Utilizing this type of financial projection offers several advantages. It facilitates informed business decisions related to pricing, expansion, and resource allocation. Furthermore, it serves as a crucial communication tool for potential investors, lenders, and other stakeholders, providing a snapshot of anticipated financial health. Its forward-looking nature enables proactive identification of potential financial challenges and opportunities, allowing for timely adjustments to business strategies.

This foundational understanding of projected financial performance lays the groundwork for exploring specific elements, such as revenue projections, cost estimations, and key performance indicators. A deeper dive into these areas will enhance comprehension of financial planning and analysis.

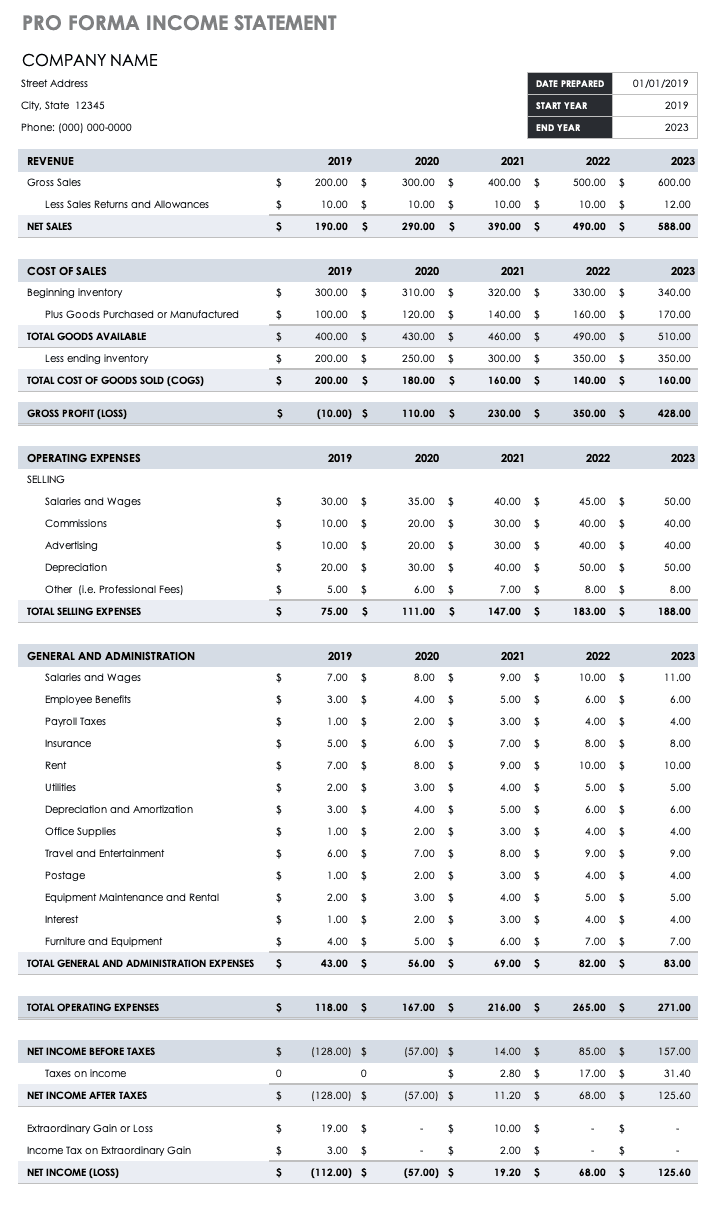

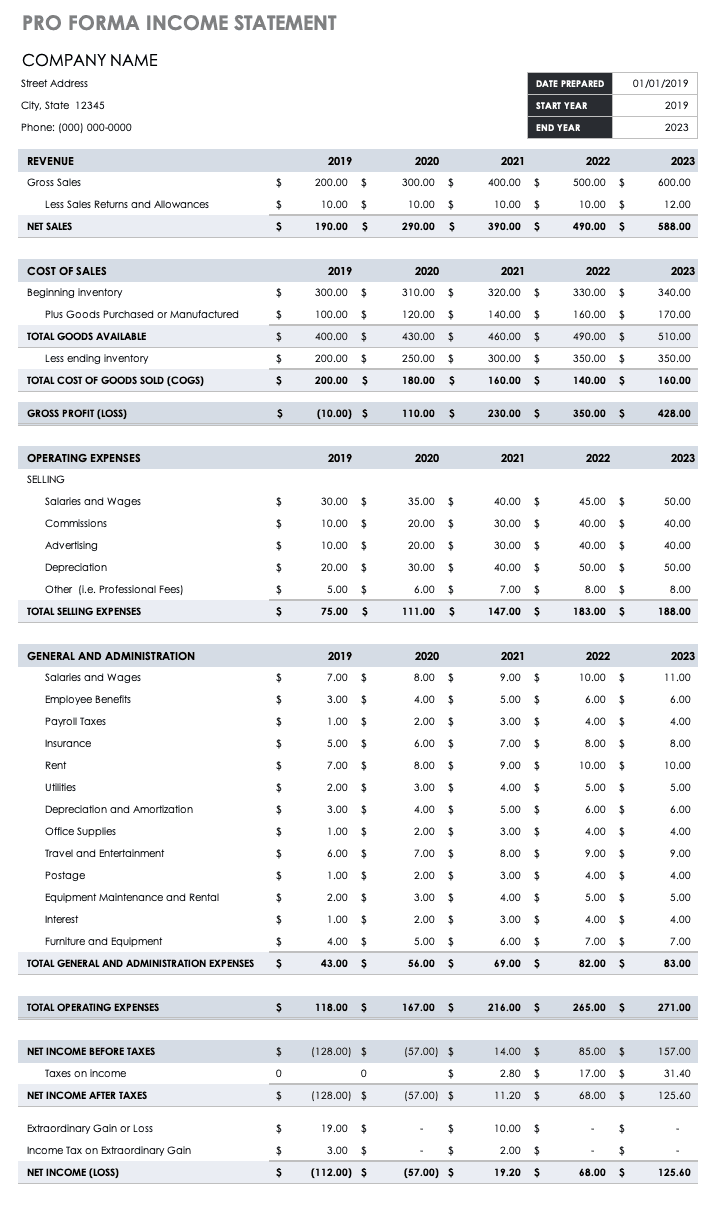

1. Revenue Projections

Revenue projections constitute a critical component of a streamlined projected income statement. Accuracy in forecasting revenue directly impacts the reliability and usefulness of the entire pro forma statement. A logical, data-driven approach to revenue projection is essential. This approach may involve analyzing historical sales data, considering market trends, evaluating pricing strategies, and incorporating anticipated sales growth from new product launches or market expansions. Cause and effect relationships are central here; for instance, an anticipated increase in marketing spend may be linked to a projected rise in customer acquisition and subsequent revenue growth. A retail business might project increased revenue during the holiday season based on past performance and current market conditions, while a startup might base its projections on user growth targets and conversion rates.

