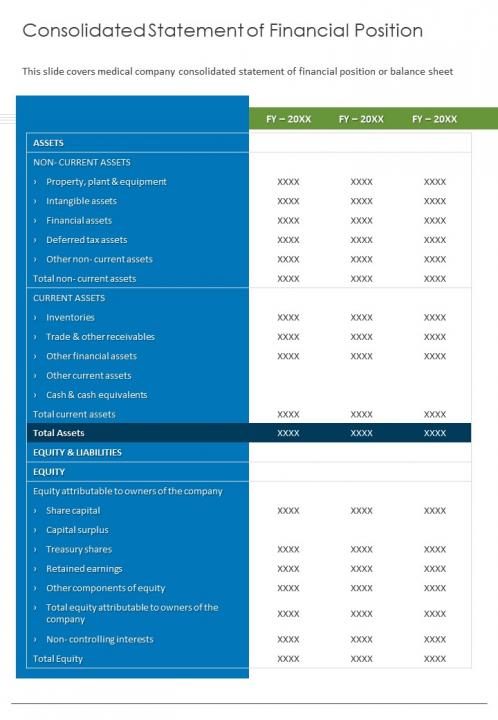

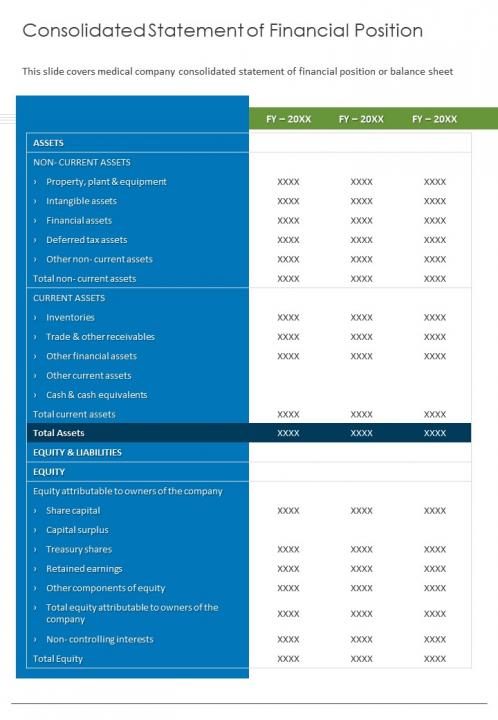

Utilizing such a pre-designed structure facilitates consistent reporting, simplifies complex financial data, and allows for efficient comparisons across reporting periods and between similar entities. This standardized approach enhances transparency for stakeholders, enabling informed decision-making by investors, creditors, and management. It streamlines the process of preparing complex financial reports and ensures compliance with reporting standards.

This foundation of understanding the structure and advantages of combined financial reporting prepares readers for a deeper exploration of specific topics, such as the intricacies of consolidation procedures, the analysis of key financial ratios, and the implications for strategic financial management.

1. Standardized Format

A standardized format is fundamental to the utility of a consolidated statement of financial position template. Consistency ensures comparability across reporting periods and between different corporate groups, enabling meaningful analysis and informed decision-making. This standardization facilitates efficient data aggregation and interpretation by stakeholders.

- Uniform Presentation of ElementsAll assets, liabilities, and equity components are presented in a predetermined order and with consistent labeling. This uniformity, often adhering to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS), allows for direct comparison and analysis of financial data. For example, current assets are always listed before non-current assets, ensuring consistent presentation across all consolidated statements.

- Defined Calculation MethodsSpecific methodologies dictate how figures are calculated and reported within the statement. For instance, the consolidation process itself, including the elimination of intercompany transactions, follows standardized procedures. This consistency prevents ambiguity and ensures the reliability of the presented information. An example would be the consistent application of the equity method for accounting for investments in associates.

- Prescribed Disclosure RequirementsTemplates often incorporate specific disclosure requirements mandated by accounting standards. These disclosures provide further context and detail, enhancing transparency and allowing stakeholders to gain a deeper understanding of the consolidated financial position. For example, disclosures related to contingent liabilities or significant accounting policies offer crucial insights.

- Facilitated Electronic Data InterchangeStandardized formatting enables seamless electronic data interchange and automated analysis. This facilitates efficient processing of large volumes of financial data, simplifies auditing procedures, and allows for integration with financial modeling and analysis tools. This is especially beneficial for large multinational corporations with complex financial structures.

These facets of standardization ensure that a consolidated statement of financial position template provides a reliable, comparable, and transparent representation of a group’s financial health. This consistent structure is essential for effective financial analysis, informed investment decisions, and regulatory compliance.

