Utilizing such a document offers several advantages, including simplified budget monitoring, improved financial planning, and readily available data for tax preparation or loan applications. This facilitates proactive financial management and allows for timely adjustments to strategies or spending habits.

The following sections delve deeper into the specific components, creation methods, and practical applications of these crucial financial summaries.

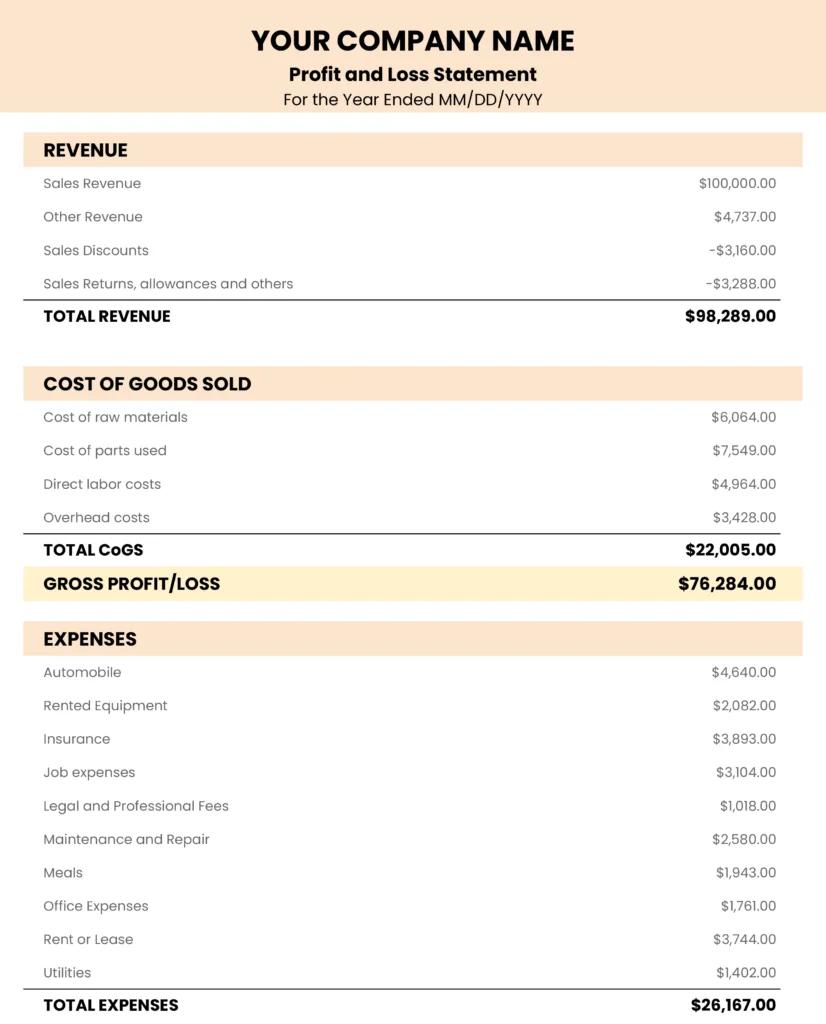

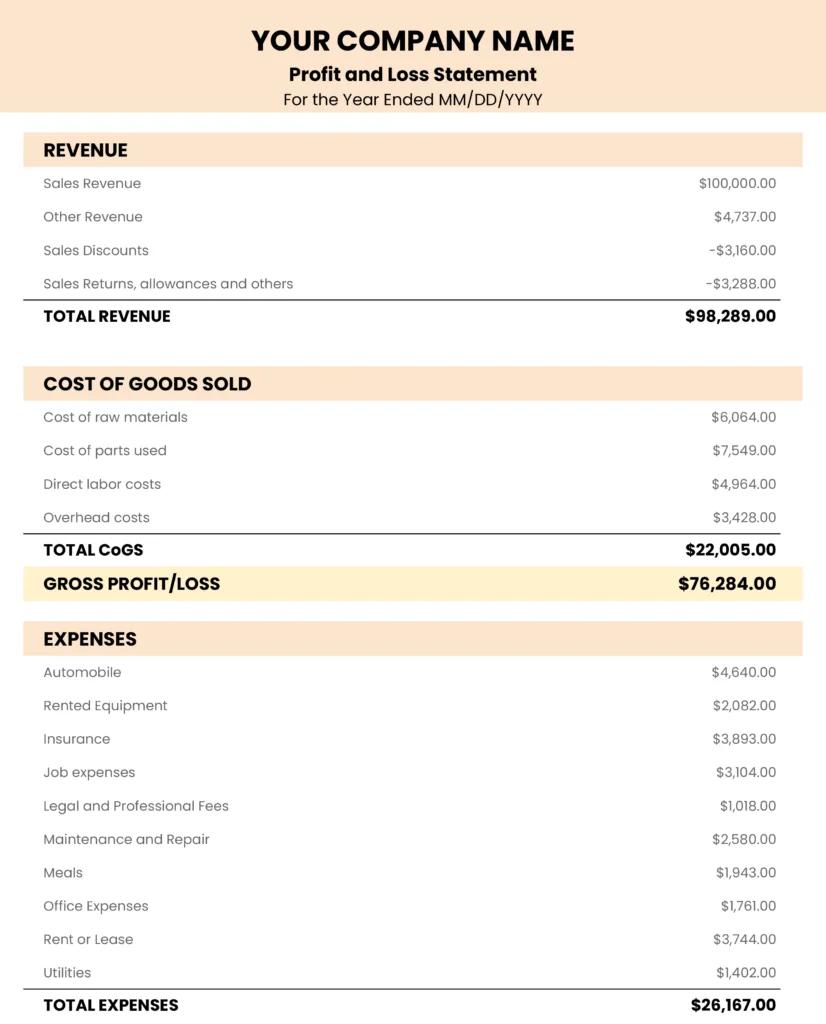

1. Revenue

Revenue, a crucial component of a year-to-date earnings statement template, represents the total income generated from business activities within a specified period. Accurate revenue reporting provides the foundation for profitability analysis and informed financial decision-making. Understanding its various facets is essential for comprehensive financial assessment.

- Sales RevenueSales revenue constitutes the primary income source for most businesses, generated from the sale of goods or services. This figure, tracked chronologically within the statement, reflects core business performance. For instance, a retailer’s sales revenue might fluctuate seasonally, offering insights into consumer behavior and informing inventory management strategies.

- Other RevenueBeyond core sales, other revenue streams, such as interest income or licensing fees, contribute to overall financial performance. These supplementary sources are itemized separately in the statement, providing a more granular view of income generation. For example, a software company might list revenue from software licenses and maintenance contracts separately to understand each segment’s contribution.

- Gross Revenue vs. Net RevenueGross revenue represents the total income before deductions, while net revenue accounts for returns, allowances, and discounts. This distinction is critical for accurate profitability calculations. A high gross revenue with substantial returns might indicate product quality issues or ineffective pricing strategies, ultimately impacting net revenue and profitability.

- Revenue RecognitionRevenue recognition principles determine when revenue is recorded in financial statements. Adhering to consistent accounting standards ensures accurate financial reporting and comparability across periods. For example, a subscription-based service recognizes revenue over the subscription period, not just at the point of sale, providing a more realistic representation of income flow.

