Utilizing such a structured record offers numerous advantages. It promotes transparency and accountability, simplifies financial reporting, and aids in identifying areas of overspending or potential savings. This improved financial awareness empowers informed resource allocation and contributes to better financial health for individuals, businesses, or organizations.

Understanding the structure and benefits of organized financial tracking lays the groundwork for exploring its various applications and best practices in detail.

1. Comprehensive Income Tracking

Accurate financial analysis requires a thorough record of all income sources. Comprehensive income tracking within a statement of receipts and expenditures template forms the foundation for sound financial management and informed decision-making.

- Identifying All Revenue StreamsSystematic documentation of all income, including sales, investments, and other revenue streams, ensures a complete financial picture. For a business, this might involve tracking sales from different product lines, online and in-store transactions, and any investment income. Accurately capturing all revenue streams is essential for calculating profitability and assessing overall financial performance.

- Regular Recording and CategorizationConsistent recording and categorization of income facilitates analysis and reporting. Regular updates, ideally daily or weekly, prevent omissions and ensure data accuracy. Categorizing income by source allows for detailed analysis of revenue streams and identification of growth areas or potential weaknesses. For example, a non-profit organization might categorize income by donation type, grant funding, and fundraising events.

- Verification and ReconciliationValidating recorded income against supporting documentation, such as invoices and bank statements, ensures accuracy and reliability. Regular reconciliation helps identify discrepancies and maintain data integrity. This process is critical for preventing errors and ensuring the financial record accurately reflects actual income received.

- Integration with Expense TrackingCombining comprehensive income tracking with detailed expense records within the template provides a holistic view of financial performance. Analyzing income alongside expenses enables calculation of net income or loss, facilitating informed budget adjustments and strategic financial planning. This integrated approach is crucial for assessing overall financial health and making informed decisions regarding resource allocation.

By meticulously tracking all income sources, organizations and individuals can leverage the statement of receipts and expenditures template to gain a clear understanding of financial performance, identify areas for improvement, and make informed decisions that support financial stability and growth.

2. Detailed Expense Categorization

Detailed expense categorization is integral to a comprehensive statement of receipts and expenditures template. Effective financial analysis relies on a granular understanding of where funds are allocated. Categorizing expenses provides insights into spending patterns, identifies areas for potential savings, and enables more accurate budgeting and forecasting.

A well-structured template facilitates this detailed categorization. Expenses should be categorized logically, considering the specific needs of the entity using the template. A business might categorize expenses by department (marketing, sales, operations), by type (salaries, rent, utilities, materials), or by project. A non-profit organization might categorize expenses by program area (education, outreach, research), by type (staffing, administrative costs, program supplies), or by grant. Consistent application of these categories ensures meaningful comparisons across periods and facilitates trend analysis.

For example, a small business using a template might discover through detailed categorization that office supply expenses have steadily increased over the past year. This realization could prompt a review of purchasing practices, potentially leading to cost-saving measures. Similarly, a non-profit analyzing program expenses might identify inefficiencies in a specific program area, leading to adjustments in resource allocation. Without detailed categorization, these insights would remain obscured.

Effective expense categorization requires a balance between detail and practicality. Excessive granularity can become cumbersome, while overly broad categories limit actionable insights. The chosen categories should align with the organization’s or individual’s specific goals and reporting requirements. Regular review and refinement of the categorization scheme ensures its continued relevance and effectiveness.

3. Specified Time Period

A defined time period is fundamental to the utility of a statement of receipts and expenditures template. This specified timeframe provides the necessary context for analyzing financial performance and making informed decisions. Whether for a business, non-profit organization, or personal finances, the chosen time period directly impacts the insights derived from the template.

- Frequency of ReportingThe reporting frequency, whether daily, weekly, monthly, quarterly, or annually, dictates the granularity of financial analysis and influences decision-making timelines. Daily or weekly reporting offers real-time insights into cash flow, while monthly or quarterly reports provide broader trends. Annual reports summarize overall financial performance for a given year. The appropriate frequency depends on the specific needs and objectives of the entity using the template.

- Comparison and Trend AnalysisConsistent time periods enable meaningful comparisons of financial data across different periods. Analyzing income and expenses over consistent timeframes reveals trends, identifies seasonal fluctuations, and facilitates performance evaluation. For example, comparing monthly expenses over a year can highlight seasonal variations in utility costs or advertising spend.

