Utilizing this type of financial projection offers several advantages. It allows for informed decision-making regarding investments, pricing strategies, and operational expenses. A clear understanding of potential future performance can help secure funding from lenders and investors. Furthermore, it serves as a benchmark against which actual results can be measured, enabling proactive adjustments to strategy and operations.

This structured approach to financial forecasting facilitates better resource allocation and risk management. The following sections will delve into the key components of constructing such a projection, including revenue forecasting, expense budgeting, and sensitivity analysis.

1. Revenue Projections

Revenue projections serve as the cornerstone of a five-year projected income statement template. They represent the anticipated sales or income a business expects to generate over the specified period. The accuracy and reliability of these projections directly impact the entire financial model, influencing profitability forecasts, investment decisions, and overall business strategy. A meticulous approach to revenue projection involves analyzing historical data, market trends, competitive landscapes, and anticipated economic conditions. For instance, a software-as-a-service (SaaS) company might project revenue based on anticipated subscriber growth rates, average revenue per user, and churn rates. Alternatively, a retail business might consider factors like foot traffic, average transaction value, and seasonal sales fluctuations. Cause and effect relationships are crucial here; changes in market share, pricing strategies, or product launches will directly impact projected revenue figures.

Developing realistic revenue projections requires a deep understanding of the business’s operating environment and potential growth drivers. Consider a manufacturing company expanding into a new market. Their revenue projections might incorporate factors such as market penetration rates, production capacity, and anticipated pricing pressures. Overly optimistic projections can lead to unrealistic expectations and misallocation of resources, while overly conservative projections might hinder growth opportunities. Scenario planning, incorporating best-case, worst-case, and most-likely scenarios, allows businesses to assess the potential impact of different market conditions on their financial performance. This approach strengthens the reliability of the five-year projected income statement as a strategic planning tool.

Accurate revenue projections facilitate informed decision-making regarding pricing, resource allocation, and investment strategies. They provide a basis for evaluating the financial feasibility of new ventures and expansion plans. Understanding the link between revenue projections and the overall five-year financial model is crucial for sound financial management and long-term sustainability. While challenges exist in predicting future revenue with absolute certainty, a robust and well-researched projection methodology significantly enhances the value and reliability of the five-year projected income statement, enabling organizations to navigate the complexities of the business environment with greater confidence.

2. Cost of Goods Sold

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a business. Within a five-year projected income statement template, COGS plays a critical role in determining gross profit and ultimately, net income. Accurate COGS projections are essential for informed pricing decisions, inventory management, and overall profitability assessments. Understanding the components of COGS and their potential variability over time is crucial for developing a realistic financial forecast.

- Direct MaterialsDirect materials encompass the raw materials and components directly used in the production process. For a furniture manufacturer, this would include wood, fabric, and hardware. Accurately forecasting direct material costs requires considering factors such as supplier pricing, potential material shortages, and anticipated production volumes. Fluctuations in these factors can significantly impact projected COGS and overall profitability within the five-year timeframe.

- Direct LaborDirect labor costs represent the wages and benefits paid to employees directly involved in production. For a clothing manufacturer, this includes the salaries of sewing machine operators and pattern cutters. Projecting direct labor costs requires analyzing factors such as labor rates, anticipated production levels, and potential changes in labor regulations. Accurately forecasting these costs is essential for maintaining healthy profit margins and making informed decisions regarding staffing and production capacity.

- Manufacturing OverheadManufacturing overhead includes all other costs directly attributable to the production process, excluding direct materials and labor. Examples include factory rent, utilities, and depreciation of manufacturing equipment. These costs are often allocated to individual products based on predetermined overhead rates. Accurately projecting manufacturing overhead requires understanding cost drivers and anticipated changes in production volumes or efficiency. Overlooking or underestimating these costs can lead to inaccurate profitability projections.

- Inventory ChangesThe change in inventory levels between the beginning and end of a period also impacts COGS. An increase in inventory suggests that more goods were produced than sold, decreasing COGS. Conversely, a decrease in inventory increases COGS. Within a five-year projection, accurately forecasting inventory changes necessitates analyzing anticipated sales growth, production capacity, and inventory management strategies. Understanding this dynamic allows for more accurate gross profit and net income projections.

Accurately projecting COGS over a five-year horizon provides valuable insights into potential profitability and informs critical business decisions. By understanding the interplay between direct materials, direct labor, manufacturing overhead, and inventory changes, businesses can develop more robust and reliable financial forecasts. This understanding allows for proactive adjustments to pricing strategies, cost optimization initiatives, and overall business planning, contributing to long-term financial health and sustainability as reflected in the five-year projected income statement.

