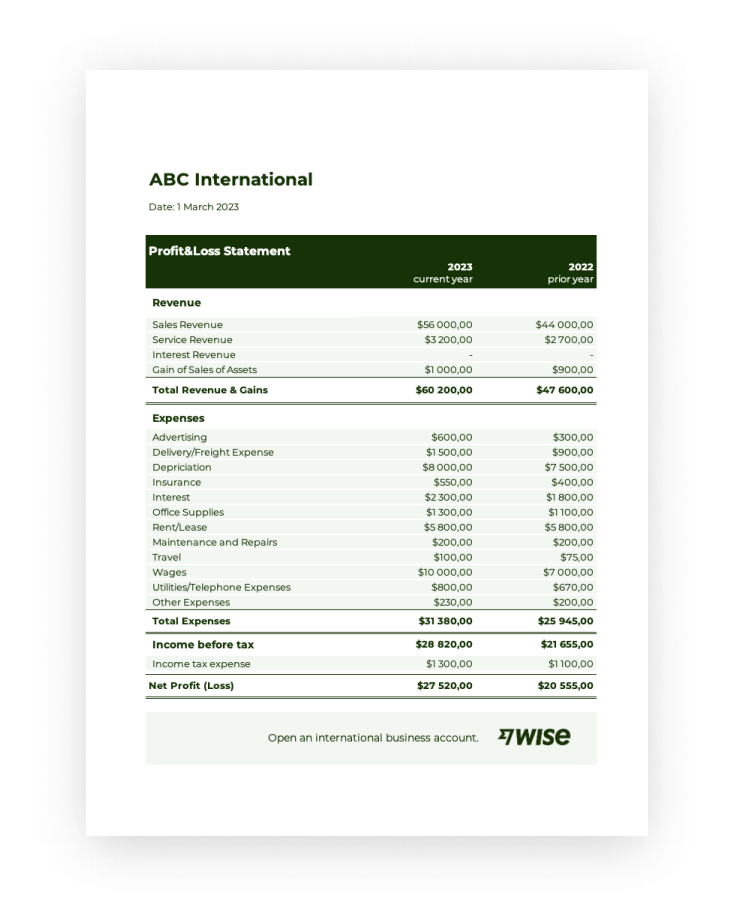

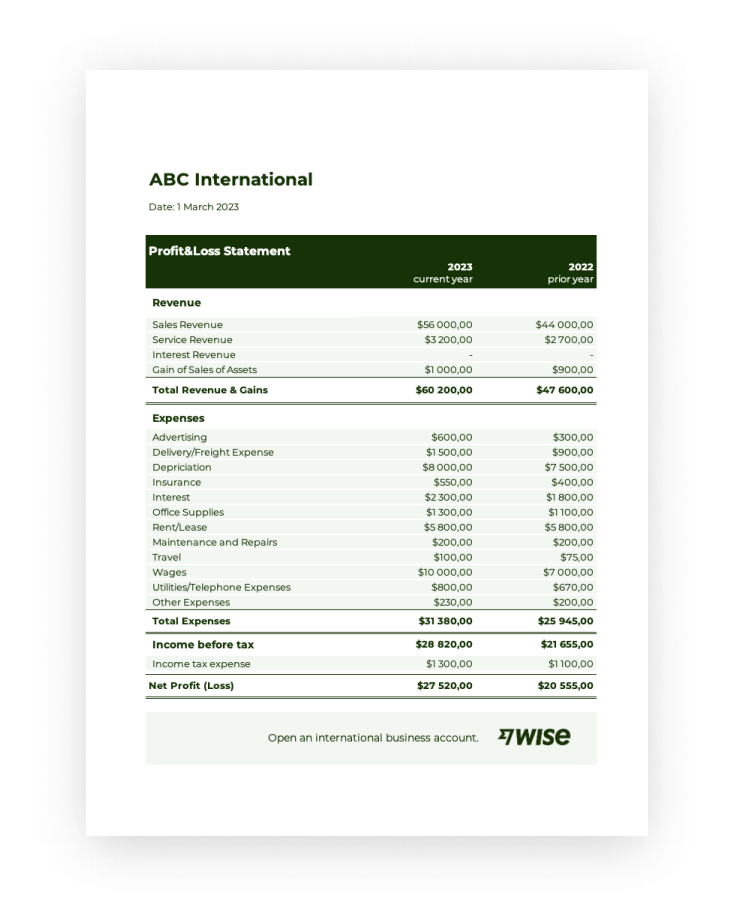

Utilizing a structured financial report designed for major banking corporations offers several advantages. It facilitates a standardized approach to financial analysis, enabling comparisons across different periods and against industry benchmarks. This structure also promotes transparency and clarity, making it easier for stakeholders, including investors and regulators, to understand the institution’s financial health. Furthermore, a pre-designed format streamlines the reporting process, saving time and resources.

This discussion will further explore the key components typically found within such a structured report, including interest income, non-interest income, provision for loan losses, and operating expenses. Understanding these elements is crucial for analyzing the profitability and overall financial stability of large banking entities.

1. Revenues

Revenue streams constitute a critical component of any financial institution’s profit and loss statement, providing insights into its core business activities and overall financial health. Examining revenue sources within a structured report, such as one tailored for a major bank, offers a granular understanding of performance drivers.

- Net Interest IncomeThis represents the difference between interest earned on assets (loans, investments) and interest paid on liabilities (deposits). Fluctuations in net interest income can reflect changes in interest rates, loan demand, and the bank’s overall lending strategy. Analyzing this metric within a standardized template allows for comparison against previous periods and competitors.

- Non-Interest IncomeThis encompasses diverse sources such as service charges, investment banking fees, trading revenue, and asset management fees. Diversification in non-interest income can indicate a broader business model and potentially mitigate reliance on interest rate-sensitive activities. Its contribution to overall revenue is readily apparent within a structured financial statement.

