Utilizing a pre-designed format for these crucial reports offers several advantages. It streamlines the reporting process, reduces the risk of errors, and ensures consistency in data presentation. This consistency is essential for internal trend analysis and benchmarking against competitors. Furthermore, a standardized format simplifies audits and facilitates communication with stakeholders, providing them with a clear and concise overview of the organization’s financial position.

This structured approach to financial reporting forms the foundation for informed decision-making, enabling management, investors, and other stakeholders to assess performance, identify areas for improvement, and plan for the future. The following sections will delve deeper into the specific components and practical applications of this crucial financial tool.

1. Standardized Format

A standardized format is fundamental to the efficacy of a fiscal year-end financial statement template. It ensures consistency, comparability, and transparency, enabling stakeholders to readily interpret and analyze financial data. This structure facilitates informed decision-making and promotes trust in the reported information.

- Uniform Presentation:Uniformity in presenting financial data across reporting periods is essential for tracking trends and identifying anomalies. Consistent line items, classifications, and terminology allow for straightforward comparison and analysis, eliminating ambiguity and enhancing clarity. For instance, consistently classifying long-term debt under liabilities ensures accurate representation of the company’s financial obligations across multiple years.

- Regulatory Compliance:Adhering to generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS) is mandatory for most organizations. A standardized format ensures compliance with these regulations, minimizing the risk of penalties and enhancing credibility with regulatory bodies and investors. Consistent application of depreciation methods, for example, ensures adherence to reporting standards.

- Simplified Audits:A standardized structure simplifies the audit process. Auditors can readily trace and verify information, reducing audit time and costs. A clear and consistent presentation of financial data allows auditors to efficiently assess the accuracy and reliability of the information presented. Consistent account reconciliation procedures, for instance, facilitate the audit trail.

- Enhanced Comparability:Standardized formats enable benchmarking against industry peers and competitors. This comparison allows for a more comprehensive understanding of an organization’s financial performance relative to its industry. Consistent reporting of key performance indicators (KPIs) like profitability margins facilitates accurate benchmarking.

Through these facets, a standardized format becomes integral to the value of a fiscal year-end financial statement template. It establishes a reliable framework for financial reporting, supporting accurate analysis, informed decision-making, and robust stakeholder communication. This consistent structure strengthens the overall integrity and reliability of the financial reporting process.

2. Key Financial Data

A fiscal year-end financial statement template serves as a structured repository for key financial data, capturing the essence of an organization’s financial performance and position at the culmination of its accounting period. This data, meticulously compiled and categorized, forms the basis for evaluating profitability, solvency, and overall financial health. The relationship between the template and the data is symbiotic; the template provides the framework, while the data gives it substance. Without accurate and complete data, the template remains an empty shell, devoid of analytical value.

Specific data points within the template hold significant weight. The balance sheet, for instance, relies on data pertaining to assets, liabilities, and equity. Accurate representation of these elements is crucial for assessing an organization’s financial stability. An overstatement of assets or an understatement of liabilities can lead to a distorted view of financial health. Similarly, the income statement depends on accurate revenue and expense data. Misrepresentation of sales figures or omission of operating costs can misrepresent profitability. Consider a scenario where cost of goods sold (COGS) is understated. This will artificially inflate gross profit margins, leading to potentially flawed business decisions based on inaccurate profitability metrics.

Understanding the interplay between key financial data and the year-end statement template is paramount for effective financial analysis. Data accuracy is essential. Even minor discrepancies can have cascading effects, leading to misinterpretations and potentially detrimental decisions. Furthermore, data completeness is crucial. Omitting relevant data points, such as contingent liabilities or off-balance sheet financing, can create an incomplete and misleading picture of financial reality. Robust internal controls and rigorous data validation processes are critical for ensuring data integrity and maximizing the analytical value derived from the fiscal year-end financial statement template. This meticulous approach to data management underpins informed decision-making and fosters stakeholder trust.

3. Year-end Reporting

Year-end reporting represents a critical juncture in the financial lifecycle of any organization. It is the culmination of a year’s financial activity, distilled and presented through the fiscal year-end financial statement template. This process provides a crucial snapshot of financial health, informing strategic decision-making and ensuring transparency for stakeholders. The template serves as the structured vehicle for this reporting, ensuring data consistency and comparability across periods.

- Culmination of Financial Activity:Year-end reporting encapsulates the entirety of an organization’s financial transactions over the preceding fiscal year. This comprehensive overview, facilitated by the structure of the template, provides a consolidated view of performance, enabling stakeholders to assess overall financial health. For example, a retailer’s year-end report will reflect all sales, purchases, and operating expenses incurred throughout the year, culminating in a net profit or loss figure.

