Navigating financial disclosures can often feel like walking through a maze, especially when you’re dealing with legal or official processes. Whether it’s for divorce proceedings, debt management, or court applications, being able to clearly articulate your financial standing is not just important; it’s essential. This is where a well-structured document comes into play, one that lays out all your income, expenses, assets, and liabilities in an easy-to-understand format.

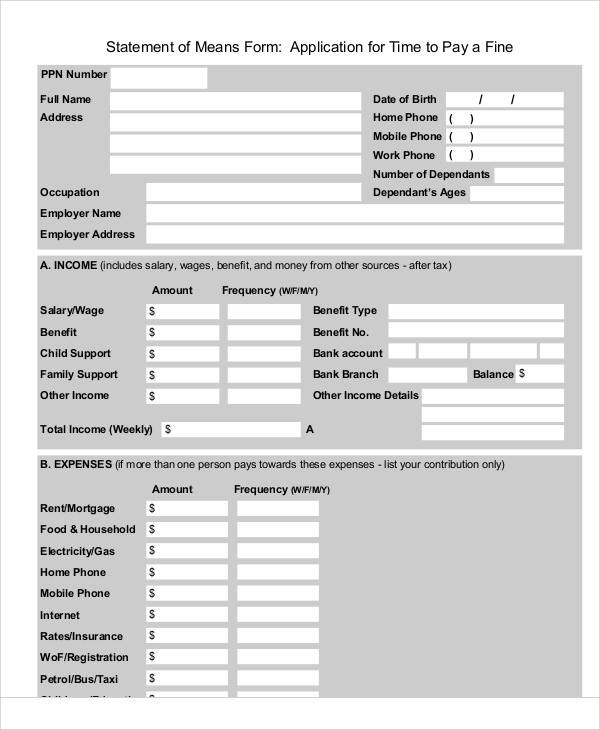

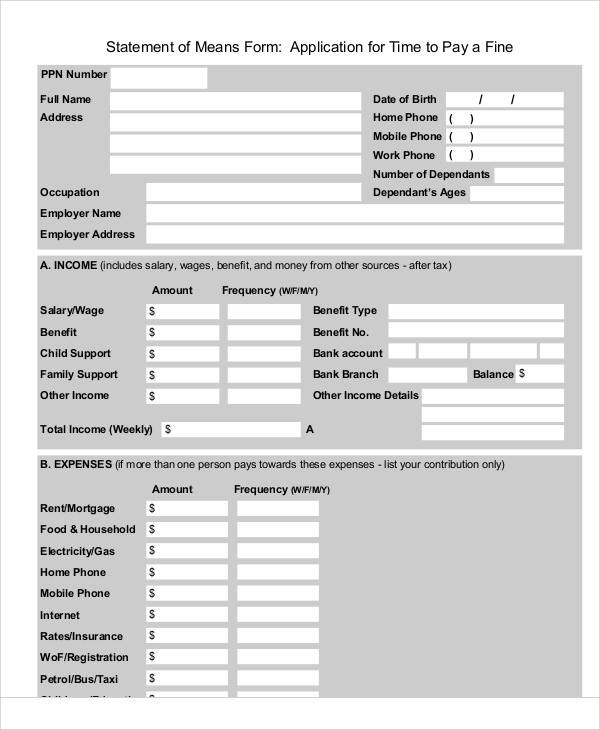

Understanding and completing such a form can be daunting if you’re starting from scratch. Many people find themselves wondering what information is truly necessary, how to present it clearly, and what level of detail is expected. The good news is that you don’t have to reinvent the wheel. A reliable statement of means form template can be your guiding light, providing a clear framework to ensure you capture all the relevant financial information accurately and comprehensively, saving you time and reducing stress during what can often be a challenging period.

Demystifying the Statement of Means: What It Is and Why You Need It

At its core, a statement of means is a comprehensive financial snapshot of an individual or household. It’s designed to provide a clear and objective picture of your financial reality, detailing exactly what you earn, what you spend, what you own, and what you owe. Think of it as your financial resume, but instead of highlighting skills, it meticulously lists every financial element that defines your economic situation. This document is typically requested by courts, legal professionals, or financial institutions when they need to make informed decisions based on your capacity to pay, your entitlement to certain benefits, or to fairly divide assets.

The necessity for a statement of means arises in various critical life situations. For instance, in family law, particularly during divorce or separation, it’s a fundamental tool for determining fair spousal maintenance, child support, and the equitable division of matrimonial assets. Similarly, if you are struggling with debt, a debt management company or a court might request this statement to assess your ability to repay and to negotiate manageable payment plans. Even in cases involving personal bankruptcy, a detailed statement of means is crucial for the official receiver to understand your financial position and distribute assets accordingly.

