Utilizing such a resource offers numerous advantages. Accessibility eliminates the need for manual calculations, reducing errors and saving time. The adjustable nature allows customization for specific business needs. Furthermore, readily available digital versions offer convenient tracking and analysis of financial data, ultimately contributing to better financial management and potential growth.

Understanding the structure and application of this tool is essential for effective financial analysis. The following sections will explore the key components in detail, offering practical guidance on how to leverage its capabilities for enhanced business performance.

1. Accessibility

Accessibility is a critical factor driving the utility of free fillable profit and loss statement templates. Removing barriers to essential financial tools empowers businesses to manage resources effectively, regardless of size or technical expertise. This accessibility translates into several key advantages:

- Cost-effectiveness:Eliminating the financial burden associated with proprietary software or professional accounting services allows businesses to allocate resources more strategically. Startups and small businesses, often operating with limited budgets, can leverage these free resources to gain crucial financial insights without significant upfront investment.

- Ease of Use:Templates typically feature intuitive interfaces and require minimal technical proficiency. This ease of use reduces the learning curve, enabling users to quickly generate and interpret financial statements. Pre-built formulas and clear instructions further simplify the process, minimizing the risk of errors.

- Availability:Free templates are readily available online, accessible 24/7 from any location with an internet connection. This eliminates geographical restrictions and allows for timely financial reporting, regardless of physical location or time zone. The ability to access and update financial data anytime, anywhere enhances flexibility and responsiveness.

- Device Compatibility:Many free templates are designed to be compatible across various devices, including computers, tablets, and smartphones. This cross-platform accessibility allows users to manage finances on the go, further enhancing convenience and responsiveness.

These facets of accessibility contribute significantly to the overall value proposition of free fillable profit and loss statement templates. By democratizing access to crucial financial management tools, these resources promote financial literacy and empower businesses to make informed decisions, fostering growth and stability.

2. Customizability

Customizability is a key feature of free fillable profit and loss statement templates, differentiating them from static, pre-printed forms. Adaptability to specific business needs ensures relevance and accuracy in financial reporting, ultimately leading to more effective financial management. Modifying these templates allows businesses to reflect unique operational structures and industry-specific requirements.

- Revenue Stream Specificity:Businesses can tailor revenue categories to match their particular income sources. For example, a consulting firm might categorize revenue by project type or client, while an e-commerce business might categorize by product line or sales channel. This granular approach facilitates more precise revenue tracking and analysis.

- Expense Categorization:Expense categories can be adjusted to reflect the specific cost structure of the business. A manufacturing company might include raw materials, labor, and factory overhead, while a software company might focus on research and development, marketing, and customer support. Customizable expense categories provide a clearer picture of where funds are allocated.

- Reporting Period Flexibility:Templates can be adapted to various reporting periods, whether monthly, quarterly, or annually. This flexibility allows businesses to align financial reporting with their internal planning cycles and external reporting requirements. Analyzing performance over different timeframes provides valuable insights into trends and seasonality.

- Integration with Other Tools:Some free templates offer compatibility with other software applications, such as spreadsheet programs or accounting software. This integration streamlines data transfer and reduces manual entry, further enhancing efficiency and accuracy in financial management. Data can be easily imported or exported for further analysis or reporting.

The customizability of these templates ensures accurate reflection of diverse business models, contributing to a more meaningful and actionable understanding of financial performance. This tailored approach empowers businesses to make informed decisions based on relevant and reliable financial data, fostering growth and long-term sustainability.

3. Accuracy

Accuracy in financial reporting is paramount for sound decision-making. Free fillable profit and loss statement templates, when used correctly, contribute significantly to maintaining accuracy in financial records. Automated calculations within these templates minimize the risk of human error inherent in manual calculations. This inherent accuracy provides a reliable foundation for assessing financial health, identifying trends, and making informed strategic decisions. For example, a business relying on manual calculations might miscalculate cost of goods sold, leading to an inaccurate gross profit margin. A template mitigates this risk through automated formulas.