2. Combined Entities

The concept of “combined entities” is central to a consolidated statement of financial position template. This statement does not merely present the individual financial positions of separate legal entities; rather, it portrays the aggregate financial health of a parent company and its subsidiaries as a single economic unit. This aggregation necessitates specific accounting procedures to eliminate intercompany transactions and balances, preventing double-counting and ensuring an accurate reflection of the group’s overall position. For example, if a parent company loans money to a subsidiary, this loan and the corresponding receivable/payable are eliminated in the consolidated statement to avoid inflating both assets and liabilities.

The inclusion of all controlled subsidiaries within the consolidated statement is crucial for providing a complete and accurate picture of the group’s financial resources and obligations. Control is typically defined by ownership of more than 50% of the voting rights. However, other factors, such as contractual agreements, can also indicate control. Understanding the scope of consolidationwhich entities are included and whyis essential for interpreting the statement. For instance, a diversified conglomerate’s consolidated statement would encompass all its subsidiaries operating in various sectors, offering a holistic view of the group’s financial strength despite the differing performances of individual segments. Conversely, excluding a significant subsidiary from consolidation, even if technically permissible under accounting standards, could mislead stakeholders about the true financial position of the group.

Properly consolidating combined entities within the template provides stakeholders with a comprehensive overview of the group’s assets, liabilities, and equity. This aggregated perspective enables more informed assessments of financial health, risk exposure, and future prospects. Challenges may arise in complex corporate structures with numerous subsidiaries or varying reporting periods. However, adhering to established accounting standards and utilizing a well-designed template ensures consistent and transparent reporting, promoting accurate interpretation and facilitating sound financial analysis.

3. Specific Point in Time

A consolidated statement of financial position provides a snapshot of a group’s financial health at a specific point in time, typically the end of a reporting period. This time-bound nature is crucial for understanding the information presented. Financial positions are dynamic, constantly fluctuating due to business operations, market conditions, and other factors. Therefore, the statement reflects the combined assets, liabilities, and equity of the parent company and its subsidiaries only at that specified moment. For example, a statement dated December 31, 2024, presents the group’s financial position on that date, and not on any date before or after. This differs from statements of comprehensive income or cash flow, which cover a period.

The specific point in time aspect allows for comparisons across different reporting periods, enabling analysis of trends and performance over time. Comparing consecutive year-end statements reveals changes in the group’s financial position, providing insights into growth, profitability, and financial stability. For instance, an increase in total assets from one year-end to the next could indicate expansion or successful investments. Conversely, a decrease in equity might signal losses or dividend distributions. Analyzing these changes over time provides a deeper understanding of the group’s financial trajectory.

Understanding the time-bound nature of this statement is fundamental for accurate interpretation and analysis. While the statement offers valuable insights into a group’s financial health at a specific moment, it does not predict future performance. Subsequent events, market fluctuations, and business decisions can significantly impact the group’s financial position. Therefore, using this statement in conjunction with other financial reports and forward-looking information provides a more comprehensive understanding of the group’s financial outlook.

4. Assets, Liabilities, Equity

The core of a consolidated statement of financial position template lies in the presentation of assets, liabilities, and equity. These three fundamental elements provide a comprehensive overview of a group’s financial health, detailing what the group owns, what it owes, and the residual interest of its owners. A clear understanding of these components and their interrelationships is essential for interpreting the statement and assessing the group’s financial standing.

- AssetsAssets represent resources controlled by the group as a result of past events and from which future economic benefits are expected to flow to the group. Examples include cash, accounts receivable, inventory, property, plant, and equipment, and intangible assets. Within a consolidated statement, these assets represent the combined resources of the parent company and its subsidiaries, after eliminating any intercompany balances. The nature and composition of a group’s assets offer insights into its operational capabilities, investment strategies, and potential for future growth. For instance, a significant investment in research and development might indicate a focus on innovation, while a large proportion of current assets could suggest strong liquidity.

- LiabilitiesLiabilities represent present obligations of the group arising from past events, the settlement of which is expected to result in an outflow from the group of resources embodying economic benefits. Examples include accounts payable, loans, bonds, and deferred revenue. In a consolidated statement, liabilities represent the combined obligations of the parent and its subsidiaries, again after eliminating intercompany balances. Analyzing liabilities provides insights into a group’s financial leverage, its dependence on external financing, and its short-term and long-term payment obligations. A high debt-to-equity ratio, for example, could signal higher financial risk.

