Having a physical or locally saved copy offers convenient access to financial data without requiring internet access. This can be particularly useful for record-keeping, budget management, tax preparation, loan applications, and other situations requiring proof of financial standing. Offline access ensures the availability of crucial financial information regardless of internet connectivity.

Further exploration of this topic will cover the process of accessing these documents, potential use cases, security considerations, and alternative methods of accessing account information.

1. Accessibility

Accessibility, in the context of financial documentation, refers to the ease with which individuals can obtain and utilize required information. Regarding printable bank statement templates, accessibility encompasses several crucial facets that impact their practical utility.

- Retrieval MethodsMultiple retrieval methods enhance accessibility. Online banking portals typically offer direct download options. Alternatively, contacting customer support or visiting a physical branch may be necessary. The availability of diverse retrieval methods caters to varying user preferences and technological capabilities. For instance, individuals with limited internet access might rely on in-person retrieval.

- Format CompatibilityCompatibility with various devices and software is crucial. Common file formats, such as PDF, ensure accessibility across different operating systems and software applications. Compatibility issues can arise with proprietary software or outdated systems, potentially hindering access to the information. Consider, for example, the challenges posed by a document format readable only by specific software not available to the user.

- User Interface DesignClear and intuitive design simplifies navigation and information extraction. Well-structured layouts, legible fonts, and logical organization improve readability and comprehension, particularly for visually impaired individuals or those using assistive technologies. A cluttered or poorly designed layout can impede access to essential information.

- Alternative FormatsProviding alternative formats, such as large print or braille, caters to users with specific accessibility needs. These options ensure inclusivity and equal access to financial information, regardless of individual limitations. The availability of alternative formats demonstrates a commitment to accessibility for all users. For example, offering braille statements ensures access for visually impaired individuals.

These facets of accessibility collectively contribute to the usability and effectiveness of printable bank statement templates. Ensuring accessibility empowers individuals to manage their financial information effectively, regardless of their technological proficiency or specific accessibility requirements. A readily accessible statement facilitates informed financial decision-making and promotes financial well-being.

2. Format

Format significantly influences the utility and readability of a printable bank statement template. A well-designed format ensures clear presentation of crucial financial information, facilitating efficient review and analysis. Several key elements contribute to an effective format. Consistent organization, with sections for account details, transaction history, and summary information, promotes quick comprehension. Clear labeling of data points, such as transaction dates, descriptions, and amounts, minimizes ambiguity. Logical date ordering, typically chronological, facilitates tracking financial activity. A standardized format across statements simplifies comparison and trend analysis over time. For instance, a consistent placement of the account balance on each statement allows for rapid assessment of financial standing. Conversely, an inconsistent or poorly organized format can impede comprehension and hinder effective financial management. Consider the difficulty of reconciling transactions in a statement lacking clear date ordering or consistent descriptions.

The choice of file format also impacts accessibility and usability. PDFs, due to their widespread compatibility and ability to preserve formatting across different devices and operating systems, represent a common and practical choice. Other formats, such as CSV or Excel-compatible files, offer advantages for data analysis and manipulation but may require specific software. Selecting an appropriate file format ensures compatibility with the user’s systems and intended use. Using a proprietary format requiring specialized software limits accessibility for individuals lacking access to such software. Conversely, providing the template in multiple formats enhances user flexibility and caters to diverse needs.

In summary, a well-defined and consistent format is essential for maximizing the value of a printable bank statement template. A logical structure, clear labeling, consistent date ordering, and an appropriate file format contribute to a clear, accessible, and user-friendly document. This facilitates informed financial decision-making and effective financial management. Challenges arise when formatting is inconsistent or inaccessible, potentially hindering accurate interpretation and analysis. Therefore, careful consideration of format is crucial for optimizing the utility of these financial documents.

