Utilizing a readily available, structured format for verifying service offers several advantages. It ensures all necessary information is gathered and presented in a consistent manner, reducing the likelihood of delays caused by incomplete or improperly formatted applications. This can significantly expedite the loan approval process, allowing veterans and service members to secure housing more quickly. Furthermore, access to these standardized forms can alleviate potential stress and confusion associated with assembling required documentation.

This article will delve into the specifics of obtaining and completing the necessary documentation for VA-backed home loans, exploring various available resources and offering practical guidance for a smooth and efficient application process. Topics covered will include specific eligibility criteria, where to access required forms, common mistakes to avoid, and tips for navigating the VA loan process successfully.

1. Eligibility Verification

Eligibility verification forms the cornerstone of the VA home loan process. The VA loan statement of service template, often referred to as the Certificate of Eligibility, serves as the primary document for this verification, confirming that a borrower meets the service requirements stipulated by the Department of Veterans Affairs.

- Length of ServiceA critical aspect of eligibility hinges on the length of service. The required duration varies depending on the era of service and whether the individual served in active duty, reserves, or National Guard. The statement of service template provides designated fields to accurately document these details, enabling lenders to swiftly assess whether the applicant meets the minimum service requirements. For instance, a veteran with service during wartime might require a shorter duration of service than a peacetime veteran.

- Character of ServiceBeyond length of service, the nature of discharge plays a vital role. The template requires documentation of discharge status, ensuring the applicant separated under honorable conditions. Anything other than an honorable discharge may impact loan eligibility. This information, clearly documented within the template, allows for transparent assessment and prevents potential complications later in the loan process.

- Type of ServiceDifferent branches of service and service categories (active duty, reserves, National Guard) have varying eligibility requirements. The template provides fields to specify the applicant’s service branch and category. This allows for precise evaluation against the specific criteria relevant to their service type, ensuring accurate assessment of eligibility. For example, active-duty service requirements differ from reserve or National Guard service.

- Supporting DocumentationWhile the statement of service template provides crucial information, supporting documentation may be necessary in certain cases. This can include DD-214 forms, deployment orders, or other relevant military records. The template often indicates where and when such documentation is required, ensuring a complete and efficient application package. This preemptive guidance minimizes delays associated with gathering additional information.

Through precise documentation of length, character, and type of service, the VA loan statement of service template establishes a clear pathway for eligibility verification. This standardized approach not only expedites the loan process but also ensures fairness and transparency for all applicants seeking to utilize their VA home loan benefits. Accurate completion of this template is essential for accessing these benefits and realizing the dream of homeownership.

2. Standardized Form

Standardized forms play a critical role in streamlining complex processes, and the VA home loan process is no exception. The VA loan statement of service template, or Certificate of Eligibility, exemplifies the benefits of standardization in ensuring efficiency and clarity for both applicants and lenders.

- Consistency and CompletenessStandardization ensures all required information is consistently captured. The template provides designated fields for specific data points, minimizing omissions and ensuring a complete application package. This reduces back-and-forth communication between lenders and applicants, significantly expediting the loan approval process. For instance, fields for service dates, branch, and discharge type ensure consistent data collection across all applications.

- Simplified Review ProcessA standardized format simplifies the lender’s review process. Information is presented in a predictable and organized manner, allowing for efficient verification and assessment of eligibility. This reduces the time required to process applications and accelerates loan approval. Lenders can quickly locate and verify the necessary information within the standardized template.

- Reduced Errors and MisinterpretationsStandardized templates minimize the risk of errors and misinterpretations. Clear instructions and predefined fields reduce ambiguity, ensuring accurate data entry and minimizing potential discrepancies. This clarity benefits both the applicant and the lender, preventing delays and misunderstandings. For example, predefined fields for dates reduce the likelihood of formatting errors that could cause confusion.

- Improved Accessibility and User ExperienceStandardized forms improve accessibility for applicants. The consistent format simplifies the application process, making it easier for veterans to understand and complete the required documentation. This user-friendly approach reduces the potential for frustration and ensures a smoother experience for those seeking to utilize their VA loan benefits. Online access to pre-filled templates further enhances accessibility.

The standardization inherent in the VA loan statement of service template contributes significantly to the efficiency and effectiveness of the VA home loan process. By ensuring consistency, simplifying review, minimizing errors, and improving accessibility, standardized forms provide tangible benefits for both applicants and lenders, ultimately facilitating access to homeownership for eligible veterans.

