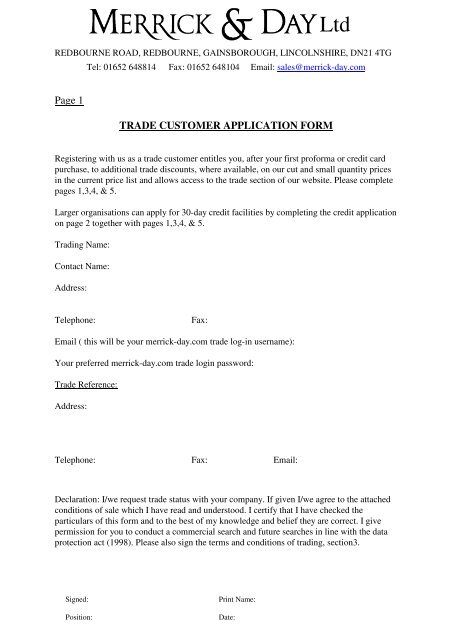

Opening a trading account might seem like a straightforward step into the financial world, but beneath the surface lies a necessary and often detailed process. Whether you’re a seasoned investor looking to diversify or a newcomer eager to make your first trade, the journey typically begins with an application. This form is more than just a formality; it’s the gateway that ensures both you and the brokerage firm are on the same page regarding regulations, risk, and your financial profile.

Navigating this application can sometimes feel daunting, filled with various sections and compliance requirements. That’s where the value of a well-structured trading account application form template truly shines. For individuals, it provides a clear roadmap of the information needed, helping you prepare thoroughly. For financial institutions, it streamlines their onboarding process, ensuring all necessary data is collected efficiently and in compliance with regulatory standards, making the entire experience smoother for everyone involved.

Why a Standardized Trading Account Application Form Template is Essential

A standardized trading account application form template offers a multitude of benefits, not just for the financial institution but also for the prospective client. For applicants, a clear, well-organized form simplifies what can often feel like a complex bureaucratic step. It helps them understand exactly what information is required, preventing confusion and reducing the likelihood of incomplete submissions. This clarity can significantly reduce the back-and-forth communication, leading to a much faster account opening experience.

From the perspective of brokerage firms and financial institutions, a consistent template is invaluable for operational efficiency and regulatory compliance. It ensures that every new client provides the same set of essential data, making it easier to process applications, conduct due diligence, and maintain accurate records. This standardization is crucial for complying with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which are non-negotiable in the financial industry.

Key Sections to Include in Your Template

When developing a trading account application form template, it’s vital to cover all bases to ensure comprehensive data collection while adhering to legal requirements. Each section serves a specific purpose in building a complete client profile. This structured approach not only helps with compliance but also allows the firm to better understand the client’s investment goals and risk appetite, ultimately leading to more suitable financial advice.

Here are some core sections that are typically found in an effective template:

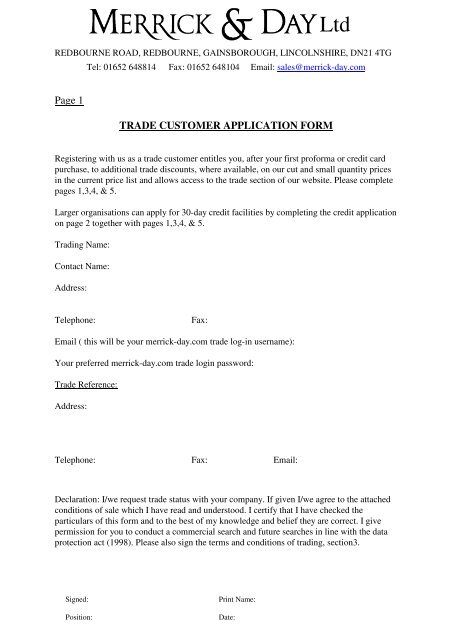

- Personal Identification Information: Full legal name, date of birth, gender, nationality, and government-issued ID details.

- Contact Information: Current residential address, phone number, and email address.

- Financial Profile: Details about income source, annual income, net worth, and liquid assets. This helps assess suitability and capacity.

- Employment Details: Current occupation, employer’s name, and industry.

- Investment Experience and Objectives: Information about past trading experience, knowledge of various financial instruments, and investment goals (e.g., capital growth, income, preservation).

- Risk Tolerance Assessment: Questions designed to gauge the applicant’s comfort level with potential losses.

- Bank Account Details: Information for funding and withdrawal purposes, including bank name, account number, and routing details.

- Regulatory Declarations and Consent: Sections for confirming understanding of risks, terms and conditions, privacy policy, and consent for data processing.

- Tax Information: Tax Identification Number (TIN) or equivalent, and residency for tax purposes.

Ensuring each of these sections is clear, concise, and easy to complete is paramount for a seamless application process, benefiting both the applicant and the financial institution.

Crafting a User-Friendly and Compliant Trading Account Application Form Template

Creating a trading account application form template that is both user-friendly and fully compliant with financial regulations requires careful consideration of design, language, and the underlying legal framework. A user-friendly template simplifies the experience for the applicant by using clear, straightforward language, avoiding jargon where possible, and presenting information in a logical flow. This includes intuitive field placement, clear instructions for each section, and the use of check boxes or dropdowns to minimize free-text entry errors.

Compliance is the backbone of any financial application form. The template must be meticulously designed to meet the rigorous requirements of global and local financial authorities, including KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations. This means incorporating mandatory fields for identity verification, source of funds, and risk assessment, ensuring that the institution collects all necessary data to prevent financial crime and protect clients. It also involves clearly stating disclaimers, terms and conditions, and privacy policies.

While a template provides a standardized structure, it should also be flexible enough to be customized for different types of trading accounts or specific regulatory environments. For instance, an application for a cryptocurrency trading account might require different disclosures or risk warnings compared to a traditional stock trading account. The template should serve as a strong foundation that can be adapted with specific questions or legal clauses pertinent to the unique services offered by a particular brokerage.

Moreover, in today’s digital age, the best trading account application form template designs are often geared towards online implementation. A well-structured digital template can integrate seamlessly with e-signature solutions, automated data validation, and secure document uploads. This digital approach not only enhances user convenience but also significantly improves processing speed and data accuracy for the financial institution, moving away from cumbersome paper-based systems.

A well-designed trading account application form template simplifies a crucial first step into the financial markets, making it accessible for individuals and efficient for institutions. It bridges the gap between complex regulatory requirements and a smooth user experience, fostering trust and clarity from the outset.

By implementing a robust and thoughtfully designed trading account application form template, financial service providers can ensure they are meeting their compliance obligations while simultaneously providing a positive onboarding experience. This foundational document is key to building lasting client relationships and supporting the secure and orderly growth of financial activities.