Have you ever found yourself in a situation where a friend or family member needed to borrow money, or perhaps you were lending to a budding small business? While the intention is always good, and trust is paramount, financial agreements, even between the closest individuals, can sometimes lead to misunderstandings. That’s where a clear, written agreement becomes incredibly helpful, providing clarity and peace of mind for everyone involved.

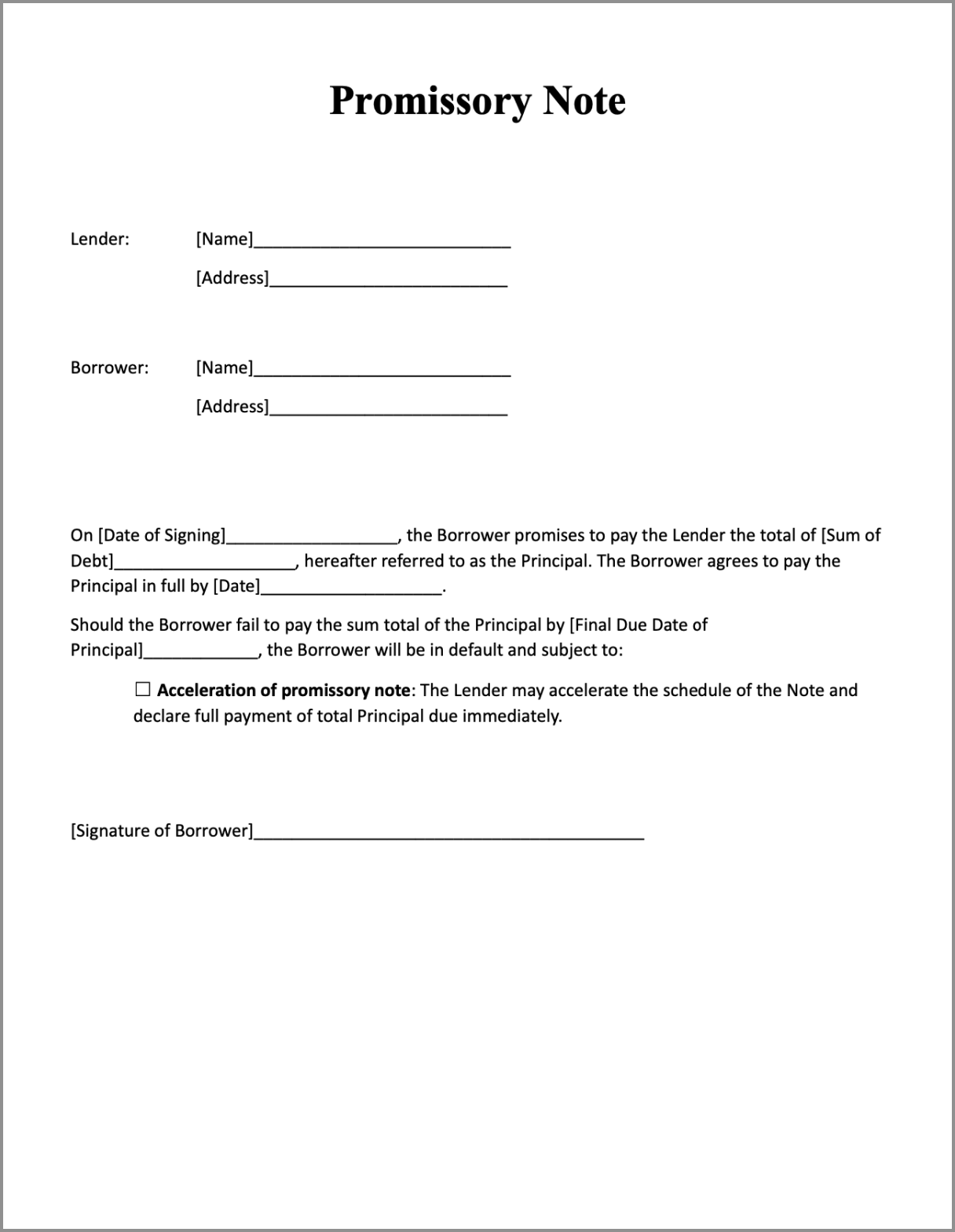

A promissory note is essentially a written promise to repay a loan. It’s a legally binding document that outlines the terms of the debt, ensuring that both the borrower and the lender understand their obligations. Creating one from scratch can seem daunting, but thankfully, a well-designed template can simplify the process immensely, making it accessible even if you’re not a legal expert.

