Utilizing a tailored financial statement offers several advantages. It enables precise profit analysis by categorizing service-related expenses, facilitating cost control and strategic pricing decisions. This structured approach simplifies financial reporting, making it easier to compare performance across periods, identify trends, and secure funding from investors or lenders. Moreover, a clear and concise financial overview facilitates effective communication of financial health to stakeholders.

This understanding of the structure and advantages of a dedicated financial reporting tool for service businesses lays the groundwork for a more detailed examination of its individual components and practical application. The following sections will delve into the specific line items, explore best practices for its creation and utilization, and discuss how it fits into a broader financial management strategy.

1. Revenues

Revenue represents the lifeblood of any service company and forms the foundation of the income statement. Accurate revenue recognition is crucial for a clear picture of financial performance. Within the context of a service company income statement template, revenues are typically categorized by service type. This allows for analysis of each service line’s contribution to overall profitability. For instance, a consulting firm might categorize revenues by project type, client segment, or specific consulting services offered. This granular approach allows management to identify high-performing services and areas needing improvement. Furthermore, understanding revenue drivers allows for informed decisions regarding resource allocation, pricing strategies, and future service development.

Several factors influence revenue recognition within a service company. Contract terms, completion milestones, and the nature of the service itself all play a role. For example, a long-term service contract might recognize revenue incrementally as milestones are achieved, rather than as a lump sum upon contract signing. Accurately reflecting the timing and amount of revenue is paramount for compliance and informed financial management. Inaccurate revenue reporting can lead to misinformed decisions and potential legal or regulatory issues. Therefore, meticulous record-keeping and adherence to accounting principles are essential.

Effective revenue management hinges on a thorough understanding of the revenue cycle, from initial service agreement to final payment. Analyzing revenue trends within the income statement provides insights into business growth, market demand, and the effectiveness of sales and marketing efforts. This information empowers businesses to adapt to market changes, optimize service offerings, and ultimately drive profitability. Integrating revenue analysis with other key metrics within the income statement offers a comprehensive view of financial health and allows for proactive management of financial performance.

2. Operating Expenses

Operating expenses represent the costs incurred in the day-to-day running of a service business. Accurate tracking and categorization within the income statement are essential for profitability analysis and informed decision-making. Understanding these expenses provides insights into cost structures, operational efficiency, and areas for potential cost optimization.

- Salaries and WagesThis category encompasses all compensation paid to employees providing services. It often represents a significant portion of total operating expenses for service-based businesses. For example, a consulting firm’s largest expense is typically consultant salaries. Effective management of salaries and wages is crucial for maintaining profitability. Within the income statement, these costs may be further categorized by department or service line to provide a more granular view of labor cost distribution.

- Rent and UtilitiesThese expenses cover the costs associated with maintaining office space or other operational facilities. Rent, electricity, water, and other utilities are essential for service delivery. Analyzing these costs within the income statement can reveal opportunities for cost reduction through energy efficiency initiatives or renegotiation of lease agreements. For instance, a company may discover that its utility costs are disproportionately high compared to industry benchmarks, prompting an investigation into energy consumption patterns.

- Marketing and AdvertisingExpenses related to promoting services and acquiring new clients fall under this category. These costs can include online advertising, public relations, and event sponsorships. Tracking marketing expenses against revenue generated provides insights into the effectiveness of marketing campaigns. For example, by analyzing the return on investment for different marketing channels, a business can optimize its marketing budget allocation for maximum impact.

- Administrative and General ExpensesThis category encompasses a range of overhead costs necessary for business administration, including office supplies, professional fees, and insurance. While often smaller individually, these expenses can accumulate significantly. Careful monitoring within the income statement allows for identification of potential cost savings through streamlining administrative processes or negotiating better rates with suppliers.

Careful analysis of operating expenses within the context of a service company income statement template provides crucial insights into cost management and profitability. By understanding the drivers of each expense category, businesses can make data-driven decisions to optimize resource allocation, improve operational efficiency, and enhance the bottom line. This analysis should be conducted regularly to identify trends, uncover potential issues, and adapt to changing market conditions.

3. Gross Profit

Gross profit occupies a central position within a service company income statement template, representing the financial buffer remaining after deducting the direct costs of service delivery from revenues. This key metric offers crucial insights into operational efficiency and pricing effectiveness. Calculated as total revenue less the cost of services sold (COS), gross profit reveals the profitability of core service offerings. Cost of services sold typically includes direct labor, materials, and other expenses directly attributable to service provision. For example, a consulting firms COS might include consultant salaries, project-related travel expenses, and software licenses directly used for client projects. A healthy gross profit margin indicates efficient resource utilization and effective pricing strategies.