Several factors influence revenue projections within a projected income statement. Pricing changes, market competition, economic conditions, and seasonality can all significantly impact projected revenue figures. Consider a manufacturing company anticipating a rise in raw material costs. This increase may necessitate a price adjustment for finished goods, impacting projected revenue. Understanding these influencing factors allows for more robust and realistic projections, crucial for informed decision-making. Ignoring these factors can lead to overly optimistic or pessimistic projections, potentially hindering effective planning.

Accurate revenue projections enable businesses to make informed decisions regarding resource allocation, budgeting, and overall strategic planning. Overly optimistic projections can lead to overspending and financial instability, while overly conservative projections may stifle growth opportunities. A clear understanding of the relationship between revenue projections and the overall projected income statement provides valuable insights into a company’s potential financial trajectory. This understanding facilitates proactive adjustments to business strategies, maximizing profitability and minimizing financial risks. It also provides a more realistic basis for engaging with potential investors and securing financing.

2. Cost of Goods Sold

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a company. Within a streamlined projected income statement, COGS plays a crucial role in determining gross profit and ultimately, net income. Accurate COGS projections are essential for realistic profitability assessments and informed decision-making.

- Direct Material CostsThese costs encompass the raw materials, components, and other direct inputs used in the production process. For a furniture manufacturer, this would include the cost of wood, fabric, and hardware. Accurate estimation of these costs within a projected income statement is crucial for determining projected gross profit margins. Fluctuations in raw material prices can significantly impact COGS and therefore, projected profitability.

