Utilizing such a framework offers numerous advantages. It enables informed budgeting and financial planning by highlighting areas of overspending and potential savings. This organized financial overview empowers individuals to make sound financial decisions, set realistic financial goals, and track progress toward achieving those objectives. Furthermore, a clear record of income and expenses can prove invaluable for tax preparation and other financial record-keeping necessities.

The following sections delve deeper into the practical application of this framework. Specific examples and detailed instructions will provide a comprehensive guide to creating and utilizing this valuable tool for improved financial management.

1. Income

Accurate income recording forms the foundation of a robust personal profit/loss statement. Income comprises all sources of financial inflow within a given period. This includes earned income (salaries, wages, business profits), investment income (dividends, interest, capital gains), and other income (rental income, royalties, gifts). Accurately capturing all income streams provides a realistic assessment of financial resources. For instance, neglecting to include interest earned on savings accounts or dividends from investments would skew the overall financial picture and hinder effective planning. The relationship between income and expenses determines net profit or loss, a crucial metric for financial health assessment. A clear understanding of total income empowers informed decisions regarding budgeting, saving, and investing.

Consider an individual receiving a regular salary and supplemental income from freelance work. Meticulous tracking of both income streams is vital for a comprehensive understanding of their financial situation. Suppose the individual earns a monthly salary of $4,000 and an additional $1,000 from freelance projects. While the salary is consistent, freelance income can fluctuate. Tracking both allows for realistic budgeting and highlights potential income variability. If freelance work diminishes, the individual can proactively adjust spending based on the accurate income reflection in the statement. Alternatively, increased freelance earnings can inform savings or investment strategies.

Thorough income documentation ensures a complete financial picture. Challenges may arise from irregular income streams, requiring diligent recording and categorization. Furthermore, differentiating between gross and net income is critical. While gross income represents total earnings, net income reflects the amount remaining after deductions (taxes, contributions). Utilizing net income figures in the statement offers a more accurate representation of disposable income and facilitates realistic financial planning. This comprehensive approach to income tracking forms an essential component of effective financial management and informed decision-making.

2. Expenses

A thorough understanding of expense tracking is crucial for utilizing a personal profit/loss statement effectively. Expenses represent the outflow of money within a given period, encompassing essential and discretionary spending. Essential expenses include necessities like housing, food, utilities, and transportation. Discretionary expenses cover non-essential items like entertainment, dining out, and hobbies. Accurate expense categorization within the statement clarifies spending patterns and facilitates informed financial decisions.

Consider an individual aiming to understand their spending habits. Categorizing expenses within the statement reveals potential areas for adjustment. Suppose the individual observes high spending on dining out. This realization can prompt a shift towards home-cooked meals, leading to potential savings. Alternatively, if a significant portion of the budget is allocated to transportation, exploring alternative commuting options like public transport or cycling might reduce costs. This practical application of expense analysis within the statement empowers informed choices and facilitates better financial management.

Effective expense tracking involves diligently recording every expenditure, regardless of size. Small, frequent expenses can accumulate significantly over time. Neglecting to track these seemingly minor costs can lead to an inaccurate financial overview. Utilizing budgeting apps, spreadsheets, or even traditional notebooks can assist in maintaining comprehensive expense records. This disciplined approach to expense management empowers individuals to identify areas for improvement, make informed financial decisions, and work towards achieving financial goals.

3. Time Period

The efficacy of a personal profit/loss statement hinges on selecting an appropriate time period. This timeframe provides the boundaries for analyzing income and expenses, enabling meaningful insights into financial trends. Selecting a relevant duration is crucial for accurate financial assessment and informed decision-making.

- Monthly TrackingMonthly tracking offers a granular view of financial activity, allowing for timely identification of spending patterns and potential budgetary adjustments. For example, an individual might notice increased utility expenses during colder months, prompting energy-saving measures. This frequent monitoring facilitates proactive financial management and allows for quick responses to changing financial circumstances.

- Quarterly ReviewQuarterly reviews provide a broader perspective on financial progress. This timeframe allows for assessing the effectiveness of budgeting strategies implemented over a longer duration. For instance, an individual saving for a down payment on a house can track progress towards their goal and adjust savings strategies as needed based on quarterly performance.

- Annual AnalysisAnnual analysis offers a comprehensive overview of financial performance over an entire year. This longer timeframe facilitates year-over-year comparisons, revealing long-term trends and providing valuable insights for tax planning and investment decisions. For example, an individual can assess the overall growth of their investment portfolio over the year and make informed decisions about future investment strategies.

