Utilizing a pre-designed structure offers several advantages. It ensures compliance with IFRS requirements, promoting transparency and comparability in financial reporting. It streamlines the reporting process, saving time and resources. Furthermore, a standardized format enhances the clarity and understandability of financial information for investors, creditors, and other users.

This article will further explore key components typically included in such a report, variations based on industry specifics, and best practices for its preparation and interpretation. It aims to equip readers with a thorough understanding of this crucial financial document and its significance in the global business landscape.

1. Revenue Recognition

Revenue recognition plays a critical role within an IFRS profit and loss statement template. IFRS 15, the standard governing revenue recognition, provides a five-step model that dictates how and when revenue from contracts with customers should be recognized. This model impacts the timing and amount of revenue reported, directly influencing the reported profit or loss. Accurately applying IFRS 15 ensures compliance and provides a true and fair view of financial performance. For instance, a software company selling a subscription service must recognize revenue over the subscription period rather than upfront, even if the customer pays the entire amount initially. This reflects the ongoing provision of services.

The connection between revenue recognition and the profit and loss statement is crucial for understanding a company’s financial health. Misrepresenting revenue can significantly distort reported profitability and mislead stakeholders. Consider a construction company engaged in a long-term project. Applying IFRS 15 correctly means recognizing revenue as the project progresses based on the percentage of completion, providing a more accurate reflection of performance compared to recognizing the entire revenue upon project completion. This impacts not only the reported profit but also various performance metrics derived from it.

Correct application of revenue recognition principles within the IFRS framework ensures transparency and comparability. This allows investors and other stakeholders to assess performance accurately and make informed decisions. Challenges can arise in complex transactions, requiring careful consideration of the five-step model. Robust internal controls and a clear understanding of IFRS 15 are crucial for accurate reporting and maintaining confidence in the financial statements. Understanding the principles of revenue recognition is therefore essential for both preparing and interpreting an IFRS profit and loss statement.

2. Expense Categorization

Accurate expense categorization is fundamental to a reliable IFRS profit and loss statement. Proper classification provides stakeholders with a clear understanding of an entity’s cost structure, contributing to informed assessments of profitability and operational efficiency. Misclassified expenses can distort reported figures, leading to misinterpretations of financial performance and hindering effective decision-making.

- Cost of Sales (COGS)COGS represents the direct costs associated with producing goods sold by a company. For a manufacturer, this includes raw materials, direct labor, and manufacturing overhead. Accurate COGS classification directly impacts gross profit, a key indicator of profitability. For example, improperly allocating manufacturing overhead as an administrative expense understates COGS and overstates gross profit, misrepresenting the cost of producing goods.

- Selling, General, and Administrative Expenses (SG&A)SG&A encompasses expenses not directly tied to production, such as salaries of sales and marketing personnel, office rent, and advertising costs. Appropriate classification distinguishes operating expenses from production costs, providing insights into the efficiency of support functions. Misclassifying sales commissions as COGS, for instance, would understate SG&A and overstate gross profit, obscuring the true cost of sales activities.

- Finance CostsFinance costs include interest expenses on borrowings and other charges related to financing activities. Proper categorization isolates the cost of financing from operating performance, allowing for a clearer assessment of core business profitability. Incorrectly classifying interest expense on a loan used for factory construction as an operating expense would overstate operating expenses and understate the true cost of financing.

- Other Expenses/IncomeThis category captures expenses and income not fitting into the primary classifications. Examples include gains or losses from the disposal of assets, impairment charges, and foreign exchange differences. Clear disclosure of these items provides context for unusual events impacting profitability. Failing to disclose a significant impairment charge separately would obscure its impact on overall profit and mislead users about recurring profitability.

The interplay between these expense categories within the IFRS profit and loss statement allows for a comprehensive analysis of financial performance. By adhering to IFRS guidelines for expense categorization, entities ensure transparency and comparability, enabling stakeholders to make informed decisions based on a clear understanding of the company’s cost structure and profitability drivers. A robust expense categorization framework, supported by appropriate internal controls, is essential for accurate financial reporting and maintaining stakeholder confidence.