Analyzing gross profit trends within the income statement allows businesses to identify potential issues and opportunities. A declining gross profit margin, for instance, might signal rising labor costs, inefficient service delivery processes, or inadequate pricing. Conversely, an increasing margin could indicate improved operational efficiency, successful cost control measures, or effective pricing adjustments. Consider a software-as-a-service (SaaS) company experiencing a decline in gross profit. This could stem from increased customer support costs due to a buggy software release. Alternatively, a rising gross profit margin might reflect successful automation of customer onboarding processes, reducing labor costs. Understanding the underlying drivers of gross profit fluctuations allows for informed decision-making and proactive management of profitability.

Gross profit serves as a crucial input for other key financial metrics, including net income and operating profit. It represents the financial foundation upon which a service business builds its profitability. Monitoring and analyzing gross profit within the context of the income statement is essential for sustainable financial health and long-term success. Challenges in accurately calculating gross profit often arise from difficulties in accurately allocating costs to specific services. Robust cost accounting systems and clear service delivery processes are essential for precise gross profit determination and, consequently, informed financial management.

4. Net Income

Net income, often referred to as the “bottom line,” represents the ultimate measure of profitability for a service company. Within the context of a service company income statement template, net income is the residual earnings after all operating expenses, interest expense, and taxes have been deducted from revenues. This figure provides a crucial indicator of a company’s financial performance and its ability to generate profit for its owners or shareholders. Understanding the components contributing to net income is essential for effective financial management and strategic decision-making.

- Operating IncomeOperating income, derived by subtracting operating expenses from gross profit, reflects the profitability of core business operations before considering non-operating items like interest and taxes. A strong operating income suggests efficient management of resources and effective cost control. For example, a consulting firm with a high operating income demonstrates efficient utilization of consultant time and effective management of project-related expenses.

- Non-Operating ItemsThese items, including interest expense and income from investments, are not directly related to core service operations. Interest expense represents the cost of borrowing money, while investment income reflects returns on investments. Including these items in the income statement provides a comprehensive view of a company’s overall financial performance, including activities outside its primary service offerings. For instance, a software company earning interest income on its cash reserves would include this income in its net income calculation.

- Income TaxesIncome taxes represent the portion of earnings owed to government entities. The amount of income tax expense depends on applicable tax laws and a company’s taxable income. This expense is a crucial component of the net income calculation, as it significantly impacts the final profitability figure. Tax planning strategies can influence the effective tax rate and, consequently, the net income.

- Net Profit MarginNet profit margin, calculated as net income divided by revenue, expresses profitability as a percentage of sales. This metric provides a standardized measure of profitability, allowing for comparisons across different companies and industries. A higher net profit margin indicates greater efficiency in converting revenue into profit. For example, two competing marketing agencies might have similar revenues, but the agency with a higher net profit margin demonstrates greater profitability.

Analyzing net income trends over time offers valuable insights into a service company’s financial health and sustainability. Consistent growth in net income signifies successful business operations and effective financial management. Conversely, declining net income can signal underlying issues requiring attention, such as rising costs, declining revenues, or ineffective pricing strategies. Utilizing a service company income statement template, with its focus on service-specific revenue and expense categories, facilitates this crucial analysis and supports informed decision-making for long-term financial success.

5. Reporting Period

The reporting period defines the timeframe covered by a service company income statement template. This period, whether a month, quarter, or year, provides the basis for analyzing financial performance and identifying trends. Selecting an appropriate reporting period is crucial for generating meaningful insights and informing strategic decision-making. The choice of reporting period often depends on the nature of the business, its size, and reporting requirements.

- Monthly ReportingMonthly reporting provides a granular view of financial performance, allowing for rapid identification of emerging trends and timely corrective action. This frequency is particularly beneficial for businesses with fluctuating revenues or expenses, enabling close monitoring of cash flow and operational efficiency. For example, a seasonal landscaping business might utilize monthly reporting to track revenue fluctuations throughout the year and adjust staffing levels accordingly. However, monthly reporting can be resource-intensive and may not always reveal long-term trends.

- Quarterly ReportingQuarterly reporting offers a balance between detailed analysis and broader trend identification. This frequency is commonly used for internal management reporting and provides a sufficient timeframe to assess the impact of strategic initiatives. For instance, a consulting firm might use quarterly reports to evaluate the success of new service offerings or marketing campaigns. Quarterly reporting also aligns with many external reporting requirements for publicly traded companies.