- Variable TimeframesWhile standard timeframes like monthly, quarterly, and annually offer structured analysis, variable timeframes can be useful for specific financial goals. For example, an individual planning a short-term project, like a home renovation, might track income and expenses specifically related to that project over its duration, providing a clear picture of project costs and resource allocation.

The choice of time period directly influences the insights derived from a personal profit/loss statement. Selecting a timeframe aligned with individual financial goals and planning horizons is essential for effective financial management. Whether it’s the detailed view of monthly tracking, the broader perspective of quarterly reviews, or the comprehensive overview of annual analysis, choosing the right timeframe empowers informed financial decisions and facilitates progress towards achieving financial objectives.

4. Net Result (Profit/Loss)

The net result, whether profit or loss, represents the culmination of all income and expenses documented within a personal profit/loss statement. This crucial metric provides a clear indication of financial health over the specified time period. A positive net result (profit) indicates income exceeded expenses, signifying effective financial management and potential for savings or investment. Conversely, a negative net result (loss) signifies expenses surpassed income, highlighting the need for budgetary adjustments and spending analysis. Understanding the net result is fundamental for evaluating financial performance and making informed decisions regarding future financial strategies.

Consider an individual with a monthly income of $5,000 and total expenses of $4,500. The resulting net profit of $500 signifies positive cash flow, enabling savings, debt reduction, or investment opportunities. Alternatively, if expenses reach $5,500, the resulting net loss of $500 necessitates careful examination of spending habits and potential adjustments to achieve a positive cash flow. This direct relationship between income, expenses, and the net result emphasizes the practical significance of understanding this key metric within a personal profit/loss statement.

Calculating the net result is straightforward: total income minus total expenses. However, its implications are far-reaching. Consistently monitoring the net result over time reveals trends in financial performance, enabling proactive adjustments to spending habits and income generation strategies. Understanding the net result empowers individuals to take control of their finances, make informed decisions, and work towards long-term financial stability. Furthermore, it provides a tangible metric for evaluating the effectiveness of budgeting strategies and financial planning efforts. This underscores the importance of the net result as a central component of a personal profit/loss statement.

5. Categorization

Categorization within a personal profit/loss statement provides the crucial structure for meaningful financial analysis. Assigning income and expenses to specific categories transforms raw financial data into actionable insights. This structured approach reveals spending patterns, highlights areas for potential savings, and facilitates informed financial decision-making. Without categorization, a profit/loss statement becomes a mere list of transactions, lacking the analytical power to inform effective financial management.

Consider an individual tracking expenses without categorization. A simple list of transactions might show numerous entries for groceries, dining out, transportation, and entertainment, offering little insight into overall spending habits. However, by categorizing these expenses into “Food,” “Transportation,” and “Entertainment,” clear patterns emerge. The individual might realize a significant portion of their budget is allocated to dining out, prompting a shift towards home-cooked meals. Similarly, categorizing income sources into “Salary,” “Investments,” and “Side Hustle” provides a clearer picture of income distribution and potential growth areas. This example illustrates the practical significance of categorization in transforming raw data into actionable insights.

Effective categorization requires a tailored approach based on individual financial priorities. Common expense categories include housing, utilities, transportation, food, healthcare, and entertainment. Income categories might include salary, investments, business income, and rental income. The flexibility of categorization allows individuals to create subcategories for more granular analysis. For instance, the “Food” category could be further divided into “Groceries” and “Dining Out.” This nuanced approach empowers individuals to pinpoint specific areas for budgetary adjustments and financial optimization. Ultimately, effective categorization within a personal profit/loss statement transforms data into knowledge, facilitating informed financial decisions and promoting long-term financial well-being.

6. Regular Tracking

Regular tracking forms the cornerstone of effective utilization of a personal profit/loss statement template. Consistent monitoring of income and expenses, ideally on a pre-determined schedule (e.g., weekly, bi-weekly, monthly), transforms the template from a static document into a dynamic tool for financial management. This ongoing engagement provides a real-time understanding of financial health, enabling proactive adjustments and informed decision-making. Without regular tracking, the template loses its relevance, failing to reflect current financial status accurately. The cause-and-effect relationship is clear: regular tracking fuels the template’s effectiveness, while neglecting tracking renders the template obsolete.

Consider an individual diligently tracking expenses for the first month of using the template, identifying areas for potential savings. However, if tracking ceases thereafter, those initial insights become irrelevant as spending habits evolve. Perhaps unforeseen expenses arise, or income fluctuates. Without continued tracking, these changes remain undetected within the template, hindering effective budgeting and financial planning. Conversely, consistent tracking allows for immediate identification of such changes, empowering timely adjustments to spending habits or income-generating strategies. This real-life example illustrates the practical significance of regular tracking as an integral component of the personal profit/loss statement template.