Furthermore, the structured format of these templates ensures consistent data entry and categorization. Pre-defined fields for revenue streams, operating expenses, and other financial metrics promote standardized reporting, reducing inconsistencies that can arise from ad-hoc methods. This consistency is crucial for comparing performance across different periods and identifying areas for improvement. Consistent data entry also facilitates integration with other financial management tools, further enhancing accuracy and efficiency. Consider a business tracking marketing expenses across various platforms. A template ensures consistent categorization, enabling accurate assessment of overall marketing ROI.

Maintaining accurate financial records is not merely a bookkeeping exercise; it is a cornerstone of responsible financial management. Free fillable profit and loss statement templates provide accessible and efficient tools for achieving this accuracy. By minimizing errors, promoting consistency, and facilitating informed decision-making, these templates empower businesses to navigate the financial landscape with confidence and clarity. While templates contribute significantly to accuracy, proper data entry and regular review remain essential for ensuring data integrity and reliable financial analysis.

4. Time-saving

Time-saving is a significant advantage offered by free fillable profit and loss statement templates. Manual preparation of financial statements is a time-consuming process, often requiring meticulous calculations and data entry. Templates automate these tasks, freeing up valuable time for business owners and managers to focus on core operational activities, strategic planning, and growth initiatives. Consider a small business owner spending several hours each month manually calculating and compiling financial data. A template can reduce this time significantly, allowing the owner to focus on customer service or product development.

The automation provided by these templates extends beyond basic calculations. Many templates offer features like pre-filled formulas, automated data entry, and report generation, further streamlining the financial reporting process. This efficiency translates into tangible time savings, allowing businesses to generate financial reports quickly and easily, facilitating timely analysis and decision-making. For instance, a template can automatically calculate gross profit, operating income, and net income, eliminating the need for manual calculations and reducing the risk of errors. This efficiency is particularly crucial during tax season or when seeking funding, where timely and accurate financial reporting is essential.

In a competitive business environment, time is a precious resource. Free fillable profit and loss statement templates provide a practical solution for optimizing time management in financial reporting. By automating tedious tasks and streamlining the reporting process, these tools empower businesses to allocate time more strategically, focusing on activities that drive growth and profitability. Ultimately, the time saved translates into increased productivity and enhanced operational efficiency, contributing to the overall success and sustainability of the business. The streamlined reporting also facilitates more frequent analysis, enabling businesses to identify and address potential issues proactively.

5. Analysis-Ready

The inherent value of a free fillable profit and loss statement template extends beyond data entry and calculation; it lies in its ability to facilitate meaningful financial analysis. An analysis-ready format empowers businesses to extract actionable insights from financial data, driving informed decision-making and strategic planning. This capability transforms a simple reporting tool into a powerful instrument for understanding business performance and identifying opportunities for improvement.

- Comparative Analysis:Standardized formatting allows for easy comparison of financial performance across different reporting periods. Tracking trends in revenue, expenses, and profitability over time provides valuable context for evaluating current performance and projecting future outcomes. For example, comparing monthly revenue figures year-over-year can reveal seasonal patterns or identify the impact of specific marketing campaigns. This comparative analysis facilitates data-driven adjustments to business strategies.

- Ratio Analysis:Data from a completed template can be used to calculate key financial ratios, such as gross profit margin, operating profit margin, and net profit margin. These ratios provide deeper insights into profitability and operational efficiency, highlighting areas of strength and weakness. For instance, a declining gross profit margin might indicate rising production costs or increased competition, prompting investigation and corrective action.

- Trend Identification:Consistent data organization enables the identification of emerging trends in revenue and expenses. Recognizing these trends allows businesses to anticipate future challenges and opportunities, proactively adjusting strategies to maximize profitability and minimize risk. A consistent upward trend in customer acquisition cost, for example, might signal the need to re-evaluate marketing strategies or explore alternative customer acquisition channels.

- Performance Benchmarking:Data from a profit and loss statement can be used to benchmark performance against industry averages or competitors. This benchmarking provides valuable context for evaluating relative performance and identifying areas where the business excels or requires improvement. Understanding industry benchmarks can motivate strategic initiatives to enhance competitive advantage and market positioning.