- Trading RevenueDerived from market-making and proprietary trading activities, this revenue source can be volatile. A detailed profit and loss statement clearly separates trading revenue from other income streams, allowing for a more precise assessment of risk and return. Analyzing its trends within a standardized report offers insights into the bank’s trading strategies and risk appetite.

- Investment Banking FeesThese fees are generated by providing advisory services for mergers and acquisitions, underwriting securities offerings, and other corporate finance activities. This revenue stream’s performance often reflects broader economic conditions and capital market activity. A structured report allows for tracking these fees separately, offering insights into the bank’s success in this competitive segment.

By carefully analyzing these distinct revenue components within a structured profit and loss statement, stakeholders gain a more comprehensive understanding of the financial institution’s core business activities, diversification efforts, and overall profitability. These insights, when viewed within a standardized framework like a Bank of America-specific template, facilitate benchmarking and informed decision-making.

2. Expenses

A comprehensive understanding of a financial institution’s expense structure is crucial for evaluating its profitability and operational efficiency. Within a profit and loss statement tailored for a major bank, such as Bank of America, expenses are categorized and analyzed to provide detailed insights into cost drivers and their impact on overall performance.

- Salaries and Employee BenefitsThis category represents the cost of compensating employees, including base salaries, bonuses, and benefits. For a large financial institution, this typically constitutes a significant portion of total operating expenses. Analyzing trends in this area, within a standardized template, can reveal insights into workforce size, compensation strategies, and the institution’s ability to manage labor costs effectively.

- Occupancy and Equipment ExpensesThese expenses relate to the costs associated with maintaining physical branches, offices, and equipment. Trends in this category can reflect the bank’s branch network strategy, investments in technology, and overall efficiency in managing physical resources. A structured report facilitates comparisons over time and against industry benchmarks.