- Budgeting and ForecastingA specified time period serves as the basis for budget development and financial forecasting. Historical data from prior periods informs future projections and allows for more accurate budget allocation. Understanding past performance within specific timeframes enables more realistic financial planning.

- Alignment with Financial ObjectivesThe chosen time period should align with the overall financial objectives. Short-term goals, such as managing cash flow, may require more frequent reporting, while long-term strategic planning benefits from annual or multi-year analysis. The selected timeframe directly influences the type of insights gained and the decisions made based on the template data.

By defining a specific time period, the statement of receipts and expenditures template becomes a powerful tool for tracking financial progress, identifying areas for improvement, and making informed decisions aligned with short-term and long-term financial objectives. This structured approach to financial management fosters greater control, accountability, and ultimately, financial success.

4. Standardized Format

A standardized format is crucial for maximizing the effectiveness of a statement of receipts and expenditures template. Consistency in structure and presentation facilitates data analysis, comparison, and interpretation. A standardized template ensures all relevant information is captured systematically, enabling clear and efficient financial reporting. This consistency allows for accurate tracking of income and expenses over time, facilitating trend analysis and informed decision-making.

Consider a business with multiple departments, each using a different format for tracking expenses. Consolidating this disparate information for overall financial reporting becomes a complex and error-prone task. A standardized template ensures uniformity across departments, simplifying aggregation and analysis. Similarly, for individuals tracking personal finances, a standardized format ensures consistency across different accounts and categories, providing a clear overview of spending habits and financial health. A standardized template might include predefined fields for date, description, category, and amount for each transaction. This structured approach ensures comprehensive data capture and facilitates sorting, filtering, and analysis.

Standardization also promotes data integrity and reduces the risk of errors. Consistent data entry practices minimize discrepancies and ensure data accuracy. This is particularly important for organizations subject to audits or regulatory compliance. A standardized template supports efficient auditing processes and ensures compliance with reporting requirements. Furthermore, a standardized format simplifies data sharing and collaboration. When multiple individuals or departments utilize the same template, information can be easily shared and analyzed, fostering greater transparency and collaboration in financial management.

5. Regular Updates

Maintaining accurate and up-to-date financial records is essential for sound financial management. Regular updates to a statement of receipts and expenditures template ensure the information reflects current financial status, enabling timely analysis and informed decision-making. Neglecting regular updates can lead to outdated and inaccurate financial information, hindering effective planning and control.

- Timely Financial OverviewRegular updates provide a real-time snapshot of financial health. Frequent entries, whether daily or weekly, ensure the template accurately reflects current income and expenses. This allows for immediate identification of potential issues, such as cost overruns or revenue shortfalls, enabling prompt corrective action. For example, a business tracking daily sales can quickly identify a decline in sales of a particular product and adjust marketing strategies accordingly.

- Improved Accuracy and ReliabilityFrequent updates minimize the risk of errors and omissions. Recording transactions soon after they occur reduces reliance on memory and ensures data accuracy. This is crucial for maintaining reliable financial records and generating accurate reports. For example, regularly recording receipts prevents lost or forgotten expenses, ensuring a complete and accurate record of expenditures.

- Enhanced Budgeting and ForecastingUp-to-date financial information is essential for effective budgeting and forecasting. Regularly updated templates provide accurate historical data, enabling more realistic projections and informed resource allocation. For instance, a non-profit organization tracking grant expenditures can use this data to project future spending and adjust budget allocations as needed.

- Facilitated Decision-MakingAccurate and timely financial information empowers informed decision-making. Regular updates enable stakeholders to assess current financial performance, identify trends, and make strategic decisions based on current data. For example, a business owner reviewing regularly updated financial statements can make informed decisions regarding investments, expansion plans, or cost-cutting measures.

Regular updates are essential for maximizing the value of a statement of receipts and expenditures template. This practice ensures the template remains a reliable tool for financial management, enabling informed decision-making and contributing to overall financial stability and success. Consistent maintenance of these records transforms the template from a static document into a dynamic tool for ongoing financial analysis and planning.

6. Accessible Format

Accessibility is a critical aspect of a statement of receipts and expenditures template. A readily accessible format ensures that the information contained within the template can be easily retrieved, understood, and utilized for financial analysis and decision-making. This accessibility impacts various stakeholders, from business owners and managers to individual users tracking personal finances. Accessibility considerations encompass both the format of the template itself and the means by which it is stored and accessed.