Accurately capturing and analyzing these revenue facets within a year-to-date earnings statement template provides a clear picture of financial performance, enabling strategic decision-making, effective resource allocation, and informed future planning.

2. Expenses

Accurate expense tracking is crucial for a comprehensive understanding of financial performance within a year-to-date earnings statement template. Expenses represent the outflow of funds incurred in generating revenue and operating a business. Categorizing and analyzing these outflows offers critical insights into cost structures, profitability, and opportunities for optimization.

- Cost of Goods Sold (COGS)COGS represents the direct costs associated with producing goods sold by a business. This includes raw materials, direct labor, and manufacturing overhead. For a manufacturing company, accurately tracking COGS is essential for determining gross profit margins and pricing strategies. Fluctuations in COGS can significantly impact profitability, highlighting the need for efficient inventory management and production processes.

- Operating ExpensesOperating expenses encompass the costs incurred in running the day-to-day business operations. These include rent, salaries, marketing, and administrative expenses. Analyzing operating expenses reveals insights into efficiency and areas for potential cost reduction. For instance, a significant increase in marketing spend without a corresponding rise in revenue might warrant a review of marketing campaign effectiveness.

- Interest ExpenseInterest expense reflects the cost of borrowing money. This is particularly relevant for businesses utilizing debt financing. Monitoring interest expense helps assess the impact of financing decisions on overall profitability. High interest payments might necessitate exploring refinancing options or adjusting capital structure.

- Tax ExpenseTax expense represents the amount owed in taxes based on taxable income. Understanding tax liabilities is crucial for financial planning and compliance. Effective tax planning strategies can minimize tax burdens and optimize financial outcomes. Variations in tax rates or regulations can significantly impact a company’s bottom line.

By meticulously tracking and categorizing these expense components within a year-to-date earnings statement template, businesses gain a clearer understanding of their cost structure, enabling informed decisions regarding pricing, resource allocation, and long-term financial planning. This detailed expense analysis allows for proactive identification of potential cost-saving measures and facilitates strategic adjustments to maximize profitability and ensure financial sustainability.