- Marketing and Advertising ExpensesThis category encompasses costs related to promoting the bank’s products and services. Analyzing these expenses can provide insights into the institution’s marketing strategies, customer acquisition costs, and brand-building efforts. Tracking these expenses within a standardized framework allows for assessing the effectiveness of marketing campaigns and their impact on revenue generation.

- Provision for Loan LossesThis represents an expense set aside to cover potential losses from non-performing loans. The provision reflects the bank’s assessment of credit risk within its loan portfolio and can fluctuate based on economic conditions and underwriting practices. A structured report allows analysts to monitor changes in the provision and assess the institution’s risk management practices. This provision is crucial for understanding future potential losses and the overall health of the loan portfolio.

Careful examination of these expense categories within a structured profit and loss statement provides critical insights into a financial institution’s operational efficiency, cost management strategies, and overall financial health. Utilizing a standardized format, such as one tailored for a major banking corporation, allows for detailed comparisons across different periods and against industry peers, facilitating a comprehensive assessment of performance and risk.

3. Profitability

Profitability serves as a central measure of a financial institution’s success and sustainability. A profit and loss statement, particularly one tailored for a complex entity like Bank of America, provides the foundational data for assessing profitability. This structured report allows for the calculation and analysis of key profitability metrics, such as net income, return on assets (ROA), and return on equity (ROE). These metrics offer insights into the institution’s ability to generate profits from its core operations, manage expenses effectively, and provide returns for shareholders. For instance, a declining ROA might indicate challenges in asset utilization or increasing competitive pressures. Examining the components contributing to net income within the statement reveals the underlying drivers of profitability trends.

Understanding profitability requires more than just looking at the bottom line. A detailed analysis of the revenue and expense components within the profit and loss statement is essential. For example, analyzing the net interest marginthe difference between interest earned and interest paidprovides insights into the profitability of core lending activities. Similarly, examining the efficiency ratio, which measures non-interest expenses as a percentage of revenue, reveals how effectively the institution manages its operating costs. These insights, derived from a structured profit and loss statement, enable stakeholders to assess the quality of earnings and the long-term sustainability of profits. Furthermore, comparing these metrics to industry averages and historical trends offers valuable benchmarking data.

Ultimately, the insights gleaned from a detailed profitability analysis, facilitated by a structured report, are crucial for informed decision-making. Investors use profitability metrics to evaluate investment opportunities, management uses them to guide strategic planning, and regulators use them to assess financial stability. Identifying trends and potential challenges in profitability allows for proactive adjustments to business strategies and risk management practices. The ability to dissect the components of profitability within a standardized framework, such as a Bank of America profit and loss statement template, empowers stakeholders to understand not only the “what” of profitability, but also the “why,” leading to more robust and effective decision-making.

4. Time Period

The specified time period covered by a financial statement is crucial for interpreting the data within a “bank of america profit and loss statement template.” Financial performance is dynamic, influenced by economic cycles, market conditions, and internal strategic decisions. Analyzing results within defined timeframesquarterly, annually, or year-to-dateprovides context and facilitates meaningful comparisons, revealing trends and potential turning points. Selecting an appropriate reporting period is essential for understanding performance fluctuations and making informed decisions.

- Quarterly ReportingQuarterly reports offer a granular view of performance, allowing for timely identification of emerging trends and prompt responses to changing market conditions. Analyzing quarterly data within a standardized template reveals seasonal patterns, the impact of short-term economic fluctuations, and the effectiveness of recent strategic initiatives. This frequency allows for more agile management and quicker adjustments to operational strategies.

- Annual ReportingAnnual reports provide a comprehensive overview of a full year’s financial activity, smoothing out short-term volatility and offering a broader perspective on long-term performance trends. Analyzing annual data within a structured template facilitates comparisons across multiple years, revealing sustained growth patterns, the impact of long-term strategic decisions, and overall financial stability. This longer timeframe provides a more stable basis for evaluating overall performance and long-term trends.

