Navigating the intricacies of estate planning can often feel like deciphering a complex puzzle. While wills and trusts typically cover major assets like real estate and substantial investments, what about all those cherished personal belongings that hold sentimental value or practical use? Things like family heirlooms, jewelry, artwork, furniture, or even vehicles often require a more specific method for transfer, especially when you want to ensure they go directly to particular individuals without the delays and costs of probate court.

This is where a dedicated form for personal property transfer comes into play. It provides a clear, legally sound way to designate who receives specific items after your passing. Instead of a general instruction in a will that might lead to confusion or disputes among beneficiaries, a detailed personal property transfer document acts as a precise roadmap for your wishes. It empowers you to clearly articulate your intentions, ensuring your treasured possessions end up exactly where you want them, fostering peace of mind for you and clarity for your loved ones.

Understanding the Importance of a Personal Property Transfer Form

When you consider your estate, it is easy to focus on the big items – your house, your retirement accounts, your investment portfolio. However, the emotional value and sometimes significant monetary value of personal property should never be underestimated. These are the items that often carry memories, history, and a piece of your legacy. Without a clear directive, such items can become a point of contention among heirs, leading to unnecessary stress and family discord during an already difficult time. This is precisely why having a dedicated instrument for these transfers is incredibly beneficial.

A personal property transfer form essentially allows you to create a separate, detailed list of tangible personal property items and specify who you wish to inherit each one. This method bypasses the need to list every single item within your will, which can become cumbersome and require frequent updates as your possessions or beneficiaries change. It offers a flexible and efficient way to manage the distribution of your belongings, ensuring your exact wishes are honored without having to amend your primary estate planning documents repeatedly.

Moreover, utilizing a proper form for these transfers can significantly streamline the estate administration process. When a will goes through probate, the court often oversees the distribution of all assets. If personal property isn’t explicitly detailed and assigned, it might fall into a residual clause, meaning it gets distributed as part of a general category, or worse, cause arguments among family members trying to decide who gets what. A clear form minimizes ambiguity, potentially reducing legal fees and the time it takes for your beneficiaries to receive their inheritance.

Think of it as adding a detailed appendix to your main estate plan. It complements your will by providing granular instructions for items that are meaningful but might not warrant individual mention in a formal legal document. For anyone serious about comprehensive estate planning, considering a transfer beneficiary personal property form template is a wise decision to ensure every piece of their legacy is handled with care and precision.

What Constitutes Personal Property for Transfer?

- Jewelry and watches

- Art collections, sculptures, and paintings

- Antiques and collectibles

- Furniture and household goods

- Books and media libraries

- Vehicles (cars, boats, RVs – though some may require separate DMV forms)

- Sentimental items like photographs, diaries, or family heirlooms

- Sporting equipment and hobby collections

Key Elements to Include in Your Personal Property Transfer Template

When preparing a document to transfer personal property, clarity and completeness are paramount. This isn’t just about listing items; it’s about creating a legally sound declaration of your intentions. Every element plays a crucial role in ensuring that your wishes are understood and executed without question. The more precise you are, the less room there is for misinterpretation or disputes among your loved ones after you’re gone, making the entire process smoother for everyone involved.