- EquityEquity represents the residual interest in the assets of the group after deducting all its liabilities. It reflects the owners’ stake in the group. Components of equity typically include share capital, retained earnings, and other reserves. Within the consolidated statement, equity represents the combined ownership interest in the parent and its subsidiaries. Changes in equity over time reflect the impact of profits, losses, dividends, and other comprehensive income items. A growing equity balance often indicates sustained profitability and reinvestment in the business.

- The Accounting EquationThe fundamental accounting equation, Assets = Liabilities + Equity, underpins the structure of the consolidated statement of financial position. This equation highlights the interconnectedness of these three elements. Any change in one element must be accompanied by a corresponding change in at least one other element to maintain balance. For example, an increase in assets through borrowing will also increase liabilities, while an increase in assets through profitable operations will increase equity. Understanding this relationship is crucial for interpreting the overall financial health of the group as presented in the consolidated statement.

By presenting assets, liabilities, and equity in a structured format, the consolidated statement of financial position template offers a concise yet comprehensive overview of a group’s financial health at a specific point in time. Analyzing these interconnected elements allows stakeholders to assess the group’s financial strength, leverage, liquidity, and overall financial performance, providing a foundation for informed decision-making.

5. Group Financial Health

Assessing the financial health of a corporate group requires a holistic view that considers the interconnected operations of the parent company and its subsidiaries. A consolidated statement of financial position template provides this comprehensive perspective by aggregating the financial information of all controlled entities, presenting a single, unified snapshot of the group’s assets, liabilities, and equity. This aggregated view is essential for evaluating the overall financial strength, stability, and performance of the group as a whole, rather than simply evaluating individual entities in isolation. This comprehensive perspective facilitates informed decision-making by investors, creditors, and management.

- Liquidity and SolvencyLiquidity refers to a group’s ability to meet its short-term obligations, while solvency reflects its long-term ability to meet all obligations. The consolidated statement allows stakeholders to assess these crucial aspects of financial health by analyzing the relationship between current assets and current liabilities (liquidity) and the relationship between total assets and total liabilities (solvency). For example, a group with a high current ratio (current assets divided by current liabilities) is generally considered to have strong liquidity, while a low debt-to-asset ratio suggests sound solvency. These insights are crucial for evaluating the group’s ability to withstand financial challenges and continue operations.

- Financial Leverage and RiskFinancial leverage refers to the extent to which a group uses debt financing. The consolidated statement reveals the group’s debt levels and its reliance on external funding. Analyzing the debt-to-equity ratio provides insights into the group’s financial risk profile. A high debt-to-equity ratio indicates higher financial leverage, which can amplify both profits and losses. While leverage can boost returns, it also increases the risk of financial distress if the group’s operating performance deteriorates. Understanding the group’s leverage and associated risks is critical for evaluating its financial stability and potential for future growth. For example, a heavily leveraged group in a cyclical industry may face significant challenges during economic downturns.

- Operational Efficiency and PerformanceWhile the consolidated statement of financial position provides a snapshot at a specific point in time, it can also offer insights into a group’s operational efficiency when analyzed in conjunction with other financial statements, such as the income statement and cash flow statement. Examining trends in asset turnover ratios, for example, can reveal how effectively the group utilizes its assets to generate revenue. A high asset turnover ratio suggests efficient asset utilization. Furthermore, changes in working capital components, such as inventory and accounts receivable, can indicate improvements or deteriorations in operational efficiency. Integrating the information from the consolidated statement with other financial data provides a more complete picture of the group’s operational performance.

- Capital Structure and OwnershipThe equity section of the consolidated statement reveals the group’s capital structure, including the contributions from shareholders and retained earnings. This information is essential for understanding the ownership structure and the distribution of profits within the group. Changes in the equity section over time reflect the impact of profitability, dividend payments, share repurchases, and other factors. Analyzing these changes provides insights into the group’s financial strategies and its commitment to returning value to shareholders. For example, a consistent increase in retained earnings might indicate a focus on reinvesting profits for future growth.

The consolidated statement of financial position template, therefore, serves as a critical tool for evaluating group financial health. By providing a consolidated view of assets, liabilities, and equity, it facilitates a comprehensive assessment of liquidity, solvency, leverage, operational efficiency, and capital structure. This holistic perspective is invaluable for stakeholders seeking to understand the true financial standing and potential of a complex corporate group. This understanding is essential for making informed investment decisions, assessing creditworthiness, and developing effective financial strategies.

Key Components of a Consolidated Statement of Financial Position Template

A consolidated statement of financial position template provides a structured framework for presenting the combined financial position of a parent company and its subsidiaries. Understanding its key components is crucial for accurate interpretation and analysis.

1. Standardized Format: A predefined structure ensures consistency and comparability. This includes uniform presentation of assets, liabilities, and equity, defined calculation methods, prescribed disclosure requirements, and facilitated electronic data interchange.

