Organizing financial information in this structured format facilitates informed decision-making for both the individual and the financial institution. It offers a clear picture of an individual’s financial health, enabling more accurate assessments for loan approvals, investment strategies, and other financial services. Furthermore, it can empower individuals to better manage their finances by providing a comprehensive overview of their own assets and liabilities.

The following sections will explore the specific components of such documents, offering guidance on proper completion and highlighting the various ways these statements can be utilized for effective financial planning and management.

1. Assets

Accurate representation of assets within a financial statement is crucial for a comprehensive understanding of an individual’s financial position. Assets, representing items of economic value owned, play a pivotal role in determining net worth and overall financial health. Categorizing and valuing assets correctly is essential for institutions to assess creditworthiness and make informed decisions regarding financial services. Several asset categories typically appear on financial statements, including liquid assets (cash, checking and savings accounts), investment assets (stocks, bonds, mutual funds), and fixed assets (real estate, vehicles). Accurately listing these holdings provides a clear picture of financial strength.

For example, an individual applying for a mortgage must disclose all significant assets. A detailed account of assets, including supporting documentation, allows the lending institution to assess the applicant’s ability to repay the loan. Similarly, accurate asset reporting is crucial for wealth management planning, enabling advisors to develop tailored strategies based on a client’s complete financial picture. Omitting or undervaluing assets can lead to inaccurate financial assessments and potentially hinder access to appropriate financial services.

In conclusion, transparency and precision in asset reporting are paramount for sound financial planning and decision-making. A thorough understanding of one’s asset portfolio, as documented within a financial statement, empowers both the individual and the financial institution to make informed choices aligned with long-term financial goals. Failure to accurately represent assets can lead to misinterpretations of financial health and potentially limit access to essential financial products and services.

2. Liabilities

Accurate representation of liabilities is essential for a comprehensive understanding of an individual’s financial standing within the context of a personal financial statement. Liabilities, representing obligations owed to others, provide a critical counterpoint to assets and play a key role in determining net worth and creditworthiness. A clear and detailed account of liabilities is crucial for financial institutions to assess risk and make informed decisions regarding loan applications and other financial services.

- Short-Term LiabilitiesThese obligations are typically due within one year and include credit card balances, short-term loans, and unpaid bills. For example, outstanding credit card debt significantly impacts credit scores and borrowing capacity. Accurately reporting these short-term obligations allows lenders to assess an individual’s ability to manage current debt and make timely payments.

- Long-Term LiabilitiesThese obligations extend beyond one year and often represent significant financial commitments. Examples include mortgages, auto loans, and student loans. The outstanding balance and repayment terms of these liabilities provide crucial information for evaluating long-term financial stability and debt management capabilities.

- Secured vs. Unsecured LiabilitiesSecured liabilities, such as mortgages or auto loans, are backed by collateral. Unsecured liabilities, like credit card debt or personal loans, are not tied to specific assets. This distinction is critical for assessing risk, as secured debts offer lenders recourse in case of default. Clearly differentiating between secured and unsecured debts within a financial statement facilitates a more nuanced understanding of an individual’s debt profile.

- Contingent LiabilitiesThese represent potential future obligations that may arise depending on the outcome of certain events. Examples include pending lawsuits or co-signed loans. While not always immediately payable, disclosing contingent liabilities is crucial for transparency and allows financial institutions to assess potential future financial burdens.

A comprehensive understanding and accurate reporting of all liabilities, ranging from short-term debts to potential future obligations, are essential for presenting a complete financial picture. This transparency allows institutions to make informed decisions regarding financial services and empowers individuals to effectively manage their financial obligations. Omitting or underreporting liabilities can lead to inaccurate assessments of financial health and potentially hinder access to necessary financial products and services.

3. Net worth calculation

Net worth calculation forms the core of a personal financial statement, providing a concise summary of an individual’s financial position. Derived from the provided information on assets and liabilities, this calculation is crucial for both the individual seeking financial services and the institution evaluating the individual’s financial health. Understanding the components and implications of net worth is essential for effective financial planning and decision-making.