- Basis for Future Planning:The insights derived from year-end reports, presented through the standardized format of the template, serve as a cornerstone for future planning and strategic decision-making. By analyzing trends in revenue, expenses, and cash flow, organizations can identify areas for improvement, allocate resources effectively, and set realistic financial goals for the coming year. For instance, identifying declining sales in a specific product line through year-end analysis can prompt a strategic shift in marketing efforts or product development.

- Compliance and Transparency:Year-end reporting plays a vital role in regulatory compliance and maintaining transparency with stakeholders. The structured format of the template ensures adherence to reporting standards, while the data itself provides investors, creditors, and regulatory bodies with a clear and concise view of the organization’s financial position. Consistent reporting of debt levels, for example, is essential for maintaining compliance with loan covenants and demonstrating financial stability to creditors.

- Performance Evaluation:The year-end financial statement template provides the framework for evaluating performance against predetermined benchmarks and goals. Key performance indicators (KPIs) derived from the reported data allow management to assess the effectiveness of operational strategies and make necessary adjustments. Comparing actual results against budgeted figures, for instance, can reveal areas of overspending or underperformance, prompting corrective actions.

These facets of year-end reporting underscore its integral connection to the fiscal year-end financial statement template. The template provides the structure, while the year-end process provides the critical data. This synergy ensures that financial information is presented accurately, consistently, and transparently, facilitating informed decision-making and fostering stakeholder trust. The rigorous nature of year-end reporting, coupled with the standardized format of the template, establishes a robust foundation for financial analysis and strategic planning.

4. Comparability

Comparability is a cornerstone of financial reporting, enabling meaningful analysis of financial performance across different periods and against industry benchmarks. A well-structured fiscal year-end financial statement template facilitates this comparability by ensuring consistent data presentation and adherence to standardized accounting principles. This consistency allows stakeholders to identify trends, assess performance relative to competitors, and make informed decisions based on reliable and comparable financial information.

- Trend Analysis:Consistent data presentation within the template allows for effective trend analysis over multiple reporting periods. By comparing financial data across consecutive fiscal years, stakeholders can identify patterns in revenue growth, expense management, and profitability. For instance, consistent reporting of sales figures enables businesses to track growth trajectories and identify potential market saturation or emerging trends.

- Benchmarking:Comparability extends beyond internal trend analysis. A standardized fiscal year-end statement allows organizations to benchmark their performance against industry averages and competitors. This external comparison provides valuable insights into relative financial health and identifies areas for potential improvement. For example, comparing a company’s profitability margins to industry averages can reveal whether its operational efficiency is in line with or lagging behind competitors.

- Investment Decisions:Investors rely on comparable financial data to make informed investment decisions. A standardized template ensures that financial information is presented consistently across different companies, allowing investors to compare investment opportunities and assess relative risks and returns. Consistent reporting of earnings per share, for instance, facilitates comparison across different investment options.

- Acquisition Analysis:In mergers and acquisitions, comparability is crucial for valuing target companies and assessing potential synergies. Standardized financial statements, facilitated by the template, enable acquirers to analyze the financial performance of target companies, compare them to industry peers, and make informed decisions about valuation and integration. Consistent reporting of assets and liabilities, for example, is essential for accurate valuation in acquisition scenarios.

The comparability facilitated by a robust fiscal year-end financial statement template is essential for sound financial analysis and informed decision-making. By ensuring data consistency and adherence to standardized accounting principles, the template empowers stakeholders to gain meaningful insights into financial performance, assess trends, benchmark against competitors, and make strategic decisions grounded in reliable and comparable financial information. This consistent structure enhances transparency and promotes trust in the reported data, ultimately strengthening the integrity of the financial reporting process.

5. Audit Readiness

Audit readiness represents a critical aspect of financial reporting, intrinsically linked to the structure and utilization of a fiscal year-end financial statement template. A well-designed template facilitates a smooth and efficient audit process, reducing costs and minimizing disruptions. This preparedness stems from the template’s inherent organization, data accuracy, and adherence to established accounting standards. A company’s ability to readily provide auditors with a comprehensive, accurate, and well-organized set of financial statements, derived directly from the template, significantly impacts the audit’s duration and complexity. For instance, a template with clearly defined account reconciliations simplifies the auditor’s task of verifying balances, while a robust chart of accounts ensures accurate categorization of transactions.

