Navigating international trade can sometimes feel like solving a complex puzzle. Businesses across North America constantly seek ways to streamline their operations and ensure compliance with trade agreements. One of the most significant frameworks governing trade between the United States, Mexico, and Canada is the USMCA, or United States-Mexico-Canada Agreement. Understanding its intricacies, especially regarding proper documentation, is vital for seamless cross-border commerce.

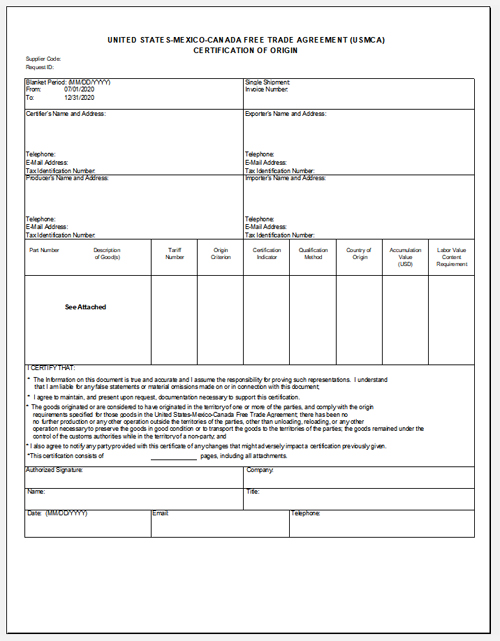

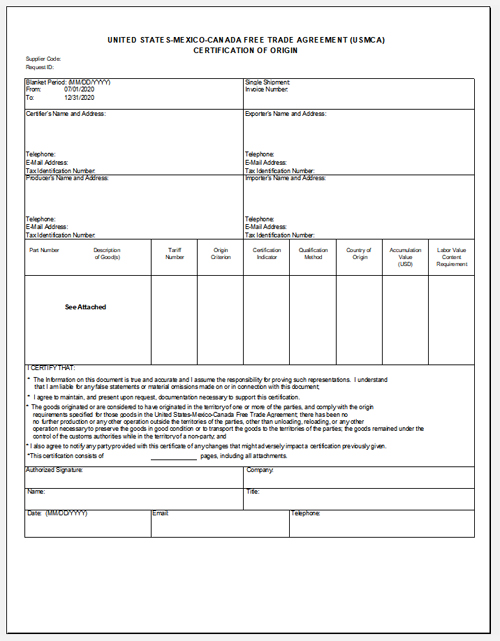

At the heart of benefiting from the USMCA is the correct use of a certificate of origin. This document proves that goods meet the agreement’s rules of origin, allowing them to qualify for preferential duty treatment. Many businesses look for a reliable usmca certificate usmca form template to ensure they are providing all the necessary information accurately and consistently. This template becomes an essential tool in their trade toolkit.

Understanding the USMCA Certificate of Origin

The USMCA certificate of origin, or certification of origin as it is officially called, is not a government-issued form but rather a set of data elements that can be provided on any commercial document, including an invoice or a separate declaration. This flexibility is designed to ease the burden on traders, but it also means that businesses must be meticulous in ensuring all required information is present and correct. The primary purpose of this certification is to declare that goods being exported from one USMCA country to another meet the origin requirements set out in the agreement. Without this declaration, importers might not be able to claim the reduced or eliminated duties that the USMCA offers, potentially increasing costs significantly.

This certification can be completed by the exporter, the producer, or the importer of the goods. This shared responsibility highlights the importance of communication and collaboration among all parties involved in the supply chain. Each entity involved has a vested interest in ensuring the goods qualify and that the documentation is accurate, as it directly impacts their financial benefits and compliance standing. Incorrect or incomplete documentation can lead to delays at the border, penalties, or even loss of preferential tariff treatment for past shipments.

One of the key advantages of properly utilizing the USMCA agreement through the certificate of origin is the significant cost savings. By proving that goods originate from a USMCA country, businesses can avoid or reduce customs duties that would otherwise apply. This directly impacts the competitiveness of products in the market, making them more attractive to buyers. For many companies, especially those with extensive cross-border supply chains, these duty savings can amount to substantial figures, reinforcing the need for diligent attention to this documentation.

