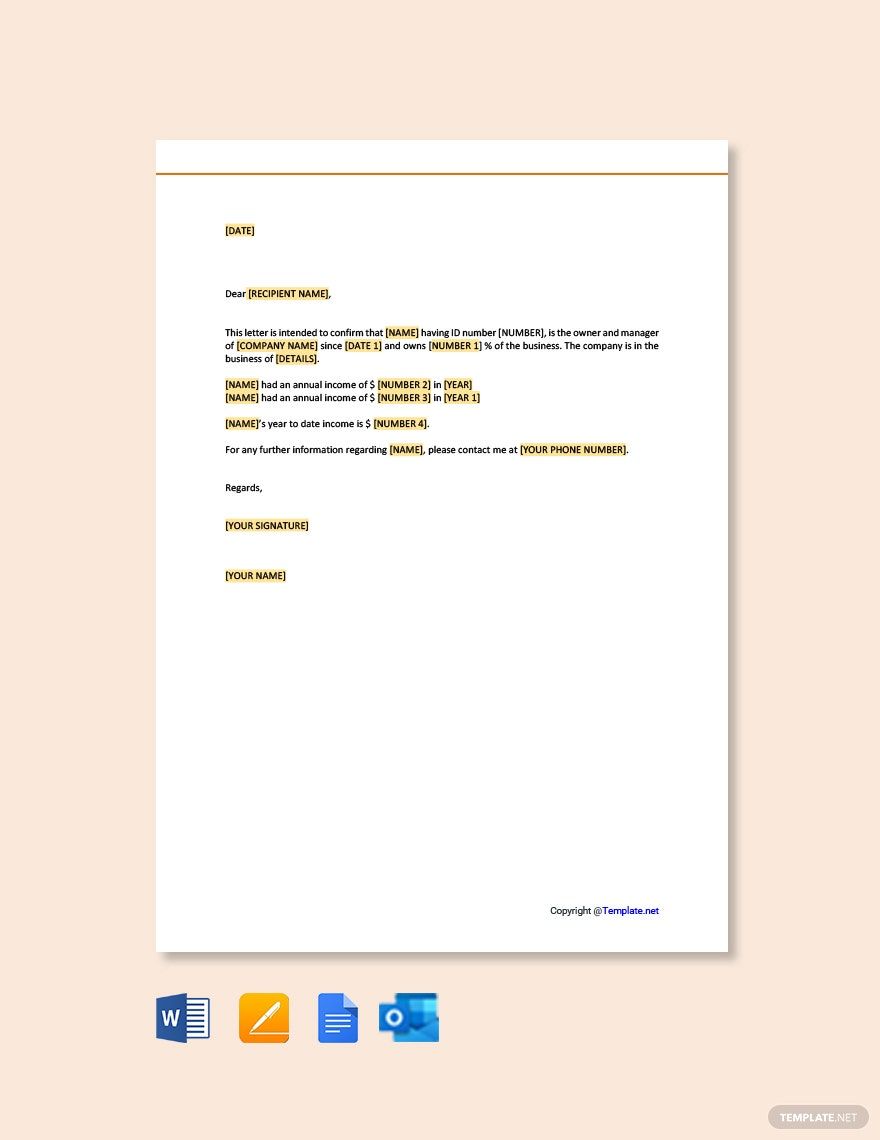

Navigating the financial world as a self-employed individual often comes with its unique set of challenges. Unlike those with traditional employment, you don’t receive regular pay stubs or W-2 forms that easily verify your earnings. This can make common tasks, like applying for a loan, renting an apartment, or even qualifying for certain benefits, feel like an uphill battle. But don’t worry, there’s a straightforward solution that can simplify this process significantly.

Understanding how to effectively demonstrate your income is crucial for financial stability and growth when you’re your own boss. You need a reliable way to present your financial standing to third parties, ensuring they have a clear and credible picture of your earning capabilities. This is precisely where a dedicated proof of income form becomes an invaluable asset in your entrepreneurial toolkit.

