Utilizing a no-cost framework for monitoring income and expenditures offers several advantages. It empowers informed financial decision-making by highlighting spending patterns and identifying areas for potential savings. Accessibility is a key benefit, allowing individuals to manage their finances without costly software or professional assistance. This accessibility can contribute to improved financial stability, reduced stress related to finances, and better planning for future goals.

The following sections will delve deeper into creating and utilizing these valuable tools, covering topics such as identifying income sources, categorizing expenses, and interpreting the results to improve financial well-being.

1. Accessibility

Accessibility is a crucial aspect of personal finance management tools. The availability of no-cost resources empowers individuals to take control of their financial well-being without facing financial barriers. This section explores the facets of accessibility related to complimentary personal cash flow statement frameworks.

- Cost-EffectivenessEliminating cost barriers allows a wider range of individuals to access and utilize these crucial tools. For someone living paycheck to paycheck, paid financial software might be out of reach, but a complimentary template offers a practical solution. This cost-effectiveness democratizes access to financial management resources, fostering financial literacy and responsible financial behavior.

- Ease of UseMany complimentary templates are designed with user-friendliness in mind, often utilizing simple spreadsheet formats or intuitive online interfaces. This ease of use eliminates the need for specialized training or technical expertise, making financial management accessible to individuals of all backgrounds. Someone unfamiliar with complex financial software can readily grasp the basic principles of a simple template and start tracking their cash flow.

- AvailabilityComplimentary templates are readily available through various online platforms, websites, and community resources. This widespread availability ensures that anyone with an internet connection can access these tools, regardless of their geographical location or socioeconomic status. This widespread availability removes geographical and logistical barriers.

- Device CompatibilityMany complimentary templates are designed to be compatible with various devices, from desktop computers to smartphones and tablets. This allows individuals to access and manage their financial information anytime, anywhere, providing flexibility and convenience. Someone who travels frequently, for instance, can still monitor their spending habits using a template on their phone.

The accessibility of complimentary personal cash flow statement templates is pivotal in promoting financial literacy and empowering individuals to take control of their finances. By removing barriers related to cost, complexity, and availability, these tools become valuable resources for anyone seeking to improve their financial well-being, regardless of their financial situation or technical expertise.

2. Track Income

Accurate income tracking forms the foundation of a reliable personal cash flow statement. A complimentary template provides the structure for systematically recording all sources of income, enabling a comprehensive view of financial inflows. This detailed record facilitates informed financial decisions. Without a clear understanding of total income, budgeting and planning become exercises in guesswork, potentially leading to overspending and financial instability. A template helps ensure all income, including salary, investment returns, freelance earnings, and other sources, is accounted for. For example, an individual might have multiple income streams, such as a primary job, a side hustle, and dividend income. A template provides designated spaces to record each of these, leading to a more accurate overall picture of income.

The benefits of meticulously tracking income extend beyond basic budgeting. By analyzing income trends over time, individuals can identify potential areas for improvement. A consistent record can reveal seasonal fluctuations in income, allowing for proactive adjustments in spending habits or savings strategies. Moreover, precise income documentation is crucial for tax purposes, ensuring accurate reporting and minimizing the risk of errors or penalties. Consider a freelancer whose income varies from month to month. Tracking income diligently allows them to anticipate lean periods and adjust expenses accordingly, or to set aside extra income during busy months to cover future expenses. This data also becomes invaluable during tax season, providing the necessary documentation to support income declarations.

In summary, tracking income within the framework of a complimentary personal cash flow statement template is essential for sound financial management. It provides the necessary data for budgeting, planning, and informed decision-making, ultimately contributing to greater financial stability and control. While manual tracking can be challenging, utilizing a template streamlines the process and reduces the likelihood of errors, making it a practical and valuable tool for anyone seeking to improve their financial well-being. The insights gained through consistent income tracking empower individuals to make informed choices regarding spending, saving, and investing, paving the way for a more secure financial future.

3. Categorize Expenses

Categorizing expenses is integral to the effective utilization of a complimentary personal cash flow statement template. The template provides a structured framework for organizing expenditures, allowing for a granular understanding of spending patterns. This categorization is crucial for identifying areas of overspending and potential savings. Without a systematic approach, expenditures can easily become obscured, hindering efforts to manage finances effectively. The template typically includes pre-defined categories, such as housing, transportation, food, and entertainment, enabling users to allocate each expense accordingly. For example, categorizing regular coffee purchases under “Food” rather than lumping them into a generic “Miscellaneous” category reveals the cumulative impact of small, frequent expenses. This awareness can prompt behavioral changes, such as brewing coffee at home, leading to significant savings over time.