Key Elements of a USMCA Certification

While there is no prescribed government form for the USMCA certification, certain data elements must be included for it to be valid. Businesses must ensure their chosen format, whether it is a custom document or a usmca certificate usmca form template, contains all these required details. Accuracy in each of these fields is paramount for the certification to be accepted by customs authorities.

Here are the essential data elements that must be provided:

- Importer, Exporter, or Producer Certification: An indication of whether the certifier is the importer, exporter, or producer.

- Certifier Information: Name, title, address, telephone number, and email address of the person completing the certification.

- Exporter Information: Name, address, email address, and telephone number of the exporter. If the producer is also the exporter, state “Producer.”

- Producer Information: Name, address, email address, and telephone number of the producer. If there are multiple producers, or if the information is confidential, it can be indicated that it is “available upon request by the importing Party.”

- Importer Information: Name, address, email address, and telephone number of the importer. If the importer is unknown, state “unknown.”

- Description and Harmonized System HS Tariff Classification of the Good: A description of the good and its HS tariff classification to the six-digit level.

- Origin Criterion: The specific rule of origin under which the good qualifies. This is crucial as it dictates how the good meets the origin requirements.

- Blanket Period: If the certification covers multiple shipments of identical goods, specify the period not exceeding 12 months.

- Authorized Signature and Date: The signature of the certifier and the date of certification.

Understanding each of these criteria, particularly the origin criterion, is fundamental. Goods can qualify based on various factors, such as being wholly obtained or produced, meeting a regional value content requirement, or undergoing a specific change in tariff classification. Businesses should carefully review the specific rules of origin for their products to determine the correct criterion to apply.

Navigating the Usmca Certificate Usmca Form Template: Best Practices

While the USMCA does not mandate a specific form, many businesses find it incredibly helpful to use a usmca certificate usmca form template. These templates are readily available from various sources, including government trade agencies, customs brokers, and international trade organizations. The benefit of using a pre-designed template is that it ensures all the required data elements are present, reducing the risk of errors or omissions that could lead to customs issues. A good template acts as a checklist, guiding the certifier through each necessary piece of information.

The accuracy of the information provided on the certificate of origin cannot be overstated. Any incorrect details, even seemingly minor ones, could invalidate the certification and lead to a denial of preferential tariff treatment. This is why due diligence is crucial. Businesses should have robust internal processes for gathering and verifying all the information before completing the template. This might involve consulting with their production teams, suppliers, or legal counsel to ensure that the goods truly meet the origin requirements.

Finding a reliable usmca certificate usmca form template is the first step toward efficient compliance. Government websites of the US, Mexico, and Canada often provide guidelines or examples of the required data elements, which can serve as a basis for creating or verifying a template. Trade associations and reputable customs brokerage firms also frequently offer templates tailored to their clients needs. It is always wise to compare templates from various trusted sources to ensure comprehensive coverage and clarity.

Once a template is chosen, best practices dictate consistent application and diligent record-keeping. Whether the certificate is completed digitally or in hard copy, businesses should maintain a thorough record of all certifications issued, along with the supporting documentation that proves the goods meet the origin criteria. This documentation might include bills of material, production records, supplier declarations, and costing data. Customs authorities can audit these records for up to five years after the importation, making meticulous record-keeping an essential component of compliance. Regularly training staff involved in international trade operations on how to correctly fill out and manage the usmca certificate usmca form template is also highly recommended.

The USMCA has significantly shaped trade relations in North America, offering considerable benefits to businesses that understand and comply with its provisions. The certification of origin is a cornerstone of this agreement, enabling companies to take full advantage of preferential tariff treatment and enhance their competitiveness.

By carefully completing the required documentation, whether through a custom internal process or by utilizing a trusted template, businesses can ensure smooth customs clearance and avoid unnecessary costs. Investing time and resources into understanding these requirements and maintaining accurate records will undoubtedly yield long-term advantages in the dynamic landscape of international trade.