- The Formula: Assets – Liabilities = Net WorthNet worth is calculated by subtracting total liabilities from total assets. A positive net worth indicates that assets exceed liabilities, signifying a stronger financial position. A negative net worth, conversely, indicates that liabilities outweigh assets. This straightforward formula provides a clear snapshot of financial health at a specific point in time.

- Implications for Financial PlanningNet worth serves as a key indicator of financial progress and stability. Tracking net worth over time allows individuals to monitor the effectiveness of their financial strategies and make adjustments as needed. A growing net worth generally signifies positive financial growth, while a declining net worth may warrant a review of spending and saving habits.

- Relevance to Loan Applications and Financial ServicesFinancial institutions rely heavily on net worth calculations when evaluating loan applications. A higher net worth suggests a lower risk for the lender, increasing the likelihood of loan approval and potentially influencing interest rates. Net worth also plays a role in determining eligibility for other financial services, such as wealth management and investment opportunities.

- Accuracy and Completeness of DataAccurate net worth calculation hinges on the completeness and accuracy of the information provided in the personal financial statement. Omitting assets or liabilities, even inadvertently, can lead to a distorted representation of financial health and potentially hinder access to appropriate financial services. Diligent record-keeping and careful attention to detail are crucial for ensuring the reliability of the net worth calculation.

In summary, net worth calculation serves as a critical component of a personal financial statement, providing valuable insights into an individual’s overall financial standing. Its implications extend beyond a simple numerical value, influencing financial planning, access to financial services, and risk assessment by financial institutions. Accurate and comprehensive data input is paramount for a reliable net worth calculation, which ultimately contributes to informed financial decision-making for both the individual and the financial institution.

4. Accurate Data Input

Accurate data input is paramount when completing a financial statement template provided by a financial institution. The reliability of the entire document, used for crucial financial decisions, rests upon the precision and completeness of the information entered. Inaccurate or incomplete data can lead to misinterpretations of financial health, potentially affecting loan approvals, investment strategies, and other financial services.

- Asset ValuationAccurate asset valuation ensures a realistic representation of an individual’s financial holdings. Listing the current market value of real estate, investments, and other assets is crucial for determining net worth. For instance, using an outdated appraisal for a property can significantly skew the overall financial picture presented. Accurate valuations provide a reliable foundation for assessing financial strength and making informed decisions.

- Liability ReportingPrecise reporting of liabilities, including outstanding loan balances and credit card debts, is critical for assessing an individual’s debt burden. Even small discrepancies in reported debts can affect credit scores and loan eligibility. For example, failing to accurately report a car loan balance can lead to an inaccurate debt-to-income ratio, potentially hindering loan approval. Thorough and precise liability reporting is essential for transparency and informed financial assessments.

- Income VerificationAccurate reporting of income, often supported by documentation such as pay stubs or tax returns, validates an individual’s ability to meet financial obligations. Misrepresenting income can lead to serious consequences, including loan denial or even legal repercussions. Providing verifiable income information is fundamental for establishing trust and ensuring the reliability of the financial statement.

- Consistency and ThoroughnessConsistent and thorough data entry, including accurate account numbers, dates, and contact information, minimizes the risk of errors and delays in processing the financial statement. Incomplete or inconsistent information can trigger additional inquiries, prolonging the review process and potentially delaying access to needed financial services. Maintaining meticulous records and carefully reviewing all entered information before submission ensures efficiency and accuracy.

The accuracy of information provided within a financial statement template directly impacts the validity of the entire document. Reliable data forms the basis for sound financial assessments by institutions and empowers individuals to make informed decisions regarding their financial future. Errors or omissions can have significant consequences, affecting access to financial products and services and potentially hindering long-term financial goals. Therefore, meticulous attention to detail and a commitment to accurate data input are essential for ensuring the reliability and effectiveness of the financial statement as a tool for financial planning and decision-making.

