Utilizing a pre-structured format for financial forecasting offers several key advantages. It facilitates informed decision-making by providing a clear picture of potential future financial outcomes. This foresight allows for proactive resource allocation and strategic planning. Moreover, it enhances communication with stakeholders, including investors and lenders, by providing a transparent and easily understood overview of projected financial health. This clear communication can foster trust and confidence in the organization’s financial stability and growth potential.

This foundation of financial foresight provides the basis for exploring critical aspects of business planning, including budgeting, resource allocation, and investment strategies. It also allows for informed analysis of potential risks and opportunities, ultimately leading to more effective and strategic decision-making for sustainable growth and success.

1. Revenue Projections

Revenue projections form the cornerstone of a statement of projected earnings template. Accurate and well-informed revenue forecasts are essential for determining potential profitability and making sound financial decisions. Understanding the various facets of revenue projection allows for a more robust and reliable financial outlook.

- Sales Forecasting MethodsVarious methods exist for forecasting sales, including historical trend analysis, market research, and sales pipeline analysis. Each method offers unique insights and may be more appropriate depending on the specific industry, business model, and data availability. Selecting the right method is critical for generating realistic and achievable revenue projections within the statement.

- Market Analysis & Growth PotentialMarket analysis plays a vital role in projecting future revenue. Understanding market size, growth potential, and competitive landscape provides valuable context for estimating realistic sales figures. Factors such as economic conditions, industry trends, and competitor activities should be considered when formulating revenue projections to ensure alignment with market realities.

- Pricing Strategies & Sales VolumePricing strategies directly impact revenue projections. Different pricing models, discounts, and promotional offers can influence sales volume and overall revenue. A clear understanding of pricing strategies and their potential impact on sales volume is crucial for accurate revenue forecasting within the projected earnings statement.

- Seasonality & Cyclical TrendsMany businesses experience seasonal fluctuations or cyclical trends in sales. Accounting for these patterns is essential for generating accurate revenue projections. Incorporating seasonality and cyclical trends within the statement ensures a more realistic and nuanced financial outlook, enabling better preparedness for periods of high or low demand.

By carefully considering these facets of revenue projection, organizations can develop a more robust and reliable statement of projected earnings. Accurate revenue forecasts provide a solid foundation for financial planning, resource allocation, and strategic decision-making, ultimately contributing to long-term financial stability and growth. Integrating these detailed revenue projections into the broader financial statement provides a comprehensive picture of anticipated performance, facilitating informed decision-making and proactive adjustments to changing market conditions.

2. Cost Estimations

Accurate cost estimations are crucial for a realistic statement of projected earnings. A comprehensive understanding of potential expenses allows for informed financial planning and effective resource allocation. Underestimating costs can lead to inaccurate profit projections and potential financial instability, while overestimating costs can hinder growth opportunities. A thorough cost analysis provides valuable insights into the financial viability of projected operations.

- Direct CostsDirect costs, such as raw materials, direct labor, and manufacturing supplies, are directly tied to production or service delivery. Accurately estimating these costs is essential for determining the cost of goods sold (COGS) and gross profit. For example, a furniture manufacturer must accurately estimate the cost of lumber, hardware, and labor required to produce each piece. These estimations directly impact the projected profitability of each item sold and the overall financial performance reflected in the projected earnings statement.

- Indirect CostsIndirect costs, also known as overhead expenses, are not directly tied to specific products or services but are essential for business operations. Examples include rent, utilities, marketing, and administrative expenses. Accurate estimation of indirect costs is crucial for determining overall operating expenses and net profit. For instance, a software company must consider rent, software licenses, and marketing expenses when projecting overall costs, which then influences the projected net profit outlined in the statement.

- Fixed Costs vs. Variable CostsUnderstanding the distinction between fixed and variable costs is crucial for accurate cost estimation. Fixed costs, such as rent and salaries, remain constant regardless of production volume, while variable costs, such as raw materials, fluctuate with production levels. Accurately classifying and estimating both fixed and variable costs allows for a more nuanced understanding of cost behavior and its impact on profitability at different production volumes. This nuanced understanding significantly impacts the projected earnings depicted in the statement, allowing for informed adjustments to pricing, production levels, and resource allocation based on projected demand and market conditions.

- Contingency PlanningCost estimations should incorporate a contingency buffer to account for unforeseen expenses or variations in projected costs. This buffer provides a financial cushion to absorb unexpected increases in material costs, labor rates, or other expenses. Incorporating a contingency demonstrates prudent financial planning and contributes to a more realistic projection of potential earnings within the statement, allowing stakeholders to understand the potential impact of unforeseen events on overall financial performance.