3. Profit Measurement

Profit measurement, a core function of the IFRS profit and loss statement, provides crucial insights into an entity’s financial performance. Accurately determining profit requires adherence to IFRS principles, impacting reported figures and influencing stakeholder perceptions. This section explores key facets of profit measurement within the context of an IFRS profit and loss statement template.

- Gross ProfitGross profit, calculated as revenue less cost of sales, reveals the profitability of core business operations. This metric reflects the efficiency of production and pricing strategies. For example, a manufacturing company with a high gross profit margin suggests effective cost management or premium pricing. Within the IFRS profit and loss statement, gross profit provides a foundational element for subsequent profit calculations and analysis.

- Operating ProfitOperating profit, derived by subtracting selling, general, and administrative expenses (SG&A) from gross profit, measures profitability from core business activities before considering financing costs and other non-operating items. It reflects the efficiency of operational management. A retailer with a rising operating profit margin signals effective control of overhead costs. Within the IFRS framework, operating profit provides a clear view of profitability from ongoing operations.

- Profit Before TaxProfit before tax, calculated as operating profit less finance costs and adding other income/expenses, represents the profit generated before accounting for income tax expense. This metric allows for comparison across entities with varying tax structures. A company with consistent growth in profit before tax demonstrates strong underlying profitability. In an IFRS profit and loss statement, this figure forms the basis for calculating income tax expense.

- Net ProfitNet profit, the final profit figure after deducting income tax expense from profit before tax, represents the bottom line the ultimate measure of profitability available to equity holders. This metric is critical for investors assessing return on investment. A company with consistently increasing net profit indicates sustainable financial performance. Within the IFRS profit and loss statement, net profit is the culmination of all revenue and expense items, representing the overall profitability of the entity during the reporting period.

These interconnected profit metrics, presented within the structured format of an IFRS profit and loss statement, offer a comprehensive view of an entity’s financial performance. Analyzing these metrics, coupled with understanding the underlying accounting principles, allows stakeholders to gain valuable insights into profitability drivers, operational efficiency, and overall financial health. Comparative analysis across different periods enhances this understanding, revealing trends and supporting informed decision-making.

4. Comparative Information

Comparative information enhances the analytical value of an IFRS profit and loss statement. Presenting financial data for the current period alongside prior periods allows stakeholders to discern trends, assess performance consistency, and gain deeper insights into an entity’s financial trajectory. IFRS standards mandate the inclusion of comparative figures, emphasizing the importance of this contextual data for informed decision-making. Analyzing year-over-year changes in revenue, for instance, reveals growth patterns and potential market shifts impacting the entity. Similarly, comparing operating expenses across periods highlights changes in cost structure and efficiency. Without comparative figures, assessing current performance in isolation provides a limited perspective, hindering a comprehensive understanding of financial health.

Real-world applications demonstrate the practical significance of comparative information. Consider a retail company experiencing a decline in net profit. Comparative figures might reveal that this decline stems from increased cost of sales due to rising supplier prices, rather than decreased sales volume. This insight allows for targeted interventions, such as negotiating better supplier contracts or adjusting pricing strategies. Conversely, comparing gross profit margins over several years can highlight a declining trend, signaling a potential erosion of pricing power or increasing competition. This prompts investigation into underlying causes, enabling timely corrective action. Such analysis would be impossible without the context provided by comparative data.

In summary, comparative information within an IFRS profit and loss statement is essential for robust financial analysis. It empowers stakeholders to move beyond static figures, facilitating trend identification, performance evaluation, and informed decision-making. Challenges can arise in ensuring data consistency across periods, particularly during periods of significant change or restructuring. However, the insights derived from comparative analysis are crucial for understanding an entity’s financial journey and projecting future performance, ultimately contributing to more effective resource allocation and strategic planning.

