Getting a home loan can feel like navigating a complex maze, right? All those forms, questions, and numbers can quickly become overwhelming. It’s enough to make anyone second-guess their dream of homeownership. But what if the starting point, the application itself, could be much simpler? Imagine cutting through the jargon and getting straight to what matters, making the entire process feel more approachable.

That’s where the idea of a simple home loan application form template comes into play. It’s designed to demystify the initial process, making it less intimidating and more accessible for everyone. Whether you’re a first-time buyer or looking to refinance, a straightforward application can significantly reduce stress and help you gather all the necessary information efficiently, setting a positive tone for your entire home loan journey.

Why Simplicity is Key for Your Home Loan Application

In a world often characterized by complexity, finding simplicity is like a breath of fresh air, especially when it comes to significant financial undertakings like securing a home loan. Traditional application forms can sometimes feel like an endless checklist, packed with legal jargon and repetitive questions that leave borrowers feeling more confused than confident. This complexity doesn’t just add to the time it takes; it can also lead to mistakes, forgotten details, and ultimately, delays in your application process. A simpler approach, however, cuts through this noise and offers a clear path forward.

Think about it from your perspective. When you’re faced with a clear, concise form, you’re more likely to fill it out accurately and completely. This isn’t just about saving a few minutes; it’s about reducing the mental load and ensuring that you present your financial situation in the best possible light. A well-designed simple home loan application form template focuses on essential information, guiding you through each step without unnecessary distractions, allowing you to focus on providing precise data rather than deciphering complicated instructions or searching for obscure details.

Moreover, the benefits of simplicity extend beyond just the applicant. Lenders, too, appreciate receiving organized and easy-to-understand applications. When forms are streamlined, it helps their processing teams review information faster, identify any missing pieces quickly, and move your application forward without unnecessary back-and-forth. This efficiency benefits everyone involved, accelerating the journey from application submission to loan approval and, eventually, to getting the keys to your new home, which is the ultimate goal.

Ultimately, opting for a simple application doesn’t mean compromising on the thoroughness or legitimacy of the process. It means optimizing it. It’s about presenting the core financial picture—your income, assets, debts, and personal details—in a way that is clear, accessible, and actionable. This approach empowers you to confidently navigate the initial steps of securing your home loan, making the entire experience feel manageable and less daunting than it otherwise could be, paving the way for a successful outcome.