- Direct Labor CostsDirect labor costs include the wages, salaries, and benefits paid to employees directly involved in producing goods. For a clothing manufacturer, this would include the wages of sewing machine operators. Projecting these costs accurately necessitates considering factors such as planned production levels, wage rates, and potential labor shortages. Accurate direct labor cost projections are vital for realistic cost of goods sold estimations.

- Manufacturing OverheadManufacturing overhead encompasses all other costs directly associated with the production process, excluding direct materials and labor. Examples include factory rent, utilities, and depreciation of manufacturing equipment. These indirect costs are allocated to units produced. Accurately projecting manufacturing overhead is crucial for a comprehensive understanding of COGS and its impact on projected profitability.

- Impact on ProfitabilityCOGS directly impacts a company’s gross profit, calculated as revenue minus COGS. A higher COGS results in a lower gross profit, underscoring the importance of managing and minimizing these costs where possible. Within a projected income statement, accurately forecasting COGS allows businesses to assess the viability of their pricing strategies and make informed decisions regarding cost control measures.

Accurate COGS projections are fundamental for generating a reliable projected income statement. By understanding the various components of COGS and their potential impact on profitability, businesses can make more informed decisions regarding pricing, production, and resource allocation. This understanding strengthens financial planning and supports strategic decision-making aimed at maximizing profitability.

3. Operating Expenses

Operating expenses represent the costs incurred in running a business outside of direct production costs. Within a simple pro forma income statement template, accurate projection of operating expenses is crucial for determining operating income and ultimately, net income. These projections offer insights into the efficiency and sustainability of a business’s operations.

- Selling, General, and Administrative Expenses (SG&A)SG&A expenses encompass costs related to sales, marketing, administrative functions, and general overhead. Examples include salaries of sales and marketing personnel, rent for office space, and advertising expenditures. Accurate projection of SG&A is vital for understanding the overall cost structure of a business and its impact on projected profitability. For example, a rapidly expanding company might anticipate a significant increase in SG&A due to hiring additional sales staff and expanding office space. These projections allow businesses to allocate resources effectively and monitor cost-effectiveness.

- Research and Development (R&D) ExpensesR&D expenses represent investments in developing new products, services, or processes. For technology companies, R&D is often a significant operating expense. Projecting R&D expenses involves assessing planned research activities, resource requirements, and anticipated timelines. Accurate R&D projections are crucial for evaluating the potential return on investment in innovation and its long-term impact on a company’s financial performance. For instance, a pharmaceutical company might project substantial R&D expenses for developing a new drug, anticipating future revenue streams from successful product launches.

- Marketing and Advertising ExpensesMarketing and advertising costs encompass expenditures related to promoting products or services. These costs can include online advertising campaigns, print media, and public relations efforts. Projecting these expenses involves considering target market reach, campaign effectiveness, and overall marketing strategy. Accurate projections are essential for evaluating the return on marketing investment and its contribution to projected revenue growth. A consumer goods company launching a new product might project increased marketing expenses to build brand awareness and drive initial sales.

- Depreciation and AmortizationDepreciation and amortization represent the allocation of the cost of tangible and intangible assets over their useful lives. While not a cash outflow, these non-cash expenses impact profitability on the income statement. Accurately projecting depreciation and amortization involves considering the value and useful life of existing assets and anticipated acquisitions. This ensures a realistic portrayal of the expense associated with using these assets in generating revenue. For a manufacturing company, this could include the depreciation of factory equipment.

Accurate operating expense projections are fundamental for creating a reliable pro forma income statement. By understanding the various categories of operating expenses and their drivers, businesses can make informed decisions regarding resource allocation, cost control measures, and overall strategic planning. This comprehensive understanding enhances the accuracy of projected profitability and provides valuable insights for managing and optimizing operational efficiency. This allows for a more informed assessment of the business’s potential financial performance and its sustainability in the long run.

4. Profit Calculations

Profit calculations represent the culmination of a simple pro forma income statement template, providing crucial insights into a company’s projected profitability. Understanding the various levels of profit and their calculations is essential for assessing financial performance and making informed business decisions. These calculations demonstrate the relationship between revenue, costs, and resulting profit, offering a clear picture of a company’s potential financial health.

