In the dynamic world of business, establishing trust and assessing creditworthiness are paramount. Whether you’re extending credit to a new client, vetting a potential partner, or simply understanding a company’s financial habits, collecting reliable information is crucial. One of the most effective ways to gain insight into a business’s payment history and reliability is through trade references, but gathering this data efficiently can often feel like a cumbersome task.

This is where a well-designed and comprehensive request for trade reference form template becomes an invaluable asset. It standardizes the information-gathering process, ensuring you collect all the necessary details consistently and professionally, saving both you and the reference provider valuable time and effort in the long run.

Why a Solid Trade Reference Form Matters for Your Business

When you’re making critical decisions about extending credit or forming partnerships, relying solely on financial statements might not give you the full picture. Trade references offer a unique, real-world perspective on how a business manages its payment obligations and conducts its operations with other suppliers. They provide anecdotal evidence and factual data from actual business relationships, highlighting patterns of reliability, promptness, and overall professional conduct. Without a structured approach, gathering this critical insight can be disorganized and lead to incomplete data, potentially affecting your risk assessment.

A well-crafted form not only simplifies the process for you but also makes it easier for the referee to provide the necessary information. It signals your professionalism and seriousness in due diligence, which can foster stronger business relationships right from the start. Imagine trying to piece together information from scattered emails or phone calls; a template eliminates that chaos, ensuring you receive consistent, comparable data points from every reference.

Key Elements to Include in Your Template

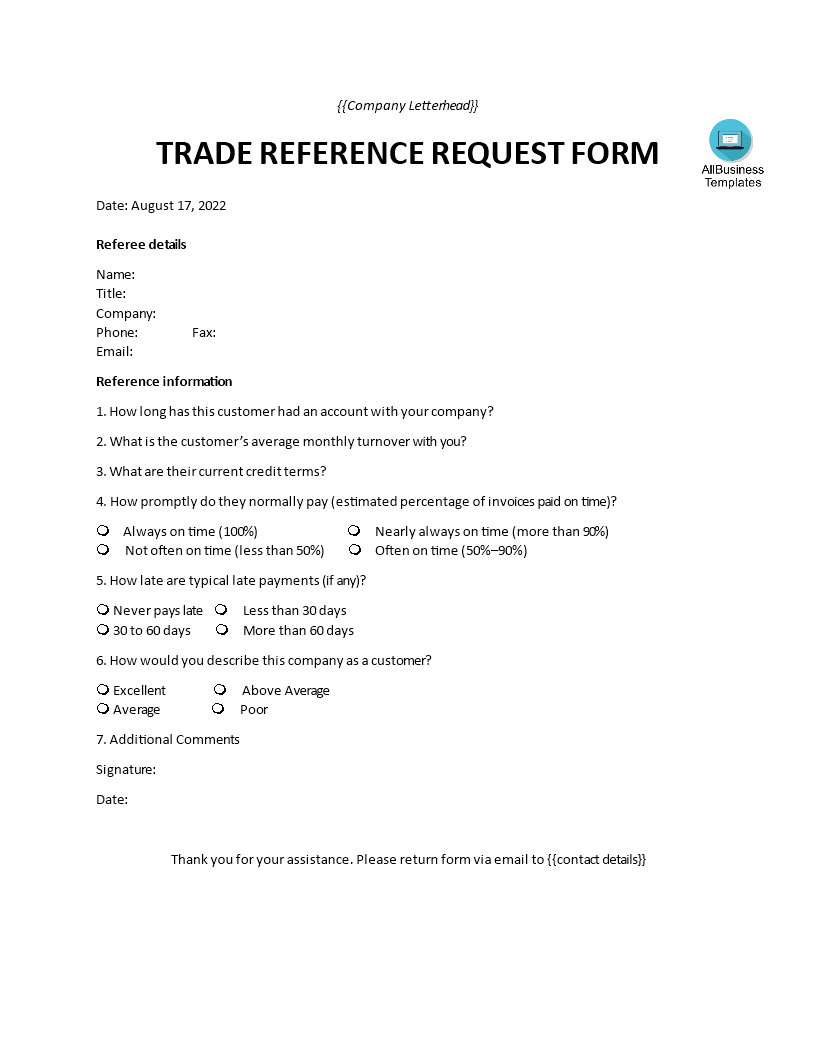

To be truly effective, your trade reference form needs to capture specific details that are pertinent to evaluating a business’s creditworthiness and operational reliability. These elements ensure you get actionable insights rather than vague statements. It is important to ask questions that elicit objective data points as much as possible, alongside any subjective assessments.

Here are some of the crucial components you should consider incorporating:

- The full legal name and contact details of the company providing the reference.

- The name and title of the individual completing the form.

- The date the account was opened with the company being referenced.

- The highest amount of credit extended and the current credit limit.

- Average monthly purchases.

- Detailed payment history (e.g., typically pays on time, within 30 days, 60 days, etc.).

- Any instances of past due payments or payment disputes.

- Overall assessment of the business relationship (e.g., reliable, satisfactory, excellent).

- Any additional comments or relevant information the reference provider wishes to share.

By including these specific questions, you ensure that the responses you receive are standardized, making it much easier to compare references and make informed decisions. It also streamlines the process for the referee, guiding them through the information you need in a clear, concise manner.

Streamlining Your Credit Application Process with a Template

Integrating a standardized request for trade reference form template into your credit application or vendor onboarding process is a game-changer for efficiency and professionalism. Instead of crafting new requests for each potential client or partner, you simply deploy your pre-designed form, saving considerable administrative time. This consistency not only makes your internal processes smoother but also projects a highly organized and professional image to those you are requesting information from, encouraging prompt and thorough responses. It removes the guesswork about what information is needed, benefiting all parties involved.

Beyond just the initial collection, using a template ensures that the data you receive is uniform, which is vital for effective analysis. When every reference provides information in the same format, you can easily compare payment histories, credit limits, and overall relationship assessments across different sources. This uniformity helps in quickly identifying patterns and potential red flags, allowing your credit department or decision-makers to assess risk more accurately and efficiently. It transforms a potentially chaotic information-gathering task into a streamlined, data-driven process.

The benefits extend to the reference providers themselves. They appreciate a clear, easy-to-understand form that respects their time by asking for specific information in an organized manner. This thoughtful approach can strengthen your network and facilitate future requests, as businesses are more likely to respond positively when the process is straightforward and unintrusive.

Ultimately, by leveraging a well-crafted request for trade reference form template, you empower your team with the tools needed to make confident, well-informed credit decisions. This strategic approach minimizes risk, fosters more secure business relationships, and contributes significantly to the financial health and stability of your organization. It’s about building a robust foundation of trust based on verified information, ensuring that every new partnership or credit extension is backed by a thorough understanding of the other party’s financial reliability.