3. Service History

Service history forms the bedrock of eligibility for VA-backed home loans. The VA loan statement of service template, formally known as the Certificate of Eligibility, directly reflects this history, serving as a crucial link between military service and access to home financing benefits. Accurate and complete service history, documented within this template, dictates eligibility and influences loan approval. This record establishes the length, character, and type of service, key determinants in qualifying for a VA loan.

The template necessitates specific details from an individual’s service history. Dates of entry and separation establish the length of service, a primary factor in determining eligibility. The character of service, reflected in the type of discharge received, plays a critical role; an honorable discharge is typically required for loan approval. The branch of service and whether the service was active duty, reserve, or National Guard, further refine eligibility requirements, as each category carries specific criteria. For instance, a veteran with six years of service in the National Guard might have different eligibility requirements than a veteran with two years of active-duty service during wartime. Omitting or inaccurately reporting these details can lead to delays or rejection of the loan application.

Understanding the direct relationship between service history and the VA loan statement of service template is essential for a smooth and successful loan application process. Accurate and thorough documentation within the template ensures efficient processing and demonstrates eligibility clearly. This connection underscores the importance of maintaining accurate military service records and understanding their implications for accessing VA loan benefits. Failure to accurately represent service history can have significant repercussions, impacting access to one of the most valuable benefits earned through military service. Consequently, careful attention to detail and thorough record-keeping are paramount.

4. Simplified Application

The VA loan statement of service template, or Certificate of Eligibility, plays a pivotal role in simplifying the often complex mortgage application process for veterans. This pre-formatted document streamlines the submission of crucial service history information, ensuring lenders receive the necessary data in a consistent and readily understandable format. This standardization minimizes the potential for missing information or misinterpretations, which can cause significant delays in loan processing. The simplified application process afforded by the template translates directly into a more efficient and less stressful experience for veterans seeking to utilize their hard-earned benefits. For example, a veteran can obtain the Certificate of Eligibility online, complete the required fields, and submit it electronically, significantly reducing the paperwork and time compared to traditional loan applications.

The structured nature of the template guides applicants through the required information, ensuring they provide all necessary details regarding their service. This reduces the likelihood of errors and omissions that could otherwise hinder the loan approval process. Furthermore, the template often includes clear instructions and explanations, simplifying complex terminology and requirements. This clarity empowers veterans to navigate the application process with greater confidence and reduces the need for extensive assistance from loan officers. Consequently, processing times are reduced, and approvals are expedited. The readily available template also promotes accessibility, allowing veterans to easily access and complete the necessary documentation, regardless of their technological proficiency or geographical location. For instance, a veteran living in a rural area can access and complete the online template without needing to travel to a VA office or lender’s physical location.

In conclusion, the simplified application process facilitated by the VA loan statement of service template represents a significant advantage for veterans seeking home financing. By streamlining information gathering, reducing errors, and promoting accessibility, this standardized document empowers veterans to access their benefits efficiently and with minimal stress. This simplification ultimately contributes to a smoother and more positive experience for those who have served their country, making the path to homeownership more accessible and less daunting.

5. Expedited Processing

Expedited loan processing is a significant advantage for borrowers, particularly veterans utilizing VA loan benefits. The VA loan statement of service template, formally the Certificate of Eligibility, plays a crucial role in accelerating this process. By providing standardized documentation of military service, the template streamlines verification, reducing delays and facilitating timely loan approvals. This efficiency benefits both lenders and borrowers, ensuring a smoother, more predictable timeline for securing home financing.

- Streamlined VerificationThe standardized format of the Certificate of Eligibility enables lenders to quickly verify a borrower’s service history. Information is presented clearly and consistently, eliminating the need for extensive follow-up or clarification. This streamlined verification process significantly reduces the time required to assess eligibility and move the loan application forward. For example, a lender can quickly locate and verify the dates of service and discharge status within the standardized template, avoiding delays that might occur with less structured documentation.

- Reduced Underwriting TimeThe comprehensive nature of the template contributes to reduced underwriting time. By providing all necessary service information upfront, the template minimizes the need for additional documentation requests. This allows underwriters to focus on other aspects of the loan application, accelerating the overall approval process. For instance, the inclusion of character of service information on the template can eliminate the need for separate requests for DD-214 forms, streamlining the underwriting process.