Why a Self Employed Proof of Income Form is Essential

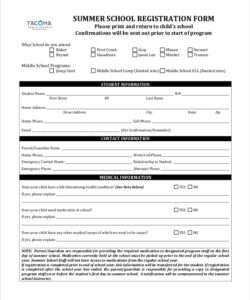

For many self-employed individuals, the concept of “proof of income” might seem daunting. After all, your income stream can be irregular, coming from various sources, and often fluctuates. However, having a structured document that consolidates this information isn’t just a good idea; it’s often a necessity for major life events. Lenders, landlords, and even government agencies need a clear, concise, and verifiable summary of your earnings before they can approve your applications or provide services.

Imagine trying to secure a mortgage without being able to clearly show your consistent earnings over time. Or perhaps you’re applying for a lease on a new apartment, and the landlord requires documented proof that you can afford the rent. These are common scenarios where a well-prepared income form can make all the difference, transforming a potentially frustrating experience into a smooth transaction. It acts as your formal declaration, backed by your financial records.

Key Scenarios Where It’s Indispensable

Knowing when and why you’ll need this document can help you be prepared. It’s not just about loans; it extends to various aspects of your personal and professional life. Here are some of the most frequent situations:

- Loan Applications: Whether it’s a personal loan, mortgage, car loan, or business loan, lenders require assurance of your repayment ability.

- Rental Applications: Landlords want to ensure you can consistently meet rent payments.

- Insurance Applications: Some insurance policies, especially those related to income protection, may require income verification.

- Government Benefits/Subsidies: Applying for healthcare subsidies, unemployment benefits (if applicable), or other social programs often necessitates a clear picture of your income.

- Child Support Calculations: In legal matters, accurate income reporting is vital for fair calculations.

- Visa and Immigration Processes: Some countries require proof of financial means for visa applicants.

By preparing a comprehensive self employed proof of income form template, you’re not just creating a document; you’re building a foundation of trust and credibility with the entities you interact with. This proactive approach saves time and reduces stress, ensuring that when opportunities arise, you’re ready to seize them without financial hurdles.

