Navigating employee benefits can sometimes feel like sifting through a maze of regulations and paperwork. Among the most valuable benefits an employer can offer are those under a Section 125 Cafeteria Plan, which allows employees to pay for certain qualified benefits with pre-tax dollars. This provides significant tax advantages for both employees and employers. However, to make these benefits work smoothly, a crucial piece of the puzzle is the employee’s formal election form, which captures their choices for the upcoming plan year.

Understanding and properly utilizing a section 125 election form template is essential for any organization offering these plans. It’s not just about filling out a document; it’s about ensuring compliance, clarity, and convenience for everyone involved. This article will walk you through the ins and outs of these forms, helping you demystify the process and even craft your own effective template.

Understanding Section 125 Plans and Your Election Form

Section 125 plans, often called cafeteria plans, are incredibly beneficial because they allow employees to choose between taxable cash (their salary) and non-taxable benefits without the chosen benefits being considered taxable income. This means contributions to plans like Flexible Spending Accounts (FSAs), Health Savings Accounts (HSAs) when offered through a cafeteria plan, and certain premium payments for health, dental, and vision insurance can be deducted from an employee’s paycheck before federal, and often state, income taxes and FICA taxes (Social Security and Medicare) are calculated. This results in more take-home pay for the employee and reduced payroll taxes for the employer.

The election form is the cornerstone of this entire process. It’s the formal document where an employee indicates their specific benefit choices for a given plan year. Without a properly completed and submitted election form, an employee cannot participate in the pre-tax benefits offered under the Section 125 plan. It’s a binding agreement that dictates how their compensation will be allocated towards these valuable, tax-advantaged benefits. Accuracy is paramount, as these elections typically cannot be changed during the plan year unless a specific qualifying life event occurs, such as marriage, birth of a child, or a change in employment status.

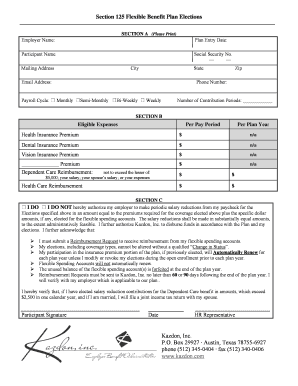

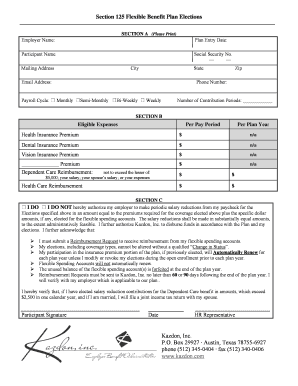

Key Elements of a Section 125 Election Form

A well-designed section 125 election form template should be comprehensive yet easy to understand, guiding employees through their choices without confusion. Here are the essential components you’d expect to find:

- Employee Information: Full name, employee ID, department, and contact details.

- Plan Year: Clearly state the effective dates for which the election applies.

- Benefit Selection: A clear list of all available benefits under the Section 125 plan, such as health insurance, dental, vision, Health FSA, Dependent Care FSA, and any other pre-tax options.

- Contribution Amounts: Spaces for employees to specify their elected contribution amounts for each benefit, particularly for FSAs, often presented as a per-pay-period deduction and an annual total.

- Waiver Options: Sections for employees to formally waive participation in certain benefits, if applicable, often accompanied by a statement confirming they understand the implications of waiving coverage.

- Terms and Conditions: A brief explanation of the rules, such as the “use-it-or-lose-it” rule for FSAs, the irrevocability of elections, and conditions for mid-year changes.

- Employee Acknowledgment and Signature: A section where the employee signs and dates the form, confirming their understanding and agreement to the terms and their elected benefits.

Ensuring all these elements are present and clearly laid out minimizes errors and administrative burden. It also ensures that both employees and the employer are clear on the commitments made regarding benefits. This detailed approach makes the administration of the Section 125 plan smoother and more compliant with IRS regulations.

Crafting Your Own Section 125 Election Form Template

Creating or customizing a section 125 election form template doesn’t have to be an intimidating task. While many HR software solutions or benefit administration platforms offer pre-built templates, understanding the core components and principles allows you to either tailor those effectively or even build one from scratch if your needs are unique. The goal is always to create a document that is legally sound, easy for employees to complete, and simple for your HR team to process.

Start by gathering all necessary information about your company’s specific Section 125 plan. This includes the exact names of the benefits offered, the per-pay-period costs for various tiers of insurance coverage, and the annual maximums for flexible spending accounts. Consistency with your Summary Plan Description (SPD) is crucial. Use clear, unambiguous language throughout the form, avoiding jargon where possible. Remember, not every employee is an expert in benefits administration, so clarity will reduce questions and errors.

When designing the layout, think about user experience. Use clear headings, checkboxes, and fill-in-the-blank fields. Provide ample space for signatures and dates. If your plan has different rules for different benefit types (e.g., a “use-it-or-lose-it” rule for FSAs versus a carryover option), make sure these distinctions are clearly noted. You might also consider including a simple instructional guide or a list of frequently asked questions directly on the form or as an accompanying document to further assist employees.

Once you have a draft, it’s advisable to have it reviewed by legal counsel or a benefits consultant. This step ensures that your template adheres to all current IRS regulations and any state-specific requirements. Regulations surrounding Section 125 plans can change, so a periodic review and update of your section 125 election form template is a good practice to maintain compliance and accuracy. A well-crafted template is an asset that streamlines open enrollment, reduces administrative overhead, and provides a professional experience for your employees.

A well-constructed and regularly updated section 125 election form template is an indispensable tool for any organization offering pre-tax benefits. It serves as the official record of an employee’s benefit choices, ensuring proper administration and compliance with tax regulations. By providing clarity and ease of use, you empower your employees to make informed decisions about their valuable benefits, while also simplifying a critical administrative process for your HR or benefits team.

Ultimately, a robust template reduces confusion, minimizes errors, and facilitates a smooth enrollment period year after year. It’s a testament to good organizational practices and a commitment to providing employees with the resources they need to manage their health and financial well-being effectively. Investing time in developing or refining this document pays dividends in efficiency and employee satisfaction.