Utilizing a standardized format promotes transparency and comparability across different businesses. This allows investors, creditors, and other stakeholders to make informed decisions based on readily accessible and consistent financial information. A clear understanding of cash movements facilitates better financial planning and management, enabling informed decisions about resource allocation and future investments.

The subsequent sections will explore the specific requirements and components of reporting cash flows under IFRS, providing practical guidance on preparing and interpreting these crucial financial statements. This includes delving into the nuances of each activity category and demonstrating how this information contributes to a comprehensive understanding of a company’s financial health.

1. Standardized Structure

A standardized structure is fundamental to the efficacy of an IFRS cash flow statement. This structure ensures consistency and comparability across different entities and reporting periods. By adhering to a prescribed format, financial statements become more transparent, allowing stakeholders to readily understand how a company generates and utilizes cash. This standardization facilitates informed decision-making by investors, creditors, and analysts. Without a consistent framework, analyzing and comparing financial performance across different companies or over time becomes significantly more challenging.

For instance, classifying cash flows into operating, investing, and financing activities provides a clear picture of a company’s core business operations, capital allocation strategies, and funding sources. A standardized presentation ensures that cash flows from the sale of inventory are consistently reported within operating activities, while proceeds from the sale of property, plant, and equipment are classified under investing activities. This consistency allows for meaningful comparisons and trend analysis, enabling stakeholders to assess the long-term sustainability and financial health of an organization.

Understanding the standardized structure is crucial for both preparing and interpreting these statements. It allows companies to present their financial performance accurately and transparently, while empowering stakeholders to make informed judgments based on reliable and comparable data. Challenges may arise when dealing with complex transactions or unique business models, requiring careful consideration of the appropriate classification within the standardized framework. However, the overarching benefit of comparability and clarity reinforces the importance of adhering to the standardized structure within IFRS cash flow statements.

2. Operating Activities

Operating activities represent the core day-to-day business functions that generate revenue and expenses. Within the context of an IFRS cash flow statement template, presenting these activities accurately is critical for assessing a company’s ability to generate cash from its principal operations. This section provides insights into the key facets of reporting operating activities under IFRS.

- Cash Receipts from CustomersThis represents the cash inflows generated from the sale of goods or services. For example, a retail company receives cash payments from customers purchasing merchandise. Accurately recording these receipts is crucial for determining the effectiveness of revenue generation and its impact on overall cash flow. Within the IFRS framework, adjustments are made for changes in accounts receivable to reflect the actual cash received during the reporting period.

- Cash Payments to SuppliersThese outflows represent payments made to suppliers for goods and services necessary for business operations. A manufacturing company, for instance, pays suppliers for raw materials. Tracking these payments is essential for understanding the cost structure and managing working capital effectively. Similar to customer receipts, changes in accounts payable are considered to reflect the actual cash outflow related to supplier payments within a specific period.

- Cash Payments to EmployeesSalaries, wages, and other employee benefits constitute significant cash outflows for most organizations. Accurately recording these payments provides insights into labor costs and their impact on profitability and cash flow. These payments are typically straightforward to measure and directly impact the cash flow from operating activities.

- Interest and Tax PaymentsCash payments for interest expenses on debt and income taxes represent other essential operating outflows. While interest paid can sometimes be classified under financing activities, under IFRS it’s generally classified as an operating activity. Income tax payments reflect the cash outflow related to a company’s tax obligations. Accurate reporting of these payments provides a clear picture of a company’s financial obligations and its effective tax rate. These outflows impact the overall assessment of cash generation from core operations.

Accurately presenting these facets within the operating activities section of an IFRS cash flow statement template is essential for stakeholders to understand the financial health and sustainability of a business. By analyzing these cash flows, investors and creditors can assess a companys ability to generate cash from its core operations, meet its short-term obligations, and reinvest in future growth. This analysis provides a more complete picture than the income statement, which is based on accrual accounting and may not reflect the actual cash position of the entity.

3. Investing Activities

Investing activities within an IFRS cash flow statement template encompass acquisitions and disposals of long-term assets and investments not classified as cash equivalents. These activities provide crucial insights into a company’s capital allocation strategies and its focus on future growth. Analysis of cash flows from investing activities helps stakeholders understand how a company invests its resources to maintain and expand its operational capacity, pursue new ventures, and manage its investment portfolio. This understanding is essential for assessing long-term growth prospects and the overall financial health of an organization.

Key examples of investing activities include:

- Purchase or Sale of Property, Plant, and Equipment (PP&E): Cash outflows for acquiring new equipment or facilities and inflows from selling existing assets are significant indicators of a company’s investment in its operational infrastructure. For instance, a manufacturing company investing heavily in new machinery may signal expansion plans, while substantial disposals might indicate restructuring or downsizing.