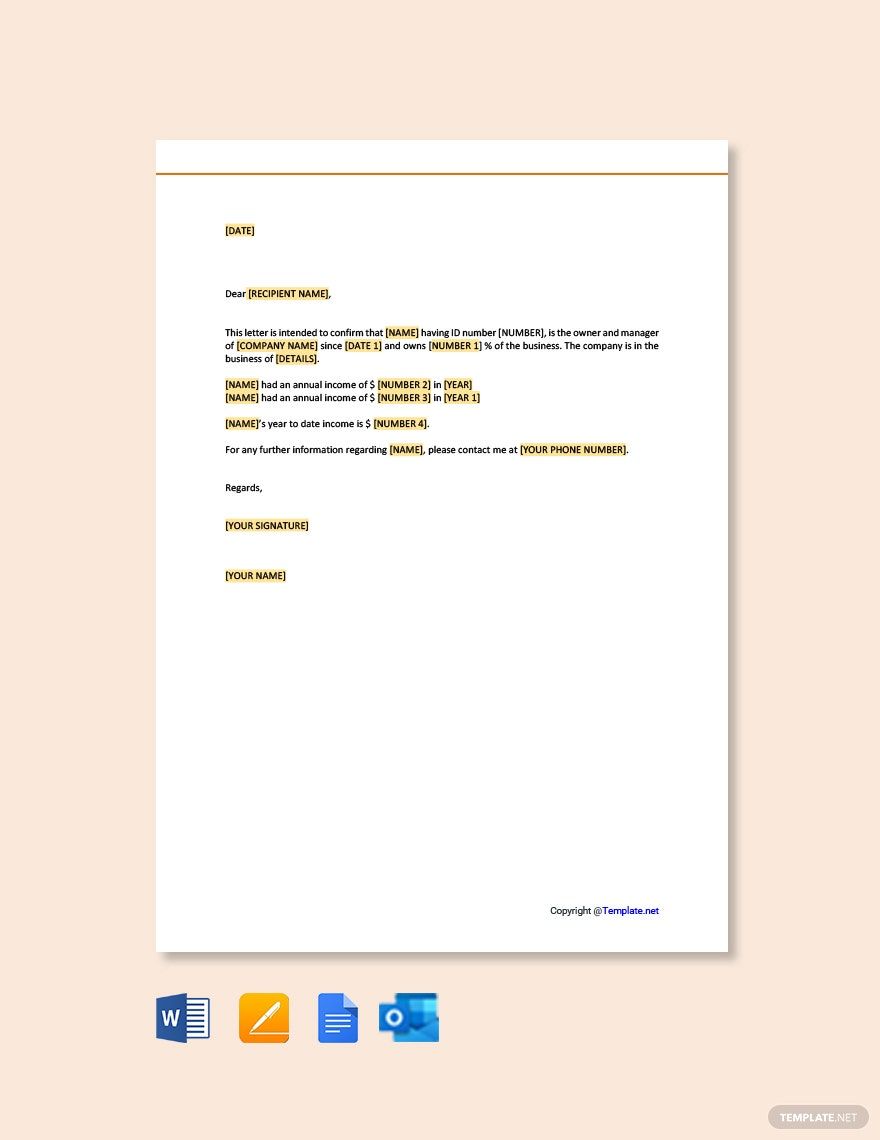

Crafting Your Own Proof of Income Form

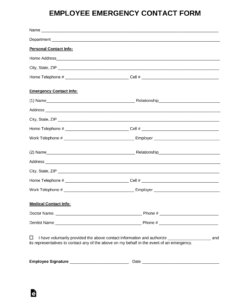

So, what exactly goes into an effective proof of income form for the self-employed? The goal is to provide a clear, concise, and verifiable snapshot of your financial health. While the exact requirements might vary slightly depending on who you’re presenting it to, a standard template should include several key pieces of information. It’s about demonstrating consistency and reliability, even if your income fluctuates month to month. Think of it as your personal financial statement, tailored for specific verification needs.

The best way to approach this is to gather all your relevant financial records before you begin. This might include bank statements, tax returns, invoices, payment receipts, and any contracts you have with clients. Having everything organized will make the process of populating your form much easier and ensure accuracy. Remember, the more detailed and verifiable your information, the stronger your proof of income will be.

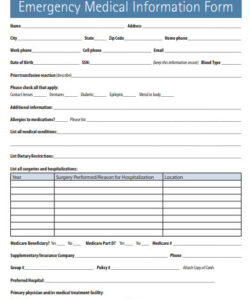

Here are essential elements to include in your self employed proof of income form template:

- Personal Information: Your full legal name, contact details, and perhaps your Social Security Number or Tax ID.

- Business Information: Your business name (if applicable), type of business, and address.

- Income Period: Specify the period the income covers (e.g., last 3 months, 6 months, or 1 year).

- Gross Income: Total income before any deductions. Break it down by source if you have multiple streams.

- Net Income: Your income after business expenses are deducted. This is often a more realistic indicator of what you actually take home.

- Supporting Documents: A list of attached documents, such as tax returns (Schedule C or 1040), bank statements, or profit and loss statements. You might even include copies of recent invoices.

- Declaration: A statement attesting to the accuracy of the information, signed and dated.

- Notary Public (Optional but Recommended): For critical applications, having the form notarized adds an extra layer of credibility.

By diligently compiling these elements, you’re creating a robust and professional document that clearly illustrates your financial capacity. It’s a proactive step that can smooth the path for many financial and personal endeavors, giving you the confidence that your income is well-documented and easily understandable by anyone who needs to review it.

Being self-employed offers incredible freedom and flexibility, but it also comes with the responsibility of managing your own administrative tasks, including income verification. Having a ready-to-use form that consolidates your financial information puts you in a much stronger position when applying for loans, housing, or any situation requiring proof of your earnings. It streamlines processes that might otherwise be cumbersome, allowing you to focus more on growing your business and less on proving your financial viability.

Ultimately, taking the time to prepare a comprehensive proof of income document is an investment in your own future. It empowers you with the ability to present your financial story clearly and confidently, opening doors to opportunities that might otherwise remain closed. With this tool in your arsenal, you’re well-equipped to navigate the financial landscape as a successful and secure self-employed professional.