- Faster Loan ClosingsExpedited processing, facilitated by the Certificate of Eligibility, ultimately leads to faster loan closings. With streamlined verification and reduced underwriting time, the overall loan timeline is compressed, enabling borrowers to close on their homes more quickly. This efficiency is particularly beneficial for veterans who may be facing time constraints or relocation deadlines. A quicker closing process can allow veterans to move into their new homes sooner, reducing stress and uncertainty.

- Improved Borrower ExperienceThe efficiency afforded by the template contributes to a more positive borrower experience. Reduced processing times and faster closings minimize stress and uncertainty, providing a smoother, more predictable path to homeownership. This improved experience reinforces the value of the VA loan benefit and provides veterans with a more seamless transition into homeownership.

The VA loan statement of service template plays a crucial role in expediting loan processing, contributing significantly to the efficiency and effectiveness of the VA home loan program. By streamlining verification, reducing underwriting time, and facilitating faster closings, the template ultimately enhances the borrower experience, making the dream of homeownership a more attainable reality for eligible veterans. This efficiency underscores the value of standardized documentation in simplifying complex processes and delivering timely benefits to those who have served.

6. Reduced Stress

The process of securing a mortgage can be inherently stressful, involving complex paperwork, stringent requirements, and often lengthy waiting periods. For veterans, the VA loan program offers significant advantages, but navigating the application process can still present challenges. The VA loan statement of service template, or Certificate of Eligibility, plays a crucial role in mitigating this stress by simplifying and streamlining a key aspect of the application process: verifying eligibility based on military service.

- Predictability and ClarityThe standardized format of the template provides predictability and clarity, eliminating ambiguity and reducing anxiety associated with uncertain requirements. Veterans know precisely what information is needed and how to present it, minimizing the risk of delays or rejections due to incomplete or incorrectly formatted applications. This predictability reduces stress associated with navigating complex and often confusing application processes.

- Simplified DocumentationGathering and organizing required documentation can be a significant source of stress during the loan application process. The template simplifies this process by consolidating key service information into a single, standardized document. This eliminates the need to assemble multiple documents from various sources, reducing the burden on veterans and streamlining the submission process. For example, instead of searching for discharge papers and other service records, veterans can simply complete the pre-formatted template, reducing time and effort.

- Faster Processing TimesLengthy processing times are a major contributor to stress during the mortgage application process. The VA loan statement of service template facilitates faster processing by providing lenders with the required information in a readily accessible and verifiable format. This reduces delays associated with document verification and allows for quicker loan approvals, minimizing the period of uncertainty and anxiety for veterans awaiting loan decisions. Faster processing translates directly to less time spent waiting and worrying about loan approval.

- Empowerment and ControlThe template empowers veterans by providing them with a clear and straightforward method of demonstrating their eligibility for VA loan benefits. This sense of control over a crucial aspect of the application process reduces stress and fosters confidence. By simplifying a complex process, the template allows veterans to focus on other important aspects of home buying, such as finding the right property and securing favorable loan terms.

By simplifying documentation, promoting faster processing, providing clarity and predictability, and empowering veterans, the VA loan statement of service template significantly reduces stress associated with the home loan application process. This reduction in stress allows veterans to focus on the excitement of homeownership rather than the complexities of securing financing, making the transition to civilian life and the pursuit of the American dream smoother and more fulfilling.