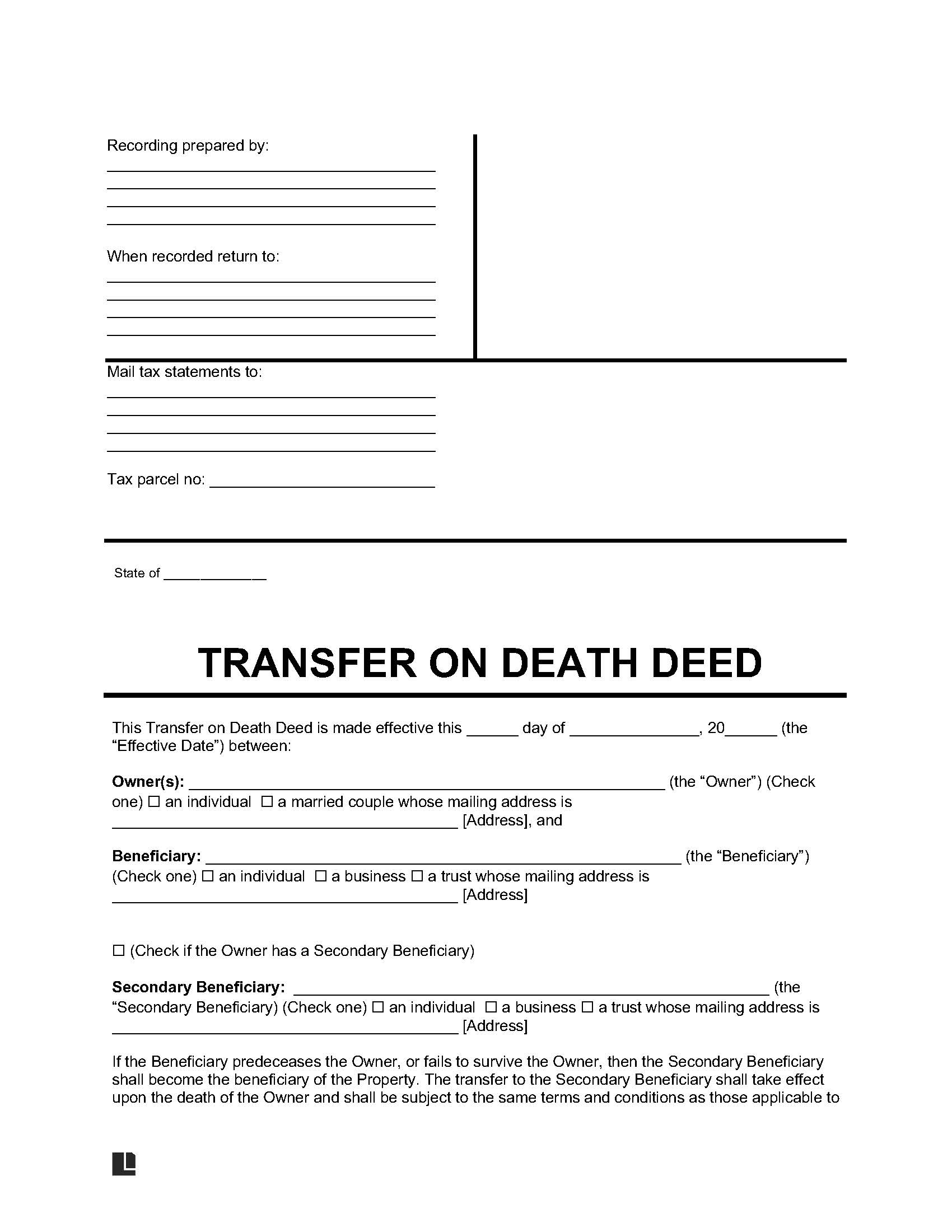

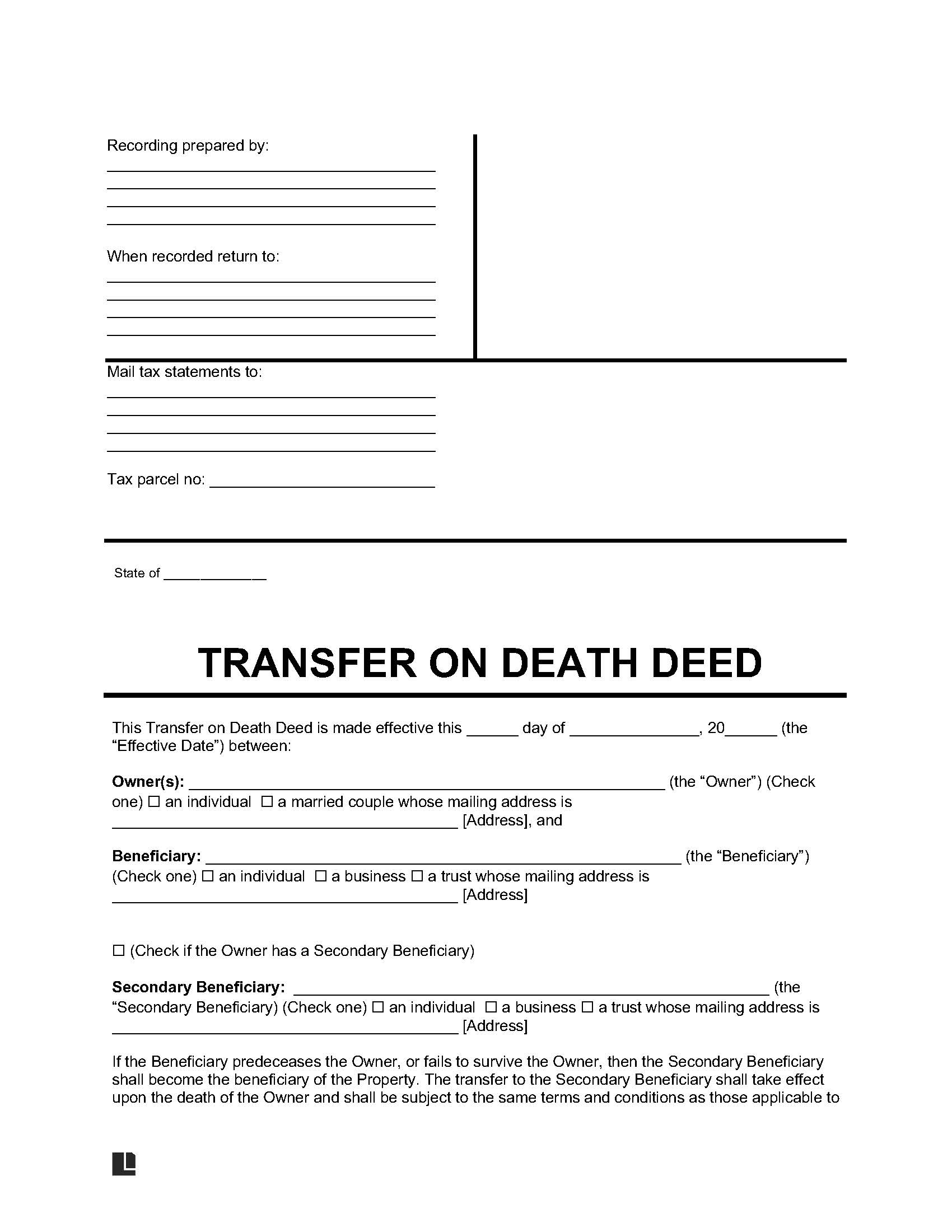

Firstly, the form should clearly identify the grantor – that’s you, the person making the gift – and your full legal name and address. Equally important is the precise identification of each beneficiary. This means their full legal name, relationship to you, and current address. Ambiguity here can lead to significant problems. If you have multiple beneficiaries with similar names, consider adding birth dates or other unique identifiers to avoid confusion.

Secondly, a detailed description of each item of personal property is absolutely essential. Don’t just write “jewelry” or “old clock.” Be specific: “Diamond solitaire engagement ring, 1.5 carats, platinum setting,” or “Grandfather clock, mahogany, circa 1880, with Westminster chimes.” Consider including serial numbers, appraisal values, or photos for high-value items. This level of detail helps avoid mix-ups and ensures the correct item goes to the intended recipient.

Finally, and critically, the document must include your signature, the date, and ideally, the signatures of witnesses. Depending on your jurisdiction, notarization might also be highly recommended or even required for certain types of transfers or to add an extra layer of legal validity. Always research the specific legal requirements in your state or country to ensure your document holds up. While a simple template can get you started, consulting with an estate planning attorney can provide invaluable guidance to tailor the document perfectly to your unique situation and local laws.

