities, optimize resource allocation, and ensure long-term stability.

Effective implementation and consistent utilization of a cash flow statement template are not merely best practices; they are essential for fulfilling the mission of charitable organizations and maintaining public trust. Embracing these financial management tools equips organizations to navigate the evolving landscape of the non-profit sector, ensuring their ability to serve beneficiaries effectively and achieve lasting impact.