5. Compliance with IFRS

Compliance with International Financial Reporting Standards (IFRS) is paramount when preparing profit and loss statements. Adherence to these globally recognized accounting standards ensures transparency, comparability, and consistency in financial reporting. This fosters trust among stakeholders and facilitates informed decision-making. A structured template helps ensure consistent application of IFRS principles.

- Revenue RecognitionIFRS 15 provides specific guidelines for recognizing revenue. A compliant statement accurately reflects the timing and amount of revenue earned, crucial for depicting true financial performance. For example, a long-term construction contract requires revenue recognition based on the percentage of completion, not upon final project delivery. Applying this standard within the template structure ensures compliance and prevents misrepresentation of earnings.

- Expense RecognitionIFRS dictates how expenses are recognized and categorized. A compliant statement accurately classifies costs, providing a clear view of the entity’s cost structure. For instance, research and development costs are expensed as incurred unless specific criteria for capitalization are met. Adhering to these principles within the template ensures accurate representation of expenses and prevents distortion of profit figures.

- Presentation and DisclosureIFRS specifies presentation formats and required disclosures for profit and loss statements. A compliant statement adheres to these requirements, enhancing clarity and comparability for users. For example, specific line items, such as revenue, finance costs, and tax expense, are mandated. Utilizing a template designed according to IFRS presentation guidelines ensures consistent disclosure and facilitates cross-company comparisons.

- Auditing and AssuranceIFRS compliance strengthens the credibility of financial statements through independent audits. Auditors verify adherence to these standards, providing assurance to stakeholders. Consistent application of IFRS, facilitated by a structured template, streamlines the audit process and reduces the risk of material misstatements. This enhances confidence in the reported financial information.

Compliance with IFRS, achieved through the consistent application of a well-structured template, underpins the reliability and integrity of profit and loss statements. This promotes informed decision-making by investors, creditors, and other stakeholders, ultimately contributing to the stability and transparency of global financial markets. Deviations from IFRS can lead to misrepresentation of financial performance, potentially damaging an entity’s reputation and eroding stakeholder trust. Therefore, meticulous adherence to these standards, supported by a robust template, is crucial for effective financial reporting.

6. Statement Presentation

Clear and consistent presentation is crucial for enhancing the understandability and usability of an IFRS profit and loss statement template. Effective presentation facilitates informed interpretation by stakeholders, enabling them to assess financial performance efficiently. A well-structured presentation adheres to IFRS disclosure requirements, ensuring compliance and promoting comparability across entities.

- Format and StructureA standardized format, often provided by the template, ensures consistency and clarity. Key elements include clear labeling of line items, appropriate use of headings and subheadings, and a logical flow from revenue to net profit. For example, separating operating activities from financing activities enhances clarity. A consistent structure facilitates comparison across different reporting periods and between entities, promoting transparency and informed analysis.

- Disclosure of Line ItemsIFRS mandates the disclosure of specific line items within the profit and loss statement, such as revenue, finance costs, and tax expense. Templates incorporate these required disclosures, ensuring compliance and providing users with essential information for analysis. For instance, disclosing separate line items for different revenue streams allows for a more granular understanding of performance. Comprehensive disclosure within the template structure empowers stakeholders to assess the various components contributing to overall profitability.

- Comparative InformationIncluding comparative figures from prior periods enhances the analytical value of the statement. Templates often facilitate this by providing columns for the current period and at least one preceding period. This enables users to identify trends and assess performance consistency. For example, comparing current year revenue with the prior year reveals growth or decline, providing insights into market dynamics and operational effectiveness. Templates designed for comparative analysis empower informed assessments of financial trajectory.

- Currency and UnitsClearly stating the reporting currency and units of measurement is fundamental. Templates typically incorporate fields for specifying these details, ensuring clarity and preventing misinterpretations. For example, disclosing that figures are presented in thousands of US dollars avoids potential confusion. Consistent use of units and currency throughout the statement, as facilitated by the template, promotes accurate understanding and cross-company comparability.