- Year-to-Date ReportingYear-to-date reporting offers a cumulative perspective on performance from the beginning of the fiscal year to a specific point in time. This allows stakeholders to track progress towards annual goals, assess the impact of year-long initiatives, and identify potential challenges or opportunities early on. Analyzing year-to-date figures within a template helps monitor performance against projections and make necessary adjustments throughout the fiscal year.

- Comparative AnalysisRegardless of the specific time period chosen, comparative analysis across multiple periods is essential. Analyzing data from consecutive quarters, comparing current year performance to previous years, or tracking year-to-date progress against prior year performance provides critical insights into growth trends, the effectiveness of strategic initiatives, and the impact of external factors. A standardized template facilitates this comparative analysis, allowing stakeholders to identify patterns, assess performance, and make informed decisions based on historical context.

Understanding the nuances of different reporting periods and their implications is crucial for effectively utilizing a “bank of america profit and loss statement template.” Selecting and analyzing data within appropriate timeframes enables stakeholders to gain a comprehensive understanding of performance trends, identify potential risks and opportunities, and make informed decisions aligned with both short-term and long-term objectives. This contextual awareness derived from time period analysis enhances the value and insights gained from the standardized template.

5. Standardized Format

A standardized format is essential for a “Bank of America profit and loss statement template.” Standardization ensures consistency, comparability, and transparency, facilitating informed decision-making by various stakeholders. A standardized structure dictates the presentation of key financial data pointsrevenues, expenses, and net incomein a predictable and easily understood manner. This consistency allows for accurate comparisons of performance across different reporting periods, facilitating trend analysis and identification of potential issues. Furthermore, standardization enables benchmarking against competitors and industry averages, providing a valuable external perspective on performance. For example, comparing Bank of America’s efficiency ratio, calculated using a standardized format, against the industry average reveals insights into its operational efficiency relative to its peers. Without a standardized format, such comparisons would be difficult and potentially misleading.

A standardized template also simplifies regulatory reporting and compliance. Regulatory bodies often require financial institutions to submit financial statements in specific formats. Adhering to these requirements ensures compliance and avoids potential penalties. Moreover, a standardized format streamlines internal reporting and analysis, enabling efficient communication of financial information across different departments and levels of management. Imagine analyzing a profit and loss statement where revenue categories are inconsistently presented each quarter. This lack of standardization would impede meaningful analysis and hinder effective decision-making. The standardized format of a template mitigates this risk, promoting clarity and facilitating informed action.

In conclusion, the standardized format of a “Bank of America profit and loss statement template” is not merely a matter of presentation; it is fundamental to the template’s utility. Standardization ensures data comparability, simplifies regulatory compliance, and enhances transparency, enabling stakeholders to glean meaningful insights from the information presented. This structured approach to financial reporting ultimately facilitates more effective decision-making, contributing to both the institution’s and the broader financial system’s stability and efficiency. The absence of standardization would introduce ambiguity and complexity, potentially obscuring critical performance trends and hindering informed decision-making by investors, management, and regulators.

Key Components of a Bank of America Profit and Loss Statement Template

Understanding the key components within a structured profit and loss statement, specifically one tailored for a major financial institution like Bank of America, is crucial for comprehensive financial analysis. These components provide a framework for assessing performance, identifying trends, and making informed decisions.

1. Net Interest Income: This crucial metric represents the difference between interest earned on assets (loans, investments) and interest paid on liabilities (deposits). Changes in net interest income often reflect shifts in interest rate environments, loan demand, and the bank’s overall lending strategy.

2. Non-Interest Income: This category encompasses diverse revenue streams beyond traditional lending activities. These include service charges, investment banking fees, trading revenue, and asset management fees. A robust non-interest income segment can diversify revenue sources and mitigate reliance on interest rate fluctuations.

3. Provision for Loan Losses: This expense reflects the bank’s assessment of potential losses from non-performing loans. The provision serves as a critical indicator of credit risk within the loan portfolio and is influenced by economic conditions and underwriting practices.