Essential Sections for Your Simplified Template

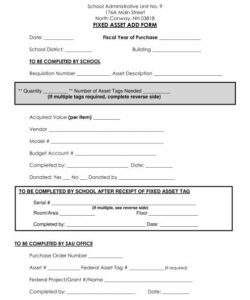

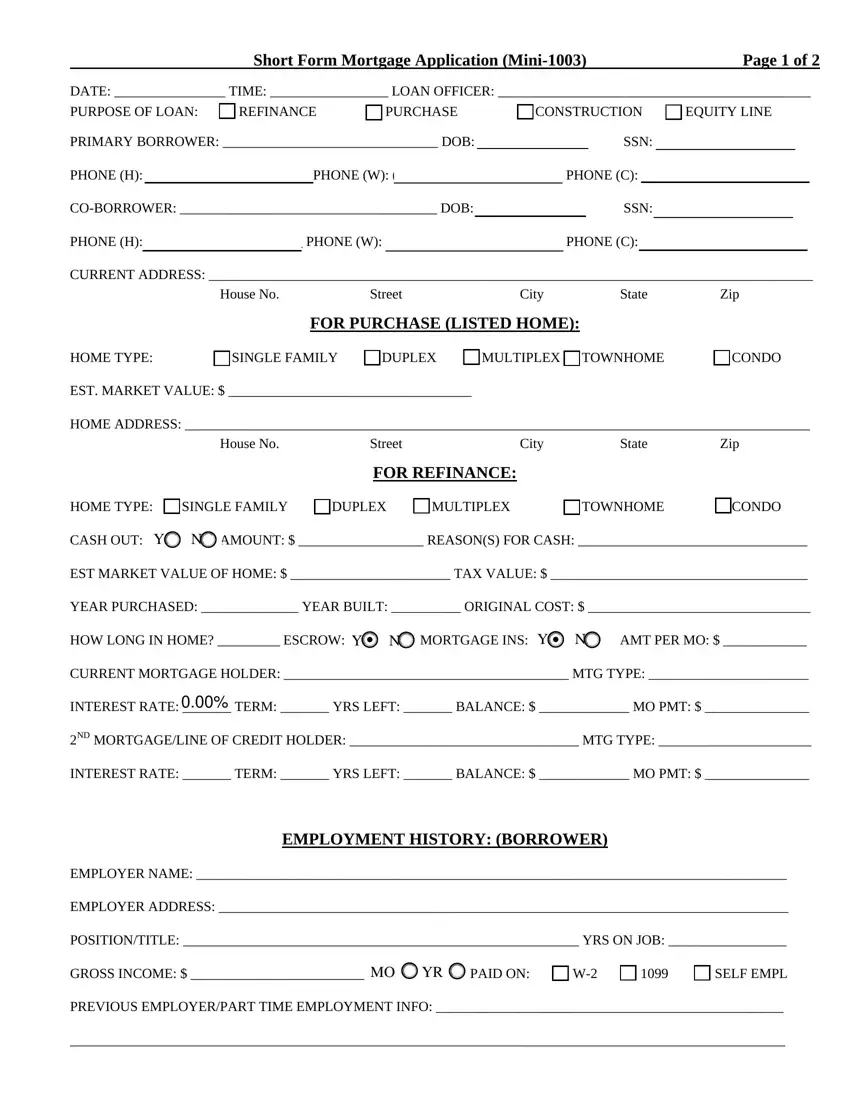

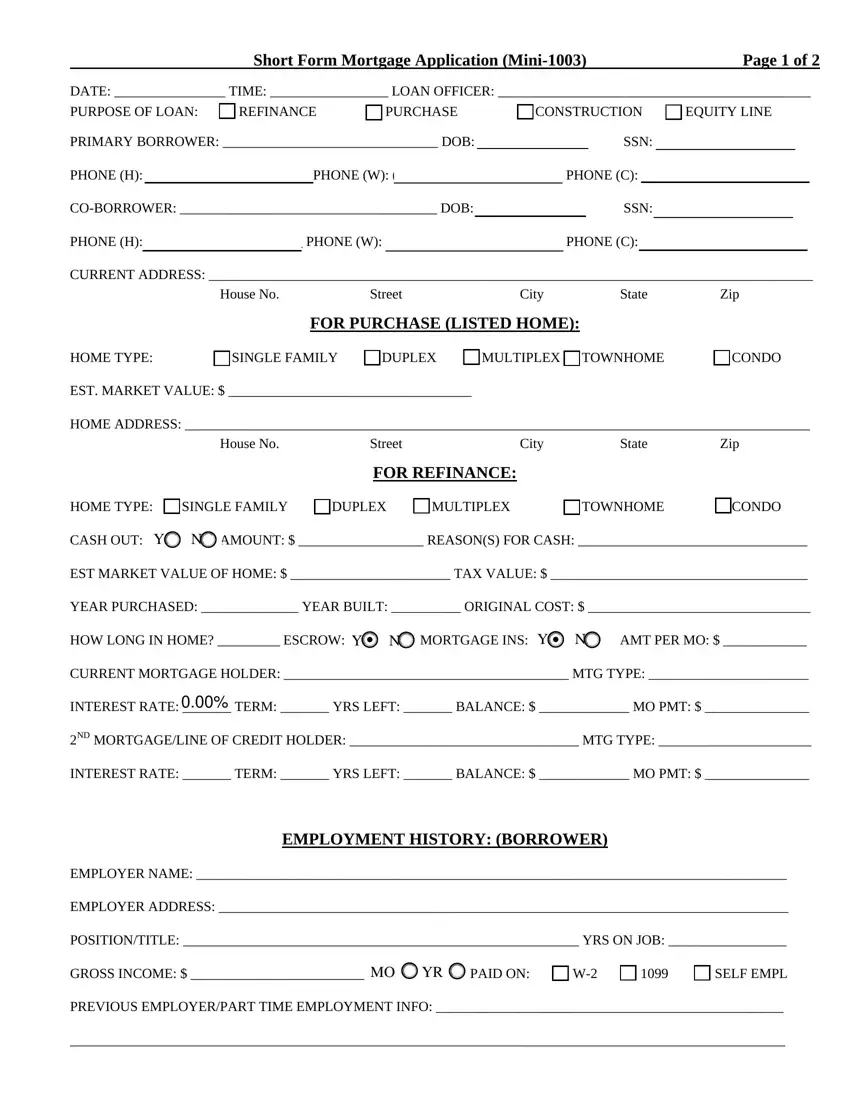

- Personal Information: Basic details like name, contact information, date of birth, and social security number.