The connection between audit readiness and the fiscal year-end financial statement template manifests in several practical ways. A standardized template ensures consistency in data presentation, enabling auditors to easily trace transactions and verify account balances. This consistency reduces the likelihood of errors and omissions, thereby streamlining the audit process. Clear documentation within the template, such as supporting schedules and detailed explanations of accounting policies, further enhances transparency and facilitates auditor understanding. Consider a scenario where a company uses a template that automatically generates a trial balance. This readily available, reconciled summary of all general ledger accounts significantly expedites the initial stages of the audit. Conversely, a disorganized or incomplete template can lead to significant audit delays, increased scrutiny, and potentially higher audit fees. A lack of proper documentation or inconsistent application of accounting principles can raise red flags for auditors, prompting more in-depth investigations and potentially impacting the auditor’s opinion on the financial statements.

In conclusion, audit readiness, facilitated by a robust fiscal year-end financial statement template, is not merely a desirable attribute but a critical component of sound financial governance. The template serves as the foundation upon which a smooth and efficient audit is built. Its structure ensures data accuracy, consistency, and transparency, fostering trust and confidence in the reported financial information. Proactive planning and meticulous maintenance of the template throughout the fiscal year significantly contribute to audit readiness, minimizing potential disruptions and reinforcing the integrity of the financial reporting process. This diligent approach ultimately benefits the organization by reducing audit costs, enhancing credibility with stakeholders, and promoting a culture of financial transparency.

Key Components of a Fiscal Year-End Financial Statement Template

A comprehensive fiscal year-end financial statement template comprises several key components, each playing a crucial role in presenting a clear and accurate picture of an organization’s financial position. Understanding these components is essential for both preparing and interpreting these vital documents.

1. Balance Sheet: The balance sheet provides a snapshot of an organization’s assets, liabilities, and equity at a specific point in time, typically the end of the fiscal year. This statement demonstrates the fundamental accounting equation: Assets = Liabilities + Equity. Accurate representation of these elements is crucial for assessing an organization’s financial stability and solvency.

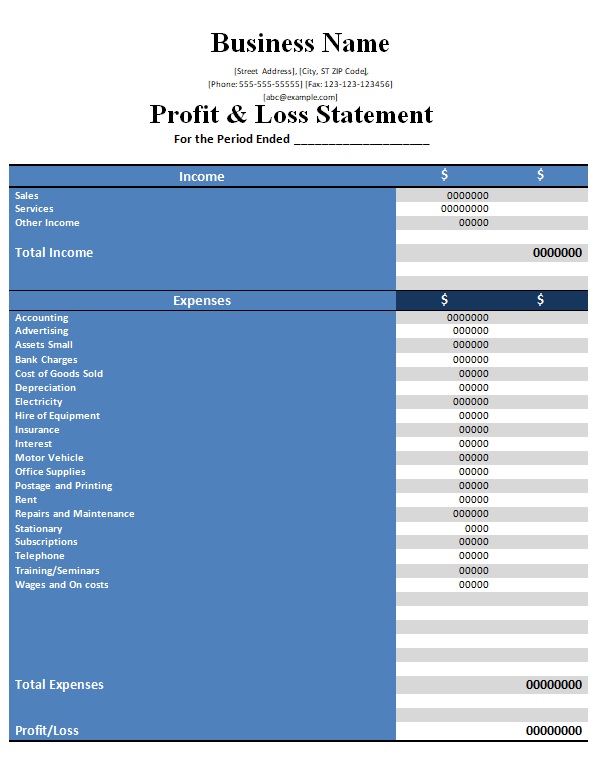

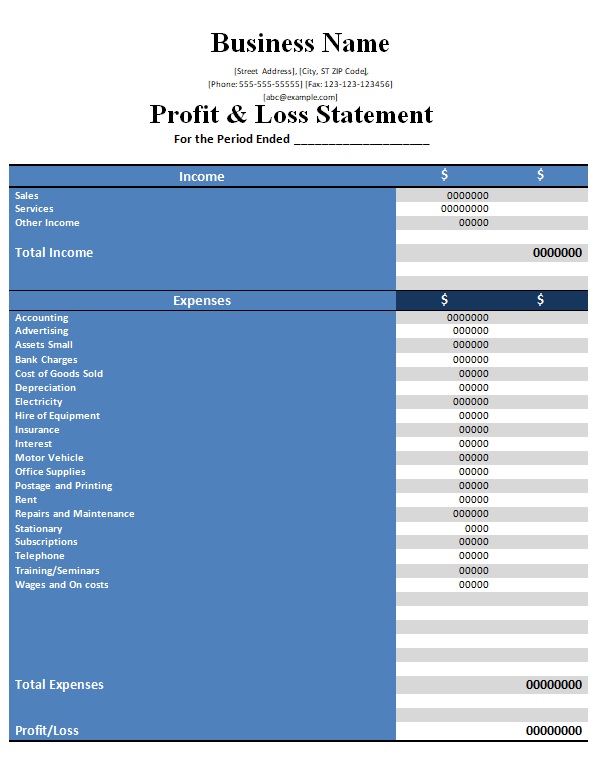

2. Income Statement: The income statement, also known as the profit and loss statement, details an organization’s revenues and expenses over a specific period, typically the fiscal year. The income statement reveals the organization’s profitability by subtracting total expenses from total revenues, resulting in net income or net loss.