By thoroughly analyzing and estimating all potential costs, organizations can develop a more accurate and reliable statement of projected earnings. This comprehensive cost analysis, encompassing direct and indirect costs, fixed and variable expenses, and contingency planning, provides a realistic foundation for financial planning, resource allocation, and strategic decision-making, ultimately contributing to informed financial management and sustainable growth. Accurate cost projections, integrated within the projected earnings statement, provide critical insights into the financial viability of operations, informing pricing strategies, production planning, and overall business strategy.

3. Profit Calculations

Profit calculations represent a core component of a statement of projected earnings template. Accurate profit projections are essential for assessing the financial viability of future operations, informing investment decisions, and securing funding. A clear understanding of how profit is calculated and its various forms provides valuable insight into an organization’s projected financial health.

- Gross ProfitGross profit represents the revenue remaining after deducting the direct costs associated with producing goods or services. Calculating gross profit provides insight into the profitability of core operations. For example, a retailer calculates gross profit by subtracting the cost of goods sold from total revenue. This figure, presented within the projected earnings statement, indicates the efficiency of production and pricing strategies.

- Operating ProfitOperating profit, also known as earnings before interest and taxes (EBIT), represents the profit generated from core business operations after accounting for both direct and indirect costs. It provides a clearer picture of overall operational efficiency. A manufacturing company, for example, would subtract operating expenses such as rent, utilities, and salaries from gross profit to arrive at operating profit. This figure, within the projected earnings statement, reflects the profitability of the business before considering financing and tax implications.

- Net ProfitNet profit, often referred to as the “bottom line,” represents the ultimate profit remaining after all expenses, including interest and taxes, have been deducted. It provides the most comprehensive view of an organization’s profitability. A service-based business, for instance, would subtract interest expense and income tax from operating profit to arrive at net profit. This final profit figure, presented in the projected earnings statement, is a key indicator of financial performance and sustainability.

- Profit MarginsProfit margins express profitability as a percentage of revenue, providing a standardized measure for comparing performance across different periods or businesses. Different profit margins, such as gross profit margin, operating profit margin, and net profit margin, offer insights into different aspects of profitability. Analyzing these margins, presented within the projected earnings statement, allows for a more nuanced understanding of cost control and pricing effectiveness, enabling comparisons across periods and against industry benchmarks.

These various profit calculations, integrated within the statement of projected earnings template, provide a comprehensive overview of anticipated financial performance. Analyzing these different profit metrics provides valuable insights for strategic decision-making, resource allocation, and evaluating the overall financial health and sustainability of projected operations. This detailed profit analysis enables informed decisions regarding pricing strategies, cost control measures, and investment opportunities, ultimately contributing to long-term financial success.

4. Timeframe Definition

Defining a specific timeframe is essential for a meaningful statement of projected earnings. The timeframe provides the temporal boundaries for the financial projections, dictating the period over which revenue, expenses, and profit are estimated. This defined period allows for focused analysis and facilitates comparison across different periods, enabling trend identification and informed decision-making. A clearly defined timeframe also ensures relevance and allows stakeholders to understand the specific period the projections cover, whether it’s a quarter, a year, or several years. For example, a startup seeking funding might present a five-year projected earnings statement to demonstrate growth potential to investors, while an established company might focus on quarterly projections for operational planning and performance evaluation.

The choice of timeframe significantly influences the granularity and accuracy of the projections. Shorter timeframes, such as monthly or quarterly projections, allow for more detailed analysis and quicker adjustments to changing market conditions, but they may be subject to greater variability and less certainty. Longer timeframes, such as annual or multi-year projections, provide a broader perspective on long-term trends and strategic goals but may be less precise due to the increased uncertainty associated with longer-term forecasting. For instance, a retail business might use monthly projections to manage inventory and staffing levels during peak seasons, while a real estate developer might use multi-year projections to assess the long-term profitability of a large-scale project. The chosen timeframe should align with the specific needs and objectives of the organization and the nature of the industry.

In conclusion, a well-defined timeframe provides the essential temporal context for a statement of projected earnings, ensuring relevance, facilitating comparison, and influencing the level of detail and accuracy. Selecting the appropriate timeframe, whether short-term for operational planning or long-term for strategic decision-making, is crucial for generating meaningful and actionable financial projections. This defined period allows stakeholders to understand the specific scope of the projections and make informed decisions based on a clear understanding of the anticipated financial performance over the designated time horizon. The choice of timeframe directly impacts the utility and interpretability of the projected earnings statement, influencing resource allocation, investment decisions, and overall financial strategy.