- Annual ReportingAnnual reporting provides a comprehensive overview of financial performance for the entire year. This timeframe is essential for evaluating overall profitability, assessing long-term trends, and comparing performance against annual budgets. Annual reports are typically used for external financial reporting to investors, lenders, and regulatory bodies. For example, a non-profit organization might utilize annual reports to demonstrate its financial health and impact to donors.

- Year-to-Date ReportingYear-to-date reporting accumulates financial data from the beginning of the fiscal year to the present date. This provides a cumulative perspective on performance and allows for tracking progress against annual targets. Year-to-date figures are often included in interim financial reports, such as monthly or quarterly statements, to provide context and facilitate comparison to prior periods. For example, a subscription-based software company might use year-to-date reporting to track customer acquisition progress against annual targets.

The choice of reporting period significantly impacts the insights derived from a service company income statement template. Selecting the appropriate frequency depends on the specific needs of the business and the desired level of detail. Consistent reporting periods allow for meaningful comparisons across time and facilitate accurate trend analysis, informing strategic decision-making and driving long-term financial success.

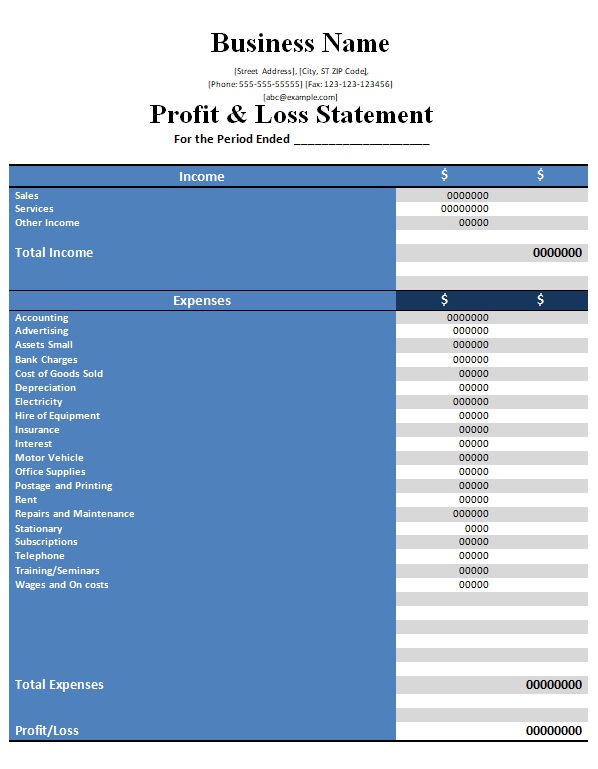

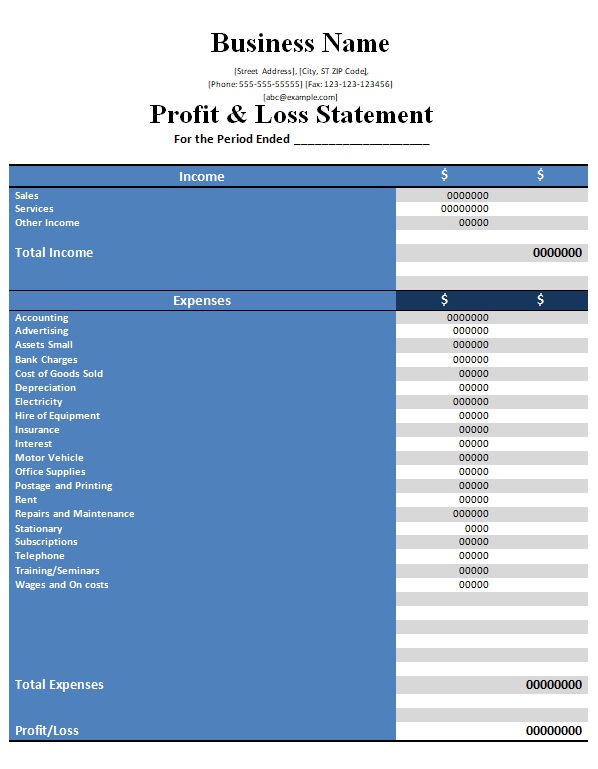

Key Components of a Service Company Income Statement Template

A well-structured income statement provides a clear and concise overview of a service company’s financial performance. Understanding the key components is crucial for interpreting the statement and extracting actionable insights.

1. Revenue: This section details all income generated from services rendered during the reporting period. It should be broken down by service type or category to facilitate analysis of individual revenue streams. Accurate revenue recognition principles must be applied.