The analysis-ready nature of these templates transforms raw financial data into actionable insights. By facilitating comparative analysis, ratio calculations, trend identification, and performance benchmarking, these templates empower businesses to move beyond simple reporting and engage in meaningful financial analysis. This analytical capability is crucial for informed decision-making, strategic planning, and ultimately, long-term business success. Leveraging these analytical capabilities allows businesses to not only understand their past performance but also to anticipate future challenges and capitalize on emerging opportunities.

6. Financial Clarity

Financial clarity, a critical outcome of effective financial management, is intrinsically linked to the utilization of free fillable profit and loss statement templates. These templates provide a structured framework for organizing financial data, transforming raw numbers into a coherent narrative of business performance. This organized presentation of revenue, expenses, and profitability fosters a deeper understanding of the financial health of an organization, enabling informed decision-making at all levels. Without a clear picture of financial performance, businesses operate in a state of uncertainty, hindering strategic planning and potentially leading to financial instability. A template provides the structure necessary to achieve this clarity, illuminating the financial landscape and empowering informed action. For example, a business struggling with declining profitability can utilize a profit and loss statement to pinpoint specific areas of concern, such as rising material costs or declining sales, enabling targeted interventions.

The accessibility and ease of use of these templates further contribute to financial clarity. readily available and requiring minimal technical expertise, they empower individuals and organizations to take control of their financial data. This accessibility democratizes financial understanding, enabling business owners, managers, and stakeholders to readily interpret financial information and participate in strategic discussions. The ability to generate accurate and up-to-date financial statements on demand fosters a culture of transparency and accountability, promoting trust and collaboration within an organization. Consider a startup seeking funding from investors. A clear and concise profit and loss statement generated from a template can effectively communicate the company’s financial health and growth potential, enhancing credibility and increasing the likelihood of securing investment.

In conclusion, financial clarity emerges as a direct consequence of utilizing free fillable profit and loss statement templates. These templates provide the structure, accessibility, and analytical framework necessary to transform raw financial data into actionable insights. This enhanced understanding empowers informed decision-making, strategic planning, and ultimately, sustainable growth. While the template itself provides a crucial tool, consistent and accurate data entry remains essential for realizing the full potential of these resources and achieving true financial clarity. This clarity empowers businesses to navigate the complexities of the financial landscape with confidence, fostering stability and long-term success.