3. Profitability

Profitability, a core objective of any business, represents the ability to generate earnings exceeding expenses. A year-to-date earnings statement template provides a crucial mechanism for assessing and tracking profitability over a specific period. This connection is fundamental to understanding financial performance and making informed business decisions. The statement allows for calculation of key profitability metrics such as gross profit, operating profit, and net profit, offering a comprehensive view of financial health. For example, a consistent decline in net profit over several months, as revealed by the statement, might signal underlying operational issues requiring immediate attention.

Analyzing profitability within the context of a year-to-date earnings statement involves comparing revenue against expenses to determine the net income or loss. This analysis can reveal trends, identify areas for improvement, and inform strategic planning. For instance, a company experiencing rising operating expenses despite steady revenue growth can utilize the statement to pinpoint specific cost drivers and implement cost-control measures. Furthermore, comparing year-to-date profitability against previous periods or industry benchmarks provides valuable context for evaluating performance and setting realistic financial goals. A software company, for example, might compare its year-to-date gross profit margin against industry averages to assess its pricing strategy and competitive positioning.

Understanding the relationship between profitability and a year-to-date earnings statement template is essential for effective financial management. This understanding enables stakeholders to assess financial health, identify areas for improvement, and make data-driven decisions to enhance profitability. Consistent monitoring and analysis of the statement facilitates proactive adjustments to business strategies, ultimately contributing to long-term financial sustainability. Challenges may include accurately categorizing expenses and ensuring data integrity within the statement. However, addressing these challenges through robust accounting practices and data validation procedures strengthens the reliability of profitability analysis and enhances its value in guiding strategic decision-making.

4. Time Period

The “time period” component is fundamental to a year-to-date earnings statement template, defining the specific timeframe for reported financial data. This period always begins at the start of the fiscal year and extends to a specified date, hence the term “year-to-date.” Understanding this temporal aspect is crucial for accurate interpretation and analysis. For example, a year-to-date statement generated on June 30th would reflect financial performance from January 1st to June 30th of that year. This differs from a standard annual statement, which covers a full fiscal year. The specific time period dictates the data included in the statement, enabling tracking of performance trends and facilitating comparisons across different periods. A retailer might use a year-to-date statement ending in December to analyze holiday sales performance, while a statement ending in March might inform quarterly tax estimations. This distinction allows for timely adjustments to business strategies based on current performance data.

The defined time period facilitates analysis of financial progress and identification of potential issues or opportunities. Comparing year-to-date performance against previous years’ corresponding periods can reveal significant trends and inform forecasting. For instance, a manufacturing company experiencing lower year-to-date revenue compared to the same period last year might investigate potential causes such as supply chain disruptions or decreased market demand. This analysis provides valuable insights for proactive decision-making and strategic adjustments. Moreover, understanding the time period is essential for regulatory compliance. Tax authorities and other regulatory bodies often require financial reports for specific periods, making the accurate time period designation within the statement critically important.

Accurate time period specification within the year-to-date earnings statement is paramount for meaningful analysis and informed decision-making. Challenges may include data integrity and consistency across reporting periods. Implementing robust data validation processes and adhering to consistent accounting principles mitigate these challenges, ensuring the reliability and comparability of financial data over time. This rigor allows stakeholders to effectively utilize the statement for performance evaluation, strategic planning, and compliance with regulatory requirements, contributing to a more comprehensive and robust understanding of financial health.

5. Standardized Format

A standardized format is essential for year-to-date earnings statement templates, ensuring consistency, comparability, and ease of interpretation. This standardized structure facilitates clear communication of financial information to stakeholders, including investors, lenders, and management. Consistency in reporting allows for accurate trend analysis and performance evaluation over time. For example, using a consistent format for revenue recognition across multiple reporting periods allows for accurate assessment of revenue growth or decline, independent of any changes in accounting practices. A standardized format also simplifies comparisons between different entities or against industry benchmarks. Imagine two companies in the same industry; standardized formats allow for direct comparison of their respective year-to-date performances, even if their internal accounting systems differ. This comparability is crucial for competitive analysis and benchmarking.

Adhering to a standardized format typically involves presenting financial data in a structured manner, with clearly defined sections for revenue, expenses, and profitability metrics. This structure allows stakeholders to quickly locate and interpret key information. Consistent terminology and accounting principles further enhance clarity and prevent misinterpretations. For instance, using standard accounting terminology for expenses like “Cost of Goods Sold” ensures consistent understanding across different businesses and analysts. This standardization also simplifies audits and ensures compliance with regulatory reporting requirements. A standardized template reduces the likelihood of errors and omissions, streamlining the audit process and reducing the risk of non-compliance penalties.