5. Regular Updates

Maintaining the accuracy of a personal financial statement through regular updates is essential for its continued relevance in financial planning and decision-making. Financial situations are dynamic, with changes in income, expenses, asset values, and liabilities occurring frequently. Regularly updating the statement ensures it reflects current financial realities, allowing for informed adjustments to financial strategies and accurate assessments by financial institutions.

For instance, a significant increase in property value should be reflected in the statement to provide an accurate picture of net worth. Similarly, paying off a substantial loan alters the debt-to-asset ratio and should be updated promptly. These updates enable individuals to monitor their financial progress effectively and allow institutions to assess risk accurately. Failure to update the statement regularly can lead to outdated information being used for crucial financial decisions, potentially resulting in missed opportunities or inaccurate risk assessments. A static, outdated document offers a limited view of one’s financial health, hindering informed financial planning.

In summary, regular updates to a financial statement template are crucial for maintaining its accuracy and relevance as a financial planning tool. This dynamic approach to financial record-keeping ensures that decisions are made based on current realities, fostering greater financial awareness and enabling more effective interactions with financial institutions. The frequency of updates depends on individual circumstances, but generally, reviewing and updating the statement annually, or more frequently when significant financial changes occur, is recommended to ensure its ongoing utility and accuracy.

6. Supporting Documentation

Supporting documentation plays a crucial role in validating the information provided within a Wells Fargo personal financial statement template. This documentation substantiates the declared assets, liabilities, income, and expenses, providing an additional layer of verification for the financial institution. The relationship between supporting documentation and the financial statement is one of verification and validation, ensuring the accuracy and reliability of the information presented. This practice fosters transparency and trust between the client and the institution.

For example, when declaring ownership of a property, a copy of the deed serves as supporting documentation. Similarly, recent pay stubs or tax returns substantiate declared income. Bank statements, loan documents, and investment account summaries further validate reported assets and liabilities. This documentation not only verifies the existence of the assets and liabilities but also confirms their value and the terms of any associated debts. Without supporting documentation, the financial statement remains unsubstantiated, potentially raising questions about its accuracy and completeness. Providing comprehensive supporting documentation streamlines the review process, facilitating efficient and informed decision-making by the financial institution.

In conclusion, supporting documentation is integral to the Wells Fargo personal financial statement template. It serves as the evidentiary foundation for the financial information declared, bolstering its credibility and allowing for a thorough and accurate assessment of an individual’s financial standing. This practice of substantiating claims with verifiable documentation is crucial for establishing trust, ensuring transparency, and facilitating informed financial decisions. The absence of adequate supporting documentation can undermine the validity of the entire financial statement, potentially delaying or hindering access to financial services. Therefore, compiling and providing comprehensive supporting documentation is essential for a successful and efficient interaction with the financial institution.

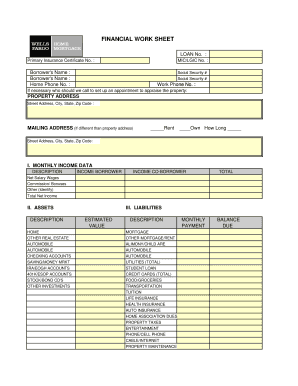

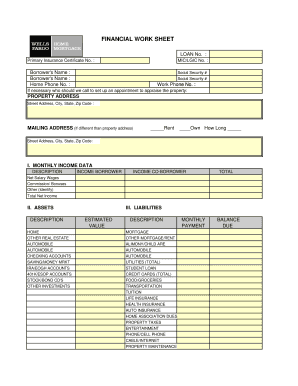

Key Components of a Personal Financial Statement

A comprehensive personal financial statement requires several key components to accurately represent an individual’s financial position. These components provide a structured overview of assets, liabilities, and net worth, enabling informed financial decision-making.

1. Assets: A detailed account of all owned assets, including liquid assets (cash, checking and savings accounts), investment assets (stocks, bonds, retirement accounts), and fixed assets (real estate, vehicles). Accurate valuation of these assets is crucial.