4. Operating Expenses: These expenses encompass the costs associated with running the bank’s day-to-day operations. Key categories include salaries and employee benefits, occupancy and equipment expenses, and marketing and advertising costs. Effective management of operating expenses is crucial for overall profitability.

5. Pre-Tax Income: This represents the bank’s earnings before accounting for income tax expenses. It is calculated by subtracting total operating expenses and the provision for loan losses from total revenues (both net interest income and non-interest income).

6. Income Tax Expense: This reflects the expense associated with federal, state, and local income taxes. The effective tax rate can provide insights into the bank’s tax planning strategies and overall profitability.

7. Net Income: This is the bottom linethe bank’s profit after all expenses and taxes have been deducted. Net income serves as a key indicator of overall financial performance and is closely monitored by investors and analysts. Analyzing the various components contributing to net income provides a comprehensive understanding of the bank’s profitability drivers.

Analyzing these key components within a structured template offers a comprehensive view of a financial institution’s performance and risk profile. This detailed analysis facilitates informed decision-making by investors, management, and regulators, contributing to a deeper understanding of the institution’s financial health and long-term sustainability.

How to Create a Bank of America Profit and Loss Statement Template

Creating a tailored profit and loss statement template requires a structured approach, incorporating key elements specific to Bank of America’s operations and financial reporting practices. The following steps outline the process of developing such a template.

1: Define the Reporting Period: Specify the timeframe for the statement, whether quarterly, annual, or year-to-date. This ensures consistency and allows for meaningful comparisons across different periods.

2: Structure Revenue Categories: Establish clear categories for reporting revenue streams. These should include net interest income, derived from lending activities, and non-interest income, encompassing sources like service charges, investment banking fees, and trading revenue.

3: Detail Expense Categories: Categorize operating expenses to provide a granular view of cost drivers. Include categories such as salaries and employee benefits, occupancy and equipment expenses, marketing and advertising costs, and the provision for loan losses, reflecting anticipated losses from non-performing loans.

4: Calculate Pre-Tax Income: Subtract total operating expenses and the provision for loan losses from total revenues (both net interest income and non-interest income) to arrive at pre-tax income.

5: Incorporate Income Tax Expense: Account for the expense associated with federal, state, and local income taxes, reflecting the bank’s effective tax rate.

6: Determine Net Income: Subtract the income tax expense from the pre-tax income to determine net income, representing the bank’s bottom-line profit after all expenses and taxes.

7: Incorporate Comparative Data: Include columns for previous periods or year-to-date figures to facilitate trend analysis and performance evaluation. This comparative data allows stakeholders to identify patterns and assess performance relative to prior periods.

8: Ensure Compliance with Regulatory Requirements: Adhere to any specific reporting requirements mandated by regulatory bodies. This ensures compliance and avoids potential penalties while also facilitating comparisons with other institutions.

Developing a robust template requires careful consideration of Bank of America’s specific business activities and reporting requirements. A well-structured template provides a clear and consistent framework for analyzing performance, facilitating informed decision-making by various stakeholders.

A structured profit and loss statement, tailored for a complex institution like Bank of America, provides essential insights into financial performance. Analyzing key components such as net interest income, non-interest income, operating expenses, and the provision for loan losses offers a comprehensive view of profitability, risk management, and operational efficiency. Standardization within the template ensures comparability across reporting periods and facilitates benchmarking against industry peers, empowering stakeholders to make informed decisions based on reliable and consistent data. Understanding the structure and key elements within this type of financial statement is crucial for assessing the institution’s overall financial health and long-term sustainability.

Careful analysis of these statements, utilizing comparative data and industry benchmarks, is critical for effective evaluation. This analysis allows for identification of emerging trends, potential challenges, and opportunities for improvement. As the financial landscape continues to evolve, leveraging the insights provided by these standardized reports remains essential for navigating complexities, mitigating risks, and ensuring long-term financial success. The ability to interpret and utilize this information effectively will be increasingly important for all stakeholders in the financial industry.