Using this concise format offers several advantages. It facilitates more efficient financial management by quickly highlighting cash surpluses or deficits. This, in turn, enables proactive decision-making regarding investments, budgeting, and funding. A clear financial picture also improves communication with stakeholders, such as investors and lenders, fostering greater transparency and trust.

This foundational understanding of managing cash flow serves as a springboard for deeper exploration of related financial concepts. Topics such as financial forecasting, budgeting, and performance analysis become more accessible with a firm grasp of cash flow dynamics.

1. Concise Format

A concise format is fundamental to a simplified cash flow statement template. Brevity and clarity are prioritized, allowing users to quickly grasp the overall financial picture without being bogged down by excessive detail. This streamlined approach focuses on essential data points, eliminating unnecessary complexities that might obscure key trends or insights. The direct cause-and-effect relationship between a concise format and ease of understanding is crucial for effective financial management. For example, a startup seeking funding can present a clear and concise cash flow projection to potential investors, highlighting key revenue drivers and expense controls. A complex, overly detailed statement, on the other hand, might overwhelm investors and hinder decision-making.

This emphasis on conciseness extends to the structure and presentation of information within the template. Clear section headings, logical categorization of cash flows (operating, investing, financing), and consistent formatting contribute to a user-friendly experience. Consider a non-profit organization tracking its grant funding. A concise cash flow statement can readily demonstrate how grant monies are utilized for program expenses, demonstrating responsible financial stewardship. This level of clarity enhances transparency and accountability, fostering trust among stakeholders. Furthermore, a concise format facilitates more efficient analysis. By presenting key figures in a streamlined manner, users can readily identify patterns, trends, and potential areas for improvement.

In summary, a concise format empowers users to efficiently extract valuable insights from financial data. This is particularly important for small businesses, non-profits, or individuals who may lack dedicated financial expertise. The ability to quickly understand cash flow dynamics allows for proactive financial management, informed decision-making, and improved communication with stakeholders. While detailed financial analysis has its place, a concise format provides a crucial foundation for understanding overall financial health and promoting financial well-being.

2. Essential Data

A simplified cash flow statement template relies on the inclusion of essential data points, carefully chosen to provide a clear and accurate representation of an entity’s financial health. While conciseness is key, omitting critical information undermines the template’s purpose. The strategic selection of data ensures a balance between simplicity and informational value, enabling effective decision-making.