5. Key Assumptions

Key assumptions form the bedrock of a statement of projected earnings template. These assumptions represent the underlying beliefs about future conditions that influence the financial projections. Explicitly stating these assumptions adds transparency and context to the projected figures, allowing stakeholders to understand the basis for the financial forecast. The relationship between key assumptions and projected earnings is one of cause and effect: changes in assumptions directly impact the projected outcomes. For instance, a projected earnings statement for a new product launch might assume a specific market penetration rate. If the actual penetration rate differs significantly from the assumption, the projected revenue and profit figures will also deviate. Another example could be a construction project’s projected earnings, which might assume specific material costs. Fluctuations in these costs due to market dynamics would directly affect the projected profit margin.

Several categories of assumptions typically underpin a projected earnings statement. Market-related assumptions address factors like market size, growth rate, and competitive landscape. Economic assumptions consider macroeconomic conditions such as inflation, interest rates, and economic growth. Operational assumptions relate to internal factors like production capacity, efficiency, and cost structure. For example, a software company projecting future earnings might assume a specific growth rate in cloud computing adoption. An automotive manufacturer might assume specific steel prices based on anticipated commodity market trends. A restaurant chain might assume specific labor costs based on anticipated wage rates. The validity and accuracy of these assumptions directly influence the reliability of the projected earnings. Robust sensitivity analysis, exploring the impact of varying assumptions, strengthens the analytical rigor of the statement.

Understanding and critically evaluating the key assumptions underlying a projected earnings statement is crucial for informed interpretation and decision-making. Challenges arise when assumptions are unrealistic, poorly defined, or not explicitly stated. This lack of transparency can undermine the credibility of the projections and lead to flawed decisions. A robust statement of projected earnings not only presents the projected figures but also clearly articulates the underlying assumptions, acknowledging potential uncertainties and their potential impact. This comprehensive approach strengthens the value of the statement as a planning and communication tool, fostering informed decision-making and fostering trust among stakeholders. Recognizing the inherent uncertainty in any projection and providing context through clearly stated assumptions ensures that the statement serves as a robust tool for strategic planning and informed decision-making, rather than a misleading representation of future performance.

6. Formatting Consistency

Formatting consistency plays a crucial role in the efficacy of a statement of projected earnings template. Standardized presentation ensures clarity, facilitates comparison across periods, and enhances interpretability. Consistent formatting encompasses elements like consistent date formats, currency denominations, and the arrangement of line items. Consider a financial analyst comparing quarterly projections. Consistent formatting allows for immediate identification of trends in revenue or expenses across the quarters, whereas inconsistent formatting could obscure these trends and impede analysis. For instance, presenting all monetary values in the same currency (e.g., USD) and using a consistent date format (e.g., YYYY-MM-DD) ensures that comparisons are straightforward and meaningful. Similarly, consistently placing revenue figures on the first line, followed by cost of goods sold, then operating expenses, creates a predictable structure that enhances understanding and analysis. Without such consistency, the document becomes less user-friendly and potentially misleading.

Consistent formatting contributes significantly to the usability and reliability of projected earnings statements. Imagine a lender reviewing financial projections from multiple businesses. Consistent formatting across these statements simplifies the review process, enabling efficient comparison and evaluation of financial health. Consider a statement that consistently presents gross profit, operating profit, and net profit in the same order and with clear labels. This allows the lender to quickly assess the profitability of each business and compare their performance using standardized metrics. Inconsistent formatting, however, might require the lender to spend additional time deciphering each statement, increasing the risk of misinterpretation and hindering efficient analysis. This consistency also aids internal analysis, enabling organizations to track their performance against projections and identify areas for improvement. Consistent formatting transforms the statement into a reliable tool for monitoring progress and making strategic adjustments.

In conclusion, formatting consistency is not merely a cosmetic aspect but a fundamental component of a robust statement of projected earnings template. It directly impacts the usability, comparability, and interpretability of the projected financial data. Consistent presentation enables efficient analysis, facilitates informed decision-making, and enhances communication with stakeholders. Challenges arise when formatting varies across different sections of the statement, or across different reporting periods. This inconsistency can lead to confusion, misinterpretation, and ultimately, flawed decisions. Prioritizing formatting consistency transforms the statement into a powerful tool for financial planning, performance evaluation, and communication, contributing to informed financial management and ultimately, organizational success. This meticulous attention to detail elevates the statement from a simple collection of numbers to a clear and actionable representation of future financial performance.