Regular tracking also facilitates identification of long-term financial trends. Sporadic tracking offers only fragmented snapshots of financial status, failing to reveal recurring patterns or gradual shifts in income and expenses. Consistent monitoring over extended periods provides the necessary data for recognizing such trends, empowering informed financial planning and goal setting. Challenges associated with regular tracking often stem from perceived time constraints or the initial effort required to establish a consistent routine. However, the long-term benefits of improved financial awareness, proactive management, and informed decision-making far outweigh these initial hurdles. Ultimately, regular tracking transforms the personal profit/loss statement template from a passive record-keeping tool into an active instrument for achieving financial well-being.

Key Components of a Personal Profit/Loss Statement Template

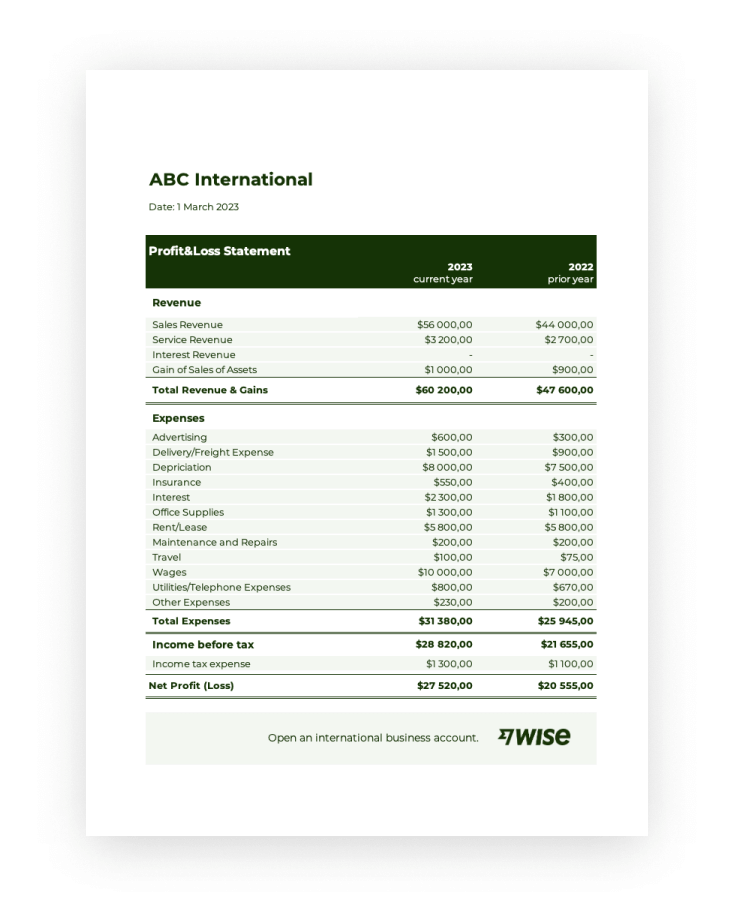

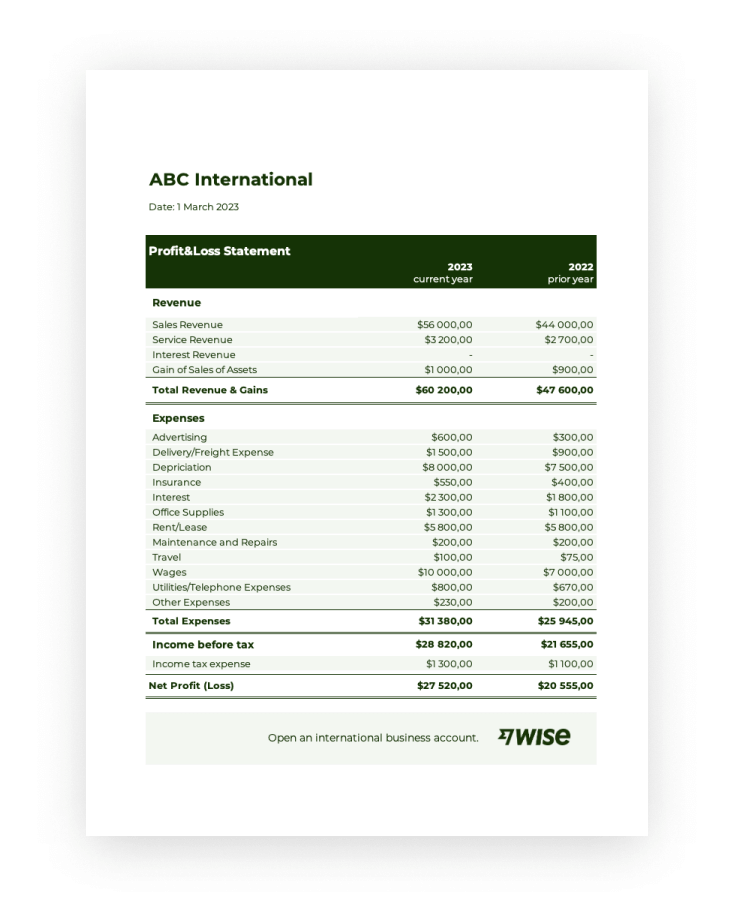

Effective financial management requires a clear understanding of income and expenses. A personal profit/loss statement template provides the framework for organizing this information, enabling informed financial decisions. Key components work together to offer a comprehensive financial overview.