A template in a digital spreadsheet format, for instance, offers advantages over a handwritten ledger. Data can be easily sorted, filtered, and analyzed using software tools. Furthermore, digital formats facilitate sharing and collaboration, enabling multiple users to access and work with the data simultaneously. Cloud-based storage solutions further enhance accessibility, allowing authorized users to access the template from anywhere with an internet connection. However, digital accessibility requires consideration of software compatibility and data security measures. Password protection and regular backups are essential for safeguarding sensitive financial information. Conversely, a physical ledger, while less prone to data breaches, lacks the flexibility and analytical capabilities of digital formats.

Consider a small business owner needing to quickly review monthly expenses while meeting with a potential investor. A readily accessible digital template, stored in the cloud, allows immediate access to the necessary information. Conversely, a business relying on a physical ledger would require time to retrieve and analyze the data, potentially hindering timely decision-making. Similarly, an individual tracking personal finances benefits from a readily accessible template when preparing tax returns or applying for a loan. The ability to quickly access and analyze financial data empowers informed decision-making and facilitates effective financial management.

Ultimately, the most accessible format depends on the specific needs and resources of the user. Balancing the benefits of digital accessibility with security considerations and the potential need for physical records is crucial. Choosing a format that facilitates efficient data entry, analysis, and retrieval ensures the statement of receipts and expenditures template remains a valuable tool for financial management.

Key Components of a Statement of Receipts and Expenditures Template

A well-structured template ensures comprehensive financial tracking and analysis. The following components are essential for effective utilization:

