Navigating the complexities of estate planning can feel like walking through a maze. Most people want to ensure their assets pass smoothly to their loved ones without unnecessary delays or costs. This often leads to concerns about probate, a lengthy and public legal process that can tie up an estate for months or even years. Fortunately, there are simpler alternatives available, and one powerful tool that has gained popularity is the Transfer on Death (TOD) designation. It allows you to bypass probate for specific assets, making the transfer of ownership swift and private.

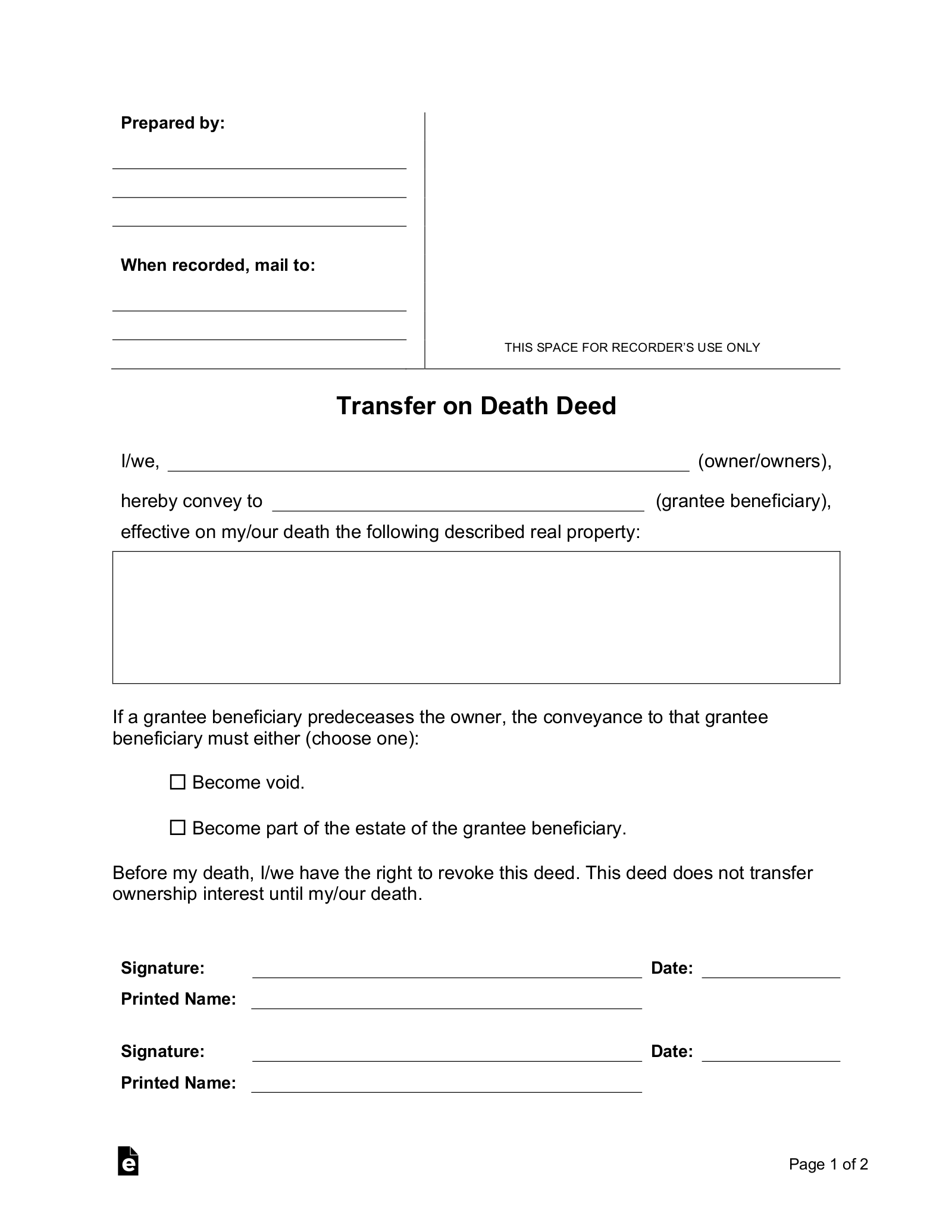

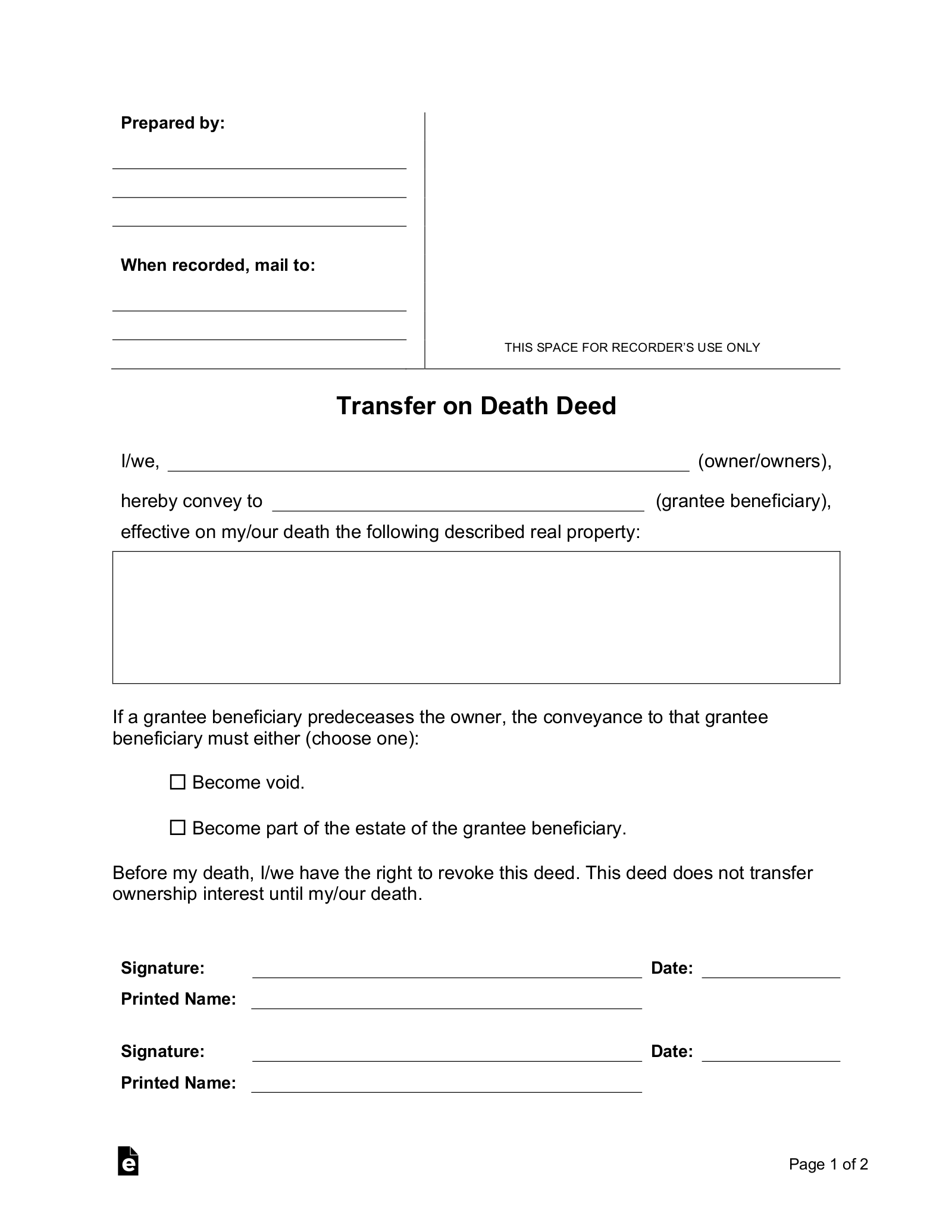

A Transfer on Death form is essentially a document that allows you to name a beneficiary who will automatically receive certain assets upon your passing, without the need for a will or the probate process. Think of it as a pre-planned route for your property, whether it’s real estate like your home, a vehicle, or sometimes even bank accounts and investments, to go directly to the person you intend. This mechanism is designed for efficiency, ensuring your beneficiaries get what they are entitled to quickly and with minimal hassle, providing peace of mind for you and your family.

Understanding What a Transfer on Death Form Does for You

A Transfer on Death (TOD) form acts as a direct link between you and your designated beneficiary, ensuring that specific assets bypass the traditional probate process entirely. When you execute a TOD deed for real estate, for example, you are essentially naming an individual or individuals who will automatically become the new owners of that property upon your death. Unlike a will, which must go through probate to be validated and executed, a TOD form takes effect immediately upon your passing, providing a seamless transfer of ownership without court intervention. This can save your heirs significant time, legal fees, and administrative burdens.

It’s important to understand that TOD forms typically apply to specific types of assets, most commonly real estate (often called a TOD deed or beneficiary deed, depending on the state) and vehicles (often called a TOD designation on the title). While some financial institutions may offer TOD or Payable on Death (POD) designations for bank accounts or investment portfolios, the primary benefit often discussed with a transfer on death form template relates to tangible property. The rules and availability of TOD forms vary significantly by state, so what might be valid in one state might not be in another. Always verify the specific laws governing TOD designations in your jurisdiction to ensure your plans are legally sound.