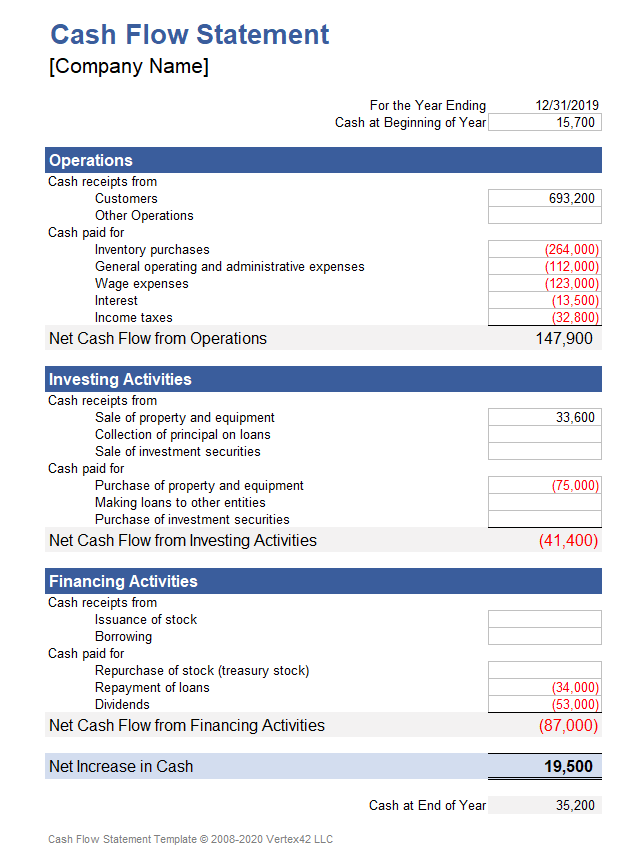

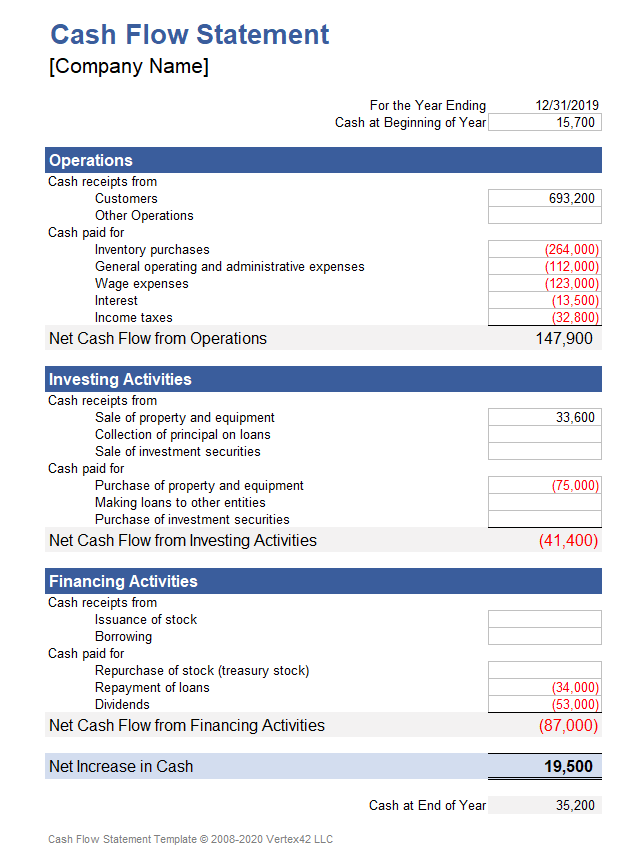

- Operating ActivitiesCash flows from core business operations are fundamental. This includes cash received from customers, payments to suppliers, salaries, and other operating expenses. For instance, a retail business would track daily sales receipts and payments for inventory. Accurately representing these flows reveals the profitability and sustainability of the core business model.

- Investing ActivitiesPurchase and sale of long-term assets, such as property, plant, and equipment (PP&E), are categorized under investing activities. Acquiring new machinery represents a cash outflow, while selling old equipment generates a cash inflow. These data points reflect an entity’s investment strategy and its potential for future growth. For example, a manufacturing company investing in new automation technology would reflect this as a significant cash outflow in this section. This information is crucial for assessing long-term capital allocation strategies.

- Financing ActivitiesFinancing activities encompass transactions related to debt, equity, and dividends. Procuring a loan results in a cash inflow, while loan repayments represent outflows. Issuing stock generates cash inflows, and dividend payments are outflows. These data points illustrate how an entity funds its operations and investments. A company issuing bonds to raise capital would reflect this as a cash inflow. Analyzing financing activities provides insights into an entitys capital structure and its financial stability.

- Net Change in CashThe net change in cash represents the overall increase or decrease in cash during the reporting period. This crucial figure is derived from the combined net cash flows from operating, investing, and financing activities. It provides a concise summary of the entity’s cash position changes, reflecting the overall impact of all financial activities. A positive net change indicates a strengthened cash position, while a negative change signals a decline. This information is essential for assessing short-term liquidity and informing financial planning.

The careful selection and presentation of these essential data points within a simplified cash flow statement template provides a powerful tool for understanding financial performance and making informed decisions. By focusing on these core elements, stakeholders can gain a clear picture of an organizations financial health and its ability to generate and manage cash effectively. This, in turn, allows for more proactive financial planning, improved resource allocation, and enhanced communication with investors and lenders.

3. User-Friendly Structure

A user-friendly structure is paramount to the effectiveness of a simplified cash flow statement template. Accessibility and ease of understanding are key considerations, enabling individuals with varying levels of financial expertise to extract meaningful insights. A well-designed structure transforms potentially complex financial data into an easily digestible format, promoting informed decision-making and fostering financial transparency.

- Clear SectioningDividing the template into distinct sections for operating, investing, and financing activities enhances clarity and organization. This logical categorization allows users to quickly locate and interpret specific cash flow information. For example, separating cash flows from core business operations (operating activities) from those related to asset purchases (investing activities) provides a more granular understanding of financial performance. This clear delineation is crucial for identifying the sources and uses of cash within an organization.

- Consistent FormattingMaintaining a consistent format throughout the template, including consistent use of fonts, headings, and numerical representations, enhances readability and reduces cognitive load. Standardized formatting ensures a seamless flow of information, enabling users to focus on the data itself rather than deciphering the presentation. For instance, consistently presenting cash inflows as positive numbers and cash outflows as negative numbers eliminates potential confusion and promotes accurate interpretation.

- Concise LanguageEmploying clear and concise language throughout the template avoids jargon and technical terms that might confuse non-financial professionals. Simple, straightforward descriptions of cash flow activities ensure accessibility for a wider audience, fostering greater transparency and understanding. For example, using “Cash from Customers” instead of “Accounts Receivable Collections” makes the information more accessible to individuals without accounting backgrounds. This promotes broader understanding and engagement with financial data.

- Visual AidsIncorporating visual aids, such as charts and graphs, where appropriate, can further enhance understanding and facilitate data interpretation. Visual representations of cash flow trends can quickly convey key insights and patterns, making complex financial data more accessible and engaging. For instance, a line graph illustrating net cash flow trends over time provides a readily digestible overview of financial performance. Visualizations like these can significantly enhance understanding, particularly for those less familiar with financial statements.