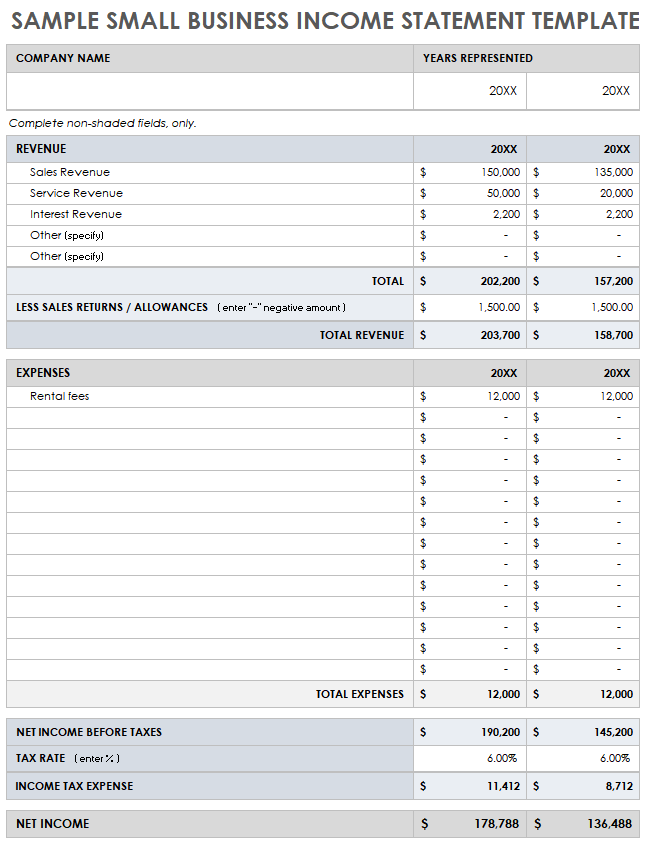

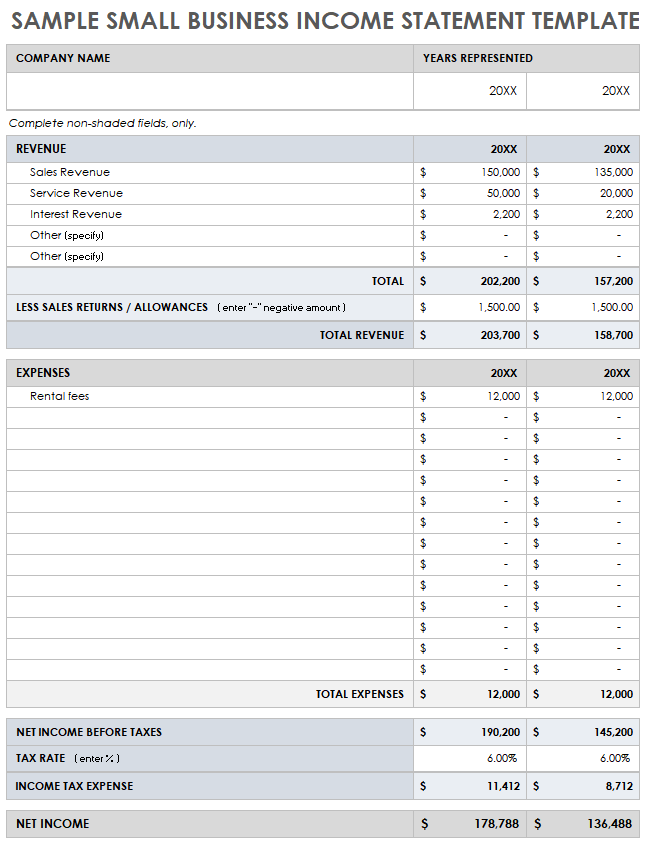

1. Reporting Period: A clearly defined timeframe, such as monthly, quarterly, or annually, establishes the scope of the financial record. This allows for consistent tracking and comparison across periods.

2. Income Section: This section details all sources of revenue, categorized for clear analysis. Categorization may include sales, investments, donations, or other relevant income streams.

3. Expense Section: This section itemizes all expenditures, categorized for analysis and control. Categories might include salaries, rent, utilities, marketing, or program-specific expenses.

4. Beginning and Ending Balances: Recording the beginning and ending balances for the reporting period provides context and facilitates reconciliation. This allows for tracking changes in financial position over time.

5. Supporting Documentation: Reference to supporting documentation, such as invoices, receipts, and bank statements, validates the recorded transactions. This enhances accuracy and transparency.

6. Totals and Subtotals: Clear calculation of totals and subtotals for income and expense categories provides an overview of financial performance. This facilitates analysis and informed decision-making.

7. Variance Analysis (Optional): Comparing actual figures against budgeted amounts allows for identification of variances and informs corrective actions. This component provides insights into budget adherence.

These components, when used together, provide a structured framework for understanding financial performance and making informed decisions. Accurate and consistent use of these elements supports effective financial management.

How to Create a Statement of Receipts and Expenditures Template

Creating a template for tracking receipts and expenditures involves several key steps. A well-structured template facilitates accurate financial recording, analysis, and reporting.

1. Define the Reporting Period: Specify the timeframe covered by the template. This might be daily, weekly, monthly, quarterly, or annually, depending on reporting needs.

2. Establish Income Categories: Determine relevant income categories. Examples include sales revenue, investment income, grants, or donations. Detailed categorization facilitates analysis of income streams.

3. Establish Expense Categories: Define expense categories relevant to the entity’s operations. Examples include salaries, rent, utilities, marketing, or program-specific expenses. Consistent categorization is crucial for expense analysis.

4. Design the Template Structure: Structure the template with columns for date, description, category, and amount for both income and expenses. Include sections for beginning and ending balances. Consider using a spreadsheet program for ease of use and calculation.

5. Incorporate Supporting Documentation: Include a mechanism for referencing supporting documentation, such as invoice numbers or receipt attachments. This enhances data integrity and facilitates audits.

6. Implement Formulas for Calculations: Utilize formulas to automatically calculate totals and subtotals for income and expense categories. This ensures accuracy and efficiency in reporting.

7. Test and Refine the Template: Pilot test the template to ensure functionality and identify any necessary adjustments. Regular review and refinement maintain the template’s relevance and effectiveness over time.

A well-designed template provides a clear framework for recording financial transactions, generating accurate reports, and informing financial decision-making. Consistent application and regular review ensure the template remains a valuable tool for financial management.

Accurate and organized financial records are essential for effective resource management. A statement of receipts and expenditures template provides a structured framework for tracking income and expenses, enabling informed financial decision-making. Standardized formatting, detailed categorization, and regular updates enhance the template’s value, promoting transparency, accountability, and sound financial practices. From individuals managing personal finances to large organizations tracking complex budgets, a well-designed template provides crucial insights into financial performance and facilitates strategic planning.

Effective financial management relies on consistent application and diligent maintenance of these records. Leveraging the insights gained from a comprehensive statement of receipts and expenditures template empowers proactive financial management, fostering stability and long-term financial success. The disciplined practice of tracking and analyzing financial data provides a foundation for informed decisions, contributing to achieving financial goals and navigating the complexities of the financial landscape.