Navigating the world of investments can sometimes feel like stepping into a complex maze, especially when you start thinking about what happens to your hard-earned assets after you’re gone. Many people focus on growing their wealth, which is fantastic, but fewer give enough thought to how that wealth will smoothly transfer to their loved ones. This is where a crucial tool known as a Transfer on Death, or TOD, designation comes into play for your stocks and other brokerage assets. It’s designed to simplify the process significantly, ensuring your intentions are clear and followed without unnecessary hassle.

Imagine being able to pass on your stock portfolio directly to your chosen beneficiaries, completely bypassing the often lengthy and public process of probate court. This is the core advantage of a TOD designation. It’s a straightforward, yet incredibly powerful, estate planning strategy that offers peace of mind. You retain full control over your assets during your lifetime, and only upon your passing do they automatically transfer to the individuals or entities you’ve named.

Understanding Transfer on Death (TOD) for Your Investments

A Transfer on Death designation, often referred to as a TOD or payable-on-death (POD) designation for bank accounts, is a simple instruction you can give to your brokerage firm. It tells them who should receive your investments, like stocks, bonds, and mutual funds, upon your death. Think of it as adding a “direct express lane” for your assets, ensuring they go straight to your beneficiaries without getting bogged down in the traditional probate process. This is different from a will, which typically needs to be validated by a court.

The beauty of a TOD designation lies in its simplicity and efficiency. When you set up a TOD, your brokerage account isn’t part of your probate estate, meaning the assets within it can be distributed much faster and more privately. This saves your loved ones considerable time, legal fees, and potential stress during an already difficult period. It’s a proactive step that demonstrates foresight and care for those you leave behind.

It’s important to understand that while a will directs the distribution of assets that pass through your probate estate, a TOD designation supersedes it for the specific assets it covers. This means if your will says your stocks go to one person, but your TOD form names another, the TOD form takes precedence for that account. This highlights the importance of keeping your designations consistent with your overall estate plan and reviewing them regularly.

Many people mistakenly believe that having a will is sufficient for all their assets. While a will is an essential part of a comprehensive estate plan, it doesn’t automatically avoid probate for all assets. Assets with named beneficiaries, like life insurance policies, retirement accounts, and increasingly, brokerage accounts with TOD designations, bypass probate altogether. This distinction is crucial for efficient and private asset transfer.

Key Benefits of a TOD Designation

- Probate Avoidance: This is perhaps the biggest advantage. Assets with a TOD designation skip the probate court process entirely, saving time and money.

- Privacy: Probate is a public process. A TOD transfer remains private, protecting your family’s financial details.

- Cost-Effective: By avoiding probate, you typically reduce legal fees and court costs associated with asset transfer.

- Quicker Distribution: Beneficiaries can often access the funds and assets much faster than if they had to wait for probate to conclude.

- Retain Control: You maintain full control over your assets during your lifetime. You can sell, trade, or change beneficiaries at any time.

