Stepping into the world of self-employment is incredibly liberating, isn’t it? You’re your own boss, setting your own hours, and building something truly yours. But alongside the freedom comes a whole new set of responsibilities, especially when it comes to managing your finances. Keeping track of every dollar spent for your business isn’t just good practice; it’s absolutely crucial for tax season and understanding your true profitability. It might sound daunting, but it doesn’t have to be.

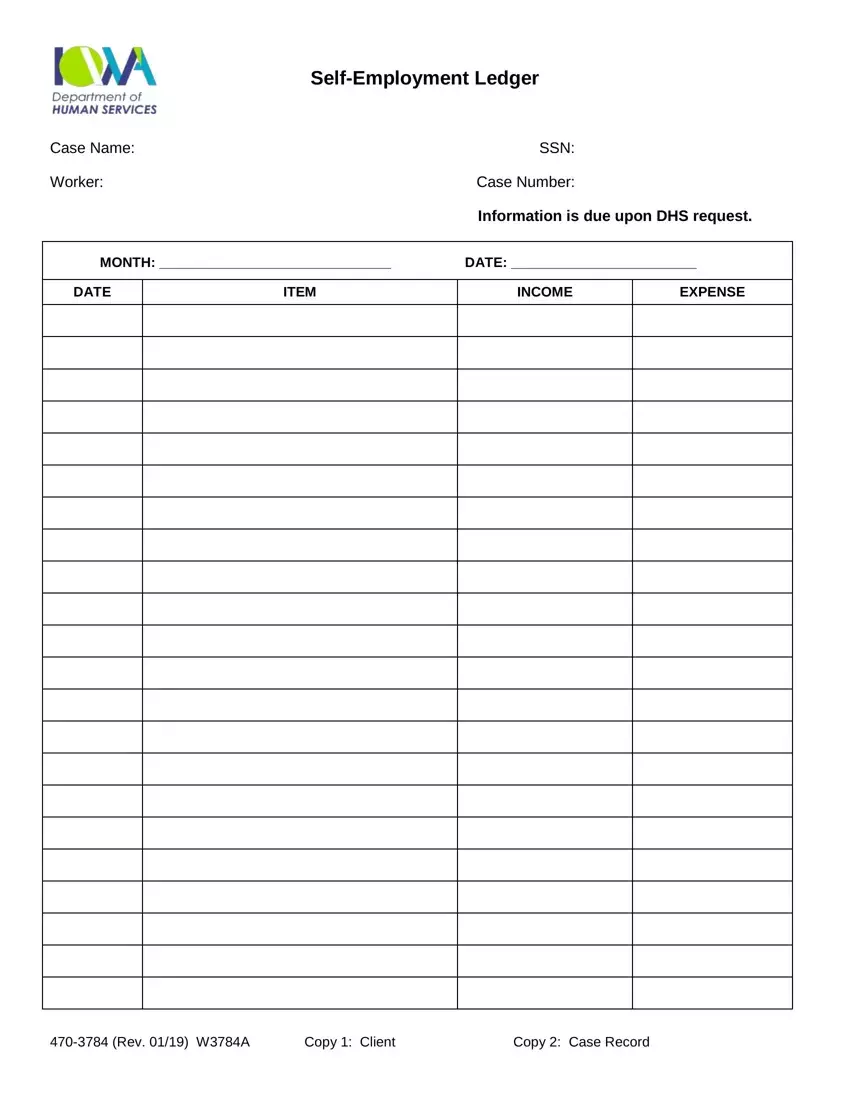

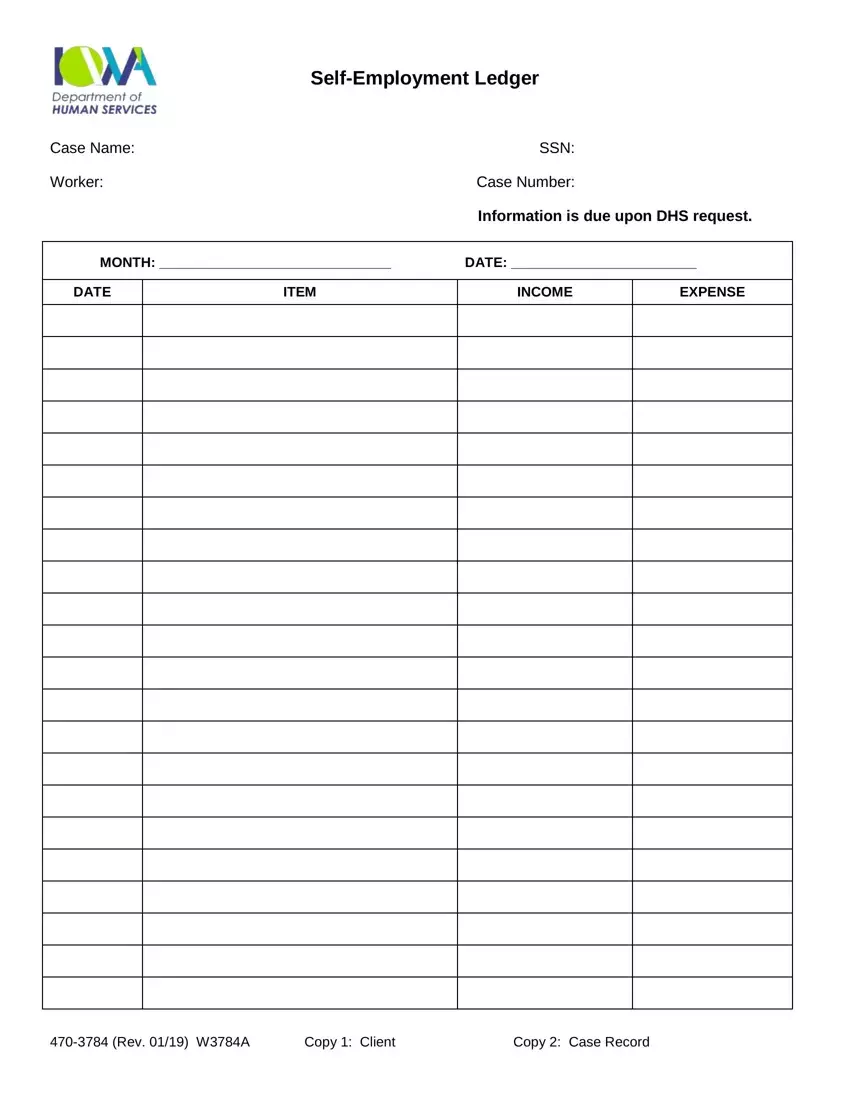

Many self-employed individuals find themselves scrambling through shoeboxes full of receipts when tax time rolls around, or worse, missing out on valuable deductions simply because they didn’t keep proper records. This is where a simple yet powerful tool comes into play: a well-designed self employed expense form template. It’s not just a piece of paper; it’s your secret weapon for staying organized, saving money, and reducing stress throughout the year.

Why a Self Employed Expense Form Template is Your Best Friend

For anyone running their own show, understanding where your money goes is fundamental to financial health. A self employed expense form template transforms a chaotic pile of receipts into an organized, understandable overview of your business expenditures. This isn’t just about pleasing the tax authorities; it’s about making informed decisions, identifying areas where you can cut costs, and ultimately, growing your business more effectively. Think of it as a financial roadmap that clearly marks all your business-related spending.

Without a systematic way to track expenses, you’re essentially flying blind. You might underestimate your true operating costs, leading to inaccurate pricing for your services or products. More importantly, you risk missing out on significant tax deductions that could save you hundreds, if not thousands, of dollars each year. The IRS allows self-employed individuals to deduct a wide range of business expenses, from office supplies to marketing costs and professional development. But to claim them, you need clear, consistent records.

A dedicated template provides that much-needed structure. It prompts you to record essential details for each transaction, ensuring you don’t forget important information when you eventually review your books. This level of detail is invaluable, not only for your peace of mind but also if you ever face an audit. Having meticulous records readily available demonstrates diligence and significantly simplifies any inquiry.

Furthermore, a consistent expense tracking system allows you to easily categorize your spending. This categorization is key to generating useful financial reports that can inform your business strategy. Are you spending too much on travel? Is your marketing budget yielding results? These are questions that a well-maintained expense form can help you answer with precision.

Key Sections to Look For in Your Template

When choosing or creating your self employed expense form template, ensure it includes the following essential fields to capture all necessary information:

- Date of Expense: When did the transaction occur?