Essential Components of a Personal Property Transfer Template

- Clear Identification of Grantor (Your Full Legal Name and Address)

- Clear Identification of Each Beneficiary (Full Legal Name, Relationship, Address)

- Detailed Description of Each Item of Personal Property

- Statement of Intent to Transfer Property Upon Death

- Space for Grantor’s Signature and Date

- Space for Witness Signatures and Dates (Typically 2 witnesses)

- (Optional but Recommended) Notary Public Acknowledgment

- (Optional) Provisions for Alternate Beneficiaries if Primary Cannot Inherit

- (Optional) Instructions for Distribution of Residual Personal Property

Taking the time to organize and document your wishes for personal property distribution is a thoughtful act that benefits everyone involved. It not only provides you with peace of mind knowing your treasured items will go to the right people, but it also alleviates a significant burden from your loved ones during a period of grief. Having a clear, pre-planned structure in place helps prevent potential disputes and ensures a smoother, more respectful distribution of your legacy.

Ultimately, preparing for the future means addressing all aspects of your estate, big and small. By proactively using a tool like a personal property transfer form, you ensure that your intentions are crystal clear and that your wishes are honored to the fullest extent. It’s a simple step that can make a profound difference in protecting your family from unnecessary stress and preserving your cherished possessions as you intend.