3. Cash Flow Statement: The cash flow statement tracks the movement of cash both into and out of an organization during the fiscal year. It categorizes cash flows into operating activities, investing activities, and financing activities, providing insights into how the organization generates and utilizes cash.

4. Statement of Changes in Equity: This statement details the changes in an organization’s equity over the fiscal year. It outlines the contributions from and distributions to owners, as well as the impact of net income and other comprehensive income on equity.

5. Notes to the Financial Statements: These notes provide additional context and details regarding the information presented in the main financial statements. They explain accounting policies, provide details about significant transactions, and disclose contingent liabilities, among other important information.

6. Supporting Schedules: While not always included directly within the template, supporting schedules provide detailed breakdowns of specific line items within the main financial statements. These schedules offer greater granularity and transparency, enabling a deeper understanding of the underlying financial data.

These interconnected components form a comprehensive picture of an organization’s financial performance and position. The balance sheet provides a static snapshot, while the income statement and cash flow statement offer dynamic views of financial activity over time. The statement of changes in equity and the accompanying notes and schedules provide further context and detail, ensuring a complete and transparent representation of the organization’s financial health.

How to Create a Fiscal Year-End Financial Statement Template

Creating a robust template requires careful planning and consideration of key financial reporting elements. A well-structured template ensures data accuracy, consistency, and comparability, facilitating informed decision-making and streamlining the audit process.

1. Define Reporting Requirements: Determine the specific reporting requirements based on the organization’s industry, legal structure, and stakeholder needs. Consider relevant accounting standards (e.g., GAAP, IFRS) and any specific regulatory requirements.

2. Select Key Financial Statements: Choose the appropriate financial statements to include in the template. Standard components include the balance sheet, income statement, cash flow statement, and statement of changes in equity. Consider the addition of supporting schedules for detailed breakdowns.

3. Design the Template Structure: Develop a clear and logical structure for each financial statement. Ensure consistent formatting, including column headings, row labels, and data entry fields. Standardized formatting promotes comparability across periods.

4. Establish a Chart of Accounts: Create a detailed chart of accounts that aligns with the organization’s specific operations. This chart provides a systematic framework for categorizing and recording financial transactions, ensuring data accuracy and consistency.

5. Incorporate Formulas and Calculations: Embed formulas and automated calculations within the template to minimize manual data entry and reduce the risk of errors. Automated calculations ensure accuracy and streamline the reporting process.

6. Implement Data Validation Rules: Incorporate data validation rules to prevent input errors and ensure data integrity. Validation rules enforce data consistency and enhance the reliability of the financial statements.

7. Integrate with Accounting Software: Integrate the template with the organization’s accounting software to automate data flow and minimize manual data entry. Integration ensures data accuracy and streamlines the reporting process.

8. Document Accounting Policies: Include clear and concise documentation of the organization’s accounting policies within the template or in accompanying notes. This documentation ensures transparency and facilitates understanding of the reported financial information.

A robust template, meticulously designed and consistently applied, provides a reliable framework for presenting accurate and comparable financial information. This structured approach enhances transparency, streamlines the audit process, and supports informed decision-making by stakeholders.

Accurate and transparent financial reporting is paramount for organizational success. A well-designed fiscal year-end financial statement template provides the crucial framework for capturing, organizing, and presenting key financial data at the culmination of each accounting period. This structured approach ensures data consistency, facilitates comparability across periods and against industry benchmarks, and streamlines the audit process. From the balance sheet’s snapshot of assets, liabilities, and equity to the income statement’s depiction of profitability and the cash flow statement’s tracking of cash movements, each component of the template plays a vital role in conveying a comprehensive picture of financial health. Data integrity, underpinned by robust internal controls and rigorous validation processes, is essential for maximizing the template’s value. Moreover, adherence to established accounting standards and regulatory requirements ensures compliance and fosters trust among stakeholders.

The effective utilization of a fiscal year-end financial statement template is not merely a matter of compliance but a strategic imperative. It empowers organizations to analyze performance trends, identify areas for improvement, and make informed decisions based on reliable financial insights. This structured approach to financial reporting strengthens financial governance, promotes transparency, and ultimately contributes to long-term sustainability and success. Continual refinement and adaptation of the template, in response to evolving business needs and reporting requirements, will further enhance its value as a crucial tool for financial management and strategic decision-making.