Key Components of a Projected Earnings Statement Template

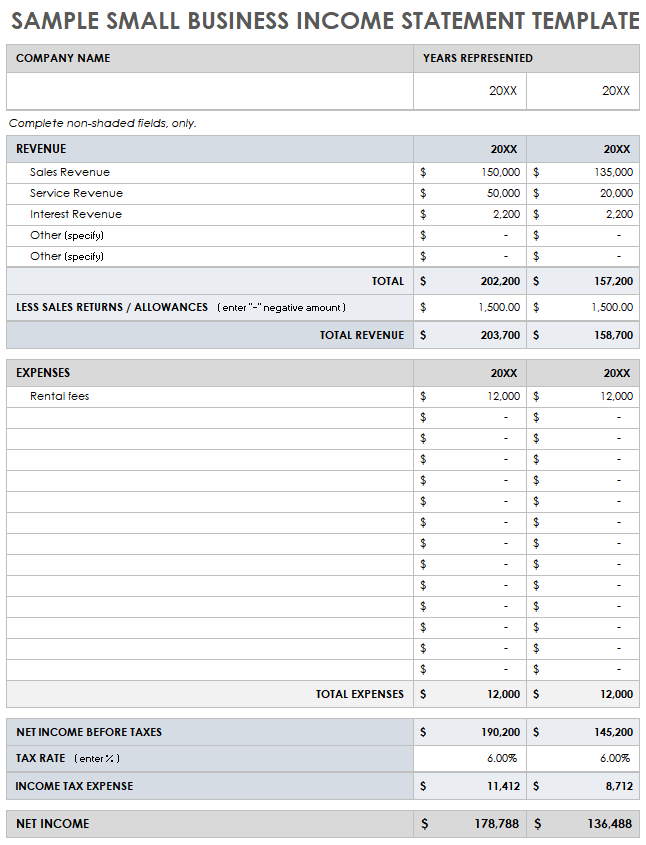

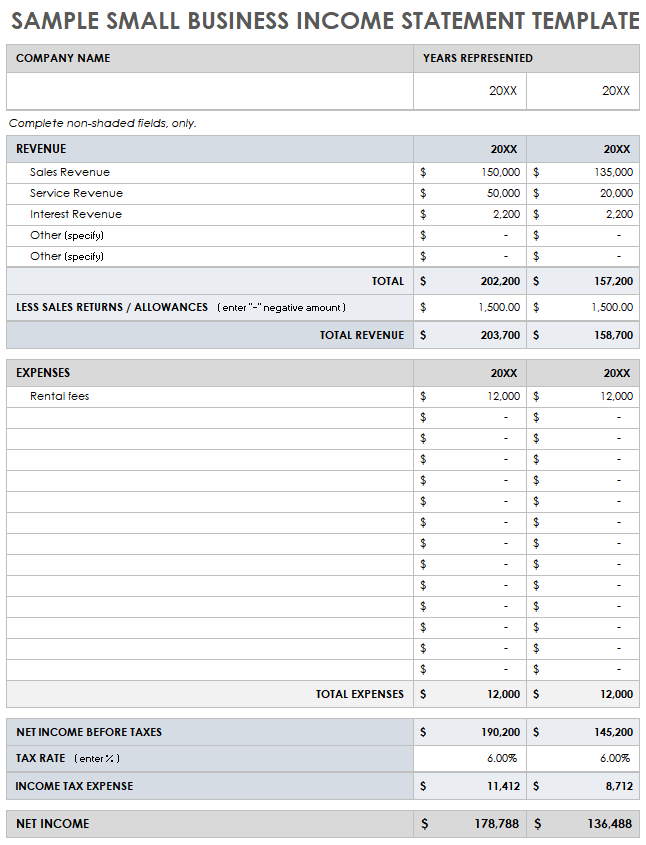

A well-structured projected earnings statement template relies on several key components working in concert. Understanding these components is crucial for developing accurate and insightful financial projections.

1. Revenue Projections: Forecasting future revenue based on market analysis, historical data, pricing strategies, and anticipated sales volume. This component forms the foundation of the projected earnings statement, influencing all subsequent calculations and projections.

2. Cost Estimations: Accurately estimating all potential costs, including direct costs (e.g., materials, labor), indirect costs (e.g., rent, marketing), and incorporating a contingency buffer for unforeseen expenses. Precise cost estimations are critical for determining profit margins and assessing financial viability.