3. Security

Security represents a paramount concern regarding printable bank statement templates. These documents contain sensitive financial information, making safeguarding against unauthorized access and fraudulent use critical. Several security measures contribute to mitigating potential risks. Strong passwords for online banking accounts form the first line of defense, preventing unauthorized access to account information and downloadable statements. Multi-factor authentication adds another layer of protection, requiring additional verification beyond passwords. Secure printing practices, such as using trusted printers and avoiding public printing locations, minimize the risk of intercepted documents. Proper disposal of printed statements, preferably through shredding, prevents information theft from discarded documents. For example, failing to secure online banking access with a strong password could allow unauthorized individuals to download and exploit financial data. Similarly, printing sensitive documents on a shared printer without appropriate safeguards risks exposing information to unintended parties.

Recognizing potential security threats is crucial. Phishing attempts, where fraudulent emails or websites mimic legitimate institutions to steal credentials, pose a significant threat. Malware infections on devices used to access or print statements can compromise data security. Social engineering tactics, where individuals are manipulated into revealing sensitive information, represent another potential vulnerability. Educating users about these threats and promoting safe online practices enhances security awareness and mitigates risks. For instance, understanding how to identify phishing emails and avoid clicking on suspicious links reduces the likelihood of compromised accounts. Regularly updating antivirus software and practicing caution when sharing personal information online further strengthens security.

Maintaining security requires continuous vigilance and proactive measures. Regularly reviewing account activity for unauthorized transactions allows for prompt detection of potential breaches. Staying informed about evolving security threats and best practices empowers individuals to adapt their security measures accordingly. Understanding the potential consequences of compromised financial data underscores the importance of robust security practices. For example, identity theft resulting from compromised bank statements can have severe financial and personal repercussions. Therefore, a comprehensive approach to security, encompassing online safety, secure printing practices, and ongoing vigilance, is essential for protecting sensitive financial information contained within printable bank statement templates.

4. Purpose

The purpose behind obtaining a printable bank statement template dictates its usage and influences related considerations. Various needs necessitate acquiring such documentation. Providing proof of income for loan applications, rental agreements, or visa applications represents a common use case. These situations require verifiable documentation of financial stability. Tracking expenses for budgeting or tax purposes constitutes another significant purpose. Printable statements offer a tangible record for analysis and categorization of financial activity. Resolving discrepancies or investigating potentially fraudulent transactions may necessitate detailed account information provided by a printed statement. For example, when applying for a mortgage, a lender typically requires several months of bank statements to verify income consistency. Similarly, during tax season, individuals might utilize printed statements to substantiate claimed deductions. When investigating unauthorized transactions, a printed statement serves as a crucial reference point for identifying and rectifying discrepancies.

The intended purpose also influences the specific information required and the duration covered by the statement. Loan applications often necessitate statements covering several months to demonstrate financial history. Budgeting purposes might require statements covering shorter periods for more granular expense tracking. Legal or investigative purposes may necessitate statements encompassing specific dates or transaction types. Understanding the required information beforehand streamlines the retrieval process and ensures the obtained document serves its intended function. Requesting a statement covering an insufficient period for a loan application could delay the approval process. Conversely, requesting an excessively long statement for budgeting purposes can create unnecessary complexity. Therefore, aligning the requested statement with its intended purpose optimizes its utility and avoids potential complications.

In summary, the purpose behind accessing a printable bank statement template serves as a crucial determinant of its effective utilization. Whether for proof of income, expense tracking, or dispute resolution, clarity of purpose informs the required information, duration, and subsequent analysis of the statement. Failing to consider the intended purpose can lead to inefficiencies and complications. Understanding this connection empowers individuals to obtain and utilize financial documentation effectively, facilitating informed financial decision-making and efficient management of personal finances. This underscores the importance of defining the purpose before accessing such documents.

5. Accuracy

Accuracy in financial documentation is paramount, especially concerning printable bank statement templates. These documents serve as official records of financial activity, and any inaccuracies can have significant consequences. Ensuring accuracy involves meticulous attention to detail and a thorough understanding of the information presented. Inaccurate information can lead to misinformed financial decisions, disputes with financial institutions, and complications with loan applications or legal proceedings. Therefore, verifying the accuracy of every detail within a printable bank statement template is crucial for responsible financial management.