2. Combined Entities: The template consolidates the financial information of the parent company and all controlled subsidiaries, presenting them as a single economic unit. Intercompany transactions and balances are eliminated to prevent double-counting.

3. Specific Point in Time: The statement represents the group’s financial position at a specific date, typically the end of a reporting period. This snapshot allows for comparisons across different periods to analyze trends and performance.

4. Assets: These represent resources controlled by the group from which future economic benefits are expected. Examples include cash, receivables, inventory, and fixed assets. Consolidated assets represent the combined resources of the parent and subsidiaries, net of intercompany eliminations.

5. Liabilities: These represent present obligations of the group arising from past events. Examples include payables, loans, and deferred revenue. Consolidated liabilities reflect the combined obligations of the group.

6. Equity: This represents the residual interest in the assets of the group after deducting all liabilities. It reflects the owners’ stake in the group. The consolidated equity reflects the combined ownership interest in the parent and subsidiaries.

7. Accounting Equation: The fundamental accounting equation (Assets = Liabilities + Equity) underpins the structure of the statement. This equation must always balance, reflecting the interconnectedness of these three elements.

8. Disclosures: Accompanying notes provide additional context and details about accounting policies, significant transactions, and other relevant information crucial for understanding the consolidated financial position.

These interconnected components provide a comprehensive and standardized view of a corporate groups financial health at a specific moment in time, enabling informed analysis and decision-making.

How to Create a Consolidated Statement of Financial Position Template

Creating a robust template requires careful consideration of accounting principles and reporting standards. A well-designed template ensures consistency, accuracy, and transparency in presenting the consolidated financial position of a corporate group.

1. Define the Reporting Entity: Clearly identify the parent company and all subsidiaries to be included in the consolidation. Control is typically determined by ownership of more than 50% of voting rights, but other factors may also indicate control. This definition establishes the scope of the consolidated financial statement.

2. Establish a Reporting Date: Specify the date for which the financial position will be reported. This date is typically the end of a reporting period, such as a fiscal quarter or year-end. The consolidated statement provides a snapshot of the group’s financial health at this specific point in time.

3. Develop a Standardized Format: Create a template with clearly defined sections for assets, liabilities, and equity. Follow a consistent order and labeling convention for each element within these sections. Adhering to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS) ensures compliance and comparability.

4. Incorporate Intercompany Eliminations: Design the template to facilitate the elimination of intercompany transactions and balances. This crucial step prevents double-counting and ensures an accurate representation of the group’s financial position. Clear instructions and formulas within the template can automate this process.

5. Include Disclosure Requirements: Incorporate necessary disclosures mandated by accounting standards. These disclosures provide additional context and detail regarding accounting policies, significant transactions, and other relevant information. This enhances transparency and allows for a more comprehensive understanding.

6. Implement Data Validation and Controls: Build data validation rules and internal controls within the template to ensure data accuracy and integrity. This reduces the risk of errors and enhances the reliability of the consolidated financial information.

7. Allow for Currency Conversion: If subsidiaries operate in different currencies, incorporate mechanisms for currency conversion into the template. This ensures consistent reporting in a single currency and facilitates meaningful comparisons across the group.

8. Facilitate Electronic Data Interchange: Design the template to enable seamless electronic data interchange and automated reporting. This streamlines the consolidation process, improves efficiency, and reduces the risk of manual errors. Consider compatibility with various software systems.

A well-designed consolidated statement of financial position template provides a structured and transparent view of a group’s financial health. Adherence to accounting standards, robust data validation, and clear disclosure requirements ensures the accuracy and reliability of the consolidated financial information, enabling informed decision-making by stakeholders.

A consolidated statement of financial position template provides a crucial framework for understanding the overall financial health of a corporate group. By consolidating the financial information of the parent company and its controlled subsidiaries into a single, unified document, this template offers a clear and comprehensive snapshot of the group’s assets, liabilities, and equity at a specific point in time. Standardized formatting, adherence to accounting principles, and robust disclosure requirements ensure comparability, transparency, and accuracy. This structured approach facilitates informed analysis of key financial metrics, enabling stakeholders to assess liquidity, solvency, leverage, and overall financial performance.

Accurate and accessible consolidated financial information is paramount for effective financial management, strategic decision-making, and fostering trust among stakeholders. As business structures continue to evolve in complexity and global interconnectedness, the importance of a well-designed and diligently implemented consolidated statement of financial position template remains paramount. Continued focus on standardization, transparency, and robust data governance practices will further enhance the utility of these crucial financial reports in navigating the complexities of the modern business landscape.