Navigating property transactions in Georgia can feel like learning a new language, especially when terms like “security deed” pop up. It’s a foundational document in real estate here, essentially serving as Georgia’s version of a mortgage. When you’re buying a home or securing a loan with real estate, understanding this document is absolutely crucial because it’s what gives a lender the legal right to your property if loan terms aren’t met.

Many individuals and businesses alike often find themselves searching for a reliable security deed in Georgia form template. Whether you’re a first-time homebuyer, a seasoned investor, or a private lender, having access to an accurate and comprehensive template can provide a valuable starting point. However, it’s vital to recognize that while a template offers a framework, real estate law is complex and nuances can make a significant difference in the legality and enforceability of such a document.

Understanding The Georgia Security Deed

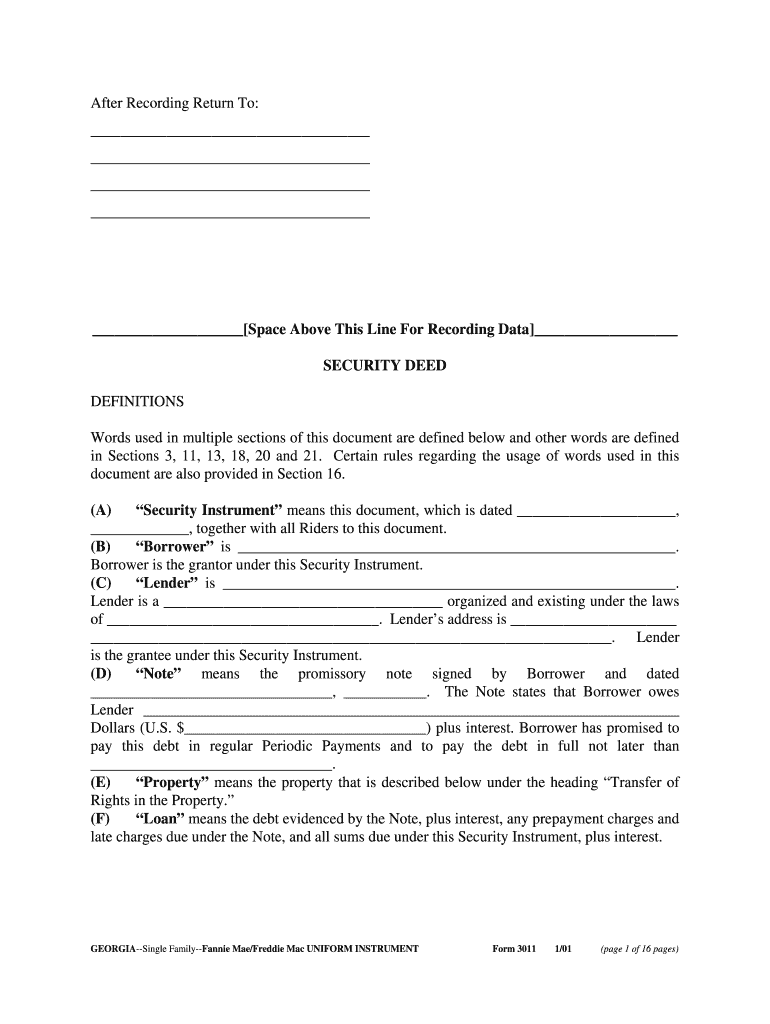

A security deed in Georgia is a legal instrument that conveys title to real estate from a borrower (grantor) to a lender (grantee) as security for a debt. Unlike a traditional mortgage in many other states, which only creates a lien, a Georgia security deed actually transfers the legal title of the property to the lender. This title transfer is conditional, meaning it’s held by the lender until the debt is fully repaid. Once the loan is satisfied, the lender is obligated to reconvey the title back to the borrower, usually through a Cancellation of Security Deed.

This particular legal structure provides lenders with a robust form of security, as they technically hold the legal title during the loan term. This arrangement simplifies the foreclosure process in Georgia compared to states where only a lien is held. For borrowers, it means understanding that while they retain possession and use of the property, the legal ownership is temporarily with the lender. It’s a critical distinction that impacts rights and responsibilities throughout the loan period.

The contents of a security deed are highly specific and must adhere to Georgia state statutes to be valid. Any missing information or errors can invalidate the document or create future legal headaches. It’s not just a simple fill-in-the-blanks exercise; each section serves a particular legal purpose. Essential elements ensure that all parties and the property itself are clearly identified, and the terms of the secured debt are explicitly stated.