3. Operating Expenses

Operating expenses represent the costs incurred in running a business’s day-to-day operations, excluding the direct costs of producing goods or services (COGS). Within a five-year projected income statement template, accurately forecasting operating expenses is crucial for determining operating income, a key indicator of profitability and operational efficiency. A thorough understanding of these expenses and their potential variability over time is essential for developing a realistic financial forecast and making informed strategic decisions.

- Selling, General, and Administrative Expenses (SG&A)SG&A expenses encompass a wide range of costs related to sales, marketing, administrative functions, and general overhead. Examples include salaries of sales and marketing personnel, advertising costs, rent for office space, and legal and accounting fees. Projecting SG&A requires careful consideration of factors such as planned marketing campaigns, staffing levels, and anticipated growth in administrative needs. These costs can vary significantly depending on the industry and business model, making accurate forecasting crucial for a reliable five-year projection.

- Research and Development (R&D) ExpensesR&D expenses represent investments in developing new products, services, or processes. These costs can include salaries of research personnel, laboratory equipment, and patent filing fees. For technology or pharmaceutical companies, R&D often constitutes a significant portion of operating expenses. Projecting R&D spending requires aligning research goals with overall business strategy and considering the potential impact of innovation on future revenue streams. Accurately forecasting these expenses is vital for assessing the long-term financial viability of investments in innovation.

- Depreciation and AmortizationDepreciation reflects the allocation of the cost of tangible assets (e.g., buildings, equipment) over their useful lives, while amortization represents the allocation of the cost of intangible assets (e.g., patents, trademarks) over their useful lives. These non-cash expenses impact a company’s reported profitability and tax liability. Projecting depreciation and amortization requires understanding the company’s asset base, estimated useful lives, and applicable accounting methods. Accurate forecasting contributes to a more comprehensive understanding of long-term profitability and cash flow.

- Impairment ChargesImpairment charges represent a reduction in the carrying value of an asset when its fair market value falls below its book value. These charges can arise from various factors, such as obsolescence, declining market conditions, or changes in business strategy. While difficult to predict precisely, incorporating potential impairment charges into a five-year projected income statement provides a more conservative and realistic view of potential future performance. Consideration of potential impairments is especially important for businesses operating in rapidly changing industries.

Accurately forecasting operating expenses over a five-year period provides crucial insights into a business’s potential profitability and operational efficiency. Understanding the various components of operating expenses, including SG&A, R&D, depreciation and amortization, and potential impairment charges, allows for more informed decision-making regarding pricing strategies, cost management initiatives, and investment priorities. This detailed analysis strengthens the five-year projected income statement, making it a more valuable tool for strategic planning and long-term financial management.

4. Profit Margins

Profit margins, representing the profitability of a business after accounting for various costs, are crucial within a five-year projected income statement template. Analyzing projected profit margins over an extended period provides insights into the long-term financial health and sustainability of a business. Understanding different types of profit margins and their interrelationships allows for informed decision-making regarding pricing, cost control, and investment strategies.

- Gross Profit MarginGross profit margin represents the percentage of revenue remaining after deducting the cost of goods sold (COGS). It reflects the efficiency of production and pricing strategies. A rising gross profit margin over the five-year projection period suggests improving production efficiency or effective pricing strategies. For example, a manufacturing company implementing lean manufacturing principles might project increasing gross profit margins due to reduced production costs. Monitoring this metric within the five-year projection enables proactive adjustments to production processes and pricing strategies.

- Operating Profit MarginOperating profit margin represents the percentage of revenue remaining after deducting both COGS and operating expenses. It reflects the overall operational efficiency of the business. A stable or increasing operating profit margin over the five-year projection indicates effective cost management and operational efficiency. For instance, a software company successfully scaling its operations might project increasing operating profit margins due to economies of scale. Analyzing projected operating profit margin within the template informs decisions regarding resource allocation and operational improvements.

- Net Profit MarginNet profit margin represents the percentage of revenue remaining after deducting all expenses, including COGS, operating expenses, interest, and taxes. It reflects the overall profitability of the business after all costs are considered. A healthy and consistent net profit margin within the five-year projection suggests sustainable profitability and financial health. For example, a retail company successfully managing its inventory and controlling operating expenses might project consistent net profit margins. This metric serves as a key indicator of long-term financial viability.

- Projected Margin TrendsAnalyzing projected profit margin trends over the five-year period provides valuable insights into the long-term financial trajectory of the business. Consistently improving margins suggest a strengthening financial position, while declining margins might indicate underlying operational challenges or increasing competitive pressures. Understanding these trends enables proactive adjustments to business strategy, pricing models, and cost management initiatives. For instance, declining projected gross profit margins might necessitate a review of supplier contracts or production processes. A thorough analysis of margin trends within the five-year projection facilitates more informed and strategic decision-making.

