In today’s fast-paced world of construction and contracting, efficiency is not just a buzzword; it’s a necessity. Managing payments can often be a time-consuming administrative task, especially when dealing with multiple subcontractors. Gone are the days when paper checks were the only option, bringing with them delays, lost mail, and endless trips to the bank. Modern solutions offer a much smoother path, and direct deposit stands out as the clear winner for both parties involved.

Embracing direct deposit means stepping into an era of streamlined transactions, ensuring that funds arrive securely and promptly in your subcontractors’ accounts. This not only speeds up the payment cycle but also significantly reduces the administrative burden for general contractors. For subcontractors, it means immediate access to their hard-earned money, without the hassle of depositing physical checks or worrying about banking hours. It’s a win-win scenario that fosters better relationships and more efficient project completion.

Why Direct Deposit is a Game-Changer for Subcontractors and Contractors Alike

The shift towards digital payments has been transformative across all industries, and construction is certainly no exception. For subcontractors who often juggle multiple projects and clients, receiving payments via direct deposit is more than just a convenience; it’s a fundamental improvement to their financial operations. It eliminates the need for physical interaction with checks, cutting down on transit time, potential for loss, and the overhead associated with manual processing. Imagine the peace of mind knowing your payment is automatically in your bank account, ready for use, rather than waiting for a check to clear.

From the subcontractor’s perspective, the benefits are clear and compelling. They gain immediate access to their funds, which is crucial for managing cash flow, paying their own suppliers, or covering operational expenses. This reliability helps them plan their finances with greater precision and reduces the stress associated with payment uncertainty. There’s no longer a need to disrupt their workday to visit a bank or ATM, freeing up valuable time that can be better spent on the job site or managing their business. The enhanced security that direct deposit offers also means less risk of fraud or theft compared to carrying physical checks.

General contractors also reap substantial rewards by implementing a direct deposit system. The administrative overhead associated with printing, signing, mailing, and tracking paper checks is virtually eliminated. This translates into significant cost savings on postage, check stock, and employee time. Furthermore, direct deposit significantly reduces the chances of errors that often plague manual processes, leading to more accurate financial records and fewer payment disputes. It simply streamlines the entire payment process, allowing contractors to focus more on their core business activities rather than payment logistics.