A user-friendly structure, encompassing clear sectioning, consistent formatting, concise language, and judicious use of visual aids, transforms a simplified cash flow statement template into a powerful tool for financial management. By prioritizing accessibility and ease of understanding, these structural elements empower individuals and organizations to effectively analyze cash flow dynamics, make informed decisions, and achieve financial success. This focus on usability ultimately contributes to improved financial literacy and promotes greater financial well-being.

4. Accessible Insights

A simplified cash flow statement template’s primary value lies in its ability to provide accessible insights into an entity’s financial health. Ready access to this information is crucial for effective financial management, enabling informed decision-making and fostering a clear understanding of financial performance. The template’s streamlined structure and focus on essential data make these insights readily available to a broader audience, regardless of their financial expertise.

- Rapid Identification of TrendsSimplified statements facilitate rapid identification of key cash flow trends. By presenting data in a concise and organized manner, patterns of cash inflows and outflows become readily apparent. For example, a consistent decline in operating cash flow over several reporting periods signals a potential problem requiring further investigation. This rapid identification allows for timely intervention and corrective action.

- Enhanced Decision-MakingAccessible insights empower stakeholders to make informed financial decisions. A clear understanding of cash flow dynamics allows for more effective resource allocation, investment planning, and debt management. For instance, a business owner can use cash flow projections from a simplified template to assess the feasibility of expanding operations or investing in new equipment. This data-driven approach reduces reliance on guesswork and promotes sound financial choices.

- Improved Communication with StakeholdersSimplified statements promote transparency and facilitate communication with stakeholders, including investors, lenders, and board members. A clear and concise presentation of financial performance builds trust and confidence, enabling more effective dialogue and collaboration. For example, a non-profit organization can use a simplified cash flow statement to clearly demonstrate how donor funds are being utilized, enhancing accountability and transparency.

- Proactive Financial ManagementAccessible insights enable proactive financial management by providing a real-time view of cash flow dynamics. This allows organizations to anticipate potential cash shortages or surpluses, enabling timely adjustments to budgets and financial plans. For instance, a business experiencing rapid growth can use cash flow projections to anticipate increased working capital needs and secure necessary financing proactively, avoiding potential disruptions to operations.

The accessibility of insights derived from a simplified cash flow statement template is fundamental to its value. By empowering stakeholders with a clear and concise understanding of financial performance, the template promotes informed decision-making, enhances communication, and fosters proactive financial management. This, in turn, contributes to improved financial health and long-term sustainability.

5. Improved Decisions

Enhanced decision-making is a direct consequence of utilizing a simplified cash flow statement template. Clear, concise, and readily accessible financial information empowers stakeholders to make informed choices, optimizing resource allocation, mitigating financial risks, and ultimately driving success. This clarity fosters proactive financial management, enabling organizations to anticipate challenges and capitalize on opportunities.

- Strategic InvestmentsSimplified cash flow statements provide the necessary insights to evaluate potential investments strategically. By projecting future cash flows under various scenarios, organizations can assess the viability and potential return on investment of different projects. For example, a company considering expanding its product line can use the template to model the expected cash inflows and outflows associated with the expansion, enabling a data-driven decision on whether to proceed. This informed approach maximizes the likelihood of successful investments and minimizes the risk of capital misallocation.

- Effective Expense ManagementCareful analysis of a simplified cash flow statement enables effective expense management. By clearly identifying sources and uses of cash, organizations can pinpoint areas of excessive spending or potential cost savings. For instance, a non-profit organization can use the template to track program expenses and identify opportunities to streamline operations, ensuring maximum impact from donor contributions. This disciplined approach to expense management strengthens financial stability and promotes long-term sustainability.

- Proactive Funding StrategiesUnderstanding cash flow dynamics enables proactive funding strategies. By projecting future cash needs, organizations can anticipate potential shortfalls and secure necessary financing in advance. For example, a startup anticipating rapid growth can use the template to forecast increased working capital requirements and proactively seek funding from investors or lenders, ensuring smooth operations during periods of expansion. This proactive approach avoids financial distress and positions organizations for sustained growth.

- Enhanced Negotiation PowerA clear understanding of one’s financial position strengthens negotiation power with suppliers, customers, and other stakeholders. A simplified cash flow statement provides concrete data to support pricing negotiations, payment terms, and other contractual agreements. For example, a business with strong positive cash flow can negotiate more favorable payment terms with suppliers, leveraging its financial strength to secure better deals. This enhanced negotiation power contributes to improved profitability and overall financial health.

The simplified cash flow statement template’s contribution to improved decision-making is a cornerstone of its value. By providing accessible insights into financial performance, the template empowers stakeholders to make data-driven choices regarding investments, expenses, funding, and negotiations. This informed decision-making process is essential for achieving financial stability, sustainable growth, and long-term success.