2. Cost of Services Sold (COS): COS encompasses all direct costs associated with delivering services, including direct labor, materials, and other expenses directly attributable to service provision. Accurate cost allocation is crucial for determining gross profit.

3. Gross Profit: Calculated as revenue minus COS, gross profit represents the profitability of core service offerings before accounting for overhead and other indirect expenses. This metric is a key indicator of operational efficiency.

4. Operating Expenses: This section details all indirect costs incurred in running the business, including salaries, rent, marketing, and administrative expenses. Categorizing operating expenses provides insights into cost structure and potential areas for optimization.

5. Operating Income: Calculated as gross profit minus operating expenses, operating income reflects the profitability of core business operations before considering non-operating items such as interest and taxes.

6. Other Income/Expenses: This section includes non-operating items such as interest income, interest expense, gains or losses from investments, and other miscellaneous income or expenses not directly related to core operations.

7. Income Before Taxes: This represents the company’s earnings before income tax expense is deducted. It’s calculated as operating income plus other income/expenses.

8. Income Tax Expense: This reflects the income tax liability for the reporting period, based on applicable tax laws and the company’s taxable income.

9. Net Income: Often referred to as the “bottom line,” net income represents the final profit or loss after all revenues and expenses have been accounted for. This key figure reflects the overall financial performance of the service company during the reporting period.

10. Reporting Period: The income statement must clearly specify the timeframe covered, whether it’s a month, quarter, or year. Consistent reporting periods enable meaningful comparisons and trend analysis over time.

Careful analysis of these components provides a comprehensive understanding of a service company’s financial health, profitability, and operational efficiency. This understanding allows for informed decision-making, strategic planning, and effective resource allocation to drive future success.

How to Create a Service Company Income Statement Template

Creating a tailored income statement template ensures accurate financial reporting for service-based businesses. The following steps outline the process of developing a structured and effective template.

1: Define the Reporting Period: Specify the timeframe covered by the income statement, whether monthly, quarterly, or annually. Consistent reporting periods are crucial for comparability and trend analysis.

2: Structure Revenue Categories: Establish clear categories for different revenue streams. This allows for analysis of individual service offerings and identification of top performers. Consider categories based on service type, client segment, or project type.

3: Outline Cost of Services Sold (COS): Detail the direct costs associated with service delivery. This includes direct labor, materials, and other expenses directly attributable to providing services. Accurate cost allocation is essential for calculating gross profit.

4: Categorize Operating Expenses: Create categories for indirect costs such as salaries, rent, marketing, and administrative expenses. Detailed categorization facilitates cost control and analysis of operational efficiency.

5: Incorporate Non-Operating Items: Include sections for non-operating income and expenses, such as interest income or expense and gains or losses from investments. This provides a comprehensive view of overall financial performance.

6: Calculate Key Metrics: Include formulas for calculating key metrics like gross profit (Revenue – COS), operating income (Gross Profit – Operating Expenses), and net income (Operating Income + Other Income/Expenses – Income Tax Expense). These metrics provide essential insights into profitability and operational efficiency.

7: Design a Clear Layout: Organize the template in a logical and easy-to-understand format. Use clear labels for each section and ensure consistent formatting for readability. Consider using a spreadsheet program for easy data entry and calculation.

8: Regularly Review and Update: Business operations and reporting requirements can change over time. Regularly review and update the template to ensure it remains relevant and accurately reflects the company’s financial activities.

A well-designed template provides a structured approach to financial reporting, enabling accurate performance analysis, informed decision-making, and effective financial management. Consistent use of the template allows for tracking of key metrics over time, facilitating identification of trends and proactive management of financial health. Regular review and refinement of the template ensure its ongoing effectiveness and alignment with evolving business needs.

Effective financial management hinges on accurate and insightful reporting. A dedicated income statement template, tailored for service-based businesses, provides a crucial tool for understanding financial performance. By focusing on service-specific revenues, cost of services sold, and operating expenses, this structured approach enables precise profit analysis, facilitates informed pricing decisions, and simplifies financial reporting for stakeholders. Understanding key metrics such as gross profit, operating income, and net income, within the context of the chosen reporting period, allows for effective cost control, identification of growth opportunities, and proactive management of financial health.

Accurate and consistent utilization of a tailored income statement template empowers service companies to navigate the complexities of the financial landscape. This structured approach provides the insights necessary to make informed decisions, optimize resource allocation, and drive sustainable growth and profitability. Regular review and analysis of financial performance, facilitated by this structured reporting, are essential for long-term success in the dynamic service industry.