- Transaction DetailsAccurate transaction details form the foundation of a reliable bank statement. This includes the correct dates, amounts, and descriptions for each transaction. Errors in these details can lead to discrepancies in account balances and difficulties in tracking expenses. For example, an incorrectly recorded transaction date could misrepresent spending patterns, affecting budget analysis. Similarly, an inaccurate transaction amount can lead to an incorrect account balance, potentially resulting in overdraft fees or missed payments.

- Account InformationAccurate account information is essential for proper identification and verification. This includes the correct account number, account holder name, and associated bank details. Errors in account information can lead to processing delays, rejected transactions, and potential security risks. For example, an incorrect account number on a statement used for a direct deposit could result in the funds being deposited into the wrong account. Similarly, discrepancies in the account holder’s name could raise concerns about identity verification and potentially delay important financial processes.

- Balance ReconciliationRegular reconciliation of the statement balance with personal records is crucial for detecting inaccuracies. Comparing the statement against check registers, receipts, and other financial records helps identify discrepancies and potential errors. Neglecting reconciliation can allow inaccuracies to persist, potentially leading to financial losses or misinformed financial decisions. For instance, failing to reconcile a statement could result in overlooking an unauthorized transaction or an incorrect bank charge, potentially leading to financial loss.

- Official VerificationWhen accuracy is critical, verifying the statement’s authenticity with the issuing financial institution provides an added layer of assurance. This is particularly important for legally sensitive matters or situations with significant financial implications. Verification can involve contacting customer support or utilizing online banking tools to confirm the statement’s validity. Relying on an unverified statement for critical financial decisions can lead to complications if discrepancies or inaccuracies emerge later. For example, submitting an unverified statement for a legal proceeding could raise questions about its authenticity and potentially undermine its evidentiary value.

These facets of accuracy collectively underscore the importance of meticulous review and verification of printable bank statement templates. Accurate financial records are fundamental for responsible financial management, informed decision-making, and successful navigation of various financial processes. Neglecting accuracy can have significant ramifications, highlighting the need for diligence and attention to detail when dealing with these crucial financial documents. Therefore, prioritizing accuracy ensures the reliability and trustworthiness of these records, ultimately contributing to sound financial practices and informed financial decisions.