- Acquisitions and Disposals of Businesses: Purchasing or selling subsidiaries or other businesses represents significant investing activities, reflecting strategic decisions to enter new markets, consolidate operations, or divest non-core assets. These transactions often involve substantial cash flows and can significantly impact a company’s overall financial position.

- Investments in Securities: Purchasing or selling stocks, bonds, or other securities not classified as cash equivalents are recorded under investing activities. These transactions reflect a company’s investment strategies and its management of excess liquidity. Positive cash flow from selling securities might indicate profitable investment decisions, while consistent purchases could represent a strategy for long-term growth.

- Loans Made to Other Entities: Providing loans to other companies or individuals is also classified as an investing activity. The cash outflow represents the initial loan, while subsequent repayments are recorded as inflows. These transactions can reveal a company’s diversification strategies and its approach to generating returns from its financial resources.

Careful scrutiny of investing activities is crucial for understanding the long-term implications of a company’s capital allocation decisions. While positive cash flow from operating activities is essential for short-term stability, consistent and strategic investments are critical for sustained growth and future profitability. Analyzing trends in investing activities, along with other components of the IFRS cash flow statement, provides a comprehensive perspective on a company’s financial health and its ability to generate value for shareholders over the long term. Challenges in interpreting investing activities may arise from complex transactions or non-cash elements. However, a thorough understanding of these activities provides invaluable insights into a company’s strategic direction and its prospects for future success.

4. Financing Activities

Financing activities within an IFRS cash flow statement template detail how a company obtains and manages its funding. This section reveals the sources of capital used to finance operations and expansion, providing critical insights into a company’s financial structure and its long-term solvency. Understanding these activities is essential for assessing the balance between debt and equity financing, the management of dividend payments, and the overall financial risk profile of an organization. A thorough analysis of financing activities complements the information derived from operating and investing activities, offering a complete picture of a company’s financial management strategies.

- Proceeds from Issuing Debt:This facet reflects cash inflows from issuing bonds, loans, or other debt instruments. Securing debt financing provides capital for various purposes, including expansion projects, working capital needs, or acquisitions. For example, a rapidly growing company might issue bonds to finance the construction of a new factory. The magnitude and frequency of debt issuance offer insights into a company’s financial leverage and its dependence on external funding.

- Repayment of Debt:Cash outflows related to principal repayments on existing debt obligations are recorded here. Consistent debt repayments demonstrate a company’s ability to manage its financial obligations and maintain a healthy debt profile. For instance, a company prioritizing debt reduction might signal a conservative financial strategy aimed at minimizing financial risk. Analyzing the balance between new debt issuance and repayments provides insights into the overall debt management strategy.

- Proceeds from Issuing Equity:This represents cash inflows from issuing new shares of stock. Equity financing provides capital without incurring debt obligations, but it dilutes existing ownership. A company issuing new shares might be raising capital for expansion, research and development, or acquisitions. The timing and volume of equity issuance can signal significant strategic initiatives and offer insights into management’s confidence in future growth prospects.

- Payment of Dividends:Cash outflows for dividend payments to shareholders represent a return on investment for equity holders. Consistent dividend payments can attract investors seeking income, but they also reduce retained earnings available for reinvestment. A company’s dividend policy reflects its approach to balancing shareholder returns with internal growth opportunities. Analyzing dividend payments alongside other financing activities provides a comprehensive understanding of capital allocation priorities.

Analyzing financing activities in the IFRS cash flow statement provides critical context for understanding a company’s overall financial strategy and its implications for long-term sustainability. By examining the interplay between debt and equity financing, dividend policies, and other financing decisions, stakeholders can assess the company’s financial risk profile, its ability to meet future obligations, and its capacity for sustained growth. This analysis, combined with insights from operating and investing activities, delivers a holistic perspective crucial for informed investment decisions and comprehensive financial analysis.

5. Cash and Equivalents

Accurately defining and presenting “Cash and cash equivalents” is fundamental to a robust IFRS cash flow statement. This element represents the most liquid assets a company holds and forms the basis for analyzing changes in a company’s immediate financial resources. A clear understanding of what constitutes cash and equivalents is crucial for interpreting the statement’s overall liquidity position and its ability to meet short-term obligations.

- Cash on Hand:This comprises physical currency and readily available funds held in checking and savings accounts. Cash on hand represents the most basic form of liquidity and is immediately available for use in daily operations or to address immediate financial needs. Its inclusion within the cash flow statement provides a transparent view of readily accessible funds.

- Demand Deposits:These are bank deposits that can be withdrawn on demand without any notice or penalty. They function similarly to cash on hand, providing immediate access to funds. Demand deposits are crucial for managing day-to-day transactions and maintaining operational flexibility. Their inclusion within cash and equivalents ensures a comprehensive view of immediately available resources.

