Navigating the world of sales and use tax can feel like a complex puzzle, especially for businesses operating in Illinois. From understanding which transactions are taxable to ensuring you’re using the correct forms for reporting, it’s a critical aspect of financial compliance. Many business owners find themselves spending valuable time trying to decipher tax codes and prepare their submissions accurately, often wishing for a clearer path.

That’s where having a reliable approach, perhaps even a well-structured sales and use tax form template for IL, can make a significant difference. Proper reporting isn’t just about avoiding penalties; it’s about maintaining good standing with the state and ensuring your business operations run smoothly. We’ll explore the ins and outs of Illinois sales and use tax, the forms involved, and how to simplify your filing process.

Understanding Illinois Sales and Use Tax Basics

Illinois imposes both a sales tax on the sale of tangible personal property at retail and a use tax on the privilege of using, in Illinois, tangible personal property purchased at retail from a retailer. For most businesses, these two taxes are intertwined and reported together. Retailers are generally responsible for collecting sales tax from their customers and remitting it to the Illinois Department of Revenue IDOR. The complexities arise when considering exemptions, deductions, and specific types of transactions.

Use tax, on the other hand, applies when an item is purchased outside Illinois for use within the state, and no Illinois sales tax was paid. This often comes into play for online purchases from out-of-state vendors who don’t collect Illinois sales tax, or for equipment bought for business use that wasn’t properly taxed at the point of sale. Businesses and individuals are responsible for self-assessing and remitting this use tax, preventing unfair advantages for out-of-state purchases over local ones.

Accurate and timely reporting of both sales and use tax is paramount. Errors can lead to audits, fines, and interest charges, creating unnecessary financial burdens and administrative headaches for your business. The IDOR takes tax compliance seriously, and understanding your obligations is the first step towards ensuring you meet them without a hitch.

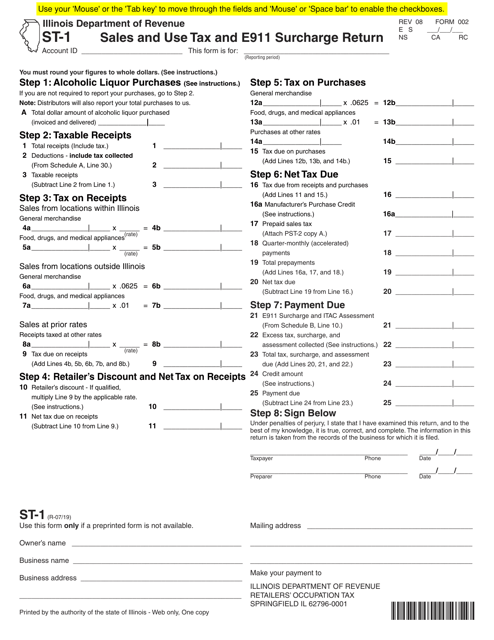

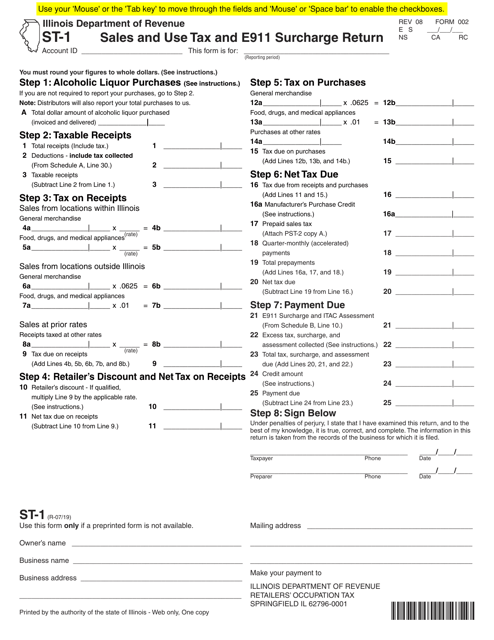

The primary form most businesses use for reporting sales and use tax in Illinois is the Form ST-1 Illinois Sales and Use Tax and E911 Surcharge Return. Other forms might be required depending on your specific industry or circumstances, such as Form ST-2 Multiple-Site Form or Form ST-4 Sales and Use Tax Resale Certificate. Knowing which form applies to your situation is crucial.

Key Components of an IL Sales and Use Tax Form

When you’re looking at a sales and use tax form template for IL, you’ll typically encounter several sections that require careful attention:

- Your business’s Illinois Account ID and Federal Employer Identification Number FEIN.

- The specific reporting period for which you are filing the return.

- Gross receipts from all sales, before any deductions or exemptions.

- Itemized deductions for non-taxable sales, such as sales for resale, sales of services, or sales to exempt organizations.

- Calculations for taxable sales and the applicable tax rate.

- Any credits or prepayments made during the period.

- The final amount of tax due or refund expected.

Navigating and Utilizing a Sales and Use Tax Form Template for Illinois

Using a comprehensive sales and use tax form template for Illinois can significantly streamline your tax preparation process. Rather than starting from scratch each reporting period, a well-designed template provides a clear framework, prompting you for all necessary information and helping you organize your data efficiently. This reduces the likelihood of errors, saves time, and ensures consistency in your reporting, which is beneficial during any potential audits.

The best place to find legitimate templates or guidance is usually the official Illinois Department of Revenue website. They often provide fillable PDF versions of their forms, which serve as excellent templates themselves. Additionally, many reputable accounting software solutions and tax compliance platforms offer built-in reporting features that function much like advanced templates, automating calculations and pre-populating fields with your sales data. Be cautious of unofficial sources that might offer outdated or incorrect forms.

Once you have your template or preferred method, the process typically involves gathering all your sales data for the reporting period. This includes gross sales, exempt sales, sales to resellers, and any other deductions. Input these figures into the designated sections of the template. The template will then guide you through the calculations, applying the correct tax rates and summing up your total tax liability. It’s like having a guided tour through your tax obligations.

For businesses with multiple locations or complex sales scenarios, the benefits of a structured approach are even greater. It allows for standardized data collection and reporting across different departments or branches, enhancing overall compliance. Always remember that while a template simplifies the process, the ultimate responsibility for accuracy lies with the taxpayer.

- Maintain meticulous records of all sales, deductions, and exemptions. This includes invoices, sales receipts, and exemption certificates.

- Regularly reconcile your sales data with your financial records to catch discrepancies early.

- Stay updated on any changes to Illinois sales and use tax laws and rates, as these can impact your filing requirements.

- Consider consulting with a tax professional, especially if your business has complex transactions or if you’re unsure about specific tax applications.

Effectively managing your sales and use tax obligations in Illinois is a fundamental part of running a successful business. By understanding the basics, identifying the correct forms, and leveraging tools like a well-structured template, you can transform a potentially daunting task into a manageable routine. It’s about being proactive and ensuring your financial records are always in order.

Taking the time to implement a systematic approach to your sales and use tax reporting will undoubtedly pay dividends in the long run. It provides peace of mind, helps avoid costly mistakes, and allows you to focus more on growing your business rather than wrestling with tax compliance.