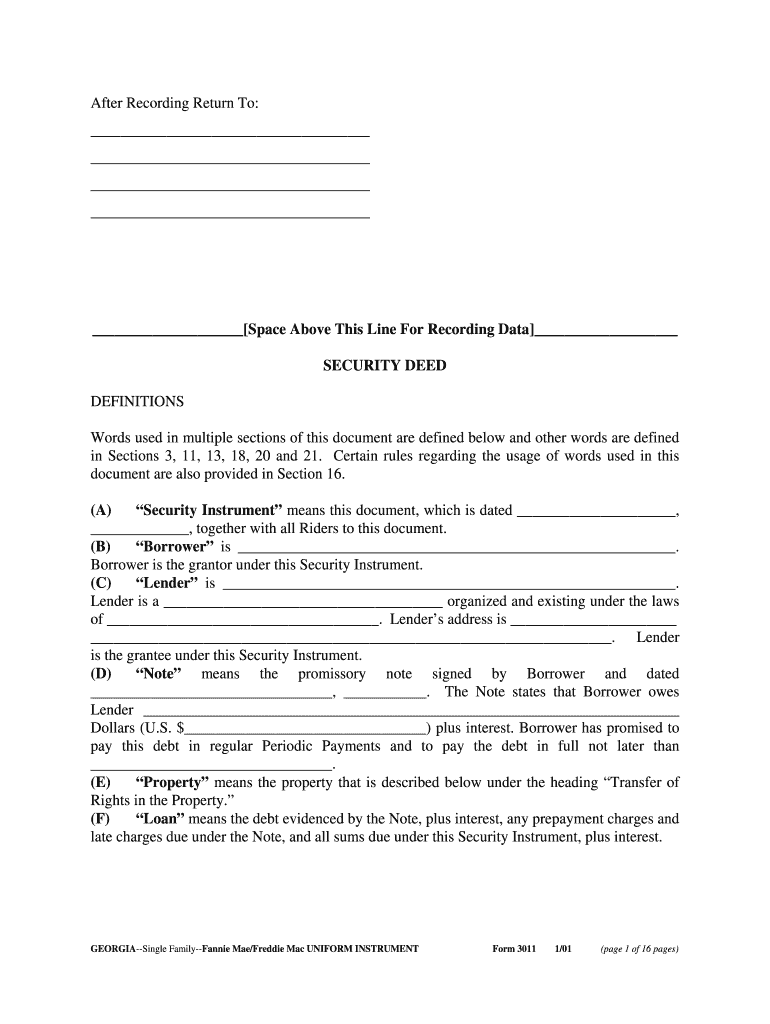

When reviewing or preparing a security deed in Georgia form template, you’ll encounter several key components that are non-negotiable for its validity and enforceability. These include:

Key Components of a Georgia Security Deed

- Parties Involved: Full legal names and addresses of the grantor (borrower) and grantee (lender).

- Property Description: A precise legal description of the real estate being conveyed, often requiring a plat book and page reference, or metes and bounds description.

- Debt Information: Details of the promissory note or debt being secured, including the principal amount, interest rate, and terms of repayment.

- Granting Clause: The language that explicitly states the conveyance of title from the grantor to the grantee.

- Warranty Clause: The grantor’s promise to defend the title against claims.

- Power of Sale Clause: Grants the lender the right to sell the property without judicial intervention in case of default.

- Execution and Attestation: Signatures of the grantor(s) and proper witnessing as required by Georgia law.

- Recording Information: Details necessary for the deed to be recorded in the county where the property is located.

Finding And Utilizing A Security Deed Form Template

The search for a security deed in Georgia form template often leads people to various online sources, legal software, or even stationery stores. While these resources can provide a starting point, it is incredibly important to approach them with caution. Generic templates, while seemingly convenient, might not encompass all the specific nuances of your transaction or the latest updates in Georgia real estate law. A template is a skeleton; the specific details and clauses are the flesh and blood that make it legally sound and applicable to your unique situation.

Using a template without understanding its implications can lead to significant legal and financial risks. For instance, an incorrectly worded property description could render the deed invalid, or missing clauses might prevent a lender from exercising their rights in case of a default. Therefore, customization is not just an option but a necessity. Every property transaction has unique elements—different loan terms, specific covenants, or individual circumstances of the parties involved—that a standard template simply cannot anticipate.

For these reasons, the best practice when dealing with a security deed, even with a template in hand, is to seek professional legal advice. An attorney specializing in Georgia real estate law can review your specific situation, tailor the template to your needs, ensure all legal requirements are met, and explain the implications of each clause. They can also help navigate the recording process, which is essential for giving public notice of the security interest and protecting the lender’s rights against other claims on the property.

Before proceeding with any real estate transaction involving a security deed, especially when relying on a template, consider these critical steps:

- Verify the Source: Ensure any template you use comes from a reputable legal resource or is provided by a legal professional.

- Consult a Lawyer: Always have a Georgia real estate attorney review or draft your security deed. This is the most crucial step to ensure accuracy and compliance.

- Understand Each Clause: Do not sign anything you do not fully understand. Ask questions about every section and term.

- Accurate Information: Double-check all names, addresses, property descriptions, and debt details for absolute accuracy. Even a minor typo can cause major issues.

- Proper Execution and Recording: Ensure the deed is signed correctly, witnessed according to Georgia law, and promptly recorded with the Clerk of Superior Court in the county where the property is located.

Ultimately, a security deed is more than just a piece of paper; it’s a critical legal agreement that protects the interests of both borrowers and lenders in Georgia real estate transactions. Its proper execution and understanding are paramount to avoiding future disputes and ensuring a smooth financial journey.

While resources like templates can be helpful starting points, the complexity of real estate law necessitates a thorough and careful approach. Ensuring your security deed is accurate, legally sound, and tailored to your specific situation will provide peace of mind and protect your interests in the long run.