The benefits of expense categorization extend beyond simple awareness. By analyzing spending within each category, individuals can make informed decisions about resource allocation. Understanding the proportion of income allocated to necessities versus discretionary spending allows for more effective budgeting and prioritization. This detailed analysis can reveal opportunities to reduce expenses in specific areas, freeing up funds for savings, investments, or debt reduction. Consider an individual consistently spending a significant portion of their income on dining out. Categorizing these expenses under “Food” highlights the potential for savings by preparing meals at home more frequently. The freed-up resources can then be redirected towards other financial goals, such as building an emergency fund.

In summary, categorizing expenses within a complimentary personal cash flow statement template is essential for gaining control over personal finances. It provides a clear picture of spending habits, identifies areas for potential savings, and facilitates informed decision-making regarding resource allocation. While the process might seem tedious initially, the long-term benefits of improved financial awareness and control outweigh the effort. The insights gained through meticulous expense categorization empower individuals to align their spending with their financial goals, creating a more stable and secure financial future. This disciplined approach to expense tracking enables a proactive approach to financial management, rather than a reactive one, fostering a sense of control and reducing financial stress.

4. Analyze Spending

Analyzing spending is a critical component of utilizing a complimentary personal cash flow statement template effectively. The template provides the raw data, but analysis unlocks the true potential for financial improvement. This process involves scrutinizing spending patterns, identifying trends, and drawing actionable insights. Without analysis, the data remains inert, offering limited value for financial planning and decision-making. Analysis transforms raw numbers into meaningful information, empowering informed choices regarding spending habits and resource allocation.

- Identifying Spending TrendsReviewing categorized expenses over time reveals recurring patterns, highlighting areas requiring attention. For example, consistent increases in entertainment spending might indicate a need for adjustments in leisure activities or budgeting practices. Recognizing these trends allows for proactive intervention, preventing escalating expenses and promoting better financial control.

- Pinpointing Areas for SavingsAnalysis can pinpoint non-essential expenses ripe for reduction or elimination. A detailed review might reveal recurring subscription services rarely used or excessive spending on dining out. Identifying these areas allows for strategic reallocation of resources towards higher-priority financial goals, such as debt reduction or saving for a down payment.

- Evaluating Needs vs. WantsA thorough spending analysis facilitates a clearer distinction between essential needs and discretionary wants. This distinction is crucial for prioritizing expenditures and making conscious choices about resource allocation. For instance, recognizing that daily coffee purchases represent a “want” rather than a “need” empowers an individual to make informed decisions about reducing such expenses and redirecting funds towards essential needs or long-term savings goals.

- Assessing Financial HealthRegular spending analysis provides valuable insights into overall financial health. By comparing income and expenses, individuals can assess whether they are living within their means and making progress towards their financial goals. Consistent deficits might signal a need for increased income, reduced spending, or a combination of both. Conversely, consistent surpluses indicate opportunities for increased savings or investments.

In conclusion, analyzing spending is the crucial bridge between data collection and informed financial decision-making within the framework of a complimentary personal cash flow statement template. By diligently reviewing and interpreting spending patterns, individuals gain a deeper understanding of their financial habits and identify actionable steps towards improved financial well-being. This analysis transforms a static record of income and expenses into a dynamic tool for achieving financial goals, promoting stability, and building a more secure financial future. The insights derived from spending analysis empower individuals to take control of their finances and make informed choices aligned with their long-term objectives.

5. Plan Financially

Financial planning and complimentary personal cash flow statement templates are intrinsically linked. A template provides the foundational understanding of income and expenses necessary for effective planning. Without a clear picture of cash flow, financial goals remain aspirations rather than achievable objectives. The template facilitates the creation of realistic budgets, allowing individuals to allocate resources strategically and track progress towards financial milestones. Consider an individual aiming to purchase a home. A template allows them to analyze current spending, identify potential savings, and project how long it will take to accumulate the necessary down payment. This informed approach replaces guesswork with data-driven planning.