Key Components of a Simplified Cash Flow Statement Template

A well-structured simplified cash flow statement template provides a concise overview of an entity’s financial performance. Several key components contribute to its effectiveness and clarity.

1. Operating Activities: This section details cash flows generated from core business operations. Key elements include cash received from customers, cash paid to suppliers, salaries disbursed, and other operating expenses. Accurate representation of these flows is crucial for assessing the profitability and sustainability of the core business model.

2. Investing Activities: Cash flows related to the acquisition and disposal of long-term assets are categorized here. Purchases of property, plant, and equipment (PP&E) represent cash outflows, while sales of these assets generate cash inflows. This section reflects an entity’s investment strategy and its implications for future growth.

3. Financing Activities: This component encompasses transactions related to debt, equity, and dividends. Securing loans results in cash inflows, while loan repayments are outflows. Issuing stock generates cash inflows, and dividend payments are outflows. Analysis of financing activities provides insights into an entity’s capital structure and financial stability.

4. Beginning Cash Balance: The starting cash balance for the given period provides a crucial reference point for understanding the net change in cash. This figure represents the cash available at the beginning of the reporting period and serves as the foundation for tracking cash flow changes.

5. Net Change in Cash: This figure represents the overall increase or decrease in cash during the reporting period, derived by summing the net cash flows from operating, investing, and financing activities. It offers a concise summary of how cash position has changed due to all financial activities.

6. Ending Cash Balance: The ending cash balance, calculated by adding the net change in cash to the beginning cash balance, represents the cash available at the end of the reporting period. This figure is crucial for assessing short-term liquidity and provides a starting point for the next reporting period.

Careful consideration of these components ensures the template provides a comprehensive and accurate representation of financial performance. This, in turn, supports informed decision-making and effective financial management. Each component plays a crucial role in painting a complete picture of an entity’s financial health.

How to Create a Simplified Cash Flow Statement Template

Creating a simplified cash flow statement template requires a structured approach, focusing on essential data and clear presentation. The following steps outline the process.

1: Define the Reporting Period: Establish the timeframe for the cash flow statement, whether it’s a month, quarter, or year. A clearly defined period ensures consistency and allows for accurate tracking of cash flows over time.

2: Structure the Template: Divide the template into three core sections: Operating Activities, Investing Activities, and Financing Activities. This categorization provides a structured framework for organizing cash flow data.

3: Determine Key Data Points: Within each section, identify the essential data points to include. For Operating Activities, focus on cash from customers, payments to suppliers, and operating expenses. Investing Activities should include purchases and sales of long-term assets. Financing Activities should cover debt, equity, and dividends.

4: Include Beginning and Ending Cash Balances: Record the cash balance at the beginning of the reporting period. This provides a starting point for tracking cash flow changes. The ending cash balance, calculated at the end of the period, reflects the net change in cash.

5: Calculate Net Cash Flow: Determine the net cash flow for each section by subtracting cash outflows from cash inflows. This provides a clear picture of cash generated or used within each activity category.

6: Calculate Overall Net Change in Cash: Sum the net cash flows from all three sections (Operating, Investing, and Financing) to arrive at the overall net change in cash for the reporting period. This crucial figure represents the overall increase or decrease in cash.

7: Design for Clarity: Use clear labels, consistent formatting, and a visually appealing layout. This enhances readability and makes the information accessible to a wider audience. Consider incorporating visual aids like charts and graphs to further improve understanding.

8. Review and Refine: Regularly review and refine the template based on user feedback and evolving business needs. This ensures the template remains relevant, user-friendly, and effective in providing valuable insights into financial performance.

A well-designed template provides a clear and concise overview of an organization’s financial health, enabling informed decision-making and effective financial management. Regularly updating and reviewing the template ensures its continued relevance and accuracy in reflecting financial performance.

Streamlined cash flow statement templates offer a crucial tool for understanding financial health. By focusing on essential dataoperating, investing, and financing activitiesthese templates provide accessible insights into cash flow dynamics. Clear categorization, consistent formatting, and concise language enhance usability, empowering stakeholders to make informed decisions. Rapid identification of trends, proactive financial management, and improved communication with stakeholders are key benefits. Effective expense control, strategic investment planning, and proactive funding strategies become attainable through readily available financial insights.

Effective financial management hinges on a clear understanding of cash flow. Leveraging simplified cash flow statement templates provides a crucial foundation for navigating financial complexities, enabling informed decision-making, and fostering sustainable growth. Embracing this approach equips organizations to proactively manage resources, mitigate risks, and achieve long-term financial well-being. The ability to readily interpret and act upon cash flow data is not merely a best practice; it is a necessity in today’s dynamic economic landscape.