Effective statement presentation, guided by a well-designed IFRS profit and loss statement template, transforms complex financial data into a readily understandable format. This empowers stakeholders to gain valuable insights into an entitys financial performance, facilitating informed decision-making. A well-presented statement fosters trust and transparency, promoting efficient capital allocation and contributing to the stability of financial markets. While adhering to IFRS presentation requirements ensures compliance, thoughtful presentation design within the template further enhances clarity and usability, maximizing the value of the information provided.

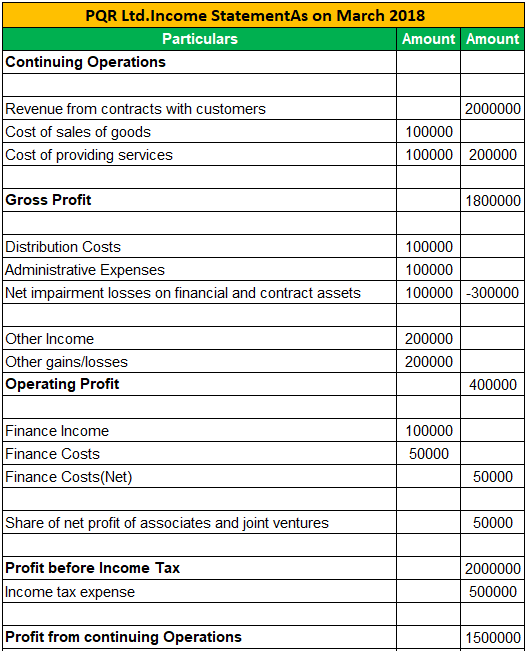

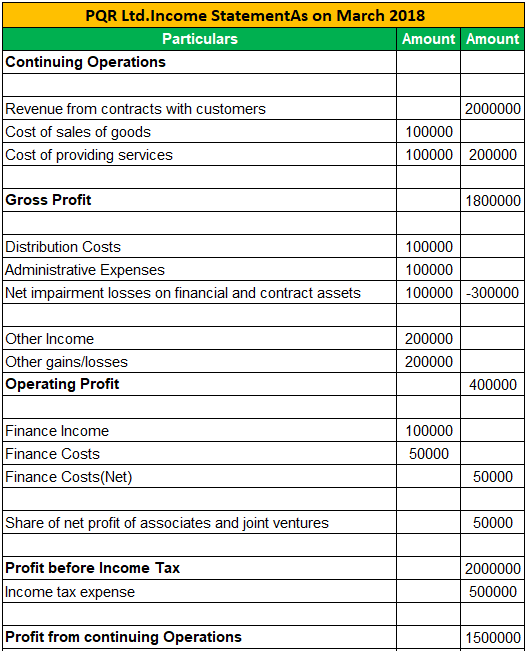

Key Components of an IFRS Profit and Loss Statement

Essential elements comprise a comprehensive International Financial Reporting Standards (IFRS) profit and loss statement. These components provide a structured framework for reporting financial performance, enabling stakeholders to assess profitability and operational efficiency.

1. Revenue: This section presents income generated from primary business activities. It reflects the top line of the statement and forms the basis for calculating subsequent profit metrics. Revenue recognition principles, as outlined in IFRS 15, dictate the timing and measurement of revenue reported.

2. Cost of Sales: Direct costs associated with producing goods or services sold are categorized here. Accurate classification is crucial for determining gross profit and assessing the efficiency of production processes. Components typically include raw materials, direct labor, and manufacturing overhead.

3. Gross Profit: Calculated as revenue less cost of sales, this metric reflects the profitability of core business operations before considering operating expenses. Analyzing gross profit margins provides insights into pricing strategies and production efficiency.

4. Operating Expenses: Costs associated with running the business, excluding cost of sales, are classified as operating expenses. These include selling, general, and administrative expenses (SG&A), such as salaries, rent, and marketing costs. Effective management of operating expenses is crucial for overall profitability.