The practical significance of this connection lies in its empowerment of informed financial decision-making. A template facilitates scenario planning, allowing individuals to explore the financial impact of various decisions. For instance, someone considering a career change can use a template to model the impact of a potential salary decrease or increase on their overall financial stability. This analysis informs a more balanced and reasoned decision-making process, minimizing financial risks and maximizing potential benefits. Furthermore, a template aids in identifying potential financial vulnerabilities, such as overreliance on a single income source or high levels of consumer debt. Recognizing these vulnerabilities allows for proactive mitigation strategies, strengthening financial resilience and reducing the impact of unforeseen circumstances.

In summary, financial planning becomes a more tangible and achievable process through the utilization of a complimentary personal cash flow statement template. The template provides the necessary data for informed decision-making, enabling individuals to set realistic goals, track progress, and mitigate potential financial risks. This connection empowers individuals to move beyond abstract aspirations and take concrete steps towards building a more secure and stable financial future. The template serves as a roadmap, guiding individuals towards their financial destinations with clarity and purpose, ultimately fostering greater financial well-being and reducing financial stress.

Key Components of a Complimentary Personal Cash Flow Statement Template

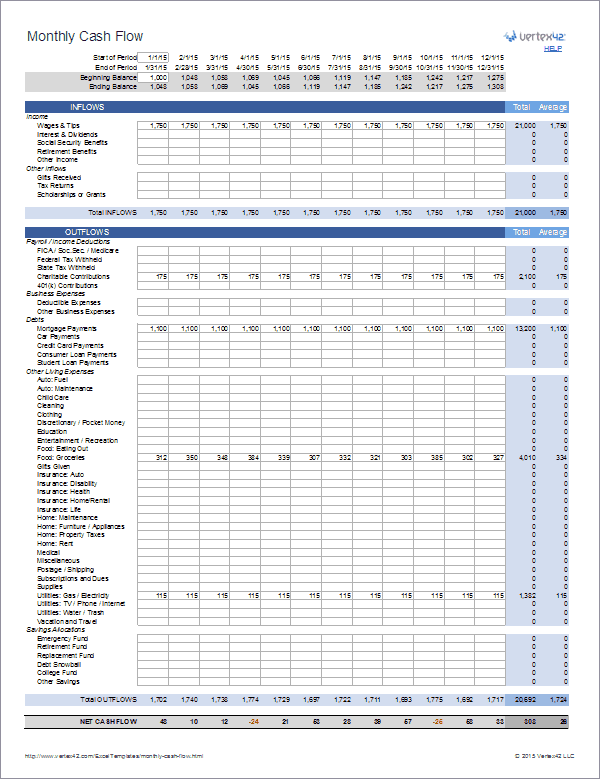

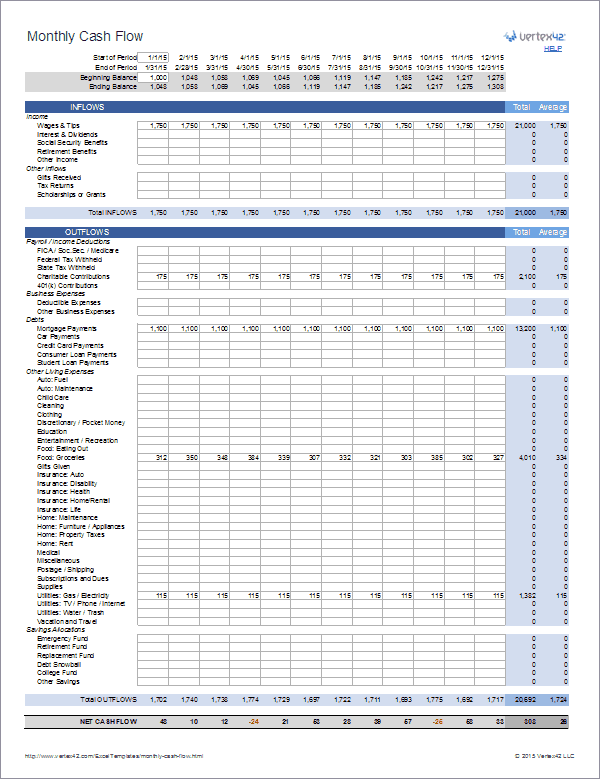

Effective financial management necessitates a clear understanding of cash flow. A complimentary personal cash flow statement template provides the structure for achieving this understanding. Several key components contribute to the template’s efficacy.