Projecting profit margins within a five-year income statement template provides a critical framework for evaluating the long-term financial health and sustainability of a business. Analyzing gross profit margin, operating profit margin, net profit margin, and their projected trends informs strategic decision-making regarding pricing, cost control, investment strategies, and overall business planning. By understanding these interrelationships and their implications, businesses can strive for sustainable profitability and long-term financial success.

5. Cash Flow Implications

A five-year projected income statement template, while crucial for understanding profitability, doesn’t fully capture the dynamics of cash movement within a business. Cash flow implications, representing the actual inflow and outflow of cash, are essential for assessing financial health and short-term liquidity. Connecting cash flow projections to the income statement provides a more comprehensive understanding of a company’s financial sustainability. The income statement recognizes revenue when earned and expenses when incurred, regardless of when cash changes hands. This accrual accounting method can mask potential cash flow challenges. For example, a company might report strong revenue growth based on sales made on credit, but experience cash flow constraints if customers delay payments. Analyzing cash flow implications bridges this gap.

Analyzing cash flow implications within the context of a five-year projected income statement involves considering factors such as projected sales growth, payment terms with customers and suppliers, capital expenditures, and financing activities. A rapidly growing company, even if profitable, might experience cash flow shortfalls if investments in inventory or equipment outpace collections from customers. Conversely, a company with declining sales might still generate positive cash flow in the short term by reducing inventory levels and delaying payments to suppliers. Understanding these dynamics allows for better management of working capital and more accurate forecasting of short-term liquidity needs. A manufacturing company investing in new equipment, for instance, can anticipate potential cash flow constraints during the initial investment phase and plan accordingly by securing financing or adjusting other expenditures.

Integrating cash flow projections with the five-year projected income statement provides a more robust and realistic view of a company’s financial outlook. This integrated approach facilitates more informed decision-making regarding investment strategies, financing options, and working capital management. Understanding the relationship between profitability as depicted in the income statement and actual cash flow is crucial for ensuring long-term financial stability. While a profitable income statement is essential, positive cash flow is ultimately what allows a business to meet its obligations, invest in growth opportunities, and navigate economic uncertainties. Failing to adequately address cash flow implications can lead to financial distress, even for companies with strong projected profitability. This integrated analysis strengthens the five-year projection, enabling businesses to make more informed decisions and ensuring long-term sustainability.

6. Key Performance Indicators (KPIs)

Key performance indicators (KPIs) provide quantifiable measures of progress towards specific business objectives. Within a five-year projected income statement template, KPIs serve as critical benchmarks for evaluating projected financial performance and making informed strategic decisions. Selecting relevant KPIs and tracking their projected trajectory over time offers valuable insights into the long-term financial health and sustainability of a business. The projected income statement provides the raw data, while KPIs offer a focused interpretation of that data, highlighting areas of strength and potential weakness. Cause-and-effect relationships become clearer when KPIs are analyzed in conjunction with the underlying financial projections. For example, a projected increase in marketing spend should ideally correlate with a projected increase in revenue-related KPIs, such as average revenue per user or customer lifetime value. Disconnects between these projected metrics might signal inefficiencies in marketing strategies.

Specific KPIs relevant to a five-year projected income statement might include revenue growth rate, gross profit margin, operating profit margin, net profit margin, return on investment (ROI), and earnings per share (EPS). For a SaaS business, customer acquisition cost (CAC) and customer lifetime value (CLTV) are crucial KPIs for assessing the long-term viability of the business model. Monitoring projected CAC and CLTV within the five-year timeframe allows for proactive adjustments to pricing, marketing strategies, and customer retention efforts. A retail business, on the other hand, might focus on KPIs such as sales per square foot, inventory turnover, and average transaction value. Analyzing projected trends in these KPIs within the five-year projection informs decisions regarding store layout, inventory management, and sales promotions. The choice of KPIs depends on the specific industry, business model, and strategic objectives of the organization.

Understanding the connection between KPIs and the five-year projected income statement is crucial for effective financial management and long-term strategic planning. KPIs provide a focused lens through which to analyze projected financial performance, identify potential challenges, and make data-driven decisions. While the income statement provides a comprehensive overview of projected financial results, KPIs offer actionable insights into specific areas of performance. Regularly monitoring projected KPIs and comparing them to industry benchmarks or internal targets allows businesses to proactively address potential issues and optimize their strategies for long-term success. Challenges may arise in selecting the most relevant KPIs and accurately forecasting their trajectory. However, a well-defined set of KPIs, aligned with strategic objectives and integrated into the five-year projected income statement, significantly enhances the value of the projection as a strategic planning tool.