5. Operating Profit: Determined by subtracting operating expenses from gross profit, this key metric reflects the profitability of core business operations. Analyzing operating profit trends reveals insights into operational efficiency and cost control measures.

6. Finance Costs: Expenses related to financing activities, such as interest expense on borrowings, are reported in this section. Separating finance costs from operating activities allows for a clearer assessment of core business profitability.

7. Profit Before Tax: This figure represents earnings before accounting for income tax expense. It provides a valuable metric for comparing profitability across entities with different tax structures.

8. Income Tax Expense: The expense associated with current and deferred income taxes is reported here. This reflects the entity’s tax obligations based on applicable tax regulations.

9. Net Profit: The bottom line of the statement, net profit represents the final profit after deducting all expenses, including income tax. This crucial metric reflects the overall profitability available to equity holders and is a key indicator of financial performance.

These interconnected components provide a comprehensive view of financial performance, enabling stakeholders to make informed assessments and decisions. Accurate classification and measurement of each component are critical for generating a reliable and transparent profit and loss statement according to IFRS.

How to Create an IFRS Profit and Loss Statement

Creating a compliant and informative International Financial Reporting Standards (IFRS) profit and loss statement requires careful consideration of key elements and adherence to specific guidelines. The following steps outline the process.

1. Determine the Reporting Period: Specify the timeframe covered by the statement, whether it’s a month, quarter, or year. A clearly defined reporting period is essential for accurate performance assessment.

2. Gather Financial Data: Collect all relevant financial information, including revenue and expense data, from internal accounting systems. Accurate data collection forms the basis of a reliable statement.

3. Choose a Template or Software: Utilize a pre-designed template or accounting software compliant with IFRS. This ensures consistent presentation and adherence to reporting standards. Templates often incorporate required disclosures and formulas for automated calculations.

4. Input Revenue Data: Record revenue earned during the reporting period according to IFRS 15, the revenue recognition standard. Accurate revenue recognition is crucial for depicting true financial performance.

5. Categorize and Input Expenses: Classify and record all expenses incurred during the reporting period. Proper categorization ensures accurate cost allocation and reveals insights into operational efficiency. Follow IFRS guidelines for expense recognition.

6. Calculate Profit Metrics: Calculate gross profit, operating profit, profit before tax, and net profit using the recorded revenue and expense figures. These metrics offer key insights into profitability at various levels.

7. Include Comparative Information: Present comparative figures from prior periods alongside current period data. This enables trend analysis and facilitates performance evaluation over time. IFRS mandates the inclusion of comparative information for enhanced context.

8. Review and Verify Accuracy: Thoroughly review the completed statement for accuracy and completeness. Verification ensures data integrity and promotes confidence in the reported financial information. Internal controls and review procedures contribute to accuracy.

A meticulously prepared IFRS profit and loss statement provides stakeholders with a clear and accurate view of financial performance. Consistent application of IFRS principles and a structured approach, often facilitated by templates or software, ensure compliance and enhance the understandability of this crucial financial report. This fosters informed decision-making and contributes to the transparency of financial reporting.

A robust, standardized financial reporting framework, adhering to International Financial Reporting Standards, provides a crucial tool for communicating financial performance. Understanding its structure, core components, and the underlying principles governing revenue and expense recognition is essential for both preparers and users of these statements. Accuracy, consistency, and transparency in its preparation are paramount for providing stakeholders with reliable information necessary for informed decision-making. Proper utilization of such a framework ensures compliance with IFRS, facilitates comparability across entities, and promotes confidence in the integrity of financial reporting.

As global financial landscapes continue to evolve, the importance of standardized, transparent financial reporting remains paramount. Emphasis on continuous improvement in reporting practices, coupled with a deep understanding of evolving IFRS guidelines, will further enhance the value and reliability of these crucial financial documents. This commitment to robust financial reporting practices strengthens global markets and fosters sustainable economic growth.