Key Components of the Certificate of Eligibility

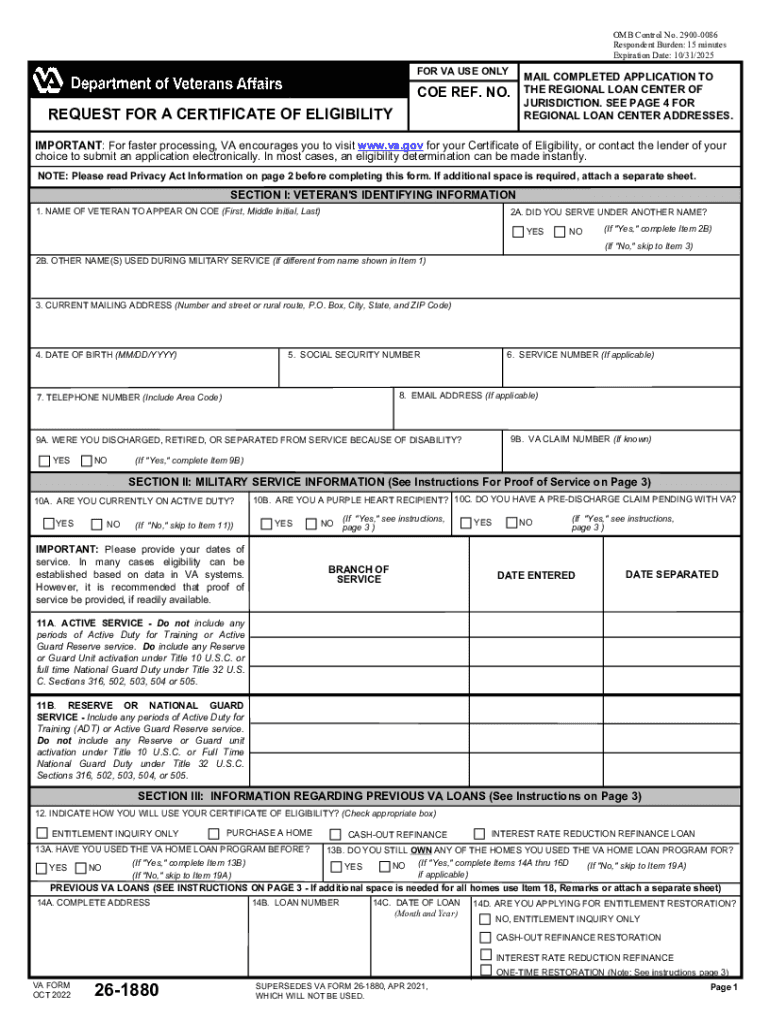

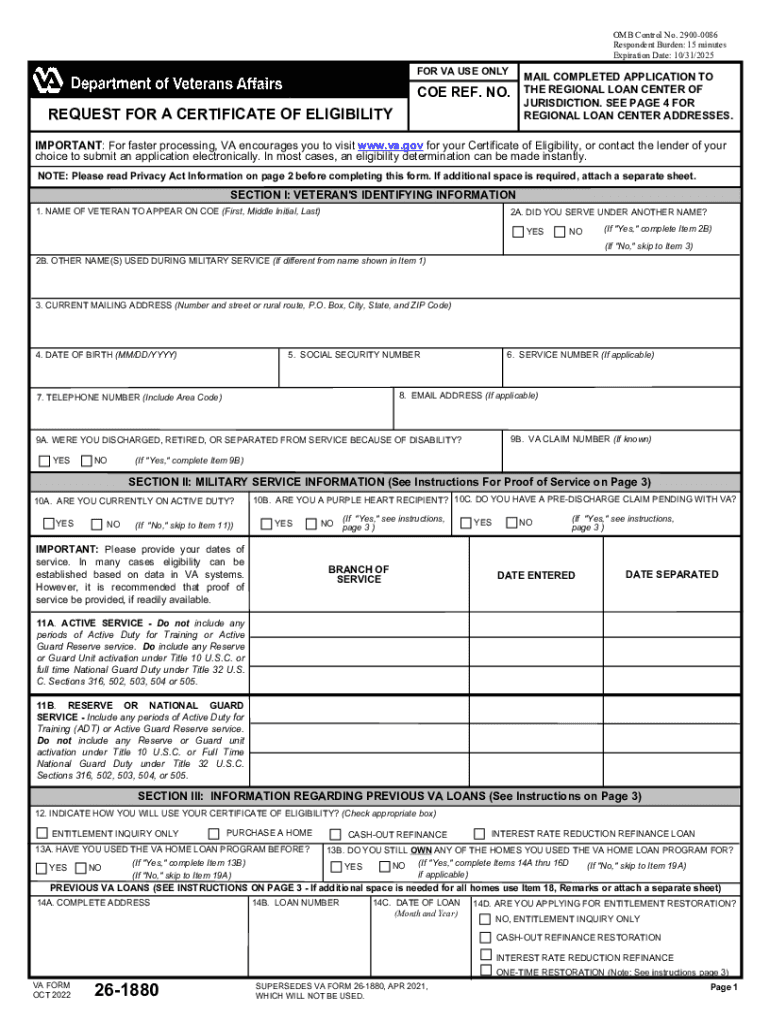

The Certificate of Eligibility (COE), often referred to as a “VA loan statement of service template,” comprises essential elements that verify a veteran’s eligibility for VA home loan benefits. Accurate completion of these components is crucial for efficient loan processing.