- Short-Term, Highly Liquid Investments:These investments, readily convertible to known amounts of cash and subject to an insignificant risk of changes in value, typically have short maturities, often three months or less. Examples include money market funds, treasury bills, and commercial paper. Their inclusion emphasizes the readily available nature of these assets, contributing to a more accurate depiction of short-term liquidity.

- Exclusions from Cash Equivalents:Certain liquid assets are excluded from the definition of cash equivalents due to their inherent investment nature and potential volatility. These typically include longer-term investments, restricted cash, and assets held for trading or other non-operational purposes. This distinction ensures that the “Cash and equivalents” figure accurately reflects assets readily available for immediate use, excluding funds earmarked for other strategic purposes.

The precise definition and presentation of “Cash and equivalents” within the IFRS framework ensures comparability and transparency in financial reporting. This clarity allows stakeholders to accurately assess a company’s liquidity position, its ability to meet short-term obligations, and its overall financial health. Understanding the components and nuances of this section is crucial for informed decision-making based on a comprehensive view of a company’s immediate financial resources. By accurately categorizing and reporting cash and equivalents, the IFRS cash flow statement provides critical insights into a companys short-term financial strength and its ability to navigate changing market conditions.

Key Components of an IFRS Cash Flow Statement

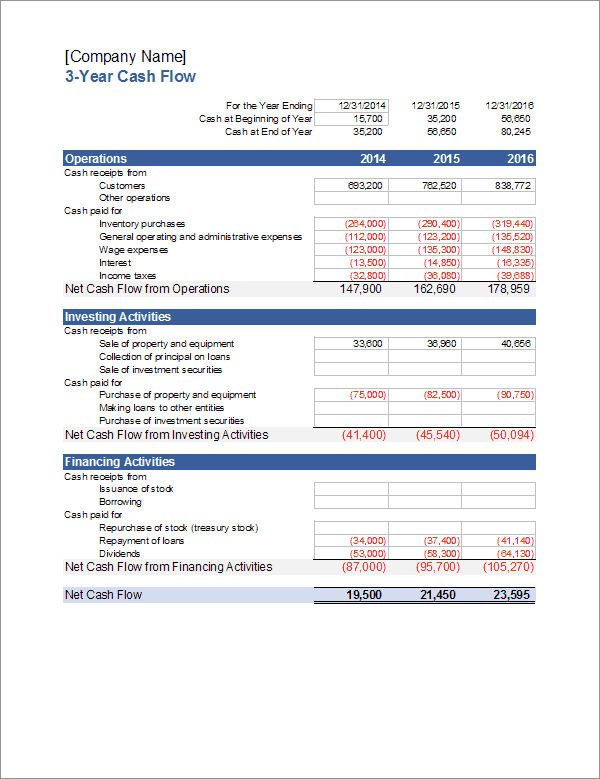

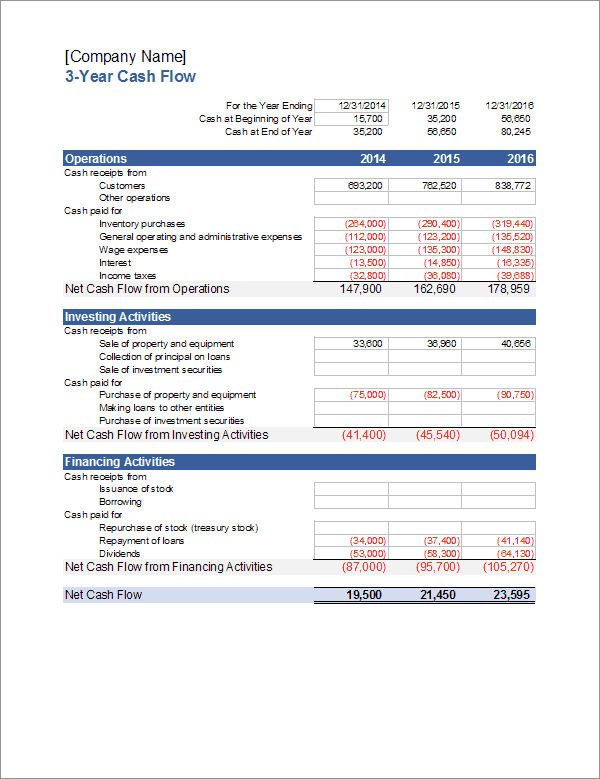

An IFRS cash flow statement provides a comprehensive overview of a company’s cash inflows and outflows, categorized into key activities for enhanced analysis. Understanding these components is crucial for assessing financial performance and liquidity.

1. Operating Activities: These represent cash flows generated from the core business operations. This includes cash received from customers, payments to suppliers and employees, interest paid, and income taxes paid. Analyzing operating cash flow reveals a company’s ability to generate cash from its primary business activities.