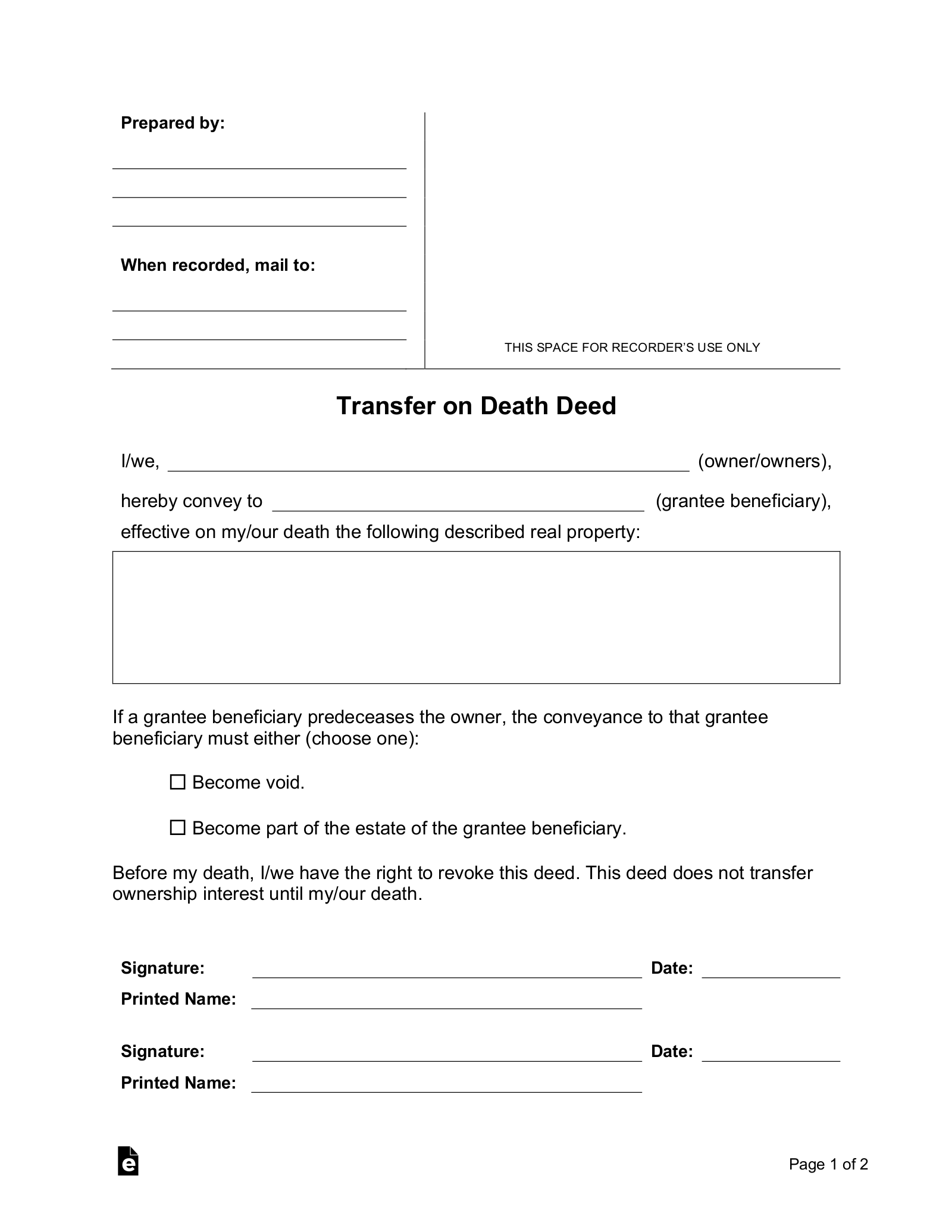

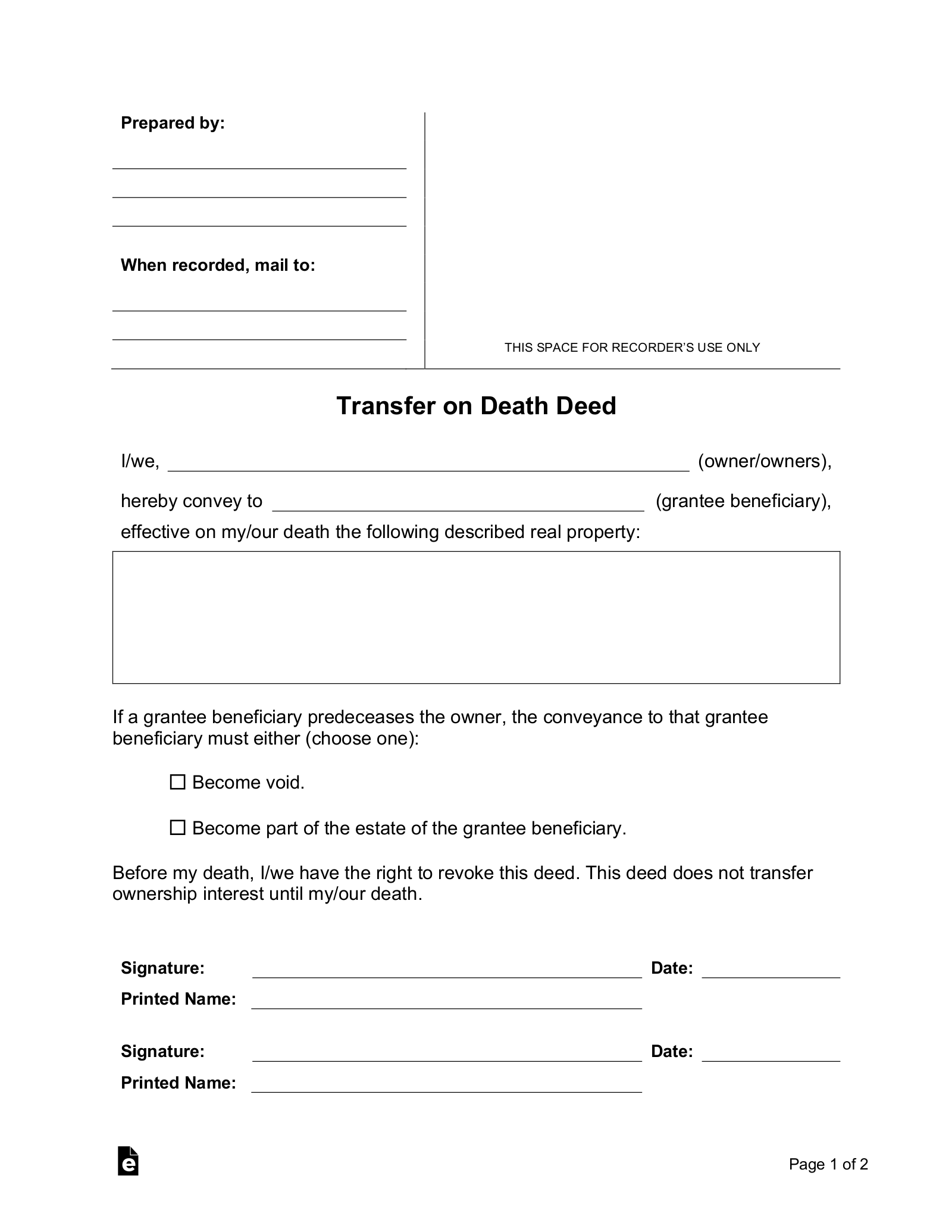

Navigating the TOD Stocks Beneficiary Form Template: What to Expect

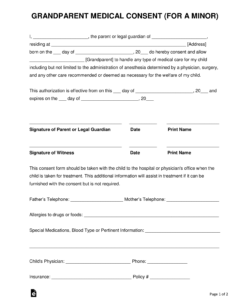

When you decide to implement a TOD designation for your stock portfolio, you’ll typically be looking for what your brokerage calls a Transfer on Death or Beneficiary Designation form. While there isn’t one universal “tod stocks beneficiary form template” that applies to all financial institutions, each brokerage will have its own specific version. These forms are usually available directly from your brokerage’s website, often in the forms or client services section, or by contacting their customer support.

The form will generally ask for a few key pieces of information to identify your account and your chosen beneficiaries. You’ll need to provide your full account details, including your account number and name. For each beneficiary, you’ll typically need their full legal name, relationship to you, date of birth, and Social Security Number or Taxpayer Identification Number. Accuracy here is paramount to avoid delays or issues during the transfer process.

Many forms also allow you to name contingent beneficiaries. These are secondary beneficiaries who would inherit your assets if your primary beneficiary passes away before you do. It’s always a good idea to name contingent beneficiaries to ensure your assets go where you intend, even in unexpected circumstances. You might also be able to specify percentage allocations if you’re naming multiple beneficiaries, ensuring each receives their intended share. Always double-check that you’ve completed all required fields and, most importantly, signed the form as instructed. An unsigned form is an invalid one!