Key Components of a Five-Year Projected Income Statement Template

Constructing a robust five-year projected income statement requires careful consideration of several key components. These elements work together to provide a comprehensive view of a company’s anticipated financial performance over the specified period.

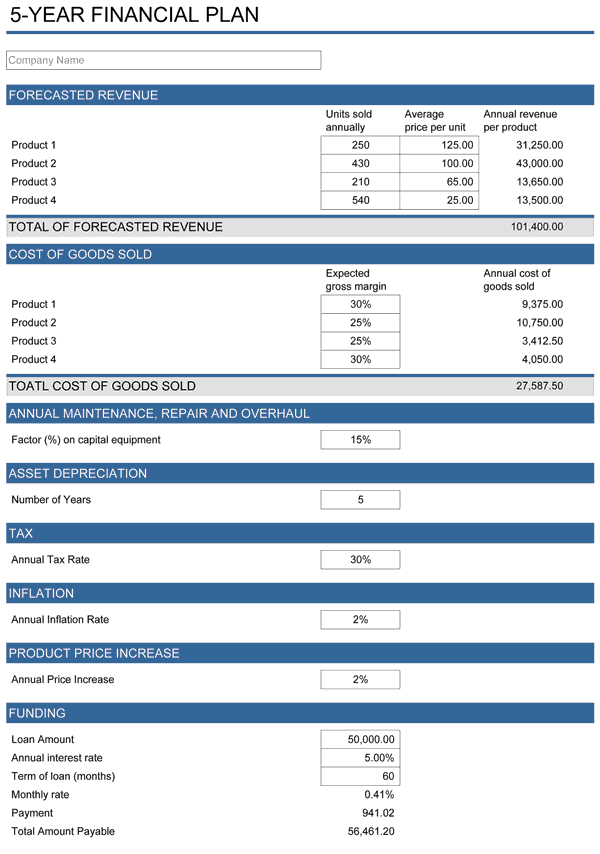

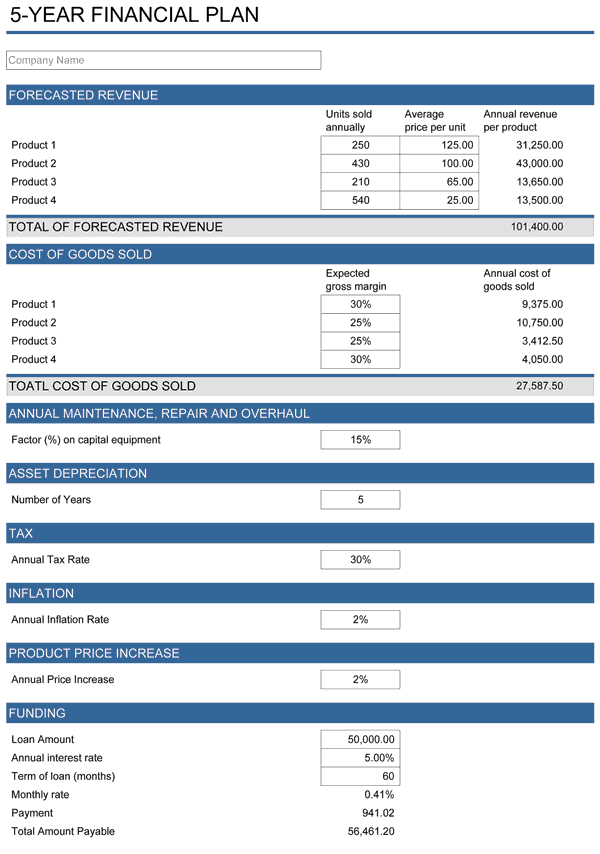

1. Revenue Projections: These form the foundation of the projected income statement, representing anticipated sales or income. Accurate revenue projections are crucial, as they directly influence all subsequent calculations of profitability and cash flow.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing goods or services sold. Accurately projecting COGS is essential for determining gross profit and understanding the relationship between production costs and revenue.

3. Operating Expenses: These represent the costs incurred in running day-to-day business operations, excluding COGS. Projecting operating expenses, such as selling, general, and administrative expenses (SG&A), research and development (R&D), and depreciation, is crucial for determining operating income.

4. Profit Margins: Various profit margins, including gross profit margin, operating profit margin, and net profit margin, provide insights into profitability at different levels. Analyzing projected profit margins helps assess the financial health and sustainability of the business.