2. Investing Activities: These activities involve the acquisition and disposal of long-term assets and investments. Key examples include purchasing or selling property, plant, and equipment, investments in other companies, and lending activities. Cash flows from investing activities provide insights into a company’s capital allocation strategy and its focus on long-term growth.

3. Financing Activities: Financing activities reflect how a company obtains and manages its capital. This encompasses proceeds from issuing debt or equity, repayment of debt, and payment of dividends. Analyzing these flows reveals a company’s capital structure and its approach to financing growth.

4. Cash and Cash Equivalents: This component represents the most liquid assets readily available for use. It includes cash on hand, demand deposits, and short-term, highly liquid investments. A clear understanding of cash and equivalents is fundamental for assessing a company’s short-term liquidity and its ability to meet immediate obligations.

5. Non-Cash Transactions: While not reflected in the cash flow figures, significant non-cash transactions are disclosed in a separate note. These transactions, such as the exchange of assets or the conversion of debt to equity, provide a more complete picture of a company’s financial activities. This disclosure enhances transparency and allows for a more comprehensive analysis of financial performance.

6. Reporting Period: The cash flow statement covers a specific period, typically a fiscal quarter or year. Comparing cash flow statements across different periods reveals trends and provides insights into a company’s evolving financial position. Analyzing these trends, along with the other components, allows stakeholders to assess the long-term sustainability of a company’s cash flows and its overall financial health. This temporal context is essential for a complete and meaningful interpretation of the statement.

A thorough analysis of these components provides a comprehensive understanding of a company’s financial performance, its sources and uses of cash, and its overall financial health. This understanding is crucial for stakeholders in making informed decisions about investment, lending, and other financial interactions with the company.

How to Create an IFRS Cash Flow Statement

Creating a compliant and informative IFRS cash flow statement requires a systematic approach. The following steps outline the process, ensuring adherence to IFRS standards and promoting clarity for stakeholders.

1. Determine the Reporting Period: Clearly define the specific period covered by the statement, whether it’s a quarter, a year, or another designated timeframe. This sets the boundaries for the data included in the statement.

2. Identify Cash and Cash Equivalents: Determine the balance of cash and cash equivalents at the beginning and end of the reporting period. This includes cash on hand, demand deposits, and short-term, highly liquid investments. Accurate categorization is crucial for assessing liquidity.

3. Analyze Operating Activities: Calculate net cash flow from operating activities using either the direct or indirect method. The direct method reports gross cash inflows and outflows, while the indirect method adjusts net income for non-cash items. Choosing the appropriate method depends on data availability and reporting preferences.

4. Analyze Investing Activities: Calculate net cash flow from investing activities. This involves recording cash flows related to the acquisition and disposal of long-term assets, investments in other entities, and lending activities. Accuracy in classifying these cash flows is essential for understanding capital allocation strategies.

5. Analyze Financing Activities: Determine net cash flow from financing activities, including proceeds from issuing debt or equity, repayment of debt, and payment of dividends. These flows provide insights into a company’s capital structure and financing decisions.

6. Calculate Net Increase/Decrease in Cash and Cash Equivalents: Sum the net cash flows from operating, investing, and financing activities to arrive at the net increase or decrease in cash and cash equivalents during the reporting period. This figure represents the overall change in a company’s readily available financial resources.

7. Reconcile Beginning and Ending Cash Balances: Reconcile the beginning cash balance with the net increase/decrease in cash and cash equivalents to arrive at the ending cash balance. This reconciliation ensures accuracy and completeness in reporting cash flows.

8. Disclose Non-Cash Investing and Financing Activities: Report significant non-cash investing and financing activities, such as asset exchanges or debt-to-equity conversions, in a separate note or supplementary schedule. This disclosure enhances transparency and provides a comprehensive view of financial activities not directly affecting cash flows.

Following these steps ensures a well-structured and informative IFRS cash flow statement that provides stakeholders with a clear understanding of a company’s financial performance, its sources and uses of cash, and its overall financial health. Accuracy and consistency in applying these principles are paramount for compliance and effective communication with investors and other stakeholders. This structured presentation facilitates informed decision-making and contributes to a transparent and reliable financial reporting process.

Standardized reporting of cash flows under IFRS provides crucial insights into an entity’s financial health, encompassing operational efficiency, investment strategies, and financing decisions. A structured approach, classifying cash flows into operating, investing, and financing activities, offers a transparent view of how a company generates and utilizes cash. Understanding the components of this structure, including the proper classification of cash and cash equivalents, is fundamental for interpreting the statement and assessing short-term liquidity and long-term solvency.

Accurate and consistent application of these principles promotes transparency and comparability across different entities, empowering stakeholders to make informed decisions. This rigorous framework fosters trust and stability within the financial ecosystem, contributing to a more robust and reliable global market. Continued adherence to these reporting standards remains essential for maintaining financial integrity and facilitating sound economic decision-making.