- Vendor/Merchant Name: Who did you pay?

- Description of Expense: What was the expense for? Be specific.

- Category: How should this expense be classified (e.g., Office Supplies, Travel, Utilities, Software)?

- Payment Method: How did you pay (e.g., credit card, debit card, cash)?

- Amount: The exact cost of the expense.

- Notes/Receipt Reference: Any additional details or a reference number for the corresponding receipt.

How to Effectively Use Your Self Employed Expense Form Template

Having the perfect self employed expense form template is only half the battle; the real magic happens when you use it consistently and correctly. The most effective approach is to make expense tracking a regular habit, not a dreaded chore reserved for year-end. Whether you decide to update it daily, weekly, or bi-weekly, consistency is paramount. Just like you check your email, dedicate a small block of time to logging your business expenses. This prevents a mountain of receipts from accumulating and makes the process far less overwhelming.

Once you’ve recorded an expense on your template, don’t forget about the physical or digital receipt. These are your proof of purchase and are crucial for verifying the information you’ve logged. It’s a good practice to scan and save digital copies of all your receipts, perhaps organizing them into folders that mirror your expense categories. Cloud storage solutions are perfect for this, ensuring your receipts are safe and accessible from anywhere. Link the digital receipt to the entry on your form, either by file name or a simple note.

Categorizing expenses correctly is another critical step. It’s tempting to just lump everything together, but accurate categorization is what allows you to understand your spending patterns and claim the right deductions come tax time. If you’re unsure how to categorize a particular expense, consult with a tax professional or reliable online resources. Getting this right from the start will save you a lot of headaches down the line.

Finally, integrate your expense form into your overall financial management system. This might mean using it alongside accounting software, or simply as a foundation for your periodic financial reviews. Regularly review your completed expense forms. This isn’t just about catching errors; it’s about gaining insights into your business’s financial health. You might spot trends, identify areas where you can save, or even realize you’re spending more in one area than you intended.

Embracing a systematic approach to tracking your business expenses using a dedicated form is one of the smartest moves you can make as a self-employed individual. It empowers you with clear financial insights, streamlines your tax preparation, and significantly reduces the stress associated with managing your business finances. It’s an investment in your peace of mind and the continued success of your venture.

By diligently maintaining accurate and organized records, you’re not just preparing for tax season; you’re building a solid foundation for your business’s future growth and profitability. Take control of your financial data, understand where every dollar goes, and watch as your entrepreneurial journey becomes even more rewarding and secure.