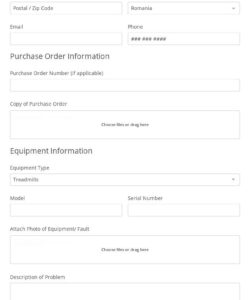

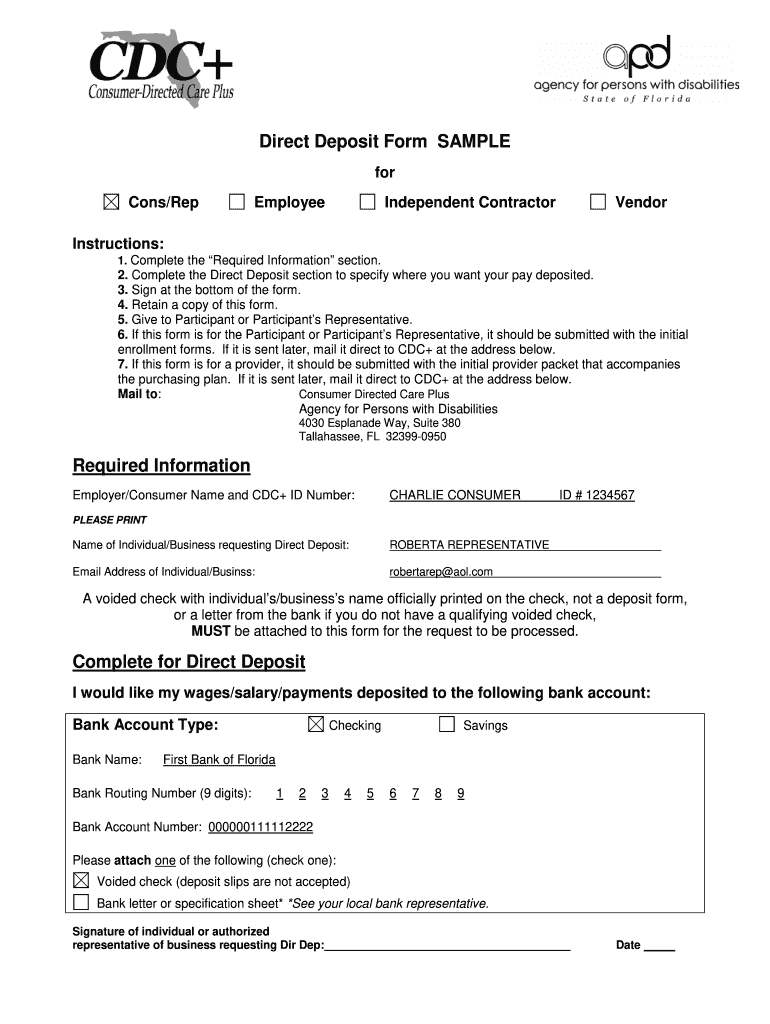

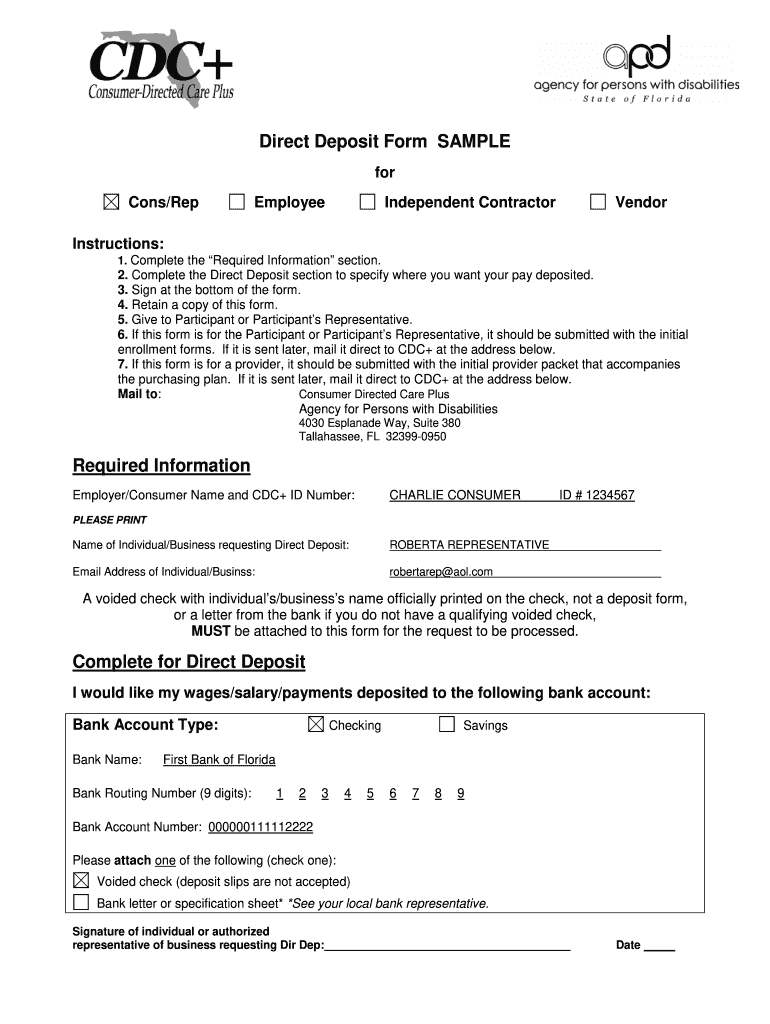

To fully leverage these advantages, a structured approach is essential, and that’s precisely where a well-designed subcontractor direct deposit form template comes into play. This standardized document ensures that all necessary banking information is collected accurately and consistently from every subcontractor, minimizing errors and ensuring a smooth setup process for electronic fund transfers. It provides a clear, uniform method for gathering critical details required by banks for successful transactions, making the transition to paperless payments as seamless as possible for everyone involved.

Essential Details on Your Direct Deposit Form

- Subcontractor’s Legal Business Name

- Subcontractor’s Federal Tax ID (EIN) or Social Security Number

- Bank Name and Address

- Bank Account Type (e.g., Checking or Savings)

- Bank Account Number

- Bank Routing Number

- Authorized Signature of the Subcontractor

- Date of Authorization

Getting Started: How to Use Your Subcontractor Direct Deposit Form Template

Embracing direct deposit for your subcontractors is a straightforward process, especially when you utilize a comprehensive subcontractor direct deposit form template. This template acts as your foundational tool, ensuring you capture all the necessary information accurately and efficiently right from the start. Its standardized format helps avoid common mistakes and ensures compliance with banking requirements, making the transition to electronic payments incredibly smooth for both parties. There’s no need to reinvent the wheel or worry about missing crucial data points when you have a reliable template at your disposal.

For the subcontractor, filling out the form is usually a quick and simple task. They will need to gather their banking details, such as their bank name, account number, and routing number, which are typically found on their checks or through their online banking portal. The template guides them through each required field, making the process intuitive. Once all the information is entered, a signature and date confirm their authorization for direct deposits, solidifying the agreement for electronic payments going forward.

Accuracy is paramount when completing a direct deposit form. Even a single incorrect digit in an account or routing number can cause significant delays or misdirected payments. Therefore, it’s always a good practice for subcontractors to double-check every piece of information they enter against their official bank documents. A small moment of vigilance during this step can prevent hours of troubleshooting and frustration down the line, ensuring that payments arrive exactly where they are intended, on time, every time.

Once the subcontractor has completed and submitted the form, the general contractor or their administrative team can process it. This typically involves inputting the banking details into their payroll or accounting system. The bank then uses this information to route funds directly into the subcontractor’s specified account whenever a payment is initiated. This entire process is designed for maximum efficiency and security, transforming what was once a cumbersome manual task into an automated, reliable system for timely financial transactions.

- Step 1: Obtain the subcontractor direct deposit form template from your general contractor or a reliable source.

- Step 2: Gather your personal and banking information, including your full name or business name, bank name, account number, and routing number.

- Step 3: Carefully fill in all the required fields on the template, ensuring every detail matches your official bank records.

- Step 4: Review the completed form for any errors or omissions, double-checking all numbers.

- Step 5: Sign and date the authorization section of the form to confirm your consent.

- Step 6: Submit the completed form to your general contractor or their designated point of contact.

Moving towards direct deposit with the aid of a solid subcontractor direct deposit form template is a clear step forward for any contracting business looking to enhance its operational efficiency and foster stronger relationships with its partners. It’s a modern solution that delivers on convenience, security, and speed, benefiting everyone involved in the payment cycle. This streamlined approach allows both contractors and subcontractors to focus on what they do best: building and delivering successful projects.

Adopting this reliable payment method means less time spent on administrative tasks and more time dedicated to growth and productivity. It’s about building a foundation of trust and efficiency that supports the ongoing success of every project, ensuring that financial transactions are as smooth and predictable as possible. Embrace the simplicity and peace of mind that comes with a well-managed direct deposit system.