What Exactly Is a Promissory Note and Why Do You Need One?

At its core, a promissory note is a formal IOU. It serves as a legal record of a debt, detailing how much money is owed, to whom it’s owed, and the specific terms of repayment. Think of it as a roadmap for the loan journey. Without it, you’re relying on verbal agreements, which, while seemingly convenient at the moment, can quickly become foggy and open to different interpretations down the line. This document provides a solid foundation, protecting the interests of both the person lending the money and the person borrowing it.

These notes are incredibly versatile. They are frequently used for personal loans between individuals, for small business financing, or even when selling a large item like a car or a piece of property where the buyer makes payments over time. It transforms a casual agreement into a professional understanding, helping to preserve relationships by preventing awkward disputes over forgotten details or misunderstandings about repayment schedules. It’s a small step that can save a lot of headaches and heartache.

Relying on a handshake for a significant sum of money, no matter how close the relationship, leaves too much to chance. Memories fade, circumstances change, and what seemed clear at the time of the loan can become a source of contention. A promissory note eliminates ambiguity by putting all the essential terms in writing. It provides a clear, undeniable record of the debt and the agreed-upon repayment plan.

Choosing to use a simple promissory note form template means you’re taking a proactive step towards financial responsibility and clarity. It doesn’t imply a lack of trust; rather, it demonstrates a commitment to transparency and fairness for all parties involved. It’s about ensuring that everyone is on the same page from day one.

Key Elements of a Solid Promissory Note

A well-crafted promissory note, even a simple one, should include several crucial pieces of information to be effective and legally sound. These elements ensure that there’s no room for confusion about the loan’s terms.

* The principal amount of the loan, clearly stating how much money was borrowed.

* Any applicable interest rate, if the loan isn’t interest-free, and how it will be calculated.

* The repayment schedule, outlining when and how payments will be made (e.g., monthly installments, a lump sum on a specific date).

* The final due date by which the entire loan must be repaid.

* Details regarding late payment penalties or grace periods, if any.

* Information on collateral, if the loan is secured by an asset.

* The full names and contact information of both the borrower and the lender.

* The date the agreement was made and the signatures of both parties involved, acknowledging their acceptance of the terms.

Finding and Customizing Your Simple Promissory Note Form Template

In today’s digital age, finding a simple promissory note form template is easier than ever. Numerous reliable legal websites and online document services offer templates that you can download and customize. When choosing a template, look for one that is straightforward, easy to understand, and specifically designed for common loan scenarios. Avoid overly complex legal jargon unless absolutely necessary, as the goal is clarity.

Once you have a template, the next step is to personalize it with the specific details of your loan. This involves filling in the blanks with the principal amount, the agreed-upon interest rate, the repayment schedule, and any other unique terms relevant to your agreement. Take your time during this customization process to ensure every detail is accurate and reflects the mutual understanding between you and the other party. Double-checking numbers, dates, and names is crucial.

Depending on your jurisdiction and the complexity or size of the loan, you might consider having the note witnessed or even notarized. While not always a legal requirement for a promissory note to be valid, notarization can add an extra layer of authenticity and make it harder for either party to deny the agreement later. Always check local laws or consult with a legal professional if you have concerns about specific requirements for your situation.

Ultimately, using a simple promissory note form template transforms a potentially awkward conversation into a clear, legally sound agreement. It provides a roadmap for repayment, protects both the lender and the borrower, and ensures that everyone is on the same page from the outset. It’s an easy yet incredibly effective way to manage personal or small business loans with professionalism and transparency, setting the stage for a positive outcome for all involved.

Formalizing any loan, whether it’s a significant sum or a smaller amount, brings peace of mind and prevents potential misunderstandings from escalating into disputes. It’s a step that demonstrates responsibility and respect for both the financial aspect and the personal relationship involved. Taking the time to properly document the terms of an agreement upfront can save considerable stress and maintain positive relations in the long run.

By clearly outlining all the terms and conditions from the beginning, you create a transparent and accountable process for managing the debt. This approach not only safeguards financial interests but also strengthens trust by eliminating ambiguity. It’s about ensuring everyone knows what to expect, fostering a smooth and predictable repayment journey for all parties.