Navigating the world of self-employment can feel like a thrilling adventure, offering unparalleled freedom and the chance to truly build something of your own. However, with that freedom comes a significant responsibility: managing your finances. Keeping meticulous records of every dollar earned and every penny spent isn’t just a good idea; it’s absolutely essential for understanding your business’s health, making informed decisions, and staying on the right side of tax regulations. For many, the thought of tracking all this can feel daunting, but it doesn’t have to be.

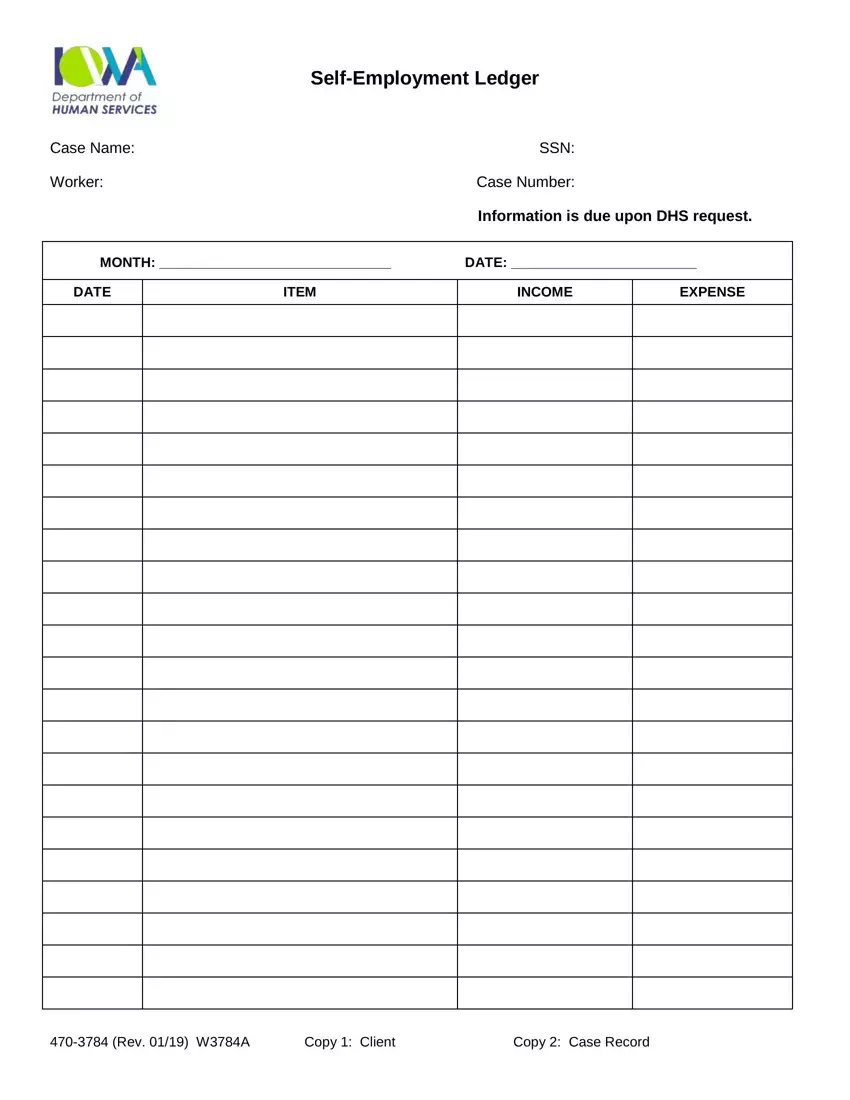

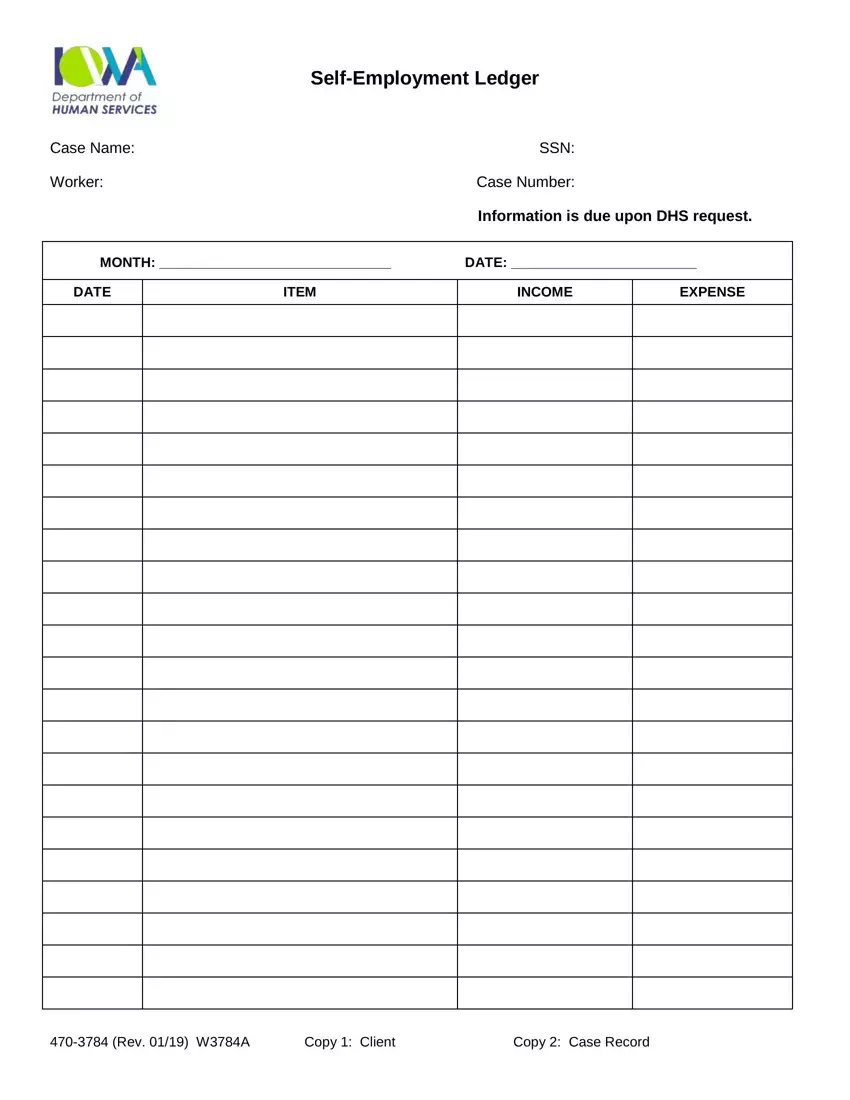

This is precisely where a reliable self employment ledger form template steps in as your new best friend. Imagine a world where your income and expenses are neatly organized, easily accessible, and perfectly clear. A well-designed ledger template eliminates the guesswork and replaces it with clarity, transforming a potentially stressful task into a straightforward, manageable routine. It provides a structured framework that guides you through the process, ensuring you capture all the necessary information without missing a beat.

Mastering Your Money with a Ledger Template

Embracing a dedicated ledger template is arguably one of the smartest moves you can make as a self-employed individual. It takes the guesswork out of your financial picture, allowing you to clearly see where your money is coming from and where it’s going. Instead of a jumble of receipts and bank statements, you’ll have a unified, chronological record that provides immediate insights into your profitability and cash flow. This clarity empowers you to identify trends, pinpoint areas for improvement, and celebrate your financial wins.

Beyond daily insights, a properly maintained ledger is your secret weapon when tax season rolls around. Gone are the days of scrambling to gather forgotten receipts and trying to recall vague expenses from months past. With every transaction meticulously logged, you’ll have a comprehensive overview of your income and all eligible deductions. This not only saves you countless hours of stress and frustration but can also ensure you’re taking advantage of every tax break available, potentially saving you a significant amount of money.

Think of your ledger not just as a compliance tool, but as a strategic business asset. By consistently tracking your finances, you gain the ability to make smarter decisions about your pricing, services, and spending habits. Perhaps you’ll notice a particular expense category is consuming too much of your budget, or that a certain service line is generating more income than you realized. These data-driven insights are invaluable for sustainable growth, helping you steer your self-employment journey in the most profitable direction.

So, what exactly makes up an effective ledger that can provide all these benefits? While templates can vary, there are core components that are universally beneficial for any self-employed person looking to get a handle on their finances.

What Goes Inside Your Ledger

- Date of transaction: Always log when the money moved.

- Description of transaction: A brief, clear note about what the income was for or what the expense purchased.

- Income amount: The money flowing into your business.

- Expense amount: The money flowing out of your business.