1. Income Sources: Accurate recording of all income sources is paramount. This includes salaries, wages, investment returns, rental income, and any other form of revenue. Precise income documentation provides the foundation for accurate cash flow analysis.

2. Expense Categories: Detailed categorization of expenses is crucial. Templates typically offer predefined categories like housing, transportation, food, and entertainment, enabling a granular understanding of spending patterns. This categorization facilitates identification of areas for potential savings.

3. Time Period: Templates generally cover a specific time period, such as a month or a year. This defined timeframe allows for tracking and comparing cash flow over consistent intervals, revealing trends and facilitating analysis.

4. Net Cash Flow Calculation: The template automatically calculates net cash flow by subtracting total expenses from total income. This key metric provides a snapshot of financial health, indicating whether income exceeds expenses or vice-versa.

5. Summary or Snapshot Section: A summary section provides a concise overview of key financial metrics, such as total income, total expenses, and net cash flow. This snapshot facilitates quick assessment of financial standing.

6. Customizable Features: Many templates offer customizable features, allowing users to tailor categories and tracking methods to their specific needs. This flexibility enhances the template’s relevance and usability.

7. Data Export Options: Some templates provide options for exporting data to other formats, such as spreadsheets or financial software. This functionality enhances data portability and facilitates more sophisticated analysis.

A structured framework, enabling informed financial decisions and fostering financial well-being, is essential for effective personal financial management. The template offers a straightforward method for tracking, analyzing, and ultimately improving one’s financial health through the outlined components.

How to Create a Free Personal Cash Flow Statement Template

Creating a complimentary personal cash flow statement template provides a structured approach to managing finances. The following steps outline the process of developing a template tailored to individual needs.

1: Choose a Format: One can opt for a simple spreadsheet program, readily available online, or utilize pre-designed templates often accessible through financial websites or educational resources. Spreadsheet software offers flexibility for customization, while pre-designed templates provide a convenient starting point.

2: Define the Time Period: Establishing a specific timeframe, typically a month or a year, ensures consistency in tracking and analysis. This defined period allows for meaningful comparisons of cash flow over time.

3: List Income Sources: All sources of income should be meticulously documented. Common sources include salaries, wages, investment returns, rental income, and other forms of revenue. Accuracy at this stage is crucial for a reliable cash flow statement.

4: Categorize Expenses: Establishing distinct expense categories facilitates a granular understanding of spending patterns. Common categories include housing, transportation, food, utilities, entertainment, and debt payments. Detailed categorization enables identification of areas for potential savings.

5: Calculate Net Cash Flow: Subtracting total expenses from total income yields the net cash flow. This crucial metric indicates whether one’s income exceeds expenses, providing a clear picture of financial health.

6: Incorporate a Summary Section: A summary section, providing a concise overview of total income, total expenses, and net cash flow, allows for quick assessment of financial standing. This snapshot facilitates efficient monitoring of financial progress.

7: Customize and Refine: Tailoring the template to individual circumstances enhances its efficacy. Adding or modifying expense categories, incorporating budgeting targets, or including sections for debt tracking or savings goals allows for a personalized and more effective financial management tool.

8: Regularly Update and Review: Consistent use and regular review of the template are crucial for its effectiveness. Updating income and expenses at regular intervals, ideally monthly, and analyzing the data for trends or areas for improvement, maximizes the template’s value as a financial management tool.

A well-structured template enables informed financial decisions and promotes financial well-being. Through meticulous tracking, categorization, and analysis, individuals gain valuable insights into their financial habits, empowering them to take control of their finances and work towards achieving their financial goals. Regular review and adaptation of the template ensure its continued relevance and efficacy as a personal financial management tool.

Complimentary personal cash flow statement templates provide accessible and invaluable tools for effective financial management. These resources empower individuals to gain a comprehensive understanding of their income and expenses, facilitating informed decision-making and fostering financial well-being. From meticulous income tracking and detailed expense categorization to insightful analysis and proactive financial planning, these templates offer a structured framework for achieving financial stability and pursuing financial goals. Their accessibility, combined with their capacity for customization and detailed analysis, makes them essential tools for anyone seeking to improve their financial health.

Financial well-being is an ongoing journey, not a destination. Regular utilization of these readily available resources cultivates financial awareness, promotes responsible financial behavior, and empowers informed choices. This proactive approach to personal finance management paves the way for greater financial security and a more confident financial future.