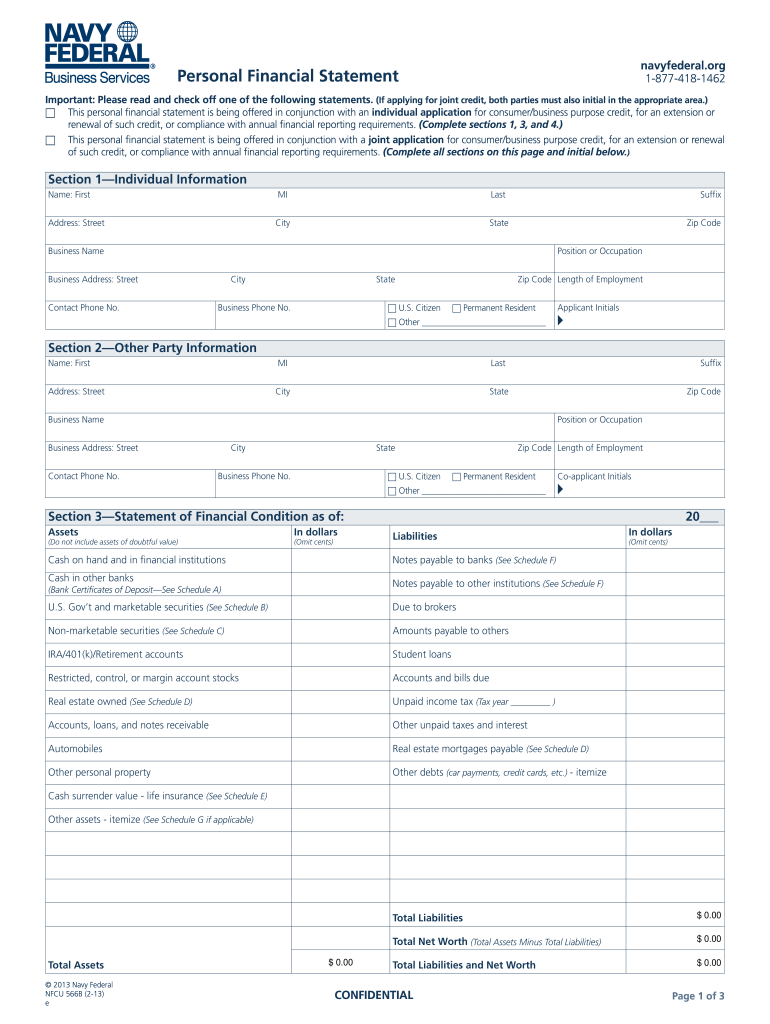

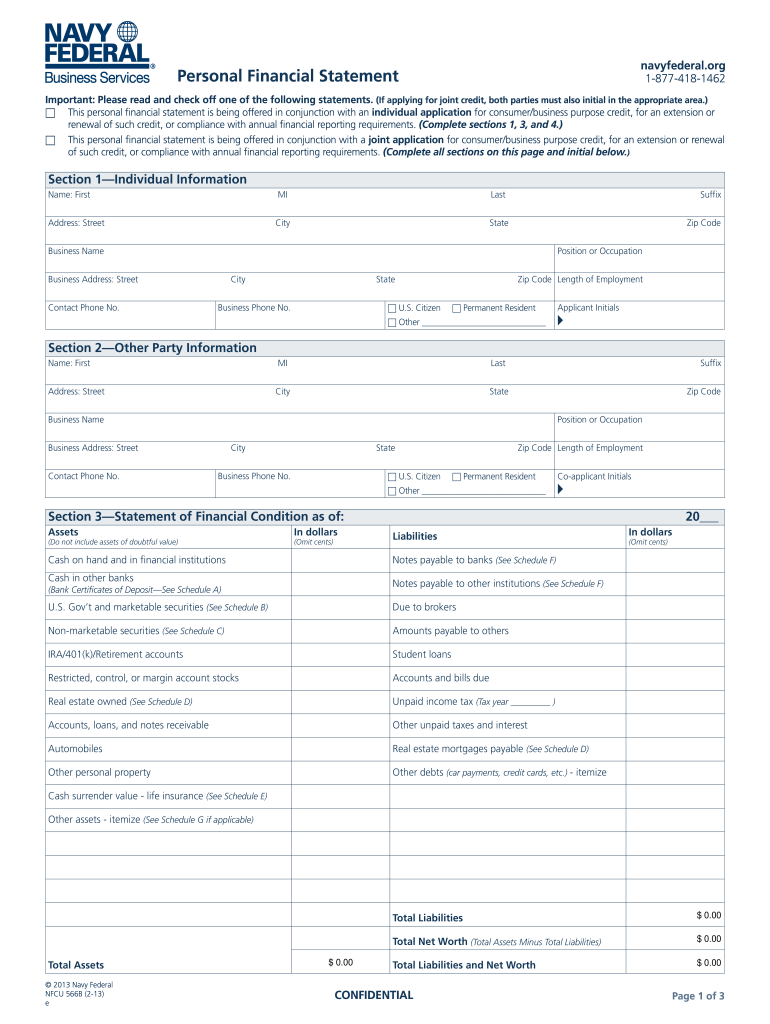

Key Components of a Printable Bank Statement Template

Understanding the core components of a printable bank statement template is crucial for effective interpretation and utilization. The following elements constitute the essential information typically found within such documents.

1. Account Information: This section identifies the specific account, including the account number, account holder name(s), and the financial institution’s name and address. Accurate account information is essential for proper identification and verification.

2. Statement Period: The statement period specifies the date range covered by the document, indicating the timeframe for the included transactions. This defined period allows for focused review of financial activity within a specific timeframe.

3. Transaction History: This section provides a detailed chronological record of all transactions during the statement period. Each transaction entry typically includes the date, description, amount, and running balance. Clear and accurate transaction details are crucial for tracking financial activity and reconciling balances.