- Employment and Income Details: Current and previous employment history, gross monthly income, and any additional income sources, ensuring clarity on all income streams.

- Financial Assets: Information on checking and savings accounts, investments, retirement funds, and other liquid or accessible assets.

- Debts and Liabilities: Outstanding loans (car loans, student loans, personal loans, credit cards), and other financial obligations like alimony or child support.

- Property Information: If applicable, details about the property you intend to purchase or refinance, including address, property type, and purchase price.

- Declaration and Authorization: A section for the applicant to sign, confirming the accuracy of information provided and authorizing necessary credit checks and financial verifications.

Crafting or Choosing Your Ideal Simple Home Loan Application Form Template

So, you’re convinced that simplicity is the way to go. The next step is either to find an existing simple home loan application form template that fits your needs or to create one from scratch. When looking for a pre-made template, consider reputable sources like financial institutions that offer general application guidelines or real estate professionals who often have simplified versions for initial inquiries. The key is to ensure it covers all the critical information lenders typically require without adding unnecessary complexity or redundant fields that might confuse applicants or slow down the process.

If you decide to craft your own template, begin by outlining the absolute essentials. Think about the core information a lender needs to get a preliminary understanding of your financial health and loan eligibility. Start with identifying information, move to income and employment, then assets and liabilities, and finally, details about the property itself. Organizing these sections logically, perhaps in a flow that mirrors how a conversation might unfold, can make the form intuitive and easy to follow, making the experience much smoother for the person filling it out.

Designing your template with a clean layout and clear headings will also significantly enhance its user-friendliness. Use simple, direct language instead of legalistic jargon whenever possible. Consider adding brief, helpful instructions for each section, explaining why certain information is needed or what specific types of data should be entered. For instance, clearly state whether a gross or net income is required, or specify if account numbers are needed. Such small touches can make a big difference in how easily and accurately an applicant can complete the form, reducing questions and potential errors.

Furthermore, anticipate common questions and integrate fields for them. For example, if you know a lender will ask about the source of a down payment, include a clear space for this information. By proactively incorporating these frequently requested details into your simple home loan application form template, you create a more comprehensive yet still straightforward document. This thoughtful design not only benefits the applicant by guiding them through the necessary disclosures but also provides lenders with a clear, concise snapshot of a borrower’s financial standing, streamlining the initial assessment and moving them closer to securing their dream home.

- Clarity over Complexity: Use plain language and avoid financial jargon where simpler terms suffice, ensuring everyone can understand what’s being asked.

- Logical Flow: Arrange sections in an intuitive order, perhaps starting with personal details and moving to financial specifics, creating a natural progression.

- Mandatory vs. Optional: Clearly mark fields that are absolutely required for initial assessment versus those that are optional but helpful, reducing confusion.

- Space for Explanations: Provide small text boxes or areas for applicants to add any necessary context or brief explanations for certain entries, like unusual income sources or debt circumstances.

- Digital Friendliness: Consider how the template will function as a digital document, ensuring it’s fillable electronically, easy to save, and simple to submit online, catering to modern convenience.

Embracing a simplified approach to your home loan application truly transforms what can be a stressful process into a manageable one. By focusing on clarity and essential information from the outset, you empower yourself to confidently step into the world of homeownership, equipped with all the necessary details organized in an accessible format. It’s about making the path to your new home smoother, faster, and much less intimidating than you might have imagined possible, setting you up for success.

Taking the time to prepare using a well-structured template not only streamlines your own efforts but also sets a positive precedent for your interactions with lenders. It demonstrates preparedness and serious intent, paving the way for a more efficient review process and potentially faster approvals. Ultimately, a straightforward application isn’t just a form; it’s your first confident step towards unlocking the door to your future home, making the entire journey feel more achievable and less daunting.