1. Income: All sources of revenue must be meticulously documented. This includes earned income (salaries, wages, business profits), investment income (dividends, interest), and any other income streams.

2. Expenses: A detailed record of all expenditures, categorized for analysis, is essential. Categorization illuminates spending patterns and identifies areas for potential adjustments. Both essential (housing, food) and discretionary (entertainment, dining out) expenses require tracking.

3. Time Period: A defined timeframe provides boundaries for analysis. This could be monthly, quarterly, or annually, depending on individual needs and goals. Choosing an appropriate time period allows for meaningful comparisons and trend identification.

4. Net Result (Profit/Loss): The net result, calculated by subtracting total expenses from total income, reveals overall financial standing within the defined time period. A positive result (profit) indicates income exceeded expenses, while a negative result (loss) signals the opposite.

5. Categorization: Organizing income and expenses into specific categories provides structure and facilitates analysis. Categorization reveals spending patterns and highlights areas for potential savings or adjustments.

6. Regular Tracking: Consistent monitoring of both income and expenses is crucial. Regular tracking ensures the statement remains relevant and provides a real-time understanding of financial health. This empowers proactive financial management and informed decision-making.

These components provide a structured framework for understanding financial health. Accurate recording and analysis of income and expenses, within a defined timeframe, allows for informed financial planning and effective progress towards financial goals. Regular monitoring and categorization enhance the template’s effectiveness, ensuring relevance and providing actionable insights.

How to Create a Personal Profit/Loss Statement Template

Creating a personal profit/loss statement template provides a structured approach to understanding individual financial health. The following steps outline the process of developing a template tailored to specific needs.

1. Define the Time Period: Establish the timeframe for analysis (e.g., monthly, quarterly, annually). This timeframe provides boundaries for data collection and allows for meaningful comparisons over time.

2. Determine Income Categories: Categorize income sources (e.g., salary, investments, business income) to provide a clear overview of income distribution. Subcategories can be added for more granular analysis (e.g., dividends, interest, capital gains within investments).

3. Establish Expense Categories: Categorize expenses (e.g., housing, transportation, food, entertainment) to illuminate spending patterns. Detailed categorization enables identification of areas for potential adjustments and savings.

4. Choose a Format: Select a suitable format for the template. Options include spreadsheets, budgeting apps, or even a simple notebook. The chosen format should facilitate easy data entry and analysis.

5. Implement Tracking Mechanisms: Establish systems for consistent data entry. This might involve linking bank accounts to budgeting apps, regularly updating spreadsheets, or diligently recording transactions in a notebook. Consistent tracking is crucial for accurate and up-to-date information.

6. Calculate Net Result: Dedicate a section for calculating the net result (profit/loss). This involves subtracting total expenses from total income for the defined time period. This key metric provides a clear indication of financial health.

7. Review and Analyze: Regularly review the completed template to identify trends, assess financial progress, and make informed decisions. Analysis should focus on areas for potential improvement, such as reducing expenses or increasing income.

A well-structured template facilitates informed financial decisions. Consistent data entry and thoughtful categorization transform raw data into actionable insights, empowering effective financial management and progress towards financial goals.

A structured approach to personal finance, facilitated by a profit/loss statement template, empowers informed financial decision-making. Through meticulous tracking of income and expenses, categorized within specific timeframes, individuals gain a comprehensive understanding of their financial health. Calculating the net result, whether profit or loss, provides a clear metric for evaluating financial performance and identifying areas for potential improvement. Consistent engagement with the template, through regular tracking and thoughtful analysis, transforms raw data into actionable insights. This organized approach facilitates proactive financial management, enabling informed choices regarding budgeting, saving, and investing.

Financial well-being hinges on awareness and action. A profit/loss statement template provides the framework for achieving both. Its consistent utilization fosters financial literacy, empowering individuals to take control of their financial destinies and work towards long-term stability and prosperity. This proactive engagement with personal finances is not merely a beneficial practice; it is a crucial step towards securing a sound financial future.