The advantages of utilizing a TOD form are quite compelling for many individuals looking to simplify their estate plan. Firstly, as mentioned, it completely bypasses probate, which means assets can be transferred to beneficiaries much faster, sometimes within weeks of death, as opposed to months or years. Secondly, it offers a level of privacy, as probate proceedings are public records, whereas a TOD transfer is typically not. Thirdly, it is often a more cost-effective solution than traditional probate, significantly reducing legal and court fees. Finally, during your lifetime, you retain full control and ownership of the asset; you can sell it, mortgage it, or change your beneficiaries without needing their consent.

However, it’s also crucial to be aware of the nuances. A TOD form does not override existing joint tenancy or tenancy by the entirety ownership structures. If you own property with someone else as joint tenants with rights of survivorship, the property will automatically pass to the surviving joint owner, regardless of any TOD designation. Also, a TOD form does not protect assets from creditors, Medicaid recovery claims, or estate taxes. It’s a powerful tool for efficient transfer but not a comprehensive solution for all estate planning needs.

Key Benefits of Using a TOD Form

- Avoids probate: Faster and cheaper transfer of assets to beneficiaries.

- Maintains control: You retain full ownership and control over the asset during your lifetime.

- Simple to create: Often just a form and recording, typically less complex than a trust.

- Private: The transfer does not become a public record through probate proceedings.

- Flexible: Can usually be revoked or changed at any time before your death without beneficiary consent.

Navigating the Process of Using a Transfer on Death Form Template

When you decide that a Transfer on Death designation is the right choice for your assets, the next step involves understanding how to effectively use a transfer on death form template. The process, while designed to be straightforward, requires careful attention to detail and adherence to your state’s specific legal requirements. Each state has its own statutes governing these forms, including what assets they apply to, what language must be used, and how they must be executed. Therefore, the very first step is always to ensure you are obtaining and using a template that is valid for your specific state and the type of asset you wish to designate.

Once you have identified the appropriate transfer on death form template for your situation, filling it out accurately is paramount. This involves correctly identifying the property, providing your legal name, and clearly naming your desired beneficiaries. You might also need to specify successor beneficiaries in case your primary beneficiary precedes you in death. Accuracy is critical, as any errors or omissions could invalidate the document and force the asset into probate, precisely what you are trying to avoid. Take your time, double-check all information, and consider having someone else review it for clarity and correctness.

Execution of the form is the next vital step. Depending on your state’s laws, a TOD form may need to be signed in the presence of witnesses, notarized, or both. For real estate, it is almost universally required that the TOD deed be recorded with the county recorder’s office in the county where the property is located. This recording makes the deed a part of the public record and officially validates it. Without proper recording, the TOD deed is generally not legally effective, and the property will likely still go through probate. Make sure to understand and fulfill all execution and recording requirements for your state.

Finally, while not legally required, it’s often a good practice to inform your beneficiaries of your plans. This can prevent confusion and disputes after your death and ensures they know what steps to take to claim the asset. Also, remember that your life circumstances and relationships can change. It is advisable to review your TOD forms periodically, perhaps every few years or after significant life events like marriage, divorce, birth of a child, or the death of a beneficiary, to ensure they still reflect your wishes. Keeping your estate plan current is just as important as setting it up initially.

- Research state laws to ensure the TOD form is valid for your asset and jurisdiction.

- Obtain the correct transfer on death form template for your specific needs.

- Fill out the form accurately, including property details and beneficiary information.

- Execute the document properly, which may involve signing, witnessing, and notarization.

- Record the document with the appropriate government office, especially for real estate.

- Inform beneficiaries of the TOD designation (optional, but recommended).

- Review and update the form periodically to reflect any changes in your life or wishes.

Utilizing a Transfer on Death form can be an exceptionally effective way to streamline the transfer of specific assets, offering a degree of control and simplicity that traditional probate often lacks. It represents a proactive step in ensuring your legacy is handled according to your wishes, providing a clear path for your beneficiaries without unnecessary delays or public scrutiny. When integrated thoughtfully into your overall estate strategy, these forms empower you to manage transitions more smoothly for your loved ones.

While the convenience of a TOD form is undeniable, it’s always wise to remember that it is one piece of a larger estate planning puzzle. For comprehensive advice tailored to your unique financial situation and family dynamics, consulting with an experienced estate planning attorney is invaluable. They can help you determine if a TOD form is suitable for your assets and ensure it aligns perfectly with your broader goals for asset distribution and legacy planning.