- Gross ProfitGross profit, calculated as revenue minus the cost of goods sold (COGS), represents the profit generated from a company’s core business operations. It reflects the efficiency of production and pricing strategies. A higher gross profit margin indicates a greater ability to generate profit from each unit sold. For example, a retailer selling clothing might have a higher gross profit margin than a grocery store due to the typically higher markup on apparel. Within a pro forma income statement, gross profit serves as a foundation for subsequent profit calculations.

- Operating IncomeOperating income, calculated as gross profit minus operating expenses, reflects the profitability of a company’s core business operations after accounting for all operating costs, excluding interest and taxes. This metric provides a clear view of the efficiency of a company’s management and operations. A higher operating income signifies better cost control and operational efficiency. For instance, a software company with high operating leverage might experience a significant increase in operating income with a relatively small increase in revenue. Within a projected income statement, operating income is a key indicator of a company’s operational health and sustainability.

- Net IncomeNet income, often referred to as the “bottom line,” represents the final profit after all expenses, including interest and taxes, have been deducted from revenue. This metric is the ultimate measure of a company’s profitability and represents the earnings available to shareholders. A positive net income indicates a profitable period, while a negative net income signifies a loss. A growing net income over time suggests a healthy and sustainable business. Within a pro forma income statement, net income is the most comprehensive measure of projected profitability, reflecting the combined impact of all revenue and expense projections.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)EBITDA, while not a direct measure of profit, is a commonly used metric to assess a company’s operating performance by excluding the effects of financing and accounting decisions. It provides a clearer picture of a company’s core profitability from operations, unaffected by capital structure or asset depreciation. A higher EBITDA generally suggests stronger operational performance. Within a pro forma income statement, EBITDA offers an additional perspective on projected profitability, particularly useful for comparing companies with different capital structures or depreciation policies. For example, two companies in the same industry might have significantly different net incomes due to varying levels of debt, but their EBITDA figures might be more comparable.

Understanding these various profit calculations within the context of a simple pro forma income statement template provides valuable insights into a company’s projected financial performance. These calculations, taken together, offer a comprehensive view of profitability, informing strategic decision-making, resource allocation, and overall financial planning. They allow businesses to assess their projected financial health, identify potential challenges, and capitalize on opportunities for growth and improved profitability. This comprehensive understanding of profit dynamics strengthens financial forecasting and facilitates more informed business decisions.

5. Time Period

The time period specified within a simple pro forma income statement template is fundamental to its meaning and application. This defined timeframe, whether a fiscal year, a quarter, or even a month, provides the context for all projected financial data. The choice of time period directly influences the granularity and focus of the projections. A shorter time frame, such as a quarter, allows for more detailed analysis of short-term performance and facilitates quicker adjustments to business strategies, while an annual projection provides a broader overview of the company’s anticipated financial health over a longer horizon. The selection of an appropriate time period depends on the specific objectives of the pro forma statement, such as securing short-term financing or evaluating long-term growth potential.

The time period serves as the basis for understanding cause-and-effect relationships within the projected financial data. For example, a seasonal business, such as a ski resort, might show significantly higher revenue and profitability in winter quarters compared to summer months. Similarly, a company launching a new product might project initial losses during the product development and launch phase, followed by increasing profitability as sales gain traction. Analyzing these trends within specific timeframes allows for more informed decision-making and resource allocation. A startup projecting rapid growth might focus on monthly or quarterly pro forma statements to closely monitor burn rate and adjust fundraising strategies, whereas an established company might prioritize annual projections for long-term planning and investor relations.

A clear understanding of the time period’s role within a pro forma income statement is crucial for accurate interpretation and effective utilization of the projected data. This understanding allows stakeholders to assess projected performance within the appropriate context, considering seasonal fluctuations, business cycles, and long-term growth trajectories. Failure to consider the time period can lead to misinterpretations of financial projections and potentially flawed business decisions. A clear definition of the time period enhances the pro forma statement’s value as a planning and communication tool, enabling more informed decisions regarding resource allocation, investment strategies, and overall business development. This ultimately contributes to more robust financial planning and improved prospects for long-term success.

Key Components of a Streamlined Projected Income Statement

Constructing a robust projected income statement requires a clear understanding of its key components. These components, when combined, provide a comprehensive view of a company’s anticipated financial performance over a defined period.