4. Beginning and Ending Balances: The statement displays the account balance at the beginning and end of the specified period. These figures provide a clear overview of the net change in account funds during the statement period, facilitating balance reconciliation and financial planning.

5. Summary Information: This section may include summarized information such as total deposits, total withdrawals, and any applicable fees or interest earned during the statement period. Summarized data provides a concise overview of key financial activity within the specified period.

6. Contact Information: Contact information for the financial institution is typically provided for inquiries or assistance regarding the statement. Accessible contact information enables users to address any questions or concerns related to the statement content or account activity.

These components collectively provide a comprehensive overview of account activity during a specified period. Accurate interpretation and utilization of this information are essential for effective financial management and informed decision-making.

How to Create a Printable Bank Statement Template

Creating a printable bank statement template requires careful consideration of formatting, data accuracy, and security implications. While replicating an official bank statement’s precise design and security features is not feasible due to proprietary formatting and security measures, a functional template for personal use can be developed following these steps. This approach focuses on creating a document for personal financial management, not a replacement for official bank-issued statements.

1: Define the Purpose: Clarifying the intended use of the template, such as budgeting, expense tracking, or record-keeping, informs the necessary information and level of detail. A template for budgeting, for instance, may require different categories than one for tracking business expenses.

2: Choose a Software: Spreadsheet software (e.g., Excel, Google Sheets, or similar applications) or word processing software with table functionality offers the necessary structure and flexibility for creating a template. Spreadsheet software generally provides better functionality for calculations and data manipulation.

3: Structure the Template: Essential components include: account information (account number, account holder name), statement period, transaction details (date, description, amount), and beginning and ending balances. Additional fields, such as transaction categories or notes, can be added based on the intended purpose. A clear and organized layout facilitates data entry and review.

4: Input Data: Data entry requires meticulous attention to accuracy. Validating information against official bank statements or transaction records minimizes errors. Automated calculations within spreadsheet software can further enhance accuracy and efficiency in tracking balances and other financial metrics.

5: Format for Clarity: Clear formatting enhances readability and comprehension. Elements such as consistent font styles, clear column headings, and logical date ordering improve the template’s usability. Visual cues, such as bolding balances or color-coding transactions, can further aid in data interpretation.

6: Security Considerations: Storing templates containing financial data requires appropriate security measures. Password-protecting files and utilizing secure storage locations safeguards sensitive information. Regularly backing up data prevents loss due to technical issues.

7: Regular Updates: Regularly updating the template with recent transactions ensures accuracy and provides a current view of financial activity. Setting reminders or establishing a consistent update schedule maintains the template’s relevance for financial management.

8: Periodic Review: Regularly reviewing the template’s effectiveness identifies potential improvements or adjustments. Evaluating whether the template continues to meet its intended purpose and adjusting the structure or content as needed maximizes its utility for ongoing financial management.

Developing a functional template provides a valuable tool for personal financial management. While such templates do not replicate the security features of official bank statements, careful attention to accuracy, security, and consistent updates enables effective tracking and analysis of financial data for informed decision-making. Remember, this template is for personal use and should not be used for official purposes requiring validated bank documentation.

Access to financial data plays a crucial role in informed financial management. Printable documents mirroring official records provide a convenient means of accessing this information offline, facilitating various financial activities, from budgeting and expense tracking to loan applications and legal proceedings. Understanding the key aspects of these documents, including format considerations, security precautions, and the importance of accuracy, ensures effective utilization and mitigates potential risks. Careful consideration of these factors empowers individuals to leverage financial information effectively for informed decision-making and responsible financial practices.

Effective financial management requires diligent organization and readily available access to accurate financial records. Leveraging tools that provide convenient access to this information, coupled with a thorough understanding of security best practices and data integrity, empowers individuals to navigate financial matters with confidence and make informed decisions that contribute to long-term financial well-being. The importance of accurate and accessible financial information remains paramount in today’s dynamic financial landscape.