Utilizing a standardized format for year-to-date earnings statement templates offers significant practical advantages. It promotes transparency, enhances comparability, and streamlines financial analysis. However, challenges can arise in adapting standardized templates to unique business needs or industry-specific reporting requirements. Overcoming these challenges requires careful selection of appropriate templates and potential customization to ensure accurate and relevant financial reporting. Ultimately, a standardized approach strengthens the reliability and utility of year-to-date earnings statements as valuable tools for financial management and decision-making.

Key Components of a Year-to-Date Earnings Statement Template

A comprehensive understanding of financial performance requires a thorough grasp of the key components within a year-to-date earnings statement template. These components provide a structured framework for analyzing income, expenses, and overall profitability within a specific timeframe.

1. Reporting Period: The “year-to-date” aspect defines the timeframe covered by the statement, starting from the beginning of the fiscal year and ending on a specified date. This precise timeframe is crucial for accurate analysis and comparison.

2. Revenue: This section details all income generated during the reporting period, including sales revenue and other income streams. Accurate revenue reporting is fundamental to profitability assessment.

3. Cost of Goods Sold (COGS): For businesses selling goods, COGS represents the direct costs associated with production, including raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

4. Operating Expenses: This category encompasses all expenses incurred in running the business, such as rent, salaries, marketing, and administrative costs. Analyzing operating expenses provides insights into efficiency and cost management.

5. Other Expenses: Expenses not directly tied to operations, such as interest expense and tax expense, are categorized separately. These expenses contribute to the overall financial picture and impact net profitability.

6. Gross Profit: Calculated as revenue minus COGS, gross profit represents the profitability of core business operations before accounting for operating and other expenses.

7. Operating Profit: This metric reflects profitability after deducting operating expenses from gross profit. It provides a clearer picture of the business’s operational efficiency.

8. Net Profit: Representing the bottom line, net profit is calculated by subtracting all expenses, including taxes and interest, from revenue. This figure signifies the overall profitability of the business during the reporting period.

These interconnected components provide a structured representation of financial performance, enabling stakeholders to assess profitability, identify trends, and make informed decisions based on a clear understanding of income and expenses within a specific timeframe.

How to Create a Year-to-Date Earnings Statement Template

Creating a robust year-to-date earnings statement template requires careful planning and organization. A well-structured template ensures accurate financial reporting and facilitates informed decision-making. The following steps outline the process:

1: Define the Reporting Period: Specify the precise start and end dates for the year-to-date period. This ensures accurate data capture and facilitates comparisons across different periods. Clarity in the reporting period is fundamental for accurate analysis.

2: Establish Revenue Categories: Create distinct categories for different revenue streams, such as sales revenue, interest income, and other revenue sources. Clear categorization provides a granular view of income generation.

3: Outline Expense Categories: Develop a comprehensive list of expense categories, including cost of goods sold (COGS), operating expenses (e.g., rent, salaries, marketing), and other expenses (e.g., interest, taxes). Detailed expense categorization facilitates cost analysis and control.

4: Calculate Gross Profit: Deduct COGS from total revenue to arrive at gross profit. This metric reflects the profitability of core business operations before considering operating expenses.

5: Calculate Operating Profit: Subtract operating expenses from gross profit to determine operating profit. This reveals the profitability of the business after accounting for day-to-day operational costs.

6: Calculate Net Profit: Deduct all remaining expenses, including interest and taxes, from operating profit to arrive at net profit. This “bottom line” figure represents the overall profitability for the defined period.

7: Choose a Format and Layout: Select a clear and easy-to-understand format for presenting the information. Consider using a spreadsheet or accounting software to streamline calculations and data entry. A well-organized layout enhances readability and facilitates analysis.

8: Review and Refine: Regularly review and refine the template to ensure it remains relevant and accurately reflects the evolving needs of the business. Regular updates ensure the template remains a valuable tool for financial management.

A well-designed template provides a structured framework for capturing and analyzing financial data, enabling effective performance monitoring, informed decision-making, and proactive financial management. Regular review and refinement of the template ensure its continued relevance and accuracy, maximizing its value as a crucial tool for financial analysis and strategic planning.

Accurate and consistent utilization of a year-to-date earnings statement template provides crucial insights into financial performance within a defined period. Understanding its components, including revenue streams, expense categories, and profitability metrics, empowers stakeholders to make informed decisions based on concrete data. Standardized formatting ensures comparability and facilitates effective analysis of trends and potential areas for improvement. Regular review and refinement of these templates are essential for adapting to evolving business needs and maintaining accuracy in financial reporting.

Effective financial management hinges on the ability to analyze performance and adapt strategies proactively. Leveraging the insights provided by a well-structured year-to-date earnings statement template allows businesses to track progress toward financial goals, identify potential challenges, and make data-driven decisions that contribute to long-term sustainability and success. The meticulous tracking and analysis facilitated by these templates offer a crucial foundation for navigating the complexities of the financial landscape and achieving sustained growth.