Key Components of an Effective Statement of Means

To be truly effective, a statement of means must be thorough, accurate, and transparent. It requires you to gather a significant amount of personal financial data, which, when compiled, presents a holistic view. While the exact sections might vary slightly depending on the jurisdiction or the specific purpose, a good template will guide you through all the essential categories. Here’s a breakdown of what you’ll typically need to include:

- Personal Information: Basic details about yourself, your dependents, and your employment status.

- Income Details: A comprehensive list of all your income sources, including salaries, wages, benefits, pensions, self-employment income, and any other regular payments you receive. It’s important to detail both gross and net amounts.

- Expenditure: This section covers all your regular outgoings. It typically includes housing costs (rent/mortgage, council tax), utility bills (gas, electricity, water), food and household expenses, transportation costs, childcare, insurance premiums, and any other regular monthly or annual expenditures.

- Assets: A list of everything you own that has monetary value. This can range from property (real estate, vehicles) to savings accounts, investments, shares, pensions, and even valuable personal possessions.

- Liabilities: A detailed account of all your debts and financial obligations. This includes mortgages, loans (personal, car), credit card balances, overdrafts, hire purchase agreements, and any other monies you owe.

The accuracy and honesty with which you complete each of these sections are paramount. Any misrepresentation can have serious legal consequences. This is precisely why having a structured statement of means form template can be so beneficial; it acts as a checklist, ensuring you don’t overlook any critical information and helping you present it in a clear, logical, and often legally compliant format. It streamlines a potentially complex task into manageable steps.

Navigating Financial Disclosures with a Statement of Means Form Template

Preparing a detailed financial disclosure document like a statement of means can feel like a monumental task. The sheer volume of information needed, coupled with the precision required, often leads to anxiety and procrastination. This is where the strategic use of a reliable statement of means form template becomes an invaluable asset. Rather than staring at a blank page, wondering how to structure your financial life on paper, a template provides a pre-designed framework, complete with headings, sections, and prompts that guide you through every necessary financial category. It removes the guesswork and provides a clear path forward, making a daunting process much more manageable.

The practical benefits of utilizing a template are numerous. Firstly, it ensures completeness. A professionally designed template will include all the standard sections required by courts or financial institutions, minimizing the risk of you omitting crucial information that could delay your case or lead to further inquiries. Secondly, it promotes consistency and clarity. The standardized layout makes your financial information easy to read and understand for anyone reviewing it, from legal professionals to judges. This can significantly speed up the assessment process. Thirdly, it is a significant time-saver. Instead of spending hours designing your own document, you can focus directly on inputing your data, which is especially beneficial when deadlines are tight.

To make the most of your statement of means form template, a little preparation goes a long way. Before you even start filling it out, gather all your relevant financial documents. This includes bank statements, pay stubs, loan agreements, credit card statements, mortgage documents, property valuations, and any other records pertaining to your income, expenses, assets, and liabilities. Having everything organized beforehand will make the data entry process much smoother and reduce the chances of errors. As you fill out each section, double-check your figures and ensure that they align with your supporting documentation. Honesty and meticulousness are your best allies here; inaccuracies, even unintentional ones, can lead to complications.

Once you’ve diligently completed your statement of means using the template, remember that your work isn’t quite done. Always make several copies for your own records and for any other parties who require them. Depending on the context, you may need to sign it in the presence of a witness or a notary public, so be sure to understand the specific submission requirements for your situation. This document often forms the basis for crucial decisions that impact your financial future, so treating its creation and submission with the utmost care is paramount. It’s a powerful tool for clear communication and informed decision-making in any financial or legal proceeding.

Ultimately, whether you’re facing a legal dispute, managing debt, or simply need a comprehensive overview of your financial standing, preparing a clear and accurate financial disclosure is a vital step. It serves as the bedrock for fair and equitable resolutions, ensuring that all parties have a transparent understanding of your economic circumstances. The effort you put into compiling this document meticulously will pay dividends by fostering clarity and facilitating smoother processes.

Empowering yourself with the right tools, like a well-structured template, transforms what could be a formidable task into a manageable one. By providing a clear roadmap for detailing every aspect of your financial life, it enables you to present your information confidently and effectively, ensuring that your financial narrative is accurately and comprehensively understood by those who need to see it. Taking this proactive step can significantly ease the burden during complex financial situations, helping you move forward with greater peace of mind.