1. Revenue Projections: Forecasting future revenue involves considering historical data, market trends, pricing strategies, and anticipated sales growth. Accuracy in revenue projections is crucial as it forms the basis for all subsequent calculations within the statement.

2. Cost of Goods Sold (COGS): COGS encompasses all direct costs associated with producing goods sold. Accurate COGS projections are essential for determining gross profit and require careful consideration of direct material costs, direct labor costs, and manufacturing overhead.

3. Operating Expenses: Operating expenses represent the costs of running the business outside of direct production. These include selling, general, and administrative expenses (SG&A), research and development (R&D), marketing and advertising, and depreciation and amortization. Accurate projections of these expenses are crucial for determining operating income.

4. Gross Profit: Calculated as revenue minus COGS, gross profit reflects the profitability of a company’s core business operations before accounting for operating expenses. This metric provides insight into the efficiency of production and pricing strategies.

5. Operating Income: Operating income, derived by subtracting operating expenses from gross profit, measures the profitability of core business operations. This metric reflects the efficiency of management and operations after considering all operating costs.

6. Net Income: Often referred to as the “bottom line,” net income represents the final profit after all expenses, including interest and taxes, have been deducted from revenue. This key metric represents the earnings available to shareholders.

7. Time Period: The defined timeframe of the pro forma statement, whether a fiscal year, quarter, or month, is crucial. This timeframe provides context for all projections and influences the granularity of the analysis. The choice of time period should align with the specific objectives of the projection.

These interconnected elements provide a comprehensive view of a company’s projected financial health, enabling informed decision-making regarding resource allocation, pricing strategies, and overall business development. Accurate and well-considered projections within each of these components contribute to a robust and reliable pro forma income statement.

How to Create a Simple Pro Forma Income Statement

Creating a streamlined projected income statement involves a structured approach, incorporating key financial data and assumptions about future performance. This process provides a valuable tool for financial planning and decision-making.

1. Define the Time Period: Specify the timeframe for the projection, whether a fiscal year, a quarter, or a month. This timeframe provides the context for all subsequent projections.

2. Project Revenue: Forecast future revenue based on historical data, market trends, pricing strategies, and anticipated sales growth. Consider factors such as seasonality, competition, and economic conditions.

3. Estimate Cost of Goods Sold (COGS): Project direct costs associated with producing goods sold. This involves estimating direct material costs, direct labor costs, and manufacturing overhead.

4. Project Operating Expenses: Estimate all other costs associated with running the business, including selling, general, and administrative expenses (SG&A), research and development (R&D), marketing and advertising, and depreciation and amortization.

5. Calculate Gross Profit: Subtract projected COGS from projected revenue to arrive at the projected gross profit. This metric offers insights into the profitability of core business operations.

6. Calculate Operating Income: Subtract projected operating expenses from projected gross profit to determine projected operating income. This metric reflects profitability after accounting for all operating costs.

7. Calculate Net Income: Deduct projected interest and taxes from operating income to arrive at projected net income. This “bottom line” figure represents the final projected profit.

8. Review and Refine: Regularly review and refine the pro forma statement as new data becomes available or business conditions change. This iterative process ensures the projection remains relevant and useful for decision-making.

A well-constructed pro forma income statement provides a clear and concise overview of projected financial performance. This structured approach to financial forecasting supports informed decision-making, resource allocation, and strategic planning. Regular review and refinement ensures the projection remains aligned with evolving business realities.

Streamlined projected income statements offer a crucial tool for financial planning and analysis, providing a structured framework for projecting future performance based on key assumptions and data-driven insights. Understanding the core components, including revenue projections, cost estimations, and profit calculations, within a defined timeframe, allows for informed decision-making regarding resource allocation, pricing strategies, and overall business development. Accurate and well-constructed projections empower businesses to anticipate potential challenges and capitalize on opportunities, fostering financial stability and sustainable growth.

Effective utilization of these financial projections requires ongoing review and refinement, adapting to evolving market conditions and incorporating new information. This dynamic approach to financial forecasting strengthens strategic planning, enhances communication with stakeholders, and ultimately contributes to a more robust and resilient business, capable of navigating the complexities of the financial landscape and achieving long-term success.