1. Veteran’s Identification Information: This section requires the veteran’s full name, social security number, date of birth, and current contact information. Accurate identification information ensures proper association of the COE with the loan application.

2. Service History Details: This section captures the veteran’s military service history, including branch of service, dates of entry and separation, and type of service (active duty, reserves, National Guard). These details determine eligibility based on length and type of service.

3. Character of Service: This component documents the veteran’s discharge status. An honorable discharge is typically required for VA loan eligibility. The COE specifies the type of discharge received and any relevant details impacting eligibility.

4. Reason for Separation: This section clarifies the reason for the veteran’s separation from service. While an honorable discharge is generally required, certain other discharge types might be considered on a case-by-case basis. Providing context for separation helps lenders assess eligibility accurately.

5. Request Date: This indicates the date the COE was requested. This date helps track the application process and ensure timely processing of the loan application.

6. Issuing Authority: The COE must be issued by the Department of Veterans Affairs or an authorized representative. This confirms the document’s authenticity and validity. The issuing authority’s information, including contact details, is typically included.

Accurate completion of each component ensures efficient loan processing and allows lenders to quickly verify eligibility, reducing potential delays and facilitating a smooth transition to homeownership for eligible veterans. These details collectively paint a clear picture of the veteran’s service record, enabling lenders to determine eligibility for VA-backed home loan benefits efficiently and accurately.

How to Obtain a Certificate of Eligibility

Obtaining a Certificate of Eligibility (COE) is a crucial step in the VA home loan process. This document verifies eligibility for VA-backed home financing. Several methods facilitate acquiring this essential certificate.

1: eBenefits Portal: The eBenefits portal provides online access to various veteran benefits, including the COE. Applicants can log in using their DS Logon, My HealtheVet, or ID.me credentials. Once logged in, navigating to the “Apply for a Certificate of Eligibility” section initiates the request process. This digital platform offers a convenient and efficient method for obtaining the COE.

2: VA Form 26-1880: Request for a Certificate of Eligibility. This form can be downloaded from the VA website or obtained from a VA regional loan center. Applicants must complete the form accurately and provide all requested information. The completed form can be mailed to the designated VA loan center for processing.

3: Through a Lender: Many VA-approved lenders can assist in obtaining the COE on behalf of their clients. This simplifies the process for borrowers, as the lender handles the request and ensures all necessary information is submitted correctly. This collaborative approach streamlines the application process.

4: Immediate Issuance through Lender: Some lenders participate in the VA’s Automated Certificate of Eligibility (ACE) program. This program allows lenders to instantly generate a COE for eligible borrowers, significantly expediting the loan process. This automated system provides immediate verification of eligibility.

Regardless of the chosen method, maintaining accurate service records ensures a smooth and efficient COE acquisition process. Incomplete or inaccurate information can lead to delays. Accessing the COE through the eBenefits portal, submitting VA Form 26-1880, or working directly with a lender provides multiple avenues for obtaining this essential document, each offering distinct advantages in terms of convenience and speed. Choosing the most appropriate method depends on individual circumstances and preferences. Proactive preparation, coupled with an understanding of available resources, streamlines the process and facilitates timely access to this crucial document for VA home loan applications. This preparedness ensures a more efficient and ultimately less stressful experience for those seeking to leverage their VA benefits.

Accurate and accessible documentation of military service is paramount for veterans seeking to utilize VA home loan benefits. The Certificate of Eligibility, often referred to as a VA loan statement of service template, serves as a critical component in this process. This document streamlines loan applications by providing a standardized format for verifying service history, ensuring lenders receive the necessary information efficiently and accurately. This standardization reduces processing times, minimizes errors, and ultimately reduces stress for applicants. Understanding the key components of the COE, including service dates, character of service, and discharge type, and knowing how to obtain it through various methods, including online portals, dedicated forms, and lender assistance, are crucial steps in navigating the VA loan process successfully. By simplifying and expediting the verification of eligibility, the COE contributes significantly to a smoother, more efficient, and ultimately more positive experience for veterans pursuing homeownership.

Leveraging earned benefits through meticulous documentation empowers veterans seeking the financial stability and security of homeownership. This careful attention to detail not only facilitates access to these crucial benefits but also underscores the importance of recognizing and honoring the service of those who have served their country. The streamlined process enabled by clear, accurate service documentation ensures these benefits remain accessible and efficiently delivered, ultimately contributing to the well-being and financial security of veterans and their families.