- Category: Essential for organizing similar transactions (e.g., supplies, marketing, travel, professional development, client payments).

- Payment method: How the transaction was made (e.g., bank transfer, credit card, cash).

- Running balance or notes: An optional but helpful field to keep a real-time tally or add specific details relevant to the entry.

Choosing and Utilizing Your Perfect Template

The beauty of a self employment ledger form template is its versatility. You’ll find a wide array of options, from simple printable PDF sheets you can fill out by hand, to sophisticated spreadsheet templates for Excel or Google Sheets, and even integrated features within small business accounting software. The key is to find a template that genuinely suits your working style and the complexity of your business. Some prefer the tactile experience of a physical ledger, while others thrive with the automation and analytical power of digital tools.

When selecting your template, consider factors like ease of use and customizability. Is it intuitive enough for you to pick up quickly? Can you add or remove columns to perfectly fit your unique income streams and expense categories? A template that feels cumbersome will quickly become a burden, so prioritize one that streamlines your workflow. Don’t be afraid to try a few different options before committing to the one that feels most natural for you to use regularly.

Once you have your chosen template, consistency becomes your superpower. The real magic of a ledger happens when you commit to entering transactions regularly, ideally daily or at least several times a week. Waiting until the end of the month, or even worse, the end of the quarter, makes the task much larger and increases the likelihood of errors or forgotten details. A few minutes dedicated each day can save you hours of headache down the line, ensuring your records are always up-to-date and accurate.

Finally, make sure to leverage the power of categorization and regular reconciliation. Assigning categories to your income and expenses allows you to quickly generate reports and analyze specific areas of your business. For instance, knowing exactly how much you spend on marketing or professional development can help you optimize those budgets. Furthermore, regularly comparing your ledger entries against your bank and credit card statements ensures that every transaction is accounted for and that your records are perfectly aligned with your actual financial activity. This step is crucial for catching errors and maintaining absolute accuracy.

Taking control of your self-employment finances doesn’t have to be a source of stress or confusion. By adopting the right tools and establishing simple, consistent habits, you can transform a daunting task into an empowering part of your business routine. A well-organized financial record-keeping system is not just about compliance; it’s about clarity, control, and confidence in your entrepreneurial journey.

So, whether you’re just starting out or looking to refine your existing financial processes, embracing a dedicated ledger template is a powerful step forward. It empowers you to make smarter decisions, minimizes the headaches of tax season, and ultimately frees up more of your valuable time and energy to focus on what you do best: building and growing your self-employed dream.