2. Liabilities: A complete listing of all outstanding debts and financial obligations, including short-term liabilities (credit card balances, unpaid bills), and long-term liabilities (mortgages, student loans, auto loans). Clear differentiation between secured and unsecured debts is important.

3. Net Worth Calculation: The difference between total assets and total liabilities, representing an individual’s overall financial position. This calculation provides a snapshot of financial health at a specific point in time.

4. Income Statement: A summary of income from all sources, including salary, investments, and other earnings. This information validates an individual’s ability to meet financial obligations and support future financial goals.

5. Expense Statement: A detailed account of all regular expenses, including housing, transportation, food, and other living costs. This component provides insights into spending patterns and helps assess financial stability.

6. Supporting Documentation: Evidence to substantiate the information provided, such as bank statements, property deeds, loan documents, pay stubs, and tax returns. This documentation validates the accuracy and completeness of the financial statement.

These components, working in concert, provide a holistic view of an individual’s financial health. Accurate and complete information within each component ensures a reliable and informative financial statement, enabling effective financial planning and informed decision-making by both the individual and any financial institutions involved.

How to Create a Wells Fargo Personal Financial Statement

Creating a comprehensive personal financial statement for Wells Fargo involves organizing financial information accurately and thoroughly. This structured approach ensures a clear and reliable representation of one’s financial standing for loan applications, wealth management, and other financial services.

1: Gather Necessary Documents: Collect all relevant financial documents, including bank statements, investment account summaries, loan documents, property deeds, pay stubs, and tax returns. These documents provide the necessary data to populate the financial statement accurately.

2: Calculate Total Assets: Determine the current market value of all owned assets. This includes liquid assets like cash and checking accounts, investment assets like stocks and bonds, and fixed assets like real estate and vehicles. Accurate valuation is crucial.

3: Calculate Total Liabilities: List all outstanding debts and financial obligations. Include short-term liabilities like credit card balances and unpaid bills, as well as long-term liabilities such as mortgages, student loans, and auto loans. Distinguish between secured and unsecured debts.

4: Determine Net Worth: Calculate net worth by subtracting total liabilities from total assets. This key figure provides a snapshot of overall financial health.

5: Detail Income and Expenses: Document all sources of income, including salary, investments, and other earnings. List all regular expenses, including housing, transportation, food, and other living costs. This information provides a comprehensive view of financial flow.

6: Organize Supporting Documentation: Arrange the collected supporting documents logically to correspond with the information presented in the financial statement. This allows for easy verification of declared assets, liabilities, income, and expenses.

7: Review for Accuracy and Completeness: Carefully review the completed financial statement and supporting documentation for accuracy and completeness. Ensure all information is up-to-date and accurately reflects current financial standing. Any discrepancies or omissions can impact the reliability of the statement.

8: Obtain the Necessary Form: Contact a Wells Fargo branch or access their website to obtain the correct personal financial statement template. Using the official template provided by the financial institution is often required. Some institutions may allow submissions through their online banking portal.

A meticulously prepared personal financial statement, supported by comprehensive documentation, provides a clear and accurate representation of an individual’s financial position. This detailed overview is crucial for informed financial planning and effective communication with financial institutions. It facilitates accurate assessments for loan applications, wealth management services, and other financial endeavors.

Accurate completion of a Wells Fargo personal financial statement template provides a crucial foundation for informed financial decision-making. This detailed overview of assets, liabilities, net worth, income, and expenses offers a comprehensive snapshot of an individual’s financial health. Meticulous attention to detail, accurate valuations, and supporting documentation are essential for ensuring the reliability and effectiveness of this document. Understanding the components and their implications allows for effective communication with financial institutions and facilitates access to appropriate financial products and services.

A well-prepared personal financial statement empowers individuals to navigate the complexities of financial planning, loan applications, and wealth management with greater clarity and confidence. It serves as a vital tool for building a secure financial future, fostering transparency, and establishing trust with financial institutions. Regular review and updates ensure its continued relevance in reflecting evolving financial circumstances and supporting sound financial strategies.