5. Cash Flow Implications: While the income statement focuses on profitability, understanding cash flow implications is essential for assessing short-term liquidity and long-term solvency. Projecting cash inflows and outflows provides a more complete picture of financial health.

6. Key Performance Indicators (KPIs): KPIs offer quantifiable measures of progress towards specific business objectives. Selecting and tracking relevant KPIs, such as revenue growth rate, return on investment (ROI), and earnings per share (EPS), provides valuable insights into projected performance and facilitates data-driven decision-making.

A well-constructed five-year projected income statement template integrates these components to provide a comprehensive and dynamic view of anticipated financial performance. This detailed analysis enables informed decision-making regarding pricing strategies, cost management, investment priorities, and overall business strategy, contributing to long-term financial health and sustainability.

How to Create a 5-Year Projected Income Statement Template

Developing a comprehensive five-year projected income statement involves a structured approach encompassing historical data analysis, market research, and strategic forecasting. The following steps outline the process:

1: Gather Historical Financial Data: Compile income statements, balance sheets, and cash flow statements for the past three to five years. This historical data serves as a foundation for identifying trends and informing future projections. Analyzing past performance provides insights into revenue patterns, cost structures, and profitability trends, which can inform future projections.

2: Conduct Market Research: Analyze industry trends, competitive landscapes, and anticipated economic conditions. Understanding market dynamics and potential growth drivers informs realistic revenue projections and cost estimations. Factors such as market size, growth potential, competitive intensity, and regulatory changes influence future financial performance.

3: Project Revenue: Forecast revenue based on historical data, market research, and anticipated pricing and sales volume. Employing different forecasting methods, such as trend analysis, regression analysis, or expert opinions, allows for a more robust revenue projection. Consider various scenarios, including best-case, worst-case, and most-likely, to assess the potential impact of different market conditions.

4: Forecast Cost of Goods Sold (COGS): Project COGS based on anticipated production volumes, material costs, and labor rates. Consider potential fluctuations in input prices and production efficiency. Accurately forecasting COGS is essential for determining gross profit and overall profitability.

5: Project Operating Expenses: Forecast operating expenses, including selling, general, and administrative expenses (SG&A), research and development (R&D), and depreciation and amortization. Consider factors such as planned marketing campaigns, staffing levels, and anticipated investments in research and development. Operating expense projections should align with overall business strategy and growth plans.

6: Calculate Projected Profit Margins: Determine projected gross profit margin, operating profit margin, and net profit margin based on projected revenue, COGS, and operating expenses. Analyzing these margins provides insights into profitability at different levels and allows for assessment of long-term financial sustainability.

7: Project Cash Flow: Develop a projected cash flow statement to assess the timing of cash inflows and outflows. Consider factors such as payment terms with customers and suppliers, capital expenditures, and financing activities. Integrating cash flow projections with the income statement provides a more comprehensive view of financial health.

8: Identify Key Performance Indicators (KPIs): Select relevant KPIs, such as revenue growth rate, return on investment (ROI), and earnings per share (EPS), to track projected performance and inform strategic decision-making. KPIs provide quantifiable measures of progress toward specific business objectives.

Building a five-year projected income statement requires a thorough understanding of the business, its operating environment, and strategic goals. A well-structured template, incorporating these key components, provides a roadmap for future financial performance and enables informed decision-making for long-term success.

A five-year projected income statement template provides a crucial framework for understanding the potential financial trajectory of a business. Through meticulous forecasting of revenue, cost of goods sold, operating expenses, and profit margins, organizations gain valuable insights into their long-term financial health and sustainability. Integrating cash flow projections and key performance indicators (KPIs) further enhances the analytical power of this tool, enabling data-driven decision-making regarding pricing strategies, cost management, investment priorities, and overall business strategy. The rigorous process of developing this comprehensive financial model requires careful consideration of historical data, market dynamics, and strategic objectives. This detailed analysis allows businesses to anticipate potential challenges, identify growth opportunities, and navigate the complexities of the business environment with greater confidence.

Developing a robust five-year projected income statement is not merely a financial exercise; it represents a commitment to strategic foresight and informed decision-making. This proactive approach to financial planning empowers organizations to adapt to evolving market conditions, optimize resource allocation, and strive for long-term financial success. The insights derived from this comprehensive financial model serve as a compass, guiding businesses towards sustainable growth and a more secure financial future. Regular review and refinement of the five-year projected income statement, incorporating actual results and updated market data, ensures its ongoing relevance and value as a strategic management tool. This continuous process of analysis and adaptation is essential for navigating the dynamic business landscape and achieving sustained financial success.