Once you’ve completed the form, you’ll need to submit it to your brokerage firm according to their instructions. This often involves mailing a physical copy, though some may offer secure online submission. After submission, it’s wise to confirm with your brokerage that the designation has been properly recorded. Remember to review your beneficiary designations periodically, especially after major life events like marriage, divorce, birth of children, or a death in the family, to ensure they still align with your wishes.

Consider these steps when completing your form:

- Gather necessary information for all primary and contingent beneficiaries.

- Locate the correct TOD form on your brokerage’s website or request it directly.

- Fill out the form clearly and accurately, paying attention to all required fields.

- Carefully consider naming contingent beneficiaries to cover all possibilities.

- Ensure the form is signed and dated as required by the brokerage.

- Submit the form according to your brokerage’s instructions and confirm receipt.

- Keep a copy of the completed and submitted form for your own records.

Taking the time to designate beneficiaries for your stocks through a TOD arrangement is a smart and considerate step in your financial planning. It’s an effective way to streamline the transfer of your assets, bypass potentially time-consuming legal processes, and provide clear instructions for your loved ones during a challenging time. This proactive measure ensures your legacy is handled precisely as you intend, offering comfort and security for your beneficiaries.

Ultimately, a TOD designation is about giving you control and ensuring your financial affairs are in order. It minimizes complexity and maximizes efficiency, allowing your wealth to transition smoothly to the next generation or chosen recipients. By addressing this important aspect of your estate plan, you can enjoy peace of mind knowing that your hard-earned investments will serve their intended purpose for those you care about most.