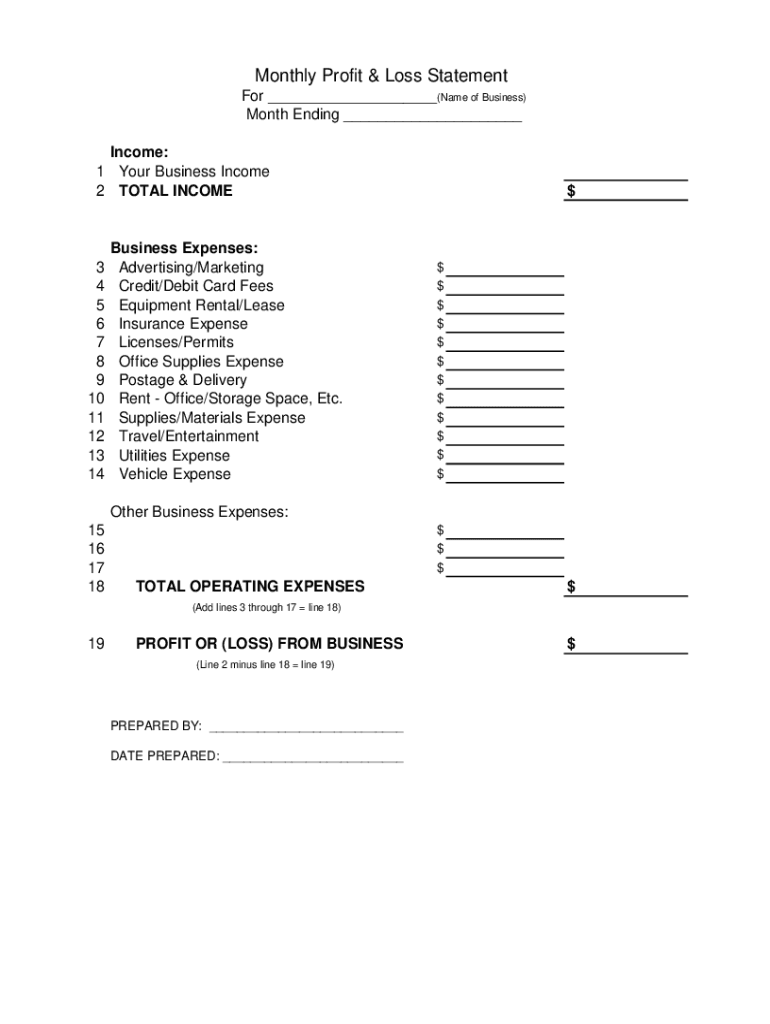

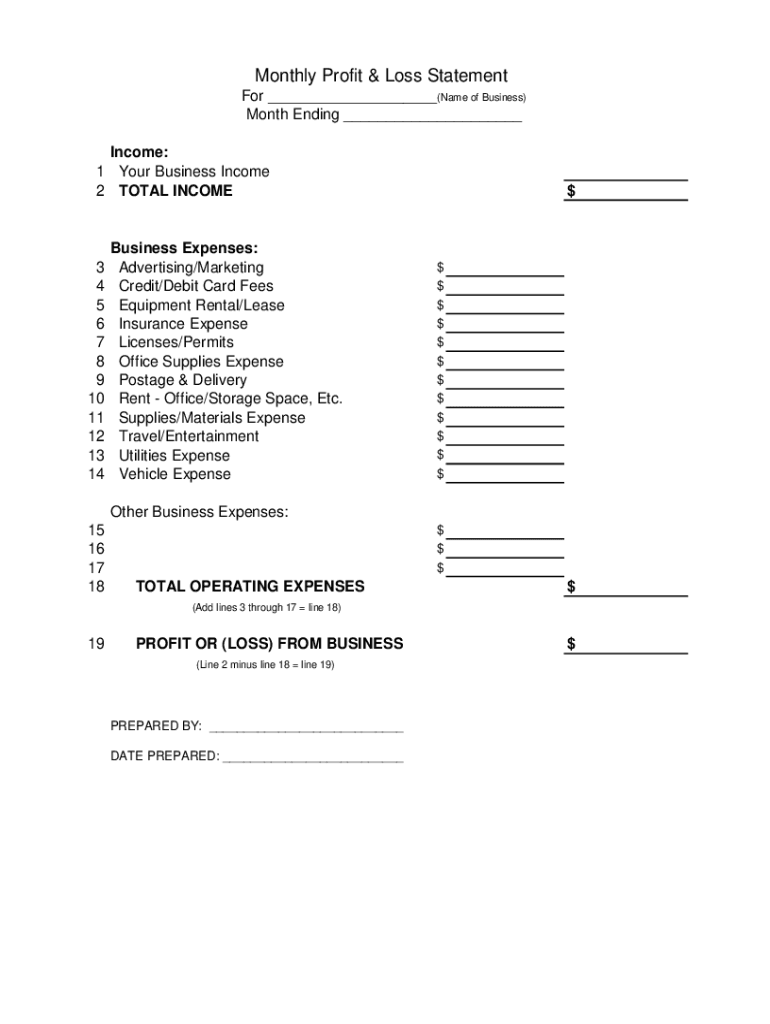

Key Components of a Profit and Loss Statement

Understanding the core components of a profit and loss statement is essential for accurate financial analysis and informed decision-making. Each element contributes to a comprehensive overview of a company’s financial performance over a specific period.

1. Revenue: This section details all income generated from business activities. It typically includes sales revenue, interest income, and other income streams. Accuracy in recording revenue is crucial for assessing overall financial performance. Different revenue streams should be clearly categorized for detailed analysis.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or services sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit reflects the profitability of core business operations before accounting for operating expenses. Analyzing gross profit trends can reveal insights into pricing strategies and production efficiency.

4. Operating Expenses: This section encompasses all costs incurred in running the business, excluding COGS. Examples include salaries, rent, marketing expenses, and administrative costs. Categorizing operating expenses allows for detailed analysis of spending patterns and cost control measures.