3. Profit Calculations: Calculating various profit metrics, including gross profit, operating profit, and net profit, to provide a comprehensive view of projected profitability. These calculations offer insights into operational efficiency and overall financial performance.

4. Timeframe Definition: Establishing a specific timeframe for the projections, whether monthly, quarterly, annual, or multi-year. The timeframe dictates the scope of the projections and influences the level of detail and accuracy.

5. Key Assumptions: Explicitly stating the underlying assumptions about future market conditions, economic factors, and operational performance that influence the projections. Transparency regarding these assumptions enhances the credibility and interpretability of the statement.

6. Formatting Consistency: Maintaining consistent formatting throughout the statement, including consistent date formats, currency denominations, and the arrangement of line items. This consistency enhances clarity, facilitates comparison across periods, and improves usability.

These interconnected components provide a framework for developing a robust and informative projected earnings statement. Accurate revenue projections, combined with thorough cost estimations and clearly stated assumptions, form the basis for reliable profit calculations. A well-defined timeframe and consistent formatting enhance the usability and interpretability of the statement, facilitating informed decision-making and effective communication with stakeholders.

How to Create a Statement of Projected Earnings Template

Developing a robust statement of projected earnings requires a structured approach and careful consideration of key components. The following steps outline the process for creating a template that facilitates informed financial planning and decision-making.

1: Define the Timeframe: Establish the reporting period for the projections (e.g., monthly, quarterly, annual, multi-year). This timeframe provides the temporal boundaries for the financial forecast and influences the level of detail required.

2: Project Revenue: Forecast future revenue based on historical data, market analysis, pricing strategies, and anticipated sales volume. Consider market trends, seasonality, and potential growth opportunities. Employing various forecasting methods, such as trend analysis or regression analysis, can enhance accuracy.

3: Estimate Costs: Thoroughly estimate all potential expenses, categorizing them as direct costs (tied directly to production) and indirect costs (overhead expenses). Incorporate both fixed costs (constant regardless of production volume) and variable costs (fluctuating with production). Include a contingency buffer for unforeseen expenses.

4: Calculate Projected Profit: Determine projected profit by subtracting estimated costs from projected revenue. Calculate gross profit, operating profit, and net profit to provide a comprehensive view of profitability. Analyze profit margins to understand the relationship between revenue, costs, and profit.

5: Articulate Key Assumptions: Clearly document all underlying assumptions influencing the projections. These assumptions may relate to market conditions, economic factors, or internal operational performance. Transparency about these assumptions adds context and credibility to the projections.

6: Ensure Formatting Consistency: Maintain consistent formatting throughout the template. Utilize standard date formats, currency denominations, and a clear, logical arrangement of line items. Consistency enhances readability, facilitates comparison across periods, and improves usability.

7: Review and Refine: Regularly review and refine the projected earnings statement as new information becomes available or market conditions change. Adaptability is essential for maintaining the relevance and accuracy of the projections.

A well-constructed template provides a framework for anticipating financial performance, supporting informed resource allocation, and facilitating strategic decision-making. The process involves projecting revenue, estimating costs, calculating profit, defining the timeframe, articulating key assumptions, and ensuring formatting consistency. Regular review and refinement are essential for maintaining the accuracy and relevance of the projections in a dynamic business environment. This structured approach provides a robust foundation for financial planning, contributing to long-term stability and growth.

Accurate and well-structured financial forecasting is essential for informed decision-making and sustainable organizational growth. A robust template for projecting earnings provides a framework for anticipating financial performance by outlining projected revenue, expenses, and resultant profit over a defined period. Key components include detailed revenue projections, comprehensive cost estimations, accurate profit calculations, a clearly defined timeframe, explicitly stated assumptions, and consistent formatting. Each element contributes to the overall reliability and interpretability of the projections, enabling stakeholders to understand the basis for the financial forecast and its potential implications. Thorough analysis of these components, coupled with regular review and refinement, ensures the ongoing relevance and accuracy of the projected earnings, enabling organizations to proactively adapt to changing market dynamics and make informed decisions that drive financial success.

Effective utilization of a structured approach to financial forecasting empowers organizations to navigate the complexities of the business environment and make informed decisions that drive sustainable growth and long-term financial health. This proactive approach to financial planning enables organizations to anticipate potential challenges, identify opportunities, and allocate resources strategically. Mastering the development and interpretation of projected earnings empowers organizations to make data-driven decisions, enhancing financial stability and maximizing the potential for long-term success in a dynamic and competitive landscape. The ability to accurately project earnings is not merely a technical skill but a strategic imperative for organizations striving to thrive in today’s complex business world.