5. Operating Income: Derived by subtracting operating expenses from gross profit, operating income reflects the profitability of the business after accounting for day-to-day operating costs. This metric is a key indicator of operational efficiency and management effectiveness.

6. Other Income/Expenses: This section captures income or expenses not directly related to core business operations, such as interest income, investment gains or losses, and one-time expenses. Including these items provides a more comprehensive picture of overall financial performance.

7. Net Income: Representing the bottom line, net income is calculated by adding other income and subtracting other expenses from operating income. This figure indicates the overall profit or loss generated by the business during the specified period. Net income is a crucial indicator of financial health and sustainability.

Careful analysis of these interconnected components provides a comprehensive understanding of financial performance, enabling informed decision-making and strategic planning for future growth and profitability. Regular review and analysis of these elements are crucial for maintaining financial health and achieving long-term business objectives.

How to Create a Free Fillable Profit and Loss Statement Template

Creating a free fillable profit and loss statement template involves structuring a digital spreadsheet to automatically calculate key financial metrics. This process enables efficient and accurate financial reporting for businesses of all sizes.

1. Choose a Spreadsheet Software: Select a spreadsheet program like Google Sheets or Microsoft Excel. These programs offer the necessary functionalities for creating formulas and formatting data.

2. Establish Reporting Period: Define the timeframe for the statement (e.g., monthly, quarterly, or annually). This ensures consistency and allows for accurate performance comparison over time.

3. Create Revenue Section: Designate cells for various revenue streams. Include labels for each revenue category (e.g., product sales, service fees, interest income). Implement formulas to sum individual revenue streams for a total revenue figure.

4. Develop Cost of Goods Sold (COGS) Section: Allocate cells for direct costs associated with producing goods or services. Categorize costs (e.g., raw materials, direct labor) and use formulas to calculate total COGS.

5. Calculate Gross Profit: Dedicate a cell to calculate gross profit by subtracting COGS from total revenue. This metric provides insight into the profitability of core business operations.

6. Outline Operating Expenses: Create cells for various operating expense categories (e.g., rent, salaries, marketing). Sum these expenses to calculate total operating expenses.

7. Determine Operating Income: Dedicate a cell to calculate operating income by subtracting total operating expenses from gross profit. This metric reveals profitability after accounting for operational costs.

8. Incorporate Other Income/Expenses: Include sections for non-operational income and expenses (e.g., interest income, investment gains/losses). Sum these figures separately.

9. Calculate Net Income: Create a cell to calculate net income by adding other income and subtracting other expenses from operating income. This crucial metric reflects the overall profit or loss.

10. Implement Formulas and Formatting: Utilize spreadsheet formulas to automate calculations. Format the template for clarity and readability. Use clear labels, consistent formatting, and potentially conditional formatting to highlight key figures.

11. Testing and Refinement: Input sample data to thoroughly test all formulas and ensure accurate calculations. Refine the template as needed based on testing results and specific business requirements.

A well-structured template ensures accurate calculation of key financial metrics, facilitating insightful analysis and informed financial decisions. Regularly reviewing and updating the template ensures ongoing accuracy and relevance.

Access to free fillable profit and loss statement templates represents a significant advantage for businesses seeking to enhance financial management practices. These readily available resources provide a structured framework for recording, calculating, and analyzing financial performance. From streamlining data entry and automating calculations to facilitating comparative analysis and trend identification, these templates empower informed decision-making and strategic planning. Key benefits include improved accuracy, significant time savings, enhanced accessibility, and the ability to customize reports to reflect unique business needs. Understanding the core components of a profit and loss statement, coupled with the effective utilization of these free resources, equips businesses with the tools necessary to navigate the complexities of financial reporting and analysis.

Leveraging the power of these accessible tools allows businesses to shift from reactive financial management to proactive strategic planning. Accurate and readily available financial data fosters a deeper understanding of business performance, enabling informed decisions that drive growth and long-term sustainability. Consistent utilization of these resources contributes to a culture of financial awareness and accountability, essential for navigating the evolving economic landscape and achieving sustained success. The insights gained from regular financial analysis, facilitated by these templates, position businesses to not only understand their